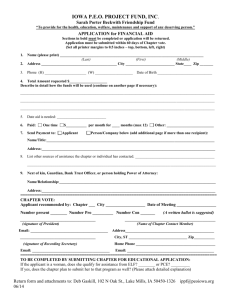

Visa® Gold Card Application & Disclosure

advertisement

Credit Card Application When you have completed your application, take it to any TSB office or mail to P.O. Box 1260, Pigeon Forge, TN 37868 Account Type Business Individual Joint Application * * We intend to apply for joint credit Business Legal Structure Sole Proprietor Partnership Corporation Limited Liability Company Applicant’s Signature Checking or NOW Account # Name APPLICANT Card Type Visa® Gold Card Co-Applicant’s Signature Financial Institution City Location Other Accounts (Any Financial Institution) Birth Date Social Security # Home Phone # Address (No PO Box) Street City State Zip Yrs at this address Mailing Address Street City State Zip Yrs at this address Previous Address Street City State Zip How long Employer Employer’s Address Street City State Business Phone # Your Position Zip Previous Employer How long Address Drivers License # State Issued Issued Date Phone # Relationship Name Address (No PO Box) Street City State Zip Employer Employer’s Address Street City State Mother’s Maiden Name Number of Dependants How long Name of nearest Relative NOT living with you CO-APPLICANT Numbers of Cards Requested:__________ Requested Limit: $ __________________ Expiration Date Address Birth Date Social Security Number Yrs at this address Home Phone # How long Business Phone # Your Position Zip Previous Employer How long Address Drivers License # State Issued Issued Date Expiration Date FINANCIAL INFORMATION Verification of Income should be provided. Please supply TSB Account where ACH from employer is credited ______________________ and/or submit copies of current pay stubs. Alimony, child support or separate maintenance Monthly Salary Other Monthly Income Total $ income need not be revealed if Applicant or CoApplicant doesn’t wish it considered as a basis for Applicant Co-Applicant Applicant Co-Applicant repaying this obligation Source of additional income: Assets (Description/In name of) Home Value $ Obligations (Company name & City location) Rent/Mortgage Real Estate Auto Vehicles, Boats,etc Charge Account Stocks, Bonds Other Cash, Savings Other Other Other Other Other Total Assets $ $ Monthly Payment Account # Total Obligations $ $ Balance $ Are there any unsatisfied liens or judgments SIGN HERE Overdraft Protection INTERNAL USE ONLY Yes! Please enroll me in the Overdraft Protection Program. My TSB Account # is________________________. I understand that funds will be automatically deposited to the designated checking account in $50.00 increments to cover items that would otherwise overdraw the account. This deposit will be a charge to the credit card, and will occur only if credit availability is sufficient. $5 will be charged to the checking account per debit or check covered by this overdraft protection. I certify that I am at least 18 years of age and the information which I have furnished on this application is true and complete. I have read the agreement and agree to the terms and conditions of the account for which I am applying. I authorize TSB to obtain information to check my credit records and statements made in this application. I understand that you will retain this application whether or not it is approved. DATE APPROVED CARD TYPE CREDIT LINE Applicant’s Signature Co-Applicant’s Signature RATE Date APPROVED BY Date # OF CARDS Tennessee State Bank Visa® Gold Credit Card Applicant’s Copy- To be retained by Applicant Interest Rates and Interest Charges Annual Percentage Rate (APR) Purchases 3.9% Introductory APR for six (6) billing cycles on new accounts After that, your APR will be 8.25% (standard APR). This APR will vary with the market based on the Prime Rate Annual Percentage Rate (APR) Balance Transfers 3.9% APR for six (6) billing cycles from the date of transfer APR for Cash Advances 18.25% After that, your APR will be 8.25% (standard APR). This APR will vary with the market based on the Prime Rate This APR will vary with the market based on the Prime Rate How to Avoid Paying Interest on Purchases* Your due date is at least 25 days after the close of each billing cycle. We will not charge you interest on your purchases if you pay your entire balance by the due date each month*. Minimum Interest Charge For Credit Card Tips from the Federal Reserve Board None To learn more about factors to consider when applying for or using a credit card, visit the website of the Consumer Financial Protection Bureau at http://www.consumerfinance.gov/learnmore. Fees Annual Fee Transaction Fees Cash Advance None Either $5 or 4% of the amount of each cash advance, whichever is greater (maximum fee: $50). Balance Transfer Fee Either $5 or 4% of the amount of each transfer, whichever is greater (maximum fee: $50). Foreign Transaction 1% of each transaction in U.S. dollars. ATM Fee None Up to $35 Up to $35 Penalty Fees Late Payment Returned Payment How We Will Calculate Your Balance: We use a method called “average daily balance (including new purchases)”. *Finance charges on cash advances and balance transfers are assessed from the day you take the cash advance or balance transfer until the day we receive payment in full, there is no grace period. Transactions for overdraft protection services are cash advances. Card Replacement Fee: Documentation Copies: Expedited Delivery Fee: Stop Payment Fee: $5—We may charge this fee for any replacement card ordered by the cardholder. $3/copy—We may charge this fee for each copy provided. $40—We may charge this fee if you request expedited delivery of new or replacement cards. $30—We may charge this fee if you request a stop payment on an automated recurring charge to your credit card account. 2 CHARITY CARD: You may elect at application to carry a charity card to show your support of the Friends of the Smokies for an annual contribution of $10 per charity card issued on the account. This contribution will be charged to your credit card account at account opening and annually thereafter. One hundred percent (100%) of contributions collected are given to the Friends of the Smokies, a non-profit organization dedicated to the preservation and protection of the Great Smoky Mountains. You may cancel this election at any time by calling Credit Card Services at (865)429-2273. If cancelled, your card will be reissued with a standard design. Disclosure Effective 05.01.2014. Information about the costs and the rates is accurate as of April 2014. This information may have changed after that date. You may contact us to find out what may have changed by directing inquiries to Tennessee State Bank, Attention Bank Card Services, P.O. Box 1260, Pigeon Forge, TN 37868-1260; or call us toll-free at (877) 908-4TSB (4872). USA Patriot Act IMPORTANT INFORMATION ABOUT PROCEDURES FOR OPENING A NEW ACCOUNT, UPDATING AN ACCOUNT OR PERFORMING TRANSACTIONS To help the government fight the funding of terrorism and money laundering activities, Federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens or updates an account or performs transactions. What this means to you: When you open or update an account or perform a transaction, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents and retain copies of those documents. When opening or updating an account, we may also ask other information of you required by current regulatory guidance such as if you perform money services business activities; if you may be related to any foreign political official; and what levels of different types of transactions you expect to perform in your account. 3