CONFIDENTIAL BUSINESS PROFILE FOR

PREPARED BY

JOHN (OVANES) MIKAELIAN, C.B.I., B.C.B., I.B.A.

2

JOHN (OVANES) MIKAELIAN, C.B.I., B.C.B., I.B.A.

INSTITUTE OF BUSINESS APPRAISERS

CERTIFIED BUSINESS INTERMEDIARY

BOARD CERTIFIED BROKER

OFFICE LOCATIONS

4666 EAST MONTE WAY

2015 S. ARLINGTON HEIGHTS RD.

PHOENIX, AZ

ARLINGTON HEIGHTS, IL

85044

60005

Office & Cell: (847) 867-0050

FAX: (847) 437-4082

PROPRIETARY AND CONFIDENTIAL INFORMATION

Venture Business Brokers, LTD., 2009, 2010, 2011, 2012, 2013

All Rights Reserved

This (document, program, book) contains the confidential and proprietary

information of Venture Business Brokers, Ltd. The copyright notice is

strictly for the purpose of protecting the copyrights of Venture Business

Brokers, Ltd., in the event of inadvertent or improper disclosure of this

confidential information to third parties. This (document, program, book)

may not be used, copied, or disclosed without the prior written consent

of Venture Business Brokers, LTD.

3

4

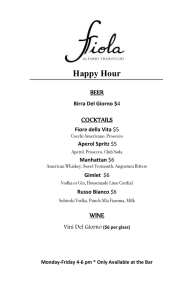

LISTING #121512

I.

OPPRTUNTY TO PURCHASE OF THIS VODKA DRAND:

Purchase Price includes the following: Trade-Mark, Product Formula, All Licenses,

All the Distribution Rights, All Websites, Customer Lists, All Computer Programs.

II.

PURCHASE PRICE;

$ 150,000.00 plus inventory

NOTE: At the present time the inventory in the warehouse is approximately $130,000.00

and in Holland at the distillery is $40,000.00.

III.

ANNUAL GROSS SALES;

$ 603,958.00 2011

IV.

SECOUNT OPPRTUNTY TO OWN THE RIGHTS FOR DISTRIBUTION IN YOUR STATE;

We will provide you with the Exclusive Rights and Interest in Yes Vodka Brands of any State for $ 50,000.00.

This will include 200 cases at no charge.

The opening shipment:

1000 cases 1 Liter at $60.00 each = $ 60,000.00

200 cases 1 Liter no charge

250 cases 750 ML at $ 50.00 each = $ 12,500.00

250 cases 750 ML Gift at $ 54.00 each = $ 10,800.00

All additional shipments are at cost plus 15% GM….plus Federal tax. We pay for the storage in the NJ warehouse, web

site, and social media resources.

Buyer will receive the rights to bottle additional sizes if the buyer chooses.

Buyer will receive the rights to purchase any {point of Sale merchandise and literature} he wants (tee shirts shot glass

etc)

Buyer will receive 25% of Yes Brands current inventory { point of Sale merchandise and literature} on hand (tee shirts

etc)

Buyer will receive the rights to purchase the exclusive sales distribution ownership contract to other States at a cost of

$20,000 each. Those states to be outlined in the asset purchase agreement.

Yes-Brands agrees that the buyer has the first right of refusal to purchase all additional assets of YES Brands at the

agreed upon price from YES brands Inc.

5

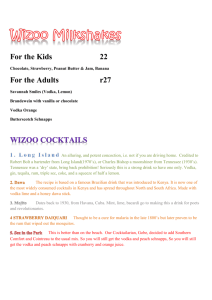

WHAT’S SO SPECIAL

ABOUT OUR BRAND NAME?

When you look at a list of vodka names many are familiar, but one stands out. Why? In spite of the

fact

that it’s the new kid on the block, only one syllable and three letters long , there isn’t one

word

more affirmative, optimistic, enthusiastic, or rich in possibilities than our brand name. To refresh your

memory and make our point here’s a partial list: Stolichnaya. 42 Below. Absolute. Grey Goose. Effen.

Belvedere. Fleischman’s. Svedka. Chopin. Russian Standard. Finlandia. Hanger One. Three Olives.

Tito’s.

Ultimate. Skyy. Crystal Head. Smirnoff. YES. Need we say more on this subject? No.

YES, WE HAVE

A PERSONALITY

TO MATCH OUR NAME.

Free Saturday night? May I join you? Is this seat taken? New in town sailor? Can I get in I’m with the

band? We all ask questions in our own ways, yet we all seek the same answer. If we think of

that stir stick in a cocktail glass as the epicenter of some great celebrations, romances, re-connects

and get-togethers, you think of a personality that’s anything but shy. Start with friendly. Go to sexy.

Then go beyond sexy, straight to flirtatious. Top it off with a desire for new experiences. Stir all that

together and you’ve got our personality.

VODKA IS BY FAR

THE MOST POPULAR

DISTILLED SPIRIT

IN THE WORLD.

So it should come as no surprise there are many vodka

brands in the world to choose from. There are vodka’s

produced in every corner of the world in any number of

flavor combinations. There are vodkas at every price

point, too. In every way, shape or form, someone has

exploited the appeal of vodka. So the essential question

becomes,

does the world have shelf space for

Yet another vodka? We think the answer is a

definitive, “YES.”

6

THE VODKA MARKET

• Vodka represents 31% of all spirits sold in the US in 2010

• Which represents a 6.1% increase over 2009

• 118 million cases (6 packs) of vodka sold in the US in 2010

• Premium & Super Premium vodka sales grew 26.6% collectively

• Ketel One - 4 million cases sold 2010 (6 packs)

• Grey Goose – 7 million cases sold 2010 (6 packs)

• Worldwide vodka market is nearing 400 million cases

(6 packs) per year

• Budget sales in year 6 for YES = 120,000 cases (6 packs)

__________________________________________________________________________

PURE SPIRITS WORLDWIDE (PSW)

•Initially established in 2006 as YES LLC

•2009 Pure Spirits Worldwide Inc. formed to raise equity capital Approximately

$2.7 million

o PSW manufactures, imports and markets YES vodka PSW owns

the exclusive formula and process to distill YES vodka

• Currently distributed in Seven states.

• Excellent product/formula and great brand package/

name; Taste test wins in 4200 of 4500 tests

• Target demographic: 21 to 38 year olds who are

active on social media and music is embedded in their everyday life

•Build a NATIONAL brand utilizing

7

YES VODKA - A GREAT PRODUCT...

• Super-premium vodka imported from Holland

• Made from 100% wheat grain

• Water purified through reverse osmosis

• Quadruple distilled/quadruple filtered

• Ultra-smooth finish borrowed from Dutch

process of distilling gin

• Winner of many blind taste tests nationwide

• Gold and Silver Sip Awards winner for taste

(and for bottle design)

So pure and smooth - Mixes well with Anything!

Distribution of YES Vodka…

• Current distribution in Seven states, which are in top 10 in

spirits consumption

• Illinois, California and Arizona with Southern Wine and Spirits.

(300 Illinois salesmen, 600 California salesmen)

• Connecticut , New Jersey, Georgia, and Wisconsin with top

distributor in the state

• We have a valuable 32 state distribution contract with Southern Wine

and Spirits to extend growth

8

Sales Results

Arizona

- 70 accounts

Account Examples:

Prime Bar

Martini Ranch

Urban Seven

Compound Grill

Silverleaf Club

Connecticut

New Jersey

Georgia

- 140

- 120 accounts

- 122 accounts

Account Examples:

Matteo's

Augur Irish Pub

Riverhouse Tavern

Polpo Restaurant

Koo At the Lake

Tony’s Package Shop

Oakville wine and liquor

700 account goal

Opened Sept. 5th, 2011

Account Examples:

Brando's Citi Cucina

Drama Night Club

Country Club Tavern

Riverside Liquors

Bourbon Street Liquor

Liquor Barn

Pin Shop Liquor

Union Liquor

Sales Results Now carried in over 2700 accounts, opened

1100 new accounts in California alone

Illinois Market

- 850 accounts

Wisconsin Market

Account Examples:

Tavern on Rush

Morton's Steak House

Wildfire

Gibson's

Side Track

YBar / Hearts / Crescendo

The Lodge Group

Cardinal Liquors

Armanetti beverage marts

Teddy’s Liquors

Account Examples:

Account Examples:

Brewski’s Sports Pub

Wolfgang’s Steakhouse

Bistro At Liberty Square

Diamond Club

Pfister Hotel & Tower

East Village Tavern

Jo Jo's Martini Lounge

Harlot

- 600 accounts

California Market

-1100 accounts

Falcon Restaurant & Lounge

Sendik’s Food Markets

Woodman’s Food Market

Bev Mo fine liquors

Otto’s

Rays Liquors

9

Key Marketing Partners

Key Marketing & Distribution Partners

Exclusive Drinks – CranSlam, LemonDinger, & At the Buzzer including YES Drink Carts

1. Bradley Center – Milwaukee Bucks Basketball, Admirals Hockey and Marquette

Basketball

2. Potawatomi Bingo & Casino, Wisconsin

3. Rivers Casino, Illinois

THREE PARTS SOCIAL

ONE PART YES VODKA

YES

10

SOCIAL MEDIA

Getting the word out. Make it two words. We know

we’re notgoing to outspend the established brands. As much as we’d like to

believe we can outwit or outhustle them, that’s a tough bet in a tough business.

What we can do is keep it simple. We’re only going to ask people to do one

thing

and one thing only. Say “YES.” What the big brands have going against them is

the very fact that they’re big. Ask the marketers of Stoli or Absolute what it’s

like

to be maintain market share. Drinking is about socializing. Socializing is about

meeting new people and trying new things. We know people love the taste of

YES. And we’re building a word of mouth accelerator to spread the love once

we’ve made friends. It’s called social media. Facebook and Twitter are a

match made in heaven for YES Vodka. New brand meet new media.

It’s

a way to make room for a new relationship.

TARGET AUDIENCE

CREATE AWARENESS

•

•

•

61MM Adults 24-38

39MM Adults 24-38 on Facebook

64% of our audience are Facebook users

Milestones

• DELIVERED 90 MILLION FACEBOOK

IMPRESSIONS

• ACQUIRED 20,000+ FACEBOOK

FANS

• 6K OPT-IN Email SUBSCRIBERS

• DISTRIBUTION IN 7 STATES

• NOW IN 2700+ ACCOUNTS

• I NTRODUCED 1.75 LITER BOTTLE

FOR SPECIAL DISTRIBUTION

• 300+ TASTING EVENTS LOCALLY

11

STRATEGY

• Long Term:

New products are typically launched into spirits industry via small niche players

• Those that gain critical mass in key markets are acquired by larger spirits companies

OR

• The growing Spirits companies sell equity by taking the company

Public to build the Brand for national distribution.

Pure Spirts Worldwide Inc. seeks a strategic buyer

V.

COMPANY HISTORY

Winner of 4,200 of 4,500 taste tests against some of the vodka industry’s best known brands, YES

Vodka is considered among industry veterans and consumers as one of the smoothest vodkas in the

world.

YES Vodka’s fast paced growth is accredited to it’s cutting edge social media campaign as well as

the fast growing spirits segment in the U.S. today. Vodka accounts for 31% of all spirits purchased

and growing.

12

The Company

When three spirits industry veterans decided to create a super-premium vodka for sale in

the U.S. market in 2006, they launched a global search for the best that vodka has to offer.

The road led them to the Dutch countryside and a meeting with master distiller, Rene

Vriends. What the YES Vodka team and Vriends mapped out was the idea of creating a

vodka from wheat with a taste so pure and refined that it would stand out in a crowded vodka field

and be appealing taken straight as a traditional martini, served on-the-rocks

or mixed into specialty drinks.

Some vodkas use inexpensive filtration methods that can give the finished product an

unwanted taste and odor. YES Vodka uses four different filters as part of our unique process.

In addition to the filtration, YES Vodka’s proprietary process starts with a reverse osmosis water

filtration and a quadruple distillation process. YES Vodka’s patented formulation creates a

super-premium vodka with a clean and smooth finish with no burn down the throat. Most vodka’s

do not have this smooth finish. YES has a very supple and delicate taste followed by a mediumbodied mouth feel with just a slight touch of citrus and spice. On the rocks, straight up or as a mix,

vodka is that most American of beverages: eminently flexible (it mixes with anything) and so light,

pure and clean that vodka enhances whatever it is mixed with.

As three men started with a mission to create a vodka of extraordinary purity, Yes Vodka’s proprietary formula and process resulted in the creation of the purest and smoothest vodka the founders had

ever tasted.

VI.

MARKET SIZE

The Vodka market is growing dramatically.

According to statistics from the January 2011 report of the Distilled Spirits Council of the United

States, vodka clearly dominates the spirits landscape.

• Vodka consumption accounts for approximately 31% of all distilled spirits sold in the U.S.

13

VI.

MARKET SIZE (CONTINUE)

• This represents overall growth in U.S. vodka case sales of 6.1% in 2010 to a total of 118 million

cases (of six packs) sold. The spirits industry reports sales in 9 Liter case volumes which represents

a 12 pack of 750 ML bottles. We converted the industry case sales data to six pack cases since that

is the case unit size that PSW and the rest of the industry actually sell.

• Vodka revenues in the U.S. totaled $4.8 billion in 2010.

• The 1st six months of 2011 have shown additional 2.6 % growth.

• The market for premium spirits has exploded in the last 20 years and is not showing any signs of

slowing down and vodka sales are continuing on an even faster pace even in a tough economy.

• Premium and super-premium vodka sales in the US grew by 26.6% in 2010.

• For YES Vodka to meet and exceed our financial projections, our case sales (assumed at 120,000

six pack cases sold a year by 2016) would only account for approximately one tenth of one percent

of the total U.S. vodka market. At that level of market share, PSW would generate a significant

profit and we believe a strong return for our shareholders. We believe we can achieve this level of

market share in the imported vodka category in the U.S.

The introduction of super premium spirit brands into the U.S. market is a continuing trend as affluent and younger consumers (21–38) are asking for specialty premium spirits by name. This ongoing

trend should escalate as advertising and marketing becomes more sophisticated in reaching and creating the desire for the best product in younger consumers with more available and discretionary

funds. We believe this age group is the right demographic target for YES vodka to pursue. Even

Bacardi and Brown-Forman, potential strategic partners for YES Vodka, have already shown interest in YES Vodka as a young and hip brand with a strong social media presence.

We believe the unique smoothness and character of YES vodka will also appeal strongly to the female consumer who traditionally likes the elegance of clear spirits and will enjoy the smoothness of

YES vodka. Many female and younger consumers, not wanting to drink the brown spirits of their

parent’s generation, have been drawn to the clean taste and visual appeal of upscale vodkas and

rums. It is estimated that over 80 million people are in our target age demographic of 21-38 in the

U.S. and that 80% of these people are Facebook users every day.

14

VII.

SOCIAL MEDIA, MARKETING AND PROMOTIONS

One of the three key pillars to our success has been our ability to develop and execute an effective

marketing and promotional campaign for YES vodka without the massive budgets of many other

spirits companies and brands. The effective use of social media tools and other technology will be

the foundation of our overall promotion and brand building strategy.

PSW utilizes Laughlin Constable (”LC”), a national branding and marketing firm with locations in

Milwaukee, Chicago and New York. As a key partner and a leading social media firms in the U.S.,

LC is also a large angel investor in PSW. LC (www.laughlin.com) has a real and significant stake

in the successful outcome of helping us to most effectively brand and market YES Vodka.

We are heavily invested in social media as a way to build awareness and buzz for YES Vodka and

to communicate regularly with our various critical audiences. We currently have 20,059 Facebook

fans with the goal of hitting over 45,000 Facebook fans by the summer of 2012. Today, YES Vodka

has more Facebook fans than some other well known vodka brands including Effen, Chopin, Stolichnaya, Tito’s and Van Gogh. These other brands have over a decade head start on YES Vodka,

yet our focus on these new digital and social media tools is allowing us to build a significant community as we build distribution.

• PSW’s Facebook advertising rewarded a prize of a trip for four to Las Vegas – this contest included YES Vodka ads being posted on over 100 million Facebook pages.

• Our goal is to be “Liked” by over 500,000 Facebook Fans by 2016.

• We participated in over 100 promotional events in 2010 and have plans to be involved in more

taste testing’s in 2011. These events are also supported by and promoted via our social media campaigns and outlets (such as Facebook, YES website, emails, Twitter and Four Square).

15

VII.

SOCIAL MEDIA, MARKETING AND PROMOTIONS (CONTINUE)

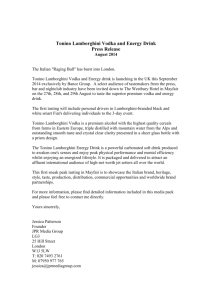

Innovative Technology

A few innovative technology developments include

the YES Shaker “app” for I-Phone users. We were

the first vodka company to offer an App. This app is

available for free in the Apple App Store and with

each shake of the I-Phone - a new YES vodka drink

recipe appears after the sound of the martini shaker

stops. We also have a YES product locator which is

available on our website to help folks find establishments that currently sell YES vodka. It is updated weekly as we are rapidly expanding our product

locations and availability.

Marketing Achievements to Date

• 90 million Facebook page impressions

• 35 different Facebook advertisements

• Interactive website, Facebook, Twitter and Foursquare platforms

• 20,000 Facebook Fans in just over three months; we surpassed the

following spirit brands in Facebook fans:

• Stolichnaya - 1,910 Facebook Fans

• Chopin - 6,854 Facebook Fans

• Effen - 15,669 Facebook Fans

• 42 Below Vodka - 8,444 Fans

• Tito’s - 12,683 Facebook Fans

• 7,000 email addresses - PSW email campaign reaches over 7,000 people bi-monthly.

• Launched 1st ads in the California market late February

focused growth strategy built around sports arena and event marketing. Our arena contracts provide

a profitable stream of business and they help to create awareness of our new brand.

16

Marketing Achievements to Date

No new brand has been able to contract with pro sports arenas this early in their life cycle. We have

three contracts signed and a few others in development. A few examples of our early arena successes are as follows:

wn Forman. We already have well established relationships at very high levels in four of the largest

spirits companies in the world via our outstanding Board of Directors.

YES is now carried in approximately 2,800 account locations in seven states (some of which are

still brand new distribution states for us) and we are pleased to have added 1,100 accounts during

the first six months of 2011 in California alone.

XI.

MANAGEMENT TIME

Larry Wojciak – President & CEO

From 1994 through 2008, Wojciak served as a key operating executive and Board member for In

GEAR Corporation, which was founded by Wojciak and two others. Wojciak and his partners built

In GEAR as wholesale to retail organization servicing all major retailers in the U.S. and abroad.

XII.

FINANCIAL SUMMARY

STATEMENT OF INCOME AND EXPENSES

2011

(11 Months)

INCOME

SALES/750 ML(Stores)

SALES/1,75 L(Arena)

SALES/BAR& RESTAURANTS

SALES/MAIL IN REBATES

TOTAL GROSS SALES

AMOUNT

TOTAL

$ 138,278.00

_200,680.00

246,568.00

<

215.00>

$__585,531.00

17

XII.

FINANCIAL SUMMARY (CONTINUED)

COST OF SALES

PURCHASES/750 ML

PURCHASES/1,75 L

PURCHASES/BAR&RESTAURANTS

PURCHASES/OTHER

$ 120,080.00

76,433.00

127,951.00

<

8,377.00>

LESS COST OF SALES

<__316,087.00>

TOTAL GROSS PROFIT

$__269,444.00

LESS OPERATING EXPENSES

PROFIT BEFORE OWNER'S

COMPENSATION (CASH FLOW)

<1,009,275.00>

$<

739,831.00>

<

605,588.00>

LESS DISCRETIONARY EXPENSES

NET INCOME AS SHOWING ON

P & L STATEMENT

$<1,373,866.00>

OPERATING EXPENSES

2011

(11 Months)

ACCOUNTING

ADVERTISING

AUDIT&TAX FEES

AUTO/EXP.(car allow)

AUTO/EXP.(gas)

BANK/CHARGES

BASE RENT, R.E. TAXES & C.A.M.

BROKER EXPENSE

DUES & SUBSCRIPTIONS

EMPLOYEE BENEFIT PROGRAMS

FREIGHT

INCOME TAX EXPENSE

INSURANCE/GENERAL

IT/SOFTWARE

$__28,865.00

1,025.00

9,507.00

37,275.00

15,480.00

1,090.00

28,704.00

94,990.00

110.00

35,140.00

7,896.00

2,947.00

10,777.00

1,427.00

18

XII.

FINANCIAL SUMMARY (CONTINUED)

IT/SUPPORT SERVICE

MARKETING/ARENA CANTRECTS

MARKETING/DIST & BROKER INCENTIV

MARKING/EMAIL COMPAING

MARKETING/EVENTS

MARKETING/GUERILLA

MARKETING/LAUGLIN

MARKETING/LAUGLIN OFFSET

MARKETING/OF PREMISE MATERILS

MARKETING/ON PREMISE MATERILS

MARKETING/PLANT&DEVELOPMENT

MARKETING/RETAIL PROMO

MARKETING/SAMPLES

MARKETING/SPONSORS

MARKETING/TECHNOLOG

MARKETING/WEARABLES & GIVEAWAYS

MARKETING/YES ARMY

MEALS & ENTERTAIMENT

MHW/WAREHOUSE FEES

LEGAL OR PROFESSIONAL

LICENSES & FEES

OFFICE EXPENSES & SUPPLIES

OTHER EXPENSE

PAYROLL PROCESSING FEES

POSTAGE

PRODUCT DEVLLOPMENT

PROFESSIONAL FEES

SALARIES/WAGES

SUPPLIES FEES

TAX/PAYROLL

TELEPHONE

TELEPHONE CELL

TRAVEL EXPENSE

UTILITIES EXPENSE

TOTAL OPERATING EXPENSES

1,406.00

50,229.00

89,801.00

10,401.00

35,668.00

33,207.00

9,425.00

<

3,770.00>

3,004.00

10,982.00

10,486.00

27,103.00

8,369.00

17,822.00

1,665.00

22,493.00

100.00

47,940.00

41,154.00

15,270.00

90.00

1,649.00

5,796.00

2,699.00

8,774.00

4,199.00

200.00

151,119.00

6,780.00

12,754.00

6,492.00

12,059.00

87,202.00

1,474.22

$1,009,275.00

NOTE: ALL OF THE ABOVE FIGURES ON THE OPERATING EXPENSES ARE BEFORE OWNERS NOTES, DRAWS,

SALARY, DEPRECIATION, AUTO EXPENSE, INSURANCE AND ALL OTHER DISCRETIONARY EXPENSES.

19

XII.

FINANCIAL SUMMARY (CONTINUED)

DISCRETIONARY EXPENSES & START-UP

2011

(11 Months)

ADVISORY FEE

DEPRECIATION/

OFFICE FURNITURE & EQUIPMENT

INTEREST

LEGAL&PROFESSIONAL(START-UP)

MARKETING/EVENTS(START-UP)

MARKETING/FACEBOOK(START-UP)

MARKETING/MODEL COST(START-UP)

MARLETING SPONSORS(START-UP)

MARKETING/WEBSITE(START-UP)

SALARIES/OFFICERS

TAX/PAYROLL OFFICERS

TRAVEL & LIVING EXP.

TOTAL OWNER'S

DISCRETIONARY EXPENSES & START-UP

XIII.

$ 18,750.00

766.00

8,594.00

42,000.00

16,000.00

17,432.00

25,568.00

10,000.00

148,956.00

280,000.00

20,000.00

17,522.00

$605,588.00

SHOWING OF THE BUSINESS

At the owner’s request, to maintain confidentiality and to avoid

disruption of the Company, all discussions concerning this Confidential Business Profile or questions about the Company should be

channeled through Venture Business Brokers, Ltd., and there should

be no direct contact with the Company or its personnel.

XV.

BROKERS DISCLOSURE & QUALIFICATIONS OF PURCHASER(S)

To better qualify our Buyers, at the time an Offer to Purchase

is submitted on this business, the offer must be accompanied

by a personal financial statement. If there is more then one

Purchaser, then we will request that they provide us with personal financial statements on all parties involved.

20

21