Investor Sentiment and Economic Forces*

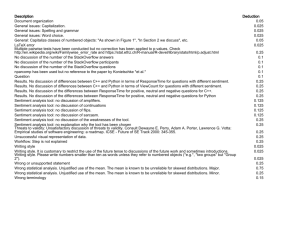

advertisement