IBM Global Business Services

Thought Leadership White Paper

Improving business performance

and competitive advantage through

the implementation of standards

Findings of the Consumer Goods Forum Global Compliance Survey

January 2011

2

Improving business performance and competitive advantage through the implementation of standards

Executive summary

The industry has invested a considerable

amount of money and resources in implementing standards. Is it beneficial? Yes!

The consumer goods industry continues to experience an

unprecedented amount of change, both in terms of the degree

of change as well as its pace. Dynamic evidence of this can be

seen in the global supply networks that are the lifeblood of the

industry. Because of the demands made by informed and

connected consumers, the products themselves are increasingly

becoming customized for local markets and micro-segments to

deliver innovative lifestyle solutions to end users.

The many facets of the industry’s complexity will likely

continue to increase in the foreseeable future. Companies

able to turn this complexity to their advantage—through a

combination of analytics, collaboration and decisive action—

will be successful in this environment. In 2006, the Global

Commerce Initiative (GCI), now part of the Consumer Goods

Forum (CGF), published an outlook report titled “2016, the

Future Value Chain”, which challenged the consumer goods

industry to:

•

Redefine the 2016 value chain by addressing new

requirements of the physical flow of goods driven by forces

like volatile energy costs and a growing population density.

•

•

Share information so that trading partners, in their bi-lateral

relationship, must more readily and freely share information

while embracing the concept that the best way to manage

increasing complexity is through transparency.

Develop new ways of working together, including

sustainable changes in culture, collaborative business planning

and new measures and rewards.1

One core capability that enables collaborative

processes is the adoption and utilization of

GS1 standards to develop and deliver

consistent business results.

Each year the Consumer Goods Forum asks its members and

partner organizations to participate in a benchmark survey

that measures the implementation of GS1 standards and

industry utilities as well as the business results they deliver.2

This year’s record-breaking participation showed that 5,624

KPI scorecards and over 2,100 capability assessments were

submitted from approximately 5,280 companies across

50 countries. As a result, this across-the-globe data provided

informative insights. The growing number of survey

participants demonstrated that not only are new companies

interested in standards and joining the process, but repeating

participants also increased participation across their divisions

and geographies year after year.

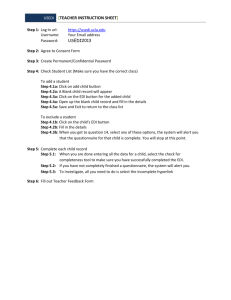

IBM Global Technology Services

This year, IBM Global Business Services (GBS) was asked

to begin an annual assessment of the scorecard findings.

We examined 4,400 key performance indicator scorecards

submitted by consumer product companies and observed

relationships between the usage of the GS1 standards,

technology and business results. As seen in Figure 1, this

assessment demonstrated that there are many relationships

to improved business results by utilizing standards.

5.2% points

savings of

distribution costs

+ 1.9% points

increased

invoice accuracy

+ 5.9% points

increased

fill rates

-61 hours reduced

lead time

5.8% points

reduced

out-of-stocks rate

Figure 1. Using GS1 standards for consumer goods companies and

associated benefits

3

An example of this would be a more efficient supply chain

through better fill rates, reductions to distribution costs,

improved on-shelf availability/reductions in out-of stocks rate

and better invoice accuracy among companies implementing

the GS1 standards.

Companies implementing a larger number of standards, or

standards on a higher level, can see even better business results.

The potential for impressive cost reduction, revenue growth

and supply chain flexibility benefits was confirmed by exploring

the survey responses. Despite the clearly demonstrated link

between standards and improved performance, there still

remains a greater potential for consumer product companies to further

embrace standards to create and sustain a competitive

advantage. This report summarizes our findings, key insights

we derived from them and the compelling benefits that

standards implementation can bring.

4

Improving business performance and competitive advantage through the implementation of standards

Global Scorecard

The global scorecard allows companies to measure their

current performance and capabilities using a global standard

set of measures. This permits a company to benchmark itself

against other groups within the same geography, the world and

distribution channel or product category. Performance gaps

can be identified and plans put in place to close gaps or even

break away from the crowd with the action planning tool. You

can also monitor progress against specific actions, as well as

long-term goals. The global scorecard is supported by Consumer Goods Forum and hosted by IBM Global Business

Services. The survey, analyses and annual report are created

and prepared by IBM Global Business Services in cooperation

with the Consumer Goods Forum.

The tool measures:

•

•

•

•

•

•

•

Standard capability assessment (a qualitative assessment

measuring the status of implementation)

Demand

Supply

Enablers (item identification, electronic messages and master

data synchronization)

Integrators

Business measures (quantitative measures such as service levels,

inventory, out-of-stocks, lead time, costs, invoice accuracy)

Implementation measures (quantitative measures such as the

level of implementation for Item and location identification,

electronic data interchange (EDI), global data synchronization)

Table 1 shows the standards measured and provides an explanation for each.

Measure

Explanation

% of consumer units allocated a GTIN

% of cases/cartons/inners allocated a GTIN

The GTIN (Global Trade Identification Number) is a globally unique number

to identify trade items (in databases), and is therefore the foundation for

global e-commerce.

% of pallets/unit loads labeled with SSCC

The SSCC (Serial Shipping Container Code) is used throughout the SC as

entity identifier for item tracing.

% of shipping or receiving locations that have been allocated a GLN

% of orders transacted via EDI

% of invoices transacted via EDI

The GLN (Global Location Number) is used to identify physical locations.

Transmission of orders between organizations by electronic means.

Transmission of invoices between organizations by electronic means.

% of shipments for which a dispatch advice was transmitted

via EDI

Shipments, which are accompanied by an electronic dispatch advice

message transmitted by electronic means.

% of shipments for which a receiving advice was transacted via EDI

Shipments, which are accompanied by an electronic receiving advice

message transmitted by electronic means.

% of sales with synchronized master data between trading partners

via the GS1 GDSN

The GDSN (Global Data Synchronization Network) is an internet-based,

interconnected network of interoperable data pools, that enables companies

around the globe to exchange accurate, compliant, standardized and

synchronized supply chain data with their trading partners using a

standardized Global Product Classification.

% of SKUs with master data loaded into a GS1-certified data pool

The proportion of manufacturers' SKUs (Stock Keeping Units) whose master

data has been loaded into a GS1-certified data pool.

% of active SKUs where the master data has been synchronized

using the GS1 Global Data Synchronization Network

SKU (Stock keeping units) where the master data has been synchronized

by GDSN

% of GTINs that are catalogued consistently with a GS1 Global

Product Classification brick code

Enabler for GDSN

Table 1. Standards to be measured

IBM Global Technology Services

5

What the global scorecard can do for you

The key capabilities of the CGF Scorecard are:

Submitted scorecards

6.000

•

•

•

•

•

•

•

•

•

•

•

Reports “as-is” status on individual companies, country/

regional and global levels

Assesses key process performance relative to peer companies

Demonstrates gaps in performance levels

Helps to support the business case for improvement projects

Provides a report building tool that can be customized

according to your specific requirements

Helps to measure success

Helps to establish priorities. Are you on the “bleeding edge”

or are there advanced practitioners among your trading

partners to help you get started?

Provides results and effects (business impact and value) of

scorecards as demonstrated in the annual report including

information across geographic regions and business types

Provides on-line action planning tool that gives visibility of

agreed actions and progress

Allows for the ability of multinational corporations to manage

global and regional programs

Data is anonymous and is treated as highly confidential

5.000

4.000

KPIs

3.000

Standard

Capability

Assessment

2.000

1.000

0

2002

2003

2004

2005

2006

2007

2008

2009

Current survey data submitted from January 1, 2009 through April30, 2010

Figure 2.

Number of submitted KPI scorecards

Revenue in m $ of survey participants

2.500.000

2.000.000

KPIs

1.500.000

Standard

Capability

Assessment

1.000.000

Participation in the measurement of section of 2009/2010 was

greatly improved, as shown by the extremely higher number of

KPI scorecards submitted in comparison to previous years.

Although the following charts (Figures 2 and 3) indicate that

the total revenue of businesses participating in the global

scorecard survey was strong, the final figures for 2009 do

exhibit a decline versus those in 2008. This was partly due to

the fact that four very large CGF member companies only

marginally participated in 2009 compared to prior years.

Yet the respondents represented a total revenue of 1.8 billion,

including 10 percent of the largest global companies listed in

the Fortune 500 for 2009. Among the CPG companies listed

in this Fortune 500, 34 percent participated in the survey.

500.000

0

2002

2003

2004

2005

2006

2007

2008

2009

Figure 3. Revenue of submitted scorecards

Common identification standards are a vital

basic enabler to permit efficient and effective

communication about products, including

replenishment and business data between

trading partners.

The greater the number of scorecards submitted, the more

relevant the results obtained, so it is critical that as many

companies as possible participate.

6

Improving business performance and competitive advantage through the implementation of standards

Key insight results

Well over 2,500 chief information officers (CIO) from

leading organizations around the globe have highlighted the

importance of information and analytics for making faster

decisions by taking action to optimize processes for more

predictable outcomes in the IBM 2009 Global CIO study.2

Companies utilizing standards can see a

flexible supply chain and improvements in

costs and revenue.

Analytics can help your business to:

The importance of common data

•

The consumer product industry is highly competitive, fastmoving and rapidly changing. With margins under constant

pressure, the globally integrated consumer goods enterprise

needs something powerful to withstand the increasing complexity

to gain a competitive advantage. The consolidation and integration

of quickly accessed and accurate data sources is the key for the

information-based company of tomorrow.

•

•

•

•

Efficiently access large volumes of information

Improve the timeliness and accuracy of plans and forecasts

Translate vast troves of structured and unstructured data into

valuable business insights

Aid in rethinking business processes and providing better

control to companies via improved transparency

Measure and monitor performance and benefits

CP industry:

• Highly competitive

• Fast-moving

• Rapidly changing

To overcome

complexity and gain

competitive advantage

• Margins under pressure

• Increasingly complex

More than 2,500 CIOs focus on Analytics*

83%

Business intelligence and analytics

Virtualization

76%%

71%%

Risk management and compliance

68%%

Customer and partner collaboration

Mobility solutions

68%%

Self-service portals

66%%

Application harmonization

64%%

64%%

Business process management

Service-oriented architecture/Web services

61%%

Unified communications

60%%

Note: CIOs were asked to select all applicable answers to the questions, “What kind of visionary plans

do you have for enhanced competitiveness?”

Business Analytics

Consolidated

data

Quickly

accessible to

be analyzed

Powerful

insights

Using standards is the key for all activities

Figure 4. Visionary plans for enhancing competitiveness for the chief information officer

IBM Global Technology Services

Standards are a prerequisite; thus data

standards drive data quality…which in turn,

drives data sharing…which can ultimately

drive better business results.

Consumer products companies are preparing to

share data

In the global scorecard survey, the Enablers’ score of the

participants for global data synchronization/data quality has

improved to values 3.1 and 3.3 (on a scale from 0=Nothing

planned to 4=Fully implemented) for manufacturers, retailers

and wholesalers, respectively. This means that the average

company is already in the implementation phase.

A practical illustration

Industry heavyweights are using standards extensively because

of the benefits that they are experiencing. As an example,

Wal-Mart and other apparel retailers recently announced an

initiative to put sophisticated RFID tags in all their clothing

throughout their stores—which is the largest of such adoptions

worldwide. Wal-Mart expects significant savings from this

initiative. Beyond more efficient recalls, loss prevention and a

better inventory oversight, RFID tags could help eliminate

checkout lines.3

7

In 2007, a similar pilot at American Apparel Inc. found that

stores with RFID technology saw sales rise up to 14.3 percent.3

On November 1st, 2010, a group of leading retailers,

manufacturers, suppliers, industry associations, technology

providers and academics introduced a broad-based initiative

to guide the adoption of RFID in retail. They believe it will

foster innovation, improve business efficiency and lead to a

better consumer shopping experience. According to research

done by the University of Arkansas, the technology has

delivered compelling benefits to the retail industry, such as

an inventory accuracy rate of more than 95 percent up from

an average of 62 percent and an out-of-stock reduction of up

to 50 percent.4

The scorecard results indicate that companies are just starting

to use the electronic product code (RFID); however, those who

are in roll-out or full implementation phase for categories like

apparel show better business results, such as a 15 percent

reduced out-of-stocks rate.

8

Improving business performance and competitive advantage through the implementation of standards

Development of the standards

Manufacturers

Manufacturers

Retailers &&Wholesalers

Retailers

Wholesalers

2007

2008

2009

2007

2008

2009

IM01 % of consumer units allocated a GTIN

97.1

96.8

92.0

91.7

97.3

96.6

IM02 % of cases/cartons/inners allocated a GTIN

82.9

87.6

86.6

77.4

82.6

87.0

86.6

IM04 % of pallets/unit loads labeled with SSCC

45.9

49.4

67.2

51.1

49.4

71.6

IM05 % of shipping or receiving locations that have been allocated

a GLN

a GLN

43.9

41.2

51.1

64.3

74.5

87.5

IM06 % of orders transacted via EDI

52.4

51.7

47.0

68.8

70.4

75.8

IM07 % of invoices transacted via EDI

41.5

47.7

45.6

63.4

67.1

78.6

IM08 % of shipments for which a dispatch advice was transmitted

via EDI

22.5

27.6

35.5

28.0

22.4

58.7

IM09 % of shipments for which a receiving advice was transacted

viavia

EDI

EDI

7.1

12.0

16.0

29.8

13.9

58.4

IM10 % of sales with synchronized master data between trading

partners via the GS1 Global Data Synchronization Network

13.5

19.0

24.4

9.4

17.0

42.4

IM11 % of sales with master data loaded into a GS1-certified data

(%)

pool

pool

(%)

37.7

41.6

**

2.9

7.0

26.5

IM12 % of active SKUs where the master data has been

synchronized using the GS1 Global Data Synchronization

Network

IM13 % of GTINs that are catalogued consistently with a GS1

Global

Product

Classification

brick

code

Global

Product

Classification

brick

code

45.7

47.2

71.0

** insufficient data available to produce a benchmark, n<5

Figure 5. Three-year results for implementation measures worldwide (revenue-weighted averages)

We observed a positive upward trend in almost all of the

standards. As a result, companies are continuously improving

their standard implementation levels, which indicate that they

can see the benefits. These findings can be supported by the

fact that a “panel sub-sample” (companies who have

participated in all surveys) showed a reasonable increase trend

over the past several years.

9

IBM Global Technology Services

Cost, revenue and a flexible supply chain

Competitive advantage

Customer

satisfaction

• Improved client relationship

• Improved customer satisfaction

• Better information availability

•

•

•

•

•

Time saving

Cost reduction

Improved supply chain operations

Improved visibility

Increased understanding of retailers

needs and become preferred

collaboration partner

• Increased sales

Store Service Level

•

Annual Revenue Growth Rate

•

Out of stocks

•

GTIN on cases/cartons/inners

SSCC

EDI for orders

EDI for despatch advice

Invoice accuracy

EDI for invoices (manufacturers)

•

Distribution costs

•

Order to delivery cycle time

GTIN on consumer units

GTIN on cases/cartons/inners

Improved Image & Brand

Less Waste

Optimized usage of resources

Better overview of inventory

GTIN on consumer units

GTIN on cases/cartons/inners

SSCC

EDI for orders

EDI despatch advise

Sales with syn master data

GTIN on consumer units

GTIN on cases/cartons/inners

EDI for orders

Sales with synchronized master

data via GDSN

Supplier Service Level

•

•

•

•

•

•

Sustainability

Improved quality

• Improved data quality

• Fewer invoice-disputes

Efficiency

As seen in Figure 6, the top-right quadrant represents

organizations with 6-10 standards implemented that have

an average minimum implementation level of 51percent.

Companies in this group reported lower distribution costs

in comparison to their peers with fewer standards adopted

and lower average implementation levels. Industry leaders

(companies that have implemented at least six standards at

an average implementation level of above 50 percent—

manufacturer as well as retailer and wholesaler) profit from

reduced distribution costs.

Roll out and full implementation

of Trading partner performance

standards (E401)

100%

Industry leaders

Figure 7. Competitive advantage chart

50% 51%

Distribution costs:

6.5%

-4

3%

Distribution costs:

11.4%

1%

Average implementation level of

standards implemented

Industry leader, companies (in dark blue quadrant) which have implemented at least 6 standards at an

average implementation level of above 50% - manufacturer as well as retailer and wholesaler - profit

from reduced distribution costs.

1

5 6

Number of standards implemented

10

Figure 6. Distribution costs and the usage of standards

As shown in Figure 8, the out-of-stock rate (the extent to

which the product is available when the consumer wants to buy

it) is much lower among companies who have implemented the

Serial Shipping Container Code (SSCC) standard or used EDI

for orders. Both actions could lead to better serve consumers

who benefit from fewer out-of-stocks and earlier access to new

products. It is essential that consumer value and satisfaction are

met to maintain shopper loyalty, not only for the brands, but

also to the retail store in order to increase sales and category

profitability.

Figure 7 illustrates that there are many beneficial relationships

between the usage of standards and business measures.

On-Shelf/POS out-of-stocks with the use of SSCC

No Implementation of

SSCC

7,8%

Difference:

-52%

Implementation of SSCC

Figure 8.

3,8%

Lower out-of-stock rate with the use of SSCC

10

Improving business performance and competitive advantage through the implementation of standards

Figure 9 illustrates that companies utilizing synchronized

master data for sales on a higher level between trading partners

with Global Data Synchronization Network (GDSN) showed

reduced distribution costs. The GDSN is an internet-based,

interconnected network of interoperable data pools that

enables companies around the globe to exchange accurate,

compliant, standardized and synchronized supply chain data

with their trading partners using a standardized Global

Product Classification.

Distribution costs with of GDSN for sales

Using GDSN for sales

1-50%

8,9%

Difference:

-44%

Using GDSN for sales

>50%

Figure 9.

5,0%

We observed many examples indicating that the higher the

implementation levels, the greater the potential for savings and

improvements. As seen in Figure 10, additional incremental

benefits are available as companies drive implementation levels

even higher. Hence, companies using more than one measure

at the same time are seeing even better results.

50 – 100%

1 – 50%

implementation implementation

level

level

Delta

Suppliers Service Level/Fill rate with

Consumer units allocated a GTIN

91.6%

94.3%

+2.7%

Invoice accuracy with

EDI for invoices

95.3%

97.2%

+1.5%

Suppliers Service Level/Fill rate with

GTIN on case/carton/inners level

93.1%

94.3%

+1.2%

Distribution costs with

EDI for orders

10.6%

5.4%

- 5.2%

12.5%

7.7%

- 4.7%

Distribution costs with

GTIN on case/carton/inners level

Distribution costs with

GTIN on case/carton/inners level and GDSN

5.1%

Distribution costs with

GTIN on case/carton/inners level and GLN

4.8%

Figure 10. Example for improved business results after boosting the

Lower distribution costs with the use of data synchronization

Companies using EDI for orders or GTIN (Global Trade

Identification Number) on cases/cartons/inners level on a

higher average implementation level, survey results showed

lower distribution costs.

implementation level

IBM Global Technology Services

Challenge your company

•

There can be benefits observed when standards

are implemented—why then, are they not being

implemented by more companies?

Companies who have implemented standards have

exhibited higher performance results compared to those

who have not done so. Boosting the implementation level

demonstrated greater results versus doing it on a lower

level. Continuing to implement standards can mean

“ongoing” improvement.

We close this report by posing several key questions:

•

•

•

Many large companies already use standards extensively.

Correlations between standards and business results identified

in this report are independent of company size. Collaboration

allows industry leaders to share experiences and contribute to

improving their business process. Why is your smaller

company missing out on such a great opportunity to

collaborate with them and gain advantage?

Retailers and wholesalers implement standards at a

higher level than manufacturers do. Results show wide

implementation of product identification standards

revealing a high potential for manufacturers. As a

manufacturer, why not implement standards at a higher level?

Companies dealing with fresh and perishable food show a

shorter lead time than those without fresh food—all the more

reason to utilize standards to remain competitive and profit

from shorter lead times. Why not take the opportunity to

•

11

profit from shorter lead times?

There are many GCI companies among the industry leaders

who firmly believe in the use of standards. Although

2008/2009 was a challenging period, survey results did reveal

a reasonable revenue growth rate of 2 percent. What factors

are preventing your company from matching or exceeding the

implementation rates of your peers and therefore gaining the

same competitive advantage these companies are achieving?

Significant discrepancies can exist in the implementation

levels across comparable different geographical regions. What

concrete steps can you take to drive standards implementation

levels higher locally and globally?

The results are clear: Standards are

invaluable and can be the basis of your

ability to gain an edge over the competition.

For more information

For additional insights about the global scorecard, visit

http://globalscorecard.net/ where you can view case studies,

conference presentations and reports and detailed results of the

GCI 2010 Compliance Survey:

http://www.globalscorecard.net/live/download/ecr_related.

asp

For further information please contact Rüdiger Hagedorn from

Consumer Goods Forum (r.hagedorn@theconsumergoodsforum.

com) or David McCarty from IBM (mccartyd@us.ibm.com).

IBM welcomes the opportunity to discuss your specific

standards implementation needs. Leveraging extensive

experience in the consumer goods industry, IBM Global

Business Services provides consulting services to Consumer

Goods Forum on the subject of developing and using

capability scorecards. Please contact your IBM marketing

representative, or visit the following website:

http://www-935.ibm.com/services/us/gbs/consulting/

About the Consumer Goods Forum

The Consumer Goods Forum is a global, parity-based industry

network, driven by its members. It brings together the CEOs

and senior management of over 650 retailers, manufacturers,

service providers and other stakeholders across 70 countries

and reflects the diversity of the industry in geography, size,

product category and format. Forum member companies have

combined sales of EUR 2.1 trillion.

The Forum was created in June 2009 by the merger of CIES

- The Food Business Forum, the Global Commerce Initiative

(GCI) and the Global CEO Forum. The Consumer Goods

Forum is governed by its Board of Directors, which includes

50 manufacturer and retailer CEOs and chairmen.

The Forum provides a unique global platform for knowledge

exchange and initiatives around five strategic priorities—

emerging trends, sustainability, safety and health, operational

excellence and Knowledge Sharing and people development

—which are central to the advancement of today’s consumer

goods industry.

The Forum’s vision is: “Better lives through better business.”

To fulfill this, its members have given the Forum a mandate to

develop common positions on key strategic and operational

issues affecting the consumer goods business, with a strong

focus on non competitive process improvement. The Forum’s

success is driven by the active participation of the key players

in the sector, who together develop and lead the

implementation of best practices along the value chain.

© Copyright IBM Corporation 2011

IBM Global Services

Route 100

Somers, NY 10589

U.S.A.

Produced in the United States of America

January 2011

All Rights Reserved

IBM, the IBM logo and ibm.com are trademarks or registered trademarks

of International Business Machines Corporation in the United States, other

countries, or both. If these and other IBM trademarked terms are marked

on their first occurrence in this information with a trademark symbol

(® or ™), these symbols indicate U.S. registered or common law

trademarks owned by IBM at the time this information was published.

Such trademarks may also be registered or common law trademarks in

other countries. A current list of IBM trademarks is available on the web

at “Copyright and trademark information” at ibm.com/legal/copytrade.

shtml

Other company, product and service names may be trademarks or service

marks of others.

“2016, the Future Value Chain,” CGF and CapGemini, 2006. http://www.

ciesnet.com/pfiles/publications/2016_Future_Value_Chain_GCI_Report06-11-01-ohne.pdf

1

2

IBM 2009 Global CIO study

http://online.wsj.com/article/NA_WSJ_PUB:

SB10001424052748704421304575383213061198090.html

3

http://www.vics.org/docs/KSurvey/press_releases/pdf/Nov_1_2010_

Press_Release_Item-Level_RFID_FINAL.pdf

4

Please Recycle

With its headquarters in Paris and its regional offices in

Washington, D.C., and Tokyo, the CGF serves its members

throughout the world.

BCE-01565-USEN-00