The relationship between international trade and economic growth

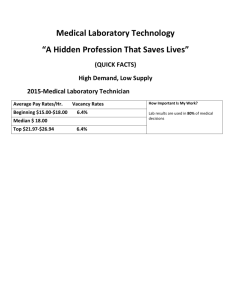

advertisement