Auto Rules - CPE Credit

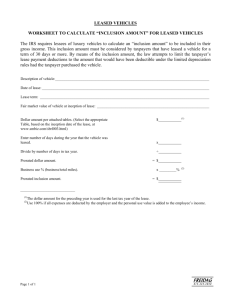

advertisement