introduction - Department of Agricultural Economics

advertisement

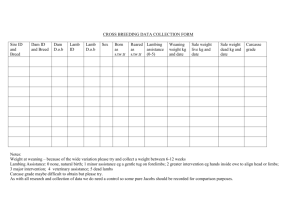

Table of Contents Executive Summary ...................................................................................................i Introduction ...............................................................................................................1 Environmental Analysis 1 Internal ...........................................................................................................1 External ..........................................................................................................2 Customer ........................................................................................................4 SWOT Analysis .........................................................................................................5 Marketing Goals and Objective .................................................................................9 Action Plan.................................................................................................................9 Product ...........................................................................................................9 Price ...............................................................................................................10 Place ...............................................................................................................11 Promotion.......................................................................................................11 Financial Analysis ......................................................................................................14 Monitor and Control ..................................................................................................16 Contingency Plan .......................................................................................................16 Summary ....................................................................................................................16 References ..................................................................................................................18 Appendix A: PowerPoint Presentation ......................................................................1 1 EXECUTIVE SUMMARY The AgGrow Marketing Group has developed this marketing plan as a solution for the American Lamb Council’s (ALC) lack of strategic direction. Through an environmental analysis, intense research, and the development of the integrated marketing approach, this proposal provides the ALC with the marketing objectives that will alleviate the industry’s lack of positioning. By correlating the industry’s strengths with its opportunities as well as minimizing its weaknesses and threats, the AgGrow Marketing Group has created a multi-faceted marketing plan that will allow the American lamb industry to increase the volume of lamb consumed and therefore the volume produced. The majority of American lamb consumers are currently located in the urban areas of the East and West coast regions of the United States. They are upper class, older citizens and are of Asian or Middle Eastern decent. The objectives of the marketing plan are to transcend consumption habits from the coastal geographic regions to the central United States by educating the consumer, creating awareness, and by developing loyal consumers. The action plan includes a description of product, price, place (distribution), and promotional activities. Fresh American Lamb® is healthier than beef, pork, and dark chicken. Consumers prefer it over Australian lamb due to the milder flavor and greater plate coverage. Given these advantages, Fresh American Lamb® is now fabricated into smaller, easier to cook cuts at the retail level that provide consumers with the desired convenience attributes. 2 The pricing of Fresh American Lamb® is largely influenced at retail and packing levels of the industry. Current retail prices range from $2.50 to $4.95 per pound. Further, we will maintain our current distribution relationships in this marketing plan. A rigorous promotional campaign will be implemented to accomplish organizational goals and objectives. In the first year, ten hotel chains, having over 2,000 nation-wide locations, will be targeted to include lamb in their restaurant menus. This promotional activity is projected to increase lamb consumption by 3.4 million pounds, which translates to an approximate 68,000 head of lambs demanded. The second and third year promotional activities will involve continued focus on the hotel chains. However, the marketing plan will more aggressively target retailers and the end consumers. These objectives will be accomplished through the utilization of trade shows, displays, and multiple advertising media, including magazines and newspapers. The promotional activities will target a market of 19.1 million consumers in seven states strategically distanced from the large packing plants in Texas and Colorado. Also during the third year, co-branding efforts with Healthy Choice® and Earnest & Julio Gallo® wines will be implemented. The effects of the third year promotional efforts equate to a nearly three-fold increase in demand from the first year. Funds for these promotional activities are acquired through the newly implemented lamb check-off program. During the first year, assessments are estimated to be $3.2 million dollars and increase to $4.9 million by the third year. These funds will be allocated to the aggressive advertising activities. Data collected through efficient consumer response and category management will be used to aid in monitoring the effectiveness of the marketing campaign in relation 3 to the ALC goals and objectives. If these objectives are not being satisfied, a contingency plan will be implemented. This plan involves expediting the marketing plan by including the East and West coast regions in the initial seven state rollout during the third year. The primary activities in these regions will involve increasing the share of current consumers. 4 INTRODUCTION The AgGrow Marketing Group has been chosen by the board of the American Lamb Council (ALC) to develop and implement a multi-faceted marketing plan targeting current non-users of lamb products in order to increase the volume of lamb consumed and ultimately produced, thereby shifting the demand curve for lamb meat. ENVIRONMENTAL ANALYSIS Internal Environment The American Lamb Council’s (ALC) mission is to facilitate the promotion of lamb and influence legislation to protect and aid the industry. It is a goal of the organization to represent the producer and seasonally promote the lamb products they produce. However, these goals are not consistent with recent changes in the economy and the meat industry. The evolution of the customer profile over the past 20 years has proven convenience and value-added items are in demand. Customers have also shown greater demand for healthier foods. The current performance of the industry’s marketing efforts is behind other close competitors for several key reasons. First, the ALC and other lamb and sheep organizations have flawed marketing strategies for the products. In addition, there is a lack of industry support for marketing objectives because of the usual expense related to effective marketing and advertising. Finally, the marketing plans that have been used in the past were unsuccessful because of the ALC’s inability to effectively implement, monitor, and control the plan. The American Sheep Industry Association (ASI), the parent company of the ALC, in cooperation with the United States Department of Agriculture (USDA), has recently 5 implemented a check-off program that will aid in the promotion of lamb. Assessments for the program will begin in July of 2002. Producers will be charged $0.03 per pound of lambs sold on the hoof, and packers will be charged $0.30 per head slaughtered (Source ASI). It is expected the lamb industry will receive $3.2 million in the first year for marketing efforts (Source Paul Rogers, ALC). With this additional funding a large scale marketing plan will be enacted with the intent to increase consumer awareness, facilitate more relationships with food retailers and ultimately increase the demand for lamb. Therefore the industry will need to aggressively focus on the needs of the lamb consumer to accomplish marketing objectives. External Environment The lamb industry faces fierce competition with many different meat products. The largest and most similar competitor is the beef industry. Since beef is a red meat, close association between lamb and beef sometimes occur. In addition, beef has effectively implemented a rigorous marketing campaign that has increased the per capita consumption of beef products. Pork is another competitor of lamb that experienced increases in per capita consumption of pork after the inception of the industry’s marketing plan. Poultry is also a competitor because it is less expensive and is assumed to be leaner than lamb. It is the high price of lamb that makes total budget competitors a major concern for the ALC. Per Capita Lamb Consumption Trends in the United States Lbs. per Year 1.2 1.0 Lamb 0.8 0.6 1985 1990 1995 2000 Year Figure 1 (foodservice.com) Figure 2 6 Lbs. per year Per Capita Consumption Trends in Competing Industries in the United States 80.0 70.0 Fresh Meat Consumption in 2002 Beef 60.0 50.0 Pork 40.0 30.0 1985 35.89% 37.06% Poultry 1990 1995 2000 Year Beef Pork Lamb Chicken .46% 26.58% Figure 3 (foodservice.com) Figure 4 (foodservice.com) As can be seen in Figure 1, there has been a steady decline in the amount of lamb consumed since 1985. This trend also correlates with the decreased production trends, which are illustrated in Figure 2. Meanwhile, poultry, beef, and pork have experienced steady, or increasing growth as demonstrated by Figure 3. It is important to note that beef, pork, and poultry all have roughly one-third of the market share of fresh meat, while lamb, has less than one-half of one percent as evidenced in Figure 4. Fortunately, the United States has experienced a very strong economy over the past 20 years. Despite some economic downturns, food products continue to see growth in demand. Consumers are showing greater buying power through increased disposable incomes yet have experienced little inflation. Because of this, consumers are more willing to purchase processed food products instead of raw products that would require more preparation at home. Increased incomes, more women in the workforce, increased single member households, and more dual income families have demonstrated the trend for less food being eaten at home. 7 It is important to note that foreign competition has been of little relevance over the past three years since the implementation of a Tariff Rate Quota on foreign lamb. The International Trade Commission (ITC) responded to dumping allegations made by U.S. producers towards Australian and New Zealand lamb producers. President Bill Clinton signed Petition 201 into law in 1998. However, Petition 201 will end in 2002, and therefore foreign competition will again be a major threat to the industry. During the three years of Petition 201’s effectiveness, ALC and lamb processors have taken advantage of technological trends and should be able to compete with foreign lamb, as packers have added fabrication facilities to their plants. Customer Environment1 Current customer profiles include specific ethnic groups on the east and west coast regions of the United States. These ethnic groups include: Greek, Hispanic, Middle Eastern, and American Indian to name a few. Avid lamb consumers are characteristically in the 55-64 age bracket as well as retired persons in the 65+ age bracket. The largest amount of lamb consumption is found in urban areas amongst those consumers in the top 20% income bracket. Potential customers for the lamb industry include food service institutions, middle-income families, and consumers located in the central and southern United States. The lack of position in these consumers’ minds make them the optimum consumers to target because they are least likely to have tried lamb before but should be more willing to consume it once they become aware of the product. Lamb is currently purchased at grocery stores, a few restaurants, and specialty shops that cater to specific ethnicities. Seasons also influence the consumption of lamb 8 as most consumption occurs during Ramadan and the Orthodox Easter as well as Christmas and Christian Easter. The reasons for not purchasing lamb include: unawareness of the product, being uneducated about the product’s health benefits, lack of purchasing power, little availability in retail outlets in the United States, and lack of convenience. The associated marketing plan will address all of these issues in the action plan and ultimately increase the demand for lamb. SWOT ANALYSIS Strengths 1. Absence of negative media Unlike the beef industry’s problem with the Mad Cow Disease scare, lamb has not found itself faced with seriously negative publicity. This inherently gives the lamb industry an advantage, as people may think of it as safer than other meat products such as beef. 2. Lamb is leaner and healthier than beef. Using tactics much like the Nutritional Meat Facts pork industry did in its “The Calor ies Total Fat Sat. Fat Cholest erol Lamb Leg 160 7g 2g 76mg Pork (Fresh ham) Beef Round 179 8g 3g 80mg 164 7g 2g 69mg boasts more health benefits as Chicken (dark) Chicken (light) 174 8g 2g 79mg can be seen in Figure 5. 147 4g 1g 72mg Other White Meat” marketing campaign, the lamb industry Figure 5 1 Assumptions based on TAMRC Report and ASI information 9 3. Lamb producers are able to respond to changes in demand quicker than other producers. Due to the shorter gestation periods and higher prolificacy in sheep, lamb producers are able to increase and decrease the supply in order to respond to demand easier and quicker than beef producers. 4. The lamb industry has access to the monetary resources it needs. The lamb industry may receive funds from the government as part of the 2002 Farm Bill. Also, a check-off program will give the industry the continued funds needed to strengthen its strategies. Weaknesses 1. No positioning Lamb has little to no place in the minds of most Americans. People do not consume much lamb relative to other meat products due to a lack of knowledge and accessibility. Further, many potential consumers fail to realize lamb is a possible alternative for fresh meat. 2. No use of brand or product image There is currently no unifying entity that promotes lamb products, which means that advertising for lamb has been extremely limited. 3. Limited retail shelf space Lamb products exhibit a minute presence in grocery stores due to the lack of interest in consumption of lamb. In fact, grocery stores average less than three foot of shelf space for lamb products (Source personal research at H.E.B.). 10 4. Little to no unity in the industry along with a lack of strategic direction. Producers and meat packers in the United States have a heavy interest in the lamb industry, yet they have been unsuccessful at unifying their marketing efforts. Opportunities 1. Cooperation of firms, such as restaurants and hotels. Hotels and restaurants have formed alliances with other groups, such as pecan growers, in which both parties benefit. Such opportunities could also be achieved in the lamb industry. 2. Higher disposable incomes As the United States moves out of a slight recession, Americans are more willing as well as more able to spend money. Having more money to spend gives lamb a greater chance of being purchased. 3. Convenience items are in demand In a time of technological advances and change, Americans are looking for every possible convenience item that is available. Lamb meat can be added to various convenience products and can be fabricated to be faster cooking. 4. Room to make a position in the minds of consumers Negative attitudes toward lamb are nonexistent due to the lack of a position in the minds of consumers. This leaves room for the lamb 11 industry to start off on the right tract with their potential consumers and gain customer loyalty. Threats 1. The end of Petition 201 Petition 201 is a tariff-rate quota that had been placed on Australian and New Zealand lamb being imported to the U.S. It was put in place in order to protect the American lamb industry. This trade barrier will be eliminated in 2002 allowing Australia and New Zealand to increase their lamb exports to the United States. 2. Reactive pressures from other commodities The lamb industry must face competition from other commodities, such as beef and pork, which have already found benefits in uniting their respective industries. The lamb industry must face the risk of these commodities taking a firm stand and trying to upgrade their marketing techniques in order to counter-act the effects of the lamb promotion. 3. Continued declining market share The lamb industry is faced with a continuous decline in market share as the amount of retail shelf space continues to diminish. Since consumers currently are not interested in purchasing lamb, retailers have no reason to supply it. Synergies Weaknesses and Threats to Strengths 12 The fact that lamb has no position in the minds of consumers gives the lamb industry the benefit of making a good first impression as well as a lasting one. By making a good impression, consumers will have the desire to purchase a greater amount of lamb, which will cause retailers to increase their amount of shelf space. This should also influence food service institutions to include more lamb dishes on their menus. Strengths to Opportunities By using the healthiness factors of lamb, the lamb industry could better influence supporting firms to purchase their products. This can also be used to aid in persuading firms to incorporate lamb into convenience food items that are intended to be healthy. MARKETING GOALS AND OBJECTIVES The marketing objectives that have been P D1 D2 established for the ALC are to increase the demand for lamb by educating the consumer, creating awareness, and by developing loyal consumers. Figure 6 illustrates the increase in demand after the implementation of the Q Figure 6 marketing plan. The long-term strategic goal is to execute a national marketing campaign by the end of the fifth year. ACTION PLAN Product Lamb in general is a more nutritious alternative for other meat sources. It has fewer calories than beef, pork, and dark chicken as well as less total fat and saturated fat. Lamb is also very comparable in the area of cholesterol (Source lambchef.com). 13 Fresh American Lamb® is preferred over New Zealand and Australian lamb due to having a milder flavor as well as greater plate coverage, which is primarily due to the fact that American lamb is grain fed while Australian lamb is grass fed. The use of fabrication technology allows packers to supply higher margin, more value-added products. Fabricators and packers have begun cutting lamb into more convenient cuts rather than only selling a whole leg of lamb. Currently lamb is in the decline stage of the product life cycle, which is evidenced by the yellow dot in Figure 7. By reintroducing Fresh American Figure 7 Lamb® as essentially a new product that offers convenience and health benefits, the product should move to the red dot in Figure 7, which is in the introduction stage. It is important to note that many of the marketing ideas for Fresh American Lamb® are still in the development stage of the product life cycle, but by the end of our promotion calendar lamb should move into the introduction stage. Price The ALC and producers have very little influence on prices themselves because lamb is a commodity. The oligopoly structure of the packers, allows them to greatly influence the prices received by the producers as well as the cost to the end consumers. Retailers and other food institutions capitalize on setting the final price to the consumer, 14 and therefore usually receive the largest margin of the food-marketing bill for lamb products. Currently, retail prices range from $2.50 to $4.95 per pound (Source ASI). Place (Distribution) The largest meat packers are located in Texas, California, and Colorado. Packers and fabricators ship FOB destination to distribution hubs and major retailers. Current methods of distribution will continue to be used in order to supply lamb to the increased number of retailers and other food service institutions. Promotion Push Various methods will be used to push Fresh American Lamb® through to both retailers and other food service institutions throughout the time of the promotional calendar. Print advertisements in both retail and food service magazines will be used in order to increase the awareness of lamb in these areas. Also, personal selling to executive chefs at hotels and restaurants as well as the retail level will be relied on heavily. Finally, the ALC will make its presence and the presence of its products known by participating in various trade shows throughout the target areas. Pull In order to appeal to the end consumer, print advertisements in magazines such as Southern Living and Women’s Day will be used. Eventually, Fresh American Lamb® print advertisements will be seen in prestigious national publications such as the 15 Wall Street Journal. In-store samples as well as point-of-sale displays will also be used to persuade end consumers to purchase Fresh American Lamb®. Promotion Calendar—1st Year During the first year, personal selling promotional activities will be utilized in order to break into new markets. These activities will be targeted toward executive chefs in large food service institutions. Hotels Adamsmark Club Med Double Tree Embassy Suites Hilton Mariott Omni Radisson Weston Wyndham #of Chains 35 46 96 159 499 987 78 237 457 47 Figure 8 lists Total 2,641 Figure 8 (Source personal research) chosen as the target market during the first year along with their corresponding number of the ten luxury hotel chains that have been locations in the United States. It is estimated that targeting these hotel chains that consumption will increase at each location by 25 pounds per week. The calculations show an increase in lamb consumption of 3.4 million pounds in the first year. From a production stand point, estimating a carcass weight of 50 pounds per lamb, production will have to increase by roughly 68,000 head to meet this new demand. It is also important to realize that promotional activities such as specials will be taking place within the restaurants at the hotel chains. These activities will primarily involve having specials that include lamb as the primary entrée. Promotion Calendar—2nd Year 16 Marketing efforts toward these hotel chains will continue throughout the second year. Toward the end of the second year, marketing efforts will simultaneously be focused toward both retailers and end consumers. Retailers will be reached primarily through personal selling; however, limited print advertising in retail magazines will also be used. Promotion Calendar—3rd Year During the third year, marketing efforts will mainly focus on the end consumer. The target market will consist of consumers over the age of 25 who live in urban areas and have an annual income of over $25,000. They will include people who are stay-at-home parents Figure 9 (U.S. Census Bureau) or consumers who have a high demand for convenience food products. The final stipulation is that they are currently non-users of Fresh American Lamb® meat products. The targeted areas will include Dallas/Fort Worth, Denver, Kansas City, Chicago, Cincinnati, St. Louis, Houston, and Atlanta. These areas were chosen based on their proximity to the large packing and fabrication facilities in Colorado and Texas and because they showed to have the lowest incidents of lamb consumption. Therefore, there will be a seven state rollout for the promotion as can be seen in Figure 9. The target market therefore totals 19.1 million people (Source U.S. Census Bureau). 17 In order to reach this target market, aggressive print advertising will be utilized along with in-store samples and point of sales displays. Exposure from the first and second year’s activities should increase awareness of Fresh American Lamb®, which will facilitate the communication objectives within the target market. Also during the third year, the ALC will enter into co-branding relationships with two very recognized brands. These include Healthy Choice® and Earnest &Julio Gallo® wines. Healthy Choice® was chosen because it is owned by Con Agra® who also owns the third largest packing plant in the United States located in Greeley, Colorado. These ties give Healthy Choice® additional incentives to join in the co-branding efforts, as they can use lower price cuts to increase margins for the company. The primary activity with Healthy Choice® will be frozen dinners with lamb as the primary entrée. Secondly, Earnest & Julio Gallo® wines was chosen because wine and lamb are considered excellent complements. Point-of-sale displays and print advertisements, such as the one seen in Figure 10 will be used to promote the co-branding efforts. Figure 10 Pro Forma Financial Analysis FINANCIAL ANALYSIS The funds for the integrated marketing plan that has been proposed will be provided solely through the check-off program. It is Year 1 3200 0 3200 Year 2 3900 1871 5771 Year 3 4900 1691 6591 560 95 106 0 384 0 13 73 710 100 397 876 1620 0 29 240 900 105 466 1068 2700 929 31 240 Administrative Expenses 98 108 152 Total Expenses 1329 4080 6591 Gain/loss 1871 1691 0 Check-off Reciepts (1000's) Carryover Total Budget Marketing Expenses (1000's) Sales Representatives Executive Chef Promotional Items Cooperative Advertising Print Advertising Co-Branding Technical Support Trade Shows/In-store prom. Figure 11 18 projected that check-off receipts will provide $3.2 million in the first year. Followed by $3.9 million in the second year and $4.9 million in the third year. As can be seen in Figure 11, the bulk of this money will be allocated towards marketing expenses. These expenses include: sales representatives, the ALC executive chef, promotional items, cooperative advertising with retailers, print advertising, co-branding advertising, technical support, and trade shows/in-store promotions. The largest amounts of money will be spent towards print advertising because it is our primary source of promotion. During the first year, eight sales representatives will be hired at $70,000 per year in order to accomplish our personal selling goals. During the second and third years, ten and twelve sales representatives will be on staff making $71,000 before getting a raise to $75,000. The executive chef is necessary for our advertising in order to develop new recipes and prepare the food for the advertisements. Promotional items include anything from coupons and lamb memorabilia to aiding the targeted hotel chains’ in-restaurant specials. In order to further encourage retailers to carry Fresh American Lamb®, cooperative advertising efforts will be used. During the third year, co-branding promotional efforts will cost $929,000. In order to continue maintenance on the ALC’s website, further technical support will be required. Finally, trade shows and in-store promotions are a vital part of our overall promotion efforts. The funds for the check-off program are also used to aid in the administration expenses as evidenced by Figure 11. It is also important to note that this integrated marketing plan does not require full utilization of the check-off receipts during the first and second years. These funds are carried over to the second and third years respectively in order to ensure accurate and 19 efficient implementation of the plan. By the end of the third year, all monetary resources are employed. MONITOR AND CONTROL Several steps will be taken to monitor the success of Fresh American Lamb®’s promotional activities and measure the effectiveness of communications with clients and consumers. In cooperation with retailers and food service institutions, effective consumer response (ECR) and category management data will be collected monthly. The results from these reports will be compared to the ALC’s strategic goals and objectives to determine if the promotional activities effectively accomplish our projections. In addition, we will continue consumer surveys and taste panel research as long as the product is in the introduction and/or growth stages of the product life cycle. The information obtained from this research will not only be used to monitor communication effectiveness, but it will essentially aid in the strategic planning of future promotion activities. CONTINGENCY PLAN While the AgGrow Marketing Group is excited and confident that the proposed marketing plan will work effectively, it is necessary to acknowledge the possibility of not meeting sales or volume objectives. Therefore, a contingency plan has been developed. This plan would involve expediting the original marketing plan to include the East and West coast regions in the initial seven state rollout in the third year. Another alternative is to further develop ways of increasing the share of the current consumers. 20 SUMMARY The AgGrow Marketing Group has developed a multi-faceted and integrated marketing plan based on the information derived in the environmental analysis of the lamb industry. This plan includes a calendar of events for the upcoming three years and involves both push and pull promotional activities. The push activities include print advertisements, personal selling, and trade shows. The pull activities include print advertisements, point-of-sale displays, and in-store samples. This marketing plan will increase the volume of lamb consumed and therefore increase sales and production, but most importantly, it will “fatten the pocket books” of the members of the American Lamb Council. 21 RESOURCES American Lamb Council (ALC), www.lambchef.com, Accessed February 2, 2002 Through May 2, 2002 American Meat Institute (AMI), www.meatami.org, Accessed March 30, 2002 American Sheep Industry Association, Inc. (ASI), www.sheepusa.org, Accessed February 2, 2002 through May 2, 2002 FoodService.com, www.foodservice.com, Accessed February 2, 2002 through May 2, 2002 H.E.B. Meat Department Manager, Brenham, Texas, Personal Interview, April 24, 2002 Nichols, et al, TAMRC Lamb Study Team, Research Report No. CM-1-91, December 1991. Rogers, Paul, Personal Interview, American Lamb Council, (303) 771-3500, April 22, 2002 U.S. Department of Agriculture (USDA), Agriculture Marketing Service, Livestock and Grain Marketing News. U.S. Department of Agriculture (USDA), Foreign Agriculture Service. Circular Series, “Livestock and Poultry: World Markets and Trade.” L&P 2-99. October 1999 U.S. Department of Agriculture (USDA), Sheep and Goats, National Agricultural Statistics 2000. U.S. Department of Commerce, Economics and Statistics Administration, “Statistical Abstract of the U.S.” 118th edition. 22