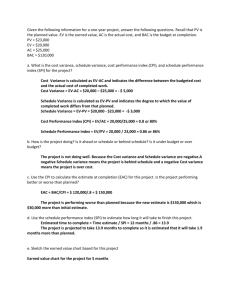

Protocols for Graphics, Reporting Volatility, and Related Topics 1

Economics 690

Tauchen

Fall 2015

Protocols for Graphics, Reporting Volatility, and

Related Topics

1 Units

1.1

Scaling Returns

The convention is to use geometric returns expressed as a percent. Thus if P i are the 5-min price observations, then we compute the returns as r i

= 100

× log ( P i

)

− log ( P i

−

1

)

1.2

Scaling Variance

The variance measures are in units of variance per day. The daily realized variance is

RV =

1 r i

2

The variance measures are convenient mathematically but very hard for the user to interpret.

Thus we will always report, unless told otherwise, the annualized versions. For the case of the realized variance this would be

Annualized Realized Variance: =

√

252

×

RV

The units are now in percent standard deviations per year.

2 Graphics

2.1

Default Matlab Graphics are Unacceptable

The default graphic for Matlab is optimized for viewing on the screen, but it is terrible for reporting results in papers and presentations. Below is a pretty bad plot of BAC 2007–2014.

A plot of the returns is equally bad. Some better graphics follow.

60

50

40

30

20

10

0

0000 0050 0100 0150 0200 0250 0300 0350 0400 0450

10

5

0

−5

−10

−15

−20

0000 0050 0100 0150 0200 0250 0300 0350 0400 0450

Some more effective plots of Bank of America are as follows:

2

Bank of America (BAC), 5−Min Returns

10

5

0

−5

−10

−15

−20

2007 2008 2009 2010 2011 2012 2013

Figure 1: Bank of America, 2007–2014

2014 2015

3

40

30

20

10

60

50

0

2007 2008 2009 2010 2011 2012 2013

Figure 2: Bank of America, 2007–2014

2014 2015

4

50

45

40

25

20

15

35

30

10

2008−01 2008−04 2008−07 2008−10

Figure 3: Bank of America, 2008

2009−01

5

Bank of America (BAC) 2008 09 16

30

29.5

29

28.5

28

27.5

27

26.5

26

25.5

09:00 10:00 11:00 12:00 13:00 14:00

Figure 4: Bank of America, September 9, 2009

15:00 16:00

6

Annualized Realized Volatility

200

150

100

50

0

Jan 03, 2007 Oct 19, 2007 Aug 11, 2008 Jun 01, 2009 Mar 17, 2010

Figure 5: Realized Variance (Annualized) XOM 2007-2010

Dec 30, 2010

7

Annualized Bipower Variation

200

150

100

50

0

Jan 03, 2007 Oct 19, 2007 Aug 11, 2008 Jun 01, 2009 Mar 17, 2010

Figure 6: Bipower Variation (Annualized) XOM 2007-2010

Dec 30, 2010

8