Review 1

advertisement

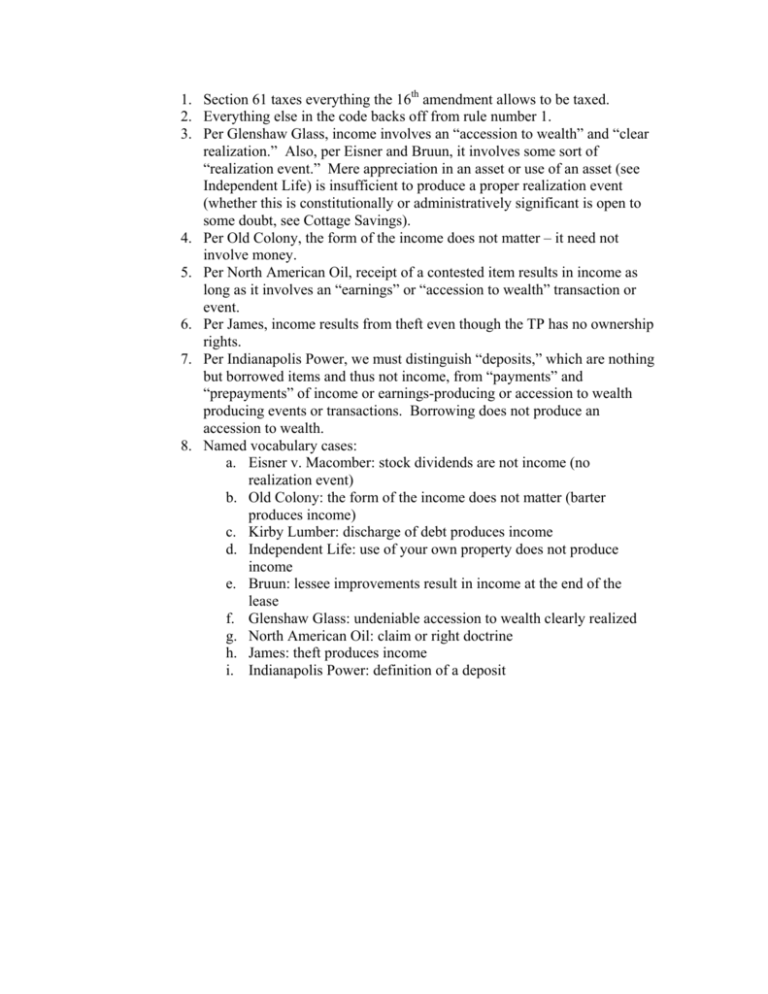

1. Section 61 taxes everything the 16th amendment allows to be taxed. 2. Everything else in the code backs off from rule number 1. 3. Per Glenshaw Glass, income involves an “accession to wealth” and “clear realization.” Also, per Eisner and Bruun, it involves some sort of “realization event.” Mere appreciation in an asset or use of an asset (see Independent Life) is insufficient to produce a proper realization event (whether this is constitutionally or administratively significant is open to some doubt, see Cottage Savings). 4. Per Old Colony, the form of the income does not matter – it need not involve money. 5. Per North American Oil, receipt of a contested item results in income as long as it involves an “earnings” or “accession to wealth” transaction or event. 6. Per James, income results from theft even though the TP has no ownership rights. 7. Per Indianapolis Power, we must distinguish “deposits,” which are nothing but borrowed items and thus not income, from “payments” and “prepayments” of income or earnings-producing or accession to wealth producing events or transactions. Borrowing does not produce an accession to wealth. 8. Named vocabulary cases: a. Eisner v. Macomber: stock dividends are not income (no realization event) b. Old Colony: the form of the income does not matter (barter produces income) c. Kirby Lumber: discharge of debt produces income d. Independent Life: use of your own property does not produce income e. Bruun: lessee improvements result in income at the end of the lease f. Glenshaw Glass: undeniable accession to wealth clearly realized g. North American Oil: claim or right doctrine h. James: theft produces income i. Indianapolis Power: definition of a deposit