Dynamic Online and Offline Channel Pricing for Heterogeneous

advertisement

International Game Theory Review, Vol. 7, No.2 (2005) 137-150

@ World Scientific Publishing Company

"b

".

World Scientific

wwwworidscienlific.com

DYNAMIC

ONLINE AND OFFLINE CHANNEL

PRICING FOR HETEROGENEOUS

CUSTOMERS

IN VIRTUAL ACCEPTANCE

GILA E. FRUCHTER.

Graduate School of Business Administraction

Bar-Ran University

Ramat-Gan 52900, Israel

fruchtg@mail.biu.ac.il

CHARLES S. TAPIERO

De1Xlrtmentof Mathematicsand Interdisciplinary Studies

Bar-Ran University

Ramat-Gan 52900,Ismel

We consider a manufacturer's dual distributions channels consisting on the one hand of

a virtual (online) channel operated directly by a manufacturer and on the other hand

of a real (offline) channel operated by an intermediate retailer. Customers are assumed

heterogeneous in their virtual acceptance, deriving a surplus according to the channel

they shop at. Assuming that customers' derived benefits are random with a known

probability distribution, we obtain a probabilistic model, which is used to construct an

inter-temporal model for shopping online. In addition, we suppose that the retailer usesa

markup pricing strategy and has a strategic role. This results in a Stackleberg differential

game where the manufacturer is leader and the retailer is a follower. The optimal policy

shows that the manufacturer charges the same price across both channels. This finding

is consistent with classical results in economics. However, our research goes beyond this

observation and indicates that the online price, the retailer's markup and the probability

to buy are affected by consumers' heterogeneity in a specific manner. Moreover, we show

that while the retailer sets a price equal to the product value, the online price is lower

and is equal to the product value less the guarantee provided by the manufacturer for

the risk the customer take to buy online. This guarantee is not discriminating and is

set to the risk of the customer with the lowest virtual acceptance. Finally, we show that

the introduction of the online store is a win-win strategy; both the customers and the

manufacturer are better off.

Keywords: Online marketing; dynamic pricing; channels of distribution;

e-commerce;

competitive strategy; game theory.

1. Introduction

The advent of the Internet has made it easier for many manufacturers who traditionally distribute their products through retailers to engage in online sales.

.Corresponding author.

137

138 G. E. Pr1J.chter

& C. S. Tapireo

According to a survey reported in the New York Times (Tedeschi, 2000), about

42% of top suppliers (e.g., IBM, Pioneer Electronics, Cisco System, Estee Lauder,

and Nike) in a variety of industries have begun to sell directly to consumersover

the Internet. In the computer industry, in addition to IBM, major manufacturers such as Compaq and HP now sell their products directly over the Internet.

Even in a country such as Japan where traditional distribution channelshave been

complex and close-knit, global electronics giant Sony has recently launched online

selling directly to Japaneseconsumers(Rahman, 2000). While more and more manufacturers are engagedin direct sales (see also, McWilliams, 1997), retailers voice

the belief that orders placed through a manufacturer's direct channel are orders

that should have been placed through them. However, direct sales typically are

modest. In 1999, the conventional bricks-and-mortal stores rang up 93% of United

States retail salesrevenue; e-commerce,by contrast, accounted for about 1% and

catalog sales the other 6% (Collet, 1999). The importance of electronic commerce

and purchasing has also been recognizedin academic research,e.g., Benjamin and

Wigand (1995) Smiee (1998) Javalgi and'Ramsey (2001), Burroughs and Sabherval

(2002).

Why does a manufacturer add an online store to distribute directly his product

rather than letting an independent retailer distribute it? To answer this question

we develop a simple model consisting of a manufacturer distributing a product to

a market of potential heterogeneouscustomers. The manufacturer may distribute

the product through either or both of two shopping choices:a network of physical

stores operated by an independent retailer and an online store operated directly

by the manufacturer. For each individual customer, the choice is between the closest physical store and the online store. We assumethat customers differ in their

acceptanceof the online channel and let consumers'heterogeneitybe expressedby

a known probability distribution. Moreover, we assumethat the probability to buy

online changesover time, reflecting technological trends and improvements in online shopping aswell as consumers'increasedsophistication in using online channels.

This results in a theory for optimal dynamic pricing of the dual channelsimplied

by the solution of a dynamic hierarchical game-theoretic problem, where the manufacturer is the price setting leader and the retailer, is a follower, setting a markup

pricing competitive strategy. A number of results are then obtained. For example,

we find that under risk neutral pricing, the manufacturer chargesthe sameprice to

the retailer and to the online customer. Our results also shed light on the way the

customer heterogeneousacceptanceof online shopping affects the pricing strategy.

Finally, we show that the introduction of an online store is a win-win strategy where

both the manufacturer and customers are better off. We are also pointing out that

with the technology improvements when more and more customers will switch to

online purchase,virtual stores will be predominant.

Previous work on dual channels (online manufacturer + independent retailer)

has focused on customers that are homogeneousin their acceptanceof online buying (Chiang et at., 2003). Dual channels with heterogeneousmarket in a static

Dynamic Online and Offline Channel Pricing

139

environment has been investigated by many researchers;among them, Moriarty

and Moran (1990), show that dual channels may reach potential buyer segments

that could not be reached by a single channel. Other streams of related literature deal with the channel coordination problem between a manufacturer and a

retailer. Among an extensive literature in a static environment we refer to Jeuland

and Shugan (1983), Ingene and Parry (1995) and over time to Jorgensenand Zaccour (2002). Finally, the related literature on supply-chain managementhas also

contributed broadly to this problem. For example, we note contributions by Abad

(1994), Parlar and Wang (1994), Weng (1994), Tersine and Barman (1995), Gilo

(1999), Netessine and Rudi (2001) and Ertek and Griffin (2002).

The rest of the paper is organized as follows. The model is discussedin the next

section. The optimal policy for a risk-neutral manufacturer and a strategic retailer

is developedin the third section. The last section reviews the results and discusses

directions for future research.

2. The Model and Notation

We consider a manufacturer who distributes a product to a market of N potential

customers.The manufacturer may distribute the product to either or both of two

shopping choices:a network of physical stores operated by an independent retailer

and an online store operated directly by the manufacturer. To each individual customer, the choice is betweenthe closestphysical store and the online store, so from

now on our discussion in the paper will be framed as if there is only one physical

store. Such choicesare broadly available to customerstoday. For example, a potential traveler may buy travel tickets through a travel agent or through the Internet

-

accessingdirectly to the company.

Buying through an online store versus an offline store (operated by a retailer)

inducesan economic-addedvalue, which is a function of the buying processparticularities. For example, buying a good in a retail store allows the customer to sensethe

product prior to its acquisition in addition to an implied guaranteeassociatedto the

retailer responsibilities. In contrast, buying through an online store provides a virtual inspection of the product. For theseand many other and related reasons,buying

through one channel or the other induces different economic-addedvalues. Manufacturers are aware of such specificities and thus they design policies that recognize

both customers' propensity to buy from one or the other channel and of course,the

selling terms exercisedat each channel. For instance, it is broadly expected that

buying travel tickets through an online site may have lower prices, usually compensated by a lack of personal contact and service, which a customer may require.

To better understand a customer acceptanceof the online channel, we restrict

this model to a homogeneousproduct while customers value on-line shopping

heterogeneouslywith a known distribution. Let V be the value of a homogenous

product in real inspection, i.e., when it is bought through a retailer. When the product is bought online through virtual inspection, we assumethat it has a smaller

140

G. E. Fr1Jchter

fj C. S. Tapireo

value (}V, where 0 ~ () ~ 1, due to the lack of contact between the consumer

and the product at its acquisition. The parameter () thus representsthe acceptance

of the virtual inspection by the consumer. We label this term as a consumer virtual acceptance.To expressconsumers'heterogeneity in the virtual acceptancewe

assume that () is a random variable with cumulative density function Fe('). The

determination of Fe(.) is an empirical question revealed by customer distribution

observed along channels acquisition. However, in the sequel, Fe(') is consideredas

an arbitrary general distribution function.

The economic-addedvalue provided to a consumerby the product can be measured by the concept of consumersurplus, which is equal in our model to the consumer value from the product, lessits price. Therefore, if the product is sold through

a retailer at a price Pr, then the resulting consumersurplus is V - Pro If the product

is sold online at the price Pan, then the resulting consumersurplus is (}V - Pan.

The decision to buy online based on the customer surplus is thus a random

event and occurs if:

-

tJT1'

v' -pan---'

~

T1' -

.

-Pr

~'>

n..

v..

v~

1

- !?:-

v-

~

Pan

(21)

\-.~,

Given a pair of prices Pan and Pr, the probability that a customer buys online is

thus:

ij(Pon,Pr)=

F9

1-

Pr - Pan

V

Dynamics: Over time, the propensity to buy online as well as the pricing policies

the manufacturer can exercise,may change.As a result, customersmay switch from

one channel to the other according the higher customer surplus they may derive

at a specific time by buying in one or the other channels. For example, buying

through a retailer may be induced by a changein the online price policy, reducing

consumer's surplus. As a result the probability that a customer will buy online or

through a retailer will also changeover the time.

Let q(t) be the probability that a customer will buy the product through an

online site at time t. We assumethe following specification for the rate of growth

of the probability q(t):

q(t)

= -a(q(t) - ij(Pon(t),Pr(t))),

q(O)= qQ, 0 ~ q ~ 1,

(2.3)

where qQis the initial condition and a > O. Note that from (2.3), if 0 ~ ij ~ 1,

we also have 0 ~ q ~ 1. In Eq. (2.3) we assume that the rate of change is a

monotonically nonincreasing (nondecreasing)function of the distance between the

current probability of buying online and the limit-probability of buying onlinel if

q(t) > ij(q(t) < ij).

Revenues:The manufacturer's revenue comes from both online and offline stores

sales.We assumethat the manufacturer supplies the retailer of the physical store at

1That is, the probability at steady-state, i.e., when q = O.

~

Dynamic Online and Offline Channel Pricing

141

a wholesaleprice, w. For simplicity, we consider that the retailer will use a markup

b for pricing, i.e.,

Pr

= (1+ b)w.

Thus, (2.2) becomes

ij(Pon,Pr:

- Fe( 1-

(1 + b)w - Pan

V

To avoid arbitrage it is necessarythat

w ~ Pono

Using the offline channel,the manufacturer incurs a cost per unit Cr that includes

the cost of manufacturing and logistics, while using the online channel, a cost per

unit Con.Normally we would expect that Con< Cr. Assuming that the manufacturer is risk-neutral, then the manufacturer's expected revenueat time t, denoted

by R(t), is given by

R(t)

.(Pon

Con)q(t)+ (w

Cr)(

q(t))]N,

where Pan = Pon(t) and w = w(t). Note that in this model, we assumethat the

manufacturer has no influence on the total number of customers,thus it is specified

exogenously.Therefore, the problem associatedto efforts that may contribute to a

growth of customers and increasethe number customers is not considered in this

model.

The decision problem: The manufacturer's decision problem, acting as a leader, is

to choosethe pricing strategy, Won,w) to maximize its own discounted profits over

a given time horizon, given that the retailer acts as a strategic follower in choosing

the markup b to maximize its own profits. Next we find the optimal pricing policy.

3. Optimal

Pricing Policy

Assumea risk-neutral manufacturer and a strategic retailer. This implies a dynamic

hierarchical game-theoretic problem. More exactly, we consider a Stackelberg differential game, with the manufacturer acting as the leader and the competitive

retailer as the follower.

Assuming that firms maximize the present value of their profit stream over an

infinite horizon, the manufacturer maximizes llm with respect to Pan and w, where

llm = l°O[(Pon - con)q+ (w - Cr)(1 - q)]Ne-rt dt.

(3.1)

The competitive retailer maximizes fir with respect to b, where

fir

= l°O[(Pr

- w)(1 -

q)N]e-rtdt.

(3.2)

142 G. E. Fruchter & C. S. Tapireo

Considering (2.4), we obtain

IIr

= hoo

bw(l

-

q)N e-rt dt.

(3.3)

Overall, the manufacturer and retailer's optimization problems can be summarized

by the following differential game:

Max IIm

=

roo {(Pon - con) q + (w

10

=

roo bw(l

10

Pon,W

Max

b

..

IIr

- q)N e-rt

s.t. Q=-a[Q-1+F91,

- Cr)(l

- q)} Ne-6t dt

dt

1-

(3.4)

(1

+ b)w

- Pan

.

.

v

--

q(O) = QQ.

To solvethe problem (3.4), given (2.6), we usedynamic optimization techniques,

see for example, Tapiero (1977, 1986, 1998) and Kamien and Schwartz (1991). We

start by solving the follower's problem, which is an optimal control probleQl. We

compute the markup of the competitive retailer as the rational reaction to the prices

used by the manufacturer. Subsequently,we solve an optimal control problem of

the manufacturer, taking into account the constraints on the manufacturer and the

reaction function of the competitive retailer. We obtain the following result with

the proof relegated to the appendix.

Theorem 1 (Optimal Dual Channel Policy). Consider a risk-neutral manufacturer who distributes a product directly by an online store and indirectly by a

retailer to a fixed number of customers that are heterogeneouswith respect to the

virtual acceptance.The manufacturer acts as a leader and the retailer as a follower.

Assume that the retailer is using a markup pricing, b, and there is no arbitrage, i.e.,

the wholesaleprice, w, is not exceedingthe online price, Pon. Then, optimal pricing

stmtegies (P~n'w*) and b*, are given by,

NV(l - q(t))

P~n = w*

= Vu

and

b* = ~ u

1

with u = u(t;0) = IiI

a Irp[q(t)]I

(3.5)

and representa Stackelbergequilibrium for the leader and follower. The corresponding retail price is p; = V. In (3.5), V is the customerproductvaluationthrougha

real inspection, q(t) is the probability to buy online and is as in (3.4), N is the total

number of customers, () is the virtual acceptance,fe is the corresponding density

function; the function cp(q) = cp[q(t)] is the solution of the following differential

equation,

-a[q -1 + Fe(u)]cp'(q)= (r

+ a)cp(q)+ (1- u)VN,

Jim cp(q(t))e-rt o. (3.6)

t-+oo

where Fe is the correspondingcumulative density function.

Proof.

SeeAppendix.

0

Dynamic Online and Offline Channel Pricing

143

ConsideringTheorem 1, the manufacturer price policy is the samefor both channels,

expressinga uniform marginal pricing procedure. This is consistent with classical

results in economics. However, both the retailer's markup and the online price

changeover time and are affected by consumers'heterogeneity in a specific manner

"

,

through u(t; fJ) = IiI I'~~

1)

,

.

/

Online and offline purchase.Considering Theorem 1 we can also characterizeonline

and offline purchase. Considering (3.5) the online customer surplus is (0 - u)V

and the offline customer surplus is always zero. Thus the offline customer gets

exactly what he pays. However, as the online purchase occurs only if the online

customer surplus exceedsthe offline customer surplus, (see (2.1)), we obtain that

the online customer surplus (0 - u)V is always positive and is zero only for the

marginal customer, that is the customer with virtual acceptance0 = u. Thus a

customer is better off with an online purchase. Moreover, all the customers with

virtual acceptancein the interval [u,1] buy online purchase, otherwise they buy

through the retailer. Thus, customers'with higher virtual acceptance (closer to 1)

have higher benefit from the online purchase.

Let

r(8) = (1 - 8)V.

The increment r( 9) can be thought as the risk a customer takes to buy online.

As 9 increasesthe customer's risk decreases.The increment

g(t; (J)= (1 - u)V

can be thought as an online guaranteeprovided by the manufacturer for the risk a

customer takes to buy online or shortly risk guarantee.For a customer with virtual

acceptance0 < u(t), this guarantee is lower than his risk thus he buys offline. For

a customer with virtual acceptance0 > u(t), the guaranteeexceedshis risk thus he

buys online. In our model, if the customer is more sophisticated and experienced

(i.e., his virtual acceptanceis closer to 1) the benefit from the guarantee provided

is higher. This happens because in our model the manufacturer's policy is nondiscriminating.

Note that, given an arbitrary distribution of customers with respect to their

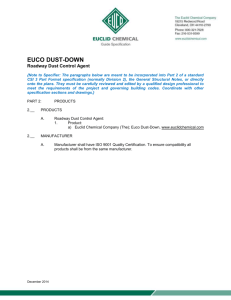

virtual acceptance,online purchase market share will be equal to 1 - F9(U) (see

Fig. 1) which is exactly the limit-probability to buy online ij. Following Fig. 1, for

a given distribution, as u = u(t; 0) decreases,the market share of online purchase

increasesand so the probability to buy online; this is because the online price

decreases.Moreover, as the risk guarantee increases, the limit-probability to buy

online increases.

Figure 1 illustrates also that the increment u determines the propensity of consumers to buy online or offline. When the distribution f9(.) shifts to the left due

to increased sophistication of consumersin shopping online or through a gradual

144 G. E. Fruchter & C. S. Tapireo

Market Share

Fig. 1. Distribution of virtual acceptance.

integration of online shopping in consumershabit, then obviously the propensity

to buy online will grow.

A special case,that assumesthat () is uniform is also revealing.

Special Case:Let the consumervirtual acceptance() be uniformly distributed in the

interval [a, 1]. In this case, Fe(x) = (x - d)/(1 - a) and fe(x) = Fe(x) = 1/(1- a)

and therefore u = (1 - a) is constant and 1 ?: () ?: 1 - a. Thisimplies:

p~ = V(l-a)

From (3.4), the optimal

probability

trajectory

n

and b* = -.::.--

for probability

to buy and the equilibrium-

becomes,

Properties and Implications: For a risk-neutml manufacturer and a stmtegic

retailer, the pricing policy is non-discriminating:

(i) The manufacturer charyes the same price to the retailer and to the online

customer,i.e., P~n = w" (seeTheorem1).

(ii) The retailer sets a price equal to the product real value, V (see Theorem1).

(iii) The manufacturer sets a price equal to the product real value minus the risk

guarantee, Vu = V - g (see(3.5) and (3.8)).

(iv) The retailer's markup and the online price change over time and are affected

,-

by consumers' heterogeneity in a specific manner I through u(tj ())

=

f9-1

Dynamic Online and Offline Channel Pricing

145

(v) A customer is better off in buying online. Specifically, the online customer's

surplus is always positive and equal to (lJ - u)V, and is higher as his virtual

acceptanceis closer to 1. The offiine customer's surplus is always zero.

(vi) The market share to buy online is exactly the limit-probability to buy online.

Moreover, since the risk guaranteeincreasesthe market share and the limitprobability increaseas well.

(vii) Particularly, if the customer virtual acceptanceis uniformly distributed in the

interval [a , 1], with density 1/ (1- a), the online price, the wholesalesprice, the

retailer's markup and the equilibrium probability take the values,P~n= w* =

V (1- a), b* = ~, and ij = ~, respectively.The risk guaranteeis a V. Thus,

as the parameter "a" increases,the online price decreases.However, the risk

guarantee, the market share as well as the limit-probability of buying online

increase.

In these circumstances, why would a manufacturer add an online store? To answer

this question we compare the optimal pr?fit of the manufacturer for q

= 0 (without

the online store) and 0 < q < 1 (with the online store). We conclude with the

following result.

Corollary 1. Assuming that Con< Cr (the online distribution's cost is less than

the offline distribution's cost), then the introduction of the online store increases

the profit of the manufacturer and decreasesthe profit of the retailer.

Proof.

SeeAppendix.

0

Considering Corollary 1 and Property (v) of "Properties and Implications" we

conclude with the following result.

Corollary 2. Assuming that Con< Cr (the online distribution's cost is less than

the offline distribution's cost), then the introduction of an online store is a win-win

strategy. Both the manufacturer and customers are better off.

An interesting question that raises up now is the following: Does the manufacturer is better off with a mi.'1:ed

(dua~ channel composedfrom both the online and

the offline store or with a pure online channel? To answer this question we compare the optimal profit of the manufacturer for q = 1 (pure online channel) and for

0 < q < 1 (mixed channel). We conclude with the following result.

Corollary

3. Assuming that Con< Cr (the online distribution's cost is less than

the offline distribution'scost),then the mixed(dual) channelthat consistsfrom an

online and offline storeis lessprofitablethan a pure online channel.

Proof.

SeeAppendix.

0

Obviously, as long as the online shopping technology is not sufficiently friendly

for some customers. there will still be a need for an intermediate retailer to make

146 G. E. Fruchter & C. S. Tapireo

additional profits on that part of consumers reluctant to buy online. However,

technology improvements may contribute to customers switching from offline to

online purchase.Accordingly, Corollary 3, points out that eventually, virtual stores

will be predominant.

The results developed in this paper lead us to a number of research questions however which we discussbelow as well as provide somedirections for future

research.

4. Conclusions

and Future Directions

We have considered in this paper a manufacturer's dual channel of distribution

that focuseson a virtual channel operated directly by the manufacturer and a real

channel operated by an intermediate retailer. The virtual channel's customers are

different in their acceptanceof the online channel and randomly distributed. This

leads to a probabilistic model, where the random distribution determines the probability to buy online. We have also assumedthat the retailer used a markup prjcing

strategy and has a strategic role. Assuming that the probability to buy online

changesover time we developed the optimal pricing policy for the dual channel

implied from a dynamic hierarchical game-theoretic problem. We found that the

manufacturer adopts a non-discriminating pricing policy. Specifically, the optimal

policy shows that the manufacturer charges the same price across both channels.

This finding is consistent with classicalresults in economics.However,our research

goesbeyond this and indicates that the online price, the retailer's markup and the

probability to buy are affected by consumers' heterogeneity in a specific manner.

Moreover, we show that while the retailer sets a price equal to the product value,

the online price is lower and is equal to the product value lessa value that worth the

guaranteeprovided by the manufacturer for the risk a customer take to buy online.

This guarantee is not discriminating and is set to the risk of the customer with the

lowest virtual acceptance.Finally, we show that the introduction of the online store

is a win-win strategy; both the customers and the manufacturer are better off. We

are also pointing out that with the technology improvements when more and more

customerswill switch to online purchase, virtual stores will be predominant.

A number of extensions might be considered however. First, the marketing

mix policy (for example, including advertising, services provided by the retailer,

guaranteesprovided by the manufacturer) can be consideredand their effects on

consumers' channel selection assessed.Second,while we have used a risk neutral

framework, it is evident that risk aversion if considered would favor a discriminating price policy and assumethe survival of a channels portfolio. In this framework, we expect that the distribution of consumers' acceptancelevel will play an

important role. Finally, while the model consideredhere is of a theoretical nature,

empirical data regarding channels selection by consumers (reveling thereby the

consumers' acceptance level) can provide a strong empirical verification to out

analvtical results.

Dynamic Online and Offiine ChannelPricing 147

Appendix

Proof of Theorem 1.

1. The retailer (follower) optimization problem

The current-value Hamiltonian of the competitive retailer is given by

Hr(q,Pon(q),w(q),b(q),Ar:

= bw(l - q)N + Ar '-a

[q

-

1 +

F9

1-

(1 + b)w - Pan

'

"

v

,

,

,.I'

where Ar is the adjoint (or co-state) variable. The necessarycondition for this

problem is aHr/{}b = 0, or

I

(l+b)w-(1 - q)N + ArbaFg

.

Pan

1-

v

=0.

SinceF8 > 0, (AI) impliesthat

>'r'< O.

From (AI) we have

(1 - q)NV

v

-+

w

ArQ

The adjoint equation,2

-\.r

= TAr

-w

Pan

- 8Hr/8q, is

-\.r = TAr + bwN + QA,

and the terminal condition is

lim

t-+oo

Ar(t)e-rt

=

o.

(A5)

In what follows we use (A3) as the characterization of the competitive retailer's

reaction. The equation,

q= -a

{q-1

+ F9 rF~-l (

then becomesa constraint of the manufacturer's optimization problem.

Next we analyze the optimal control problem of the manufacturer.

2. The manufacturer (leader) optimization problem

The current-value Hamiltonian of the manufacturer is,

where Am is the adjoint (or co-state) variable.

2In case of an open loop solution.

(A6)

148 G. E. Fruchter & C. S. Tapireo

It is easy to seethat the necessaryconditions for this problem, oHm/oPon = 0

and oHm/ow = 0, cannot be satisfied. Thus, there is no interior solution for this

problem. Moreover, since ~

= qN > 0 and Pon .$:w is necessarythat P~n = w*.

tJPon

In addition, since ~

= (1 - q)N > 0 and Pr = (1 + b)w .$:V is necessarythat

w* = m. Thus we conclude with

and p; = v:

b= [l-F~-l(_i!~:!::)]

(- (l-q)NV

~'-l

9

ArQ )

where

.).r

= (r+a)Ar + [l-F~-J

Let

>'r = cp(q).

Considering (All)

(A9) becomes

(All)

and (A2) and since F8 = f(), where f() is the density function,

b* = .!. - 1

u

(A12)

where

(1 - q)NV

u = fil(

,

Icp(q)la

(A13)

,

Considering the boundary condition, we obtain that cp(q)satisfies,

-a[q

-1

= (r +a)cp(q) + (1- u)VN,

+F8(U)]cp'(q)

Finally substituting

lim cp(q(t))e-rt =0.

t-+oo

(A12) in (A8) we conclude with

P~n = w* = V u.

0

Proof of Corollary 1.

To provethis we needto comparethe optimal profit of the manufacturerfor q = 0

(without the online store) and 0 < q < 1 (with the online store). Considering

Theorem1 the optimal profit of the manufacturerbecomes

n:n =

Loo[(P~n

- con)q+ (w* - Cr)(l - q)]Ne-rtdt

= 100 {w* -lconq + Cr(l-

q)]}Ne-rtdt.

(A15)

Let

7rm(q)

= w* -

rCanq

+ c..(l - q)l.

0 <

Q <

I.

(A16)

Dynamic Online and Offline Channel Pricing

149

As we assumeCon< Cr, obtain for'v'q E (0,1),

7rm(q)= w*

On the other

- [conq+ Cr(l- q)] = w* hand, given that

q >

[(con - Cr)q + Cr] > w*

0 the retailer's

Jooob*w*(l- q)Ne-rtdt is diminished by (1- q).

-

optimal

Cr

= 7rm(O).

profit

n;

=

0

Proof of Corollary 3.

To prove this we compare the optimal profit of the manufacturer for q = 1 (pure

online channel) and for 0 < q < 1 (mixed channel). Using the notation in the proof

of Corollary 1, and again since Con< Cr, we obtain for'v'q E (0,1),

7rm(q) = w*

- [conq+ Cr(l- q)] = w*

- [(Cr-

con)(l- q)] - Con< w* - Con= 7rm(l).

0

References

Abad, P. L. [1994] "Supplier pricing and lot sizing when demand is price se~itive,"

European Journal of Operational Research78, 334-354.

Benjamin, R. and Wignad, R. [1995] "Electronic markets and virtual value chains on the

information highway," Sloan Management Review, 62-72 (Winter).

Burroughs, R. E. and Sabherval, R. [2002] "Determinants of retail electronic purchasing:

A multi-period investigation," INFOR (Canada) 40, 35-56.

Chiang, W. K., Chhajed, D. and Hess, J. [2003] "Direct marketing, indirect profits: A

strategic analysis of dual-channel supply-chain design," Management Science49(1),

1-20.

Collet, S. [1999] "Channel conflicts push Levi to halt Web sales," Computerword

33(45) 8.

Ertek, G. and Griffin, P. M. [2002] "Supplier and buyer-driven channels in a two-stage

supply chain," JIE Transactions 34, 691-700.

Gilo, D. [1999] "Does a supplier have the market power we thought it had," Working Paper,

Harvard Law School, www.law.harvard.edu.prograrnsjolin_center.papersjpdf.

Ingene, C. A. and Parry, M. E. [1995] "Channel coordination when retailers compete,"

Marketing Science 14(4), 360-377.

Javalgi, R. and Ramsey, R. [2001] "Strategic issuesof e-commerceas an alternative global

distribution channel," International Marketing Review 18(4), 376-391.

Jeuland, A. P. and Shugan, S. M. [1983] "Managing channel profits," Marketing Science

2, 239-272.

Jorgensen,S. and Zaccour, G. [2002] "Channel coordination over time: Incentive equilibria

and credibility," Journal of Economics Dynamics and Control 27(5), 801-822.

McWilliams, G. [1997] "World wind on the Web," Business Week (April 7).

Moriaty, R. T. and Moran, U. [1990] "Managing hybrid marketing systems," Harvard Bus.

Rev. 90(6), 146-155.

Netessine, S. and Rudi, N. [2001] "Supply chain structures on the Internet: Marketing

operations coordination," Working paper available at www.milsrudi.com.

Parlar, M. and Wang, Q. [1994]Discounting decisions in a supplier buyer relationship with

a linear buyer's demand, JIE Transactions 26(2), 34-41.

Rahman, B. [2000] "Sony to sell direct via net," Financial Times (February 2).

Samiee, S. [1998] "Exporting and the Internet: A conceptual perspective," International

Marketina Review 15(5). 413-426.

150 G. E. F'l-uchter& C. S. Tapireo

Tapiero, C. S. [1977] Managerial Planning: An Optimum and Stochastic Control Approach,

Gordon Breach, two volumes.

Tapiero, C. S. [1998] Applied Stochastic Models and Control in Management, NorthHolland, Amsterdam-New York (January).

Tapiero, C. S. [1998] Applied Stochastic Models and Control in Finance and Insumnce,

Kluwer Academic Press, Boston (April).

Tedeschi, B. [2000] "Compresseddata; big companies go slowly in devising net strategy,"

New York Times (March 27).

Tersine, R. and Barman, S. [1995] "Economic purchasing strategies for temporary price

discounts," European Journal of Opemtional Research80, 328-345.

Weng, Z. K. [1995] "Channel coordination and quantity discounts," Management Science

41, 1509-1522.