12.2-notes-week-4-bank-recon

advertisement

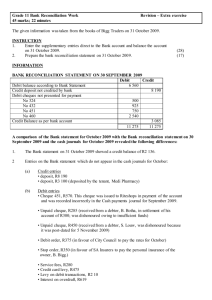

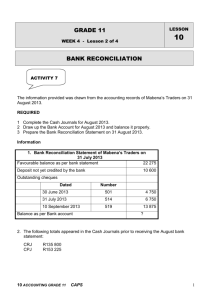

GRADE 11 WEEK 4 - Lesson 4 of 4 LESSON 12 BANK RECONCILIATION CLASS TEST ON BANK RECONCILIATION 12 ACCOUNTING GRADE 11 CAPS 1 ACCOUNTING GRADE 11 CLASS TEST BANK RECONCILIATION Total marks 35; time 25 minutes QUESTION The following information was taken from the records of Sun Traders. REQUIRED 1 Complete the Bank account for February 2013 2 Prepare the Bank Reconciliation Statement on 28 February 2013 (23) (12) INFORMATION 1 The following Bank Reconciliation Statement appeared in the books of Sun Traders on 31 January 2013 . Outstanding deposit 12 040 Outstanding cheques No 102 (21 August 2012) 136 No 396 (24 February 2013) 2 880 No 410 (20 March 2013) 7 652 2 The bookkeeper closed off the Cash Journals before the Bank Statement was received. The bank balance on 28 February, after posting the cash journals was a favourable balance of R21 864 3 The bank statement received from XYZ Bank on 28 February showed a favourable balance of R10 564. 4 The following items appeared on the Bank Statement but not the cash journals: Deposit of R12 040 Deposit of R3 840 from a debtor, S Smit Debit order for R6 400 to Outsurance to pay for insurance on the business vehicles of R3 800 and the balance on the owner’s private vehicle. Cheque no 396 appeared on the bank statement as R2 088. The bank entry is correct. The cheque was used to pay for stationery. 12 ACCOUNTING GRADE 11 CAPS 2 5 6 Unpaid cheque for R4 660. This cheque had been received from B Baloyi in settlement of his debt of R4 700. Cheque no 433 for R10 280. The original entry in the CPJ was for R8 280. The amount in the bank statement is correct. The cheque was issued to pay for trading stock. Cheque no 997 for R500. This amount was wrongly debited to our bank account as the payer was Zibi Traders. The following charges: - Service fees - Cash deposit fee - Interest on debit balance R300 R160 R240 The following items appeared in the Cash Journals but not on the Bank Statement: Cheque No 429 for R9 200 dated 15 March and issued to Walkman Wholesalers. Cheque No 443 for R900 and dated 28 February 2013 and issued to Seaside Traders. A deposit on 28 February 2013 for R19 560 Cheque No 102 had been issued to Oldies Homes as a donation. A new cheque No 444 was issued to Oldies Homes on 28 February for R1 000 as a donation. No entries have been made to record this cheque and it does not appear on the bank statement. 12 ACCOUNTING GRADE 11 CAPS 3 ACCOUNTING GRADE 11 CLASS TEST BANK RECONCILIATION Total marks 35; time 25 minutes /35 NAME________________________________________________________ GENERAL LEDGER OF SUN TRADERS BANK 23 BANK RECONCILIATION STATEMENT ON 28 FEBRUARY 2013 Debit Credit 12 12 ACCOUNTING GRADE 11 CAPS 4 ACCOUNTING GRADE 11 CLASS TEST – BANK RECONCILIATION MEMO GENERAL LEDGER OF SUN TRADERS BANK 2009 Jan 1 Balance 31 Debtors control / S Smit Stationery 21 864 3 840 792 136 Donation 2009 Jan 31 Insurance Drawings 3 800 2 600 Debtors control / B Baloyi Trading stock 4 660 2 000 Bank charges 460 Interest on overdraft 240 Donation 1 000 Balance c/d 11 872 26 632 Feb 1 Balance b/d 26 632 11 872 [23] Bank Reconciliation statement on 28 February 2013 Debit Credit Credit balance according to Bank statement 10 564 Credit outstanding deposit 19 560 Credit amount wrongly debited 500 Debit outstanding cheques: No 429 9 200 No 443 900 No 410 7 652 No 444 1 000 Debit balance according to bank account 11 872 15 312 15 312 if both totals are the same [12] 12 ACCOUNTING GRADE 11 CAPS 5