Your Bank + Elan Financial Services =

advertisement

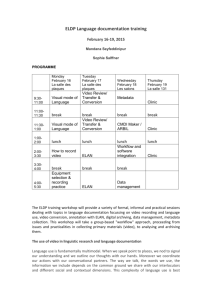

Your Bank + Elan Financial Services = Credit Card Issuing Alliance Leveraging the power of your brand. Strengthening your suite of credit card products. Partnership for your success. Collaborative Partnership Structure When you partner with Elan, your brand is the foundation of our alliance structure. Elan provides the tools and resources to achieve greater success, reduce expenses, and drive bottom-line results. Here are some of the resources available to our partners: Extensive Tools • Applicant prescreen and instant decision capabilities • Support cardmember inquiries • Accept branch payments Tenured Team • Relationship manager to champion the alliance • Marketing and training specialists to ensure growth • Direct support hotline to assist your employees with all questions Comprehensive Reporting • Product performance • Cardmember list • Marketing campaign results • Employee sales tracking About Elan Our History • A wholly owned subsidiary of U.S. Bancorp. • A market leader with almost 50 years of experience. • Currently partner with more than 1,600 financial institutions. Our Credit Card Issuing Alliance • In-house processing and servicing platforms for our partners. • 100% domestic service via Elan-owned service centers. • Brand-centric marketing strategy – customers see only your brand. Our Marketing Program Elan fully funds a turnkey marketing program that leverages your brand on all cardmember-facing materials. Take satisfaction in knowing your brand always plays the lead role, while we support your program behind the scenes — all at no cost. This program includes direct mail campaigns, telemarketing and branch promotions for both cardmembers and employees. You can also choose to opt in to these programs. Visa Signature Elite Rewards Program Guide ® CASH BACK * GIFT CARDS * MERCHANDISE * TRAVEL Employee Marketing Campaigns • Monthly and quarterly employee promotions • Customized promotions to generate awareness and engagement Call Center Marketing • Employee and group incentives for call center staff • Leverage Elan’s online application tool Web Marketing • Online application accessible to customers Direct Mail Campaigns • Six target campaigns annually • Leverage your customer list to target all cardmember segments Ongoing Portfolio Marketing • Targeted offers to retain interest from existing cardmembers • Target and resell value proposition to lapsed cardmembers Cash R Amer ewards ican E xpres ® s Ca rd Trave l Rew ards Amer ican E xpres ® s Ca rd Bonus PLUS* Rewards Rewa rd Bonus um* Platin Leverage Elan’s highly robust credit card products to successfully compete against the top 10 issuers. s* Our Product Suite REWARDS Cash back n n Merchandise and Gift Cards n n n Travel n n n n n REWARDS EARNED 3% cash back on gas purchases1 n 2% cash back on supermarket purchases1 n 3X points on airline purchases n 2X points on hotel & restaurant purchases2 n 2 25% monthly points bonus3 n 50% monthly points bonus 3 n 1 point / 1% per dollar on all purchases (base earn)1,2,3 n n n n BONUSES 2,500 points ($25 value) awarded after first purchase4 n 5,000 points ($50 value) awarded after first purchase4 n n 7,500 points ($75 value) awarded after first purchase4 n INTRO APR 0%5 intro APR for first 6 billing cycles on purchases and balance transfers 0%5 intro APR for first 12 billing cycles on purchases and balance transfers Annual Fee 5 n n n n None $50 None $95 n None *Includes both Visa and MasterCard Associations. 1 Cash Rewards Card Points: You will earn 1 Reward Point (“Point”) for each dollar of Net Purchases (purchases minus credits and returns) charged to your Account during each billing cycle. You will also earn 1 additional Point (for a total of 2 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at merchant locations that are classified in the merchant category code of supermarkets. The number of additional Points earned on supermarket Purchases is unlimited. In addition, you will earn 2 additional Points (for a total of 3 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at merchant locations that are classified in any of the following merchant category codes: automated fuel dispensers and service stations, up to a maximum of $6,000 spent during each 12 month period commencing on the anniversary date of this Account. Automated fuel dispenser and service station purchases above $6,000 (for the remainder of that 12 month period) will earn at a rate of 1 Point for each dollar of Net Purchases charged to your Account during each billing cycle. 2 Travel Rewards Card Points: You will earn 1 Reward Point (“Point”) for each dollar of Net Purchases (purchases minus credits and returns) charged to your Account during each billing cycle. You will also earn 1 additional Point (for a total of 2 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at merchant locations that are classified in any of the following merchant category codes: hotels and restaurants. In addition, you will earn 2 additional Points (for a total of 3 Points) for each dollar of Net Purchases charged to your Account during each billing cycle at merchant locations that are classified in the merchant category code of airlines. 3 The Elan Rewards Program is subject to change. Points earned on Net Purchases (purchases minus credits and returns). Points expire five years from the end of the quarter in which they are earned. Bonus Rewards: The 25% more in bonus rewards consists of 1 Reward Point for each dollar of Net Purchases plus an additional 25% (0.25) in points awarded based upon the total points earned on Net Purchases within a billing cycle (total 1.25%). Bonus Rewards Plus: The 50% more in bonus rewards consists of 1 Reward Point for each dollar of Net Purchases plus an additional 50% (0.50) in points awarded based upon the total points earned on Net Purchases within a billing cycle (total 1.50%). Monthly net purchase bonus points will be applied each billing cycle. 4 Reward points can be redeemed as a cash deposit to a checking or savings account or as a statement credit to your credit card account. First purchase bonus points will be applied 6 to 8 weeks after first purchase and are not awarded for balance transfers or cash advances. 5 Visa Bonus Rewards, Visa Bonus Rewards PLUS, Cash Rewards American Express® Card, Travel Rewards American Express® Card: The 0% introductory APR applies to purchases and balance transfers and is valid for the first 6 billing cycles. Thereafter, the APR may vary and as of 02-21-15, the undiscounted variable APR for Purchases and Balance Transfers is 11.99%-22.99% (based on your creditworthiness). Visa Platinum: The 0% introductory APR applies to purchases and balance transfers and is valid for the first 12 billing cycles. Thereafter, the APR may vary and as of 02-21-15, the undiscounted variable APR for Purchases and Balance Transfers is 9.99%-20.99% (based on your creditworthiness). The variable APR for Cash Advances is 23.99%. Cash Advance fee: 4% of each advance amount, $10 minimum. Convenience Check fee: 3% of each check amount, $5 minimum, Cash Equivalent fee: 4% of each cash amount, $20 minimum. Balance Transfer fee of 3% of each transfer amount, $5 minimum. There is a $2 minimum interest charge where interest is due. The annual fee is $0 for Visa Bonus Rewards, Visa Platinum and Cash Rewards American Express Card. The annual fee is $50 for Visa Bonus Rewards PLUS and $95 for Travel Rewards American Express Card. Foreign Transaction fee: 2% of each foreign purchase transaction or foreign ATM advance transaction in U.S. Dollars. 3% of each foreign purchase transaction or foreign ATM advance transaction in a Foreign Currency. $0 Foreign Transaction Fees for Travel Rewards American Express Card. We apply your minimum payment to balances with lower APRs first, including promotional balances. Amounts paid over the minimum payment will be applied in the order of highest to lowest APR balances. We may change APRs, fees and other Account terms in the future based on your experience with Elan Financial Services and its affiliates as provided under the Cardmember agreement and applicable law. The creditor and issuer of these cards is Elan Financial Services, pursuant to separate licenses from Visa U.S.A. Inc. and American Express. American Express is a federally registered service mark of American Express. Reduce Your Risk On the surface, credit cards may appear to be a profitable business line, but profitability is severely impacted by compliance, fraud events and execution costs. These risks are augmented by today’s rapidly changing environment. Consider the bottom-line impacts of leveraging Elan’s infrastructure. When you partner with Elan, you are removing servicing costs, processing costs, collection costs and more: Comparison Structure Alliance Self-Issue Regulatory Liability Elan Bank Funding Liability Elan Bank Regulatory Capital Liability Elan Bank Loan Loss Elan Bank Origination / Marketing Elan Bank Underwriting Elan Bank Statements & Remittance Elan Bank Servicing Elan Bank Collections Elan Bank Interest Income Elan / Bank Bank Interchange Income Elan / Bank Bank Fee Income Elan / Bank Bank Bank Bank Management & Legal Elan Bank Funding Costs Elan Bank Card Loan Losses Elan Bank Card Fraud Losses Elan Bank Processor Costs Elan Bank Association Dues / Costs Elan Bank Rewards Expenses Elan Bank Portfolio Marketing Management Elan Bank Legal Execution Revenues New Account Incentive Expenses Know Your Competition Today, more than 85% of credit card spending is captured by the top 10 issuers – and that trend will only continue to grow. % of Total Industry Spend for Top 10 Issuers 85.84% 2012 69.38% 2007 Count on Your Results +3 8% Our program delivers the desired attributes of a pleased cardmember. We focus on creating high-quality products that earn our top-of-wallet designation from our cardmembers. Our best-in-class, engaged partners have an average 20% customer penetration rate.* See below how Elan drives better results in comparison to the industry average. Annual Spend Elan Industry +2 0% We focus on delivering a value proposition to the cardmember that entices use and drives loyalty. Credit Lines Our ability to provide high lines of credit help cardmembers feel comfortable making purchases. Elan Industry +6% Activation Strong initial offers and a compelling ongoing rewards proposition drive activation success. *Source: Elan proprietary data as of Q3 2013 Industry Elan