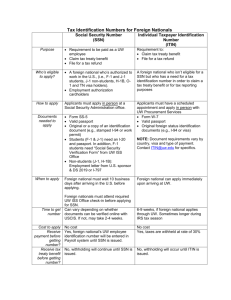

Understanding Your IRS Individual Taxpayer

advertisement