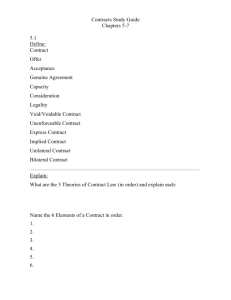

Law 108A - UVic LSS

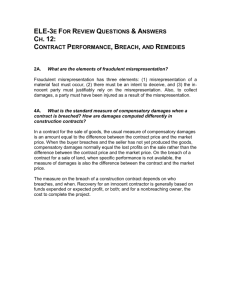

advertisement