US

Name:

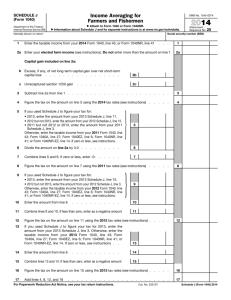

Form 1040 and 1040NR, Line 21: Other Income Worksheet

MARK STARLING

SSN:

454-25-3380

TSJ

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

26

27

28

29

30

Gambling winnings from Form W-2G .............................................................................

Form 1099-MISC, lines 3, 7, and 8 ................................................................................

Taxable distributions from education savings accounts (ESAs) and QTPs ..........................................

Recovery of itemized deductions

................................................................................

Foreign income exclusion from Form 2555, line 45 .................................................................

Foreign income exclusion from Form 2555-EZ, line 18 ............................................................

Income addition from Form 6478, line 2

..........................................................................

Income addition from Form 8814, line 12 ..........................................................................

Taxable Archer MSA distributions from Form 8853, line 8 ..........................................................

Taxable Medicare Advantage MSA distributions from Form 8853, line 12 ...........................................

Taxable long-term care insurance contract payments from Form 8853, line 26 ......................................

Taxable HSA distributions from Form 8889, line 16 ...............................................................

Income for failure to maintain HDHP coverage from Form 8889, line 20 .............................................

Jury duty pay ....................................................................................................

NOL carried forward - enter as a negative amount ................................................................

Medicaid waiver payments to a care provider incorrectly reported on Form W-2 ......................................

Describe - CANCELLATION OF DEBT

Describe Describe Describe Describe Describe Describe Describe Describe Describe Describe Describe Describe Describe -

31 Total other income

...................................................................................................

Oc 2015 Universal Tax Systems, Inc. and/or its affiliates and licensors.

All rights reserved.

2015

Amount

800.

800.

USW10407

Affordable Care Act Worksheet

US

2015

Name: MARK STARLING

SSN: 454-25-3380

Did the taxpayer, spouse, or any dependent receive insurance through the Marketplace? See Form 8962 .............. X Yes

No

Was the taxpayer, spouse, or any dependent granted a Marketplace exemption or do you want to apply for

X No

a Marketplace, household income, or gross income exemption? See Form 8965 ......................................

Yes

MARK STARLING

X Had a minimum essential coverate and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

Had a minimum essential coverage and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

DELORES NEWTON

X Had a minimum essential coverage and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

Had a minimum essential coverage and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

Had a minimum essential coverage and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

Had a minimum essential coverage and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

Had a minimum essential coverage and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

Had a minimum essential coverage and/or is applying for or was granted an exemption for the entire year

Had a minimum essential coverage and/or is applying for or was granted an exemption for part of the year

Check the boxes for each month

Did not have minimum essential coverage and is not claiming an exemption for any part of the year

this person did not have minimum

essential coverage and is NOT

January

February

March

April

May

June

claiming an exemption on Form 8965....

July

August

September

October

November

December

Oc 2015 Universal Tax Systems, Inc. and/or its affiliates and licensors.

All rights reserved.

USW10408

Form

1040 U.S. Individual Income Tax Return 2015

Department of the Treasury - Internal Revenue Service

(99)

For the year Jan. 1-Dec. 31, 2015, or other tax year beginning

Your first name and initial

OMB No. 1545-0074

,2015, ending

IRS Use Only-Do not write or staple in this space.

See separate instructions.

,20

Last name

Your social security number

MARK STARLING

454-25-3380

Last name

Spouse's social security number

Home address (number and street). If you have a P.O. box, see instructions.

k

Apt. no.

l

If a joint return, spouse's first name and initial

2245 Elm Avenue

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below (see instructions).

Presidential Election Campaign

Check here if you, or your spouse if filing

jointly, want $3 to go to this fund. Checking a box below will not change your tax

or refund.

DUBLIN OH 43017Foreign country name

Filing Status

Check only one

box.

Exemptions

Foreign province/state/county

1

2

3

6a

b

c

If more than (1) First name

four depen- DELORES

dents, see

instructions

and check

here j

Last name

NEWTON

social security number

relationship to you

for child tax credit

(see instructions)

560-25-3380PARENT

6c who:

.onlived

. did notwithliveyouwith

0

you due to divorce

or separation

(see instructions)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Wages, salaries, tips, etc. Attach Form(s) W-2

. . . . . . . . . . . . . . . . . . . .

Taxable interest. Attach Schedule B if required

. . . . . . . . . . . . . . . . . . .

Tax-exempt interest. Do not include on line 8a

. . . .

8b

Attach Forms(s)

Ordinary dividends. Attach Schedule B if required

. . . . . . . . . . . . . . . . . .

W-2 here. Also

Qualified dividends . . . . . . . . . . . . . . . . . . .

9b

attach Forms

Taxable refunds, credits, or offsets of state and local income taxes . . . . . . . . . . .

W-2G and

Alimony received . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1099-R if tax

was withheld.

Business income or (loss). Attach Schedule C or C-EZ . . . . . . . . . . . . . . . .

Capital gain or (loss). Attach Schedule D if required. If not required, check here j

If you did not

Other gains or (losses). Attach Form 4797 . . . . . . . . . . . . . . . . . . . . . .

get a W-2,

IRA distributions . . . . 15a

b Taxable amount . . . .

see instructions.

Pensions and annuities . 16a

b Taxable amount . . . .

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

Farm income or (loss). Attach Schedule F

. . . . . . . . . . . . . . . . . . . . . .

Unemployment compensation

. . . . . . . . . . . . . . . . . . . . . . . . . . . .

Social security benefits . 20a

b Taxable amount . . . .

Other income. List type and amount CANCELLATION OF DEBT

Combine the amounts in the far right col for lines 7 through 21.This is your total income

Reserved

. . . . . . . . . . . . . . . . . . . . . . .

23

Adjusted

Certain business expenses of reservists, performing artists,

Gross

and fee-basis gov. officials. Attach Form 2106 or 2106-EZ

24

Income

25 Health savings account deduction. Attach Form 8889 . .

25

26 Moving expenses. Attach Form 3903 . . . . . . . . . .

26

27 Deductible part of self-employment tax. Attach Schedule SE 27

28 Self-employed SEP, SIMPLE, and qualified plans . . . .

28

29 Self-employed health insurance deduction

. . . . . . .

29

30 Penalty on early withdrawal of savings . . . . . . . . .

30

31a Alimony paid b Recipient's SSNj

31a

32 IRA deduction . . . . . . . . . . . . . . . . . . . . .

32

33 Student loan interest deduction

. . . . . . . . . . . .

33

34 Reserved

. . . . . . . . . . . . . . . . . . . . . . .

34

35 Domestic production activities deduction. Attach Form 8903 35

36 Add lines 23 through 35

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

37 Subtract line 36 from line 22. This is your adjusted gross income . . . . . . . . . .

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

BCA

7

8a

b

9a

b

10

11

12

13

14

15a

16a

17

18

19

20a

21

22

23

24

Foreign postal code

You

Spouse

Single

4 X Head of household (with qualifying person). (See instructions.)

Married filing jointly (even if only one had income)

If the qualifying person is a child but not your dependent, enter

Married filing separately. Enter spouse's SSN above

this child's name here.j

and full name here. j

5

Qualifying widow(er) with dependent child

X Yourself. If someone can claim you as a dependent, do not check box 6a . . . . . .

checked on

j Boxes

6a and 6b

1

Spouse . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(4) v/ if child under No. of children

Dependents:

(2) Dependent's

(3) Dependent's

age 17 qualifying

d Total number of exemptions claimed

Income

Make sure the SSN(s) above

and on line 6c are correct.

.

7

8a

.

9a

.

10

11

12

13

14

15b

16b

17

18

19

20b

21

22

.

.

.

.

.

.

.

.

.

j

.

j

36

37

Dependents on 6c

not entered above

0

1

Add numbers

on lines above

2

j

23,400.

2,000.

800.

26,200.

26,200.

Form

1040 (2015)

US1040$2

MARK STARLING

Form 1040 (2015)

454-25-3380

38 Amount from line 37 (adjusted gross income) . . . . . . . . . . . . . . . . . . . . . .

39a Check

You were born before Jan. 2, 1951,

Blind.

j Total boxes

if:

Spouse was born before Jan. 2, 1951,

Blind.

checked j 39a

b If your spouse itemizes on a separate return or you were a dual-status alien, check here j 39b

40 Itemized deductions (from Schedule A) or your standard deduction (see left margin) . .

41 Subtract line 40 from line 38 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

42 Exemptions. If line 38 is $154,950 or less, multiply $4,000 by the number on line 6d. Otherwise, see instructions .

43 Taxable income. Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- . .

44 Tax (see instructions). Check if any from: a

Form(s) 8814 b

Form 4972 c

45 Alternative minimum tax (see instructions). Attach Form 6251 . . . . . . . . . . . . .

46 Excess advance premium tax credit repayment. Attach Form 8962 . . . . . . . . . . . .

47 Add lines 44, 45, and 46 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . j

48 Foreign tax credit. Attach Form 1116 if required . . . . . .

48

49 Credit for child and dependent care expenses. Attach Form 2441 .

49

898.

50 Education credits from Form 8863, line 19 . . . . . . . .

50

51 Retirement savings contributions credit. Attach Form 8880

51

52 Child tax credit. Attach Schedule 8812, if required . . . .

52

53 Residential energy credits. Attach Form 5695 . . . . . . .

53

54 Other credits from Form: a

3800 b

8801 c

54

55 Add lines 48 through 54. These are your total credits . . . . . . . . . . . . . . . . . .

56 Subtract line 55 from line 47. If line 55 is more than line 47, enter -0- . . . . . . . . . . j

Tax and

Credits

2

Page

38

26,200.

40

41

42

43

44

45

46

47

9,250.

16,950.

8,000.

8,950.

898.

j

Standard

Deduction

for-

|People who

check any

box on line

39a or 39b or

who can be

claimed as a

dependent,

see

instructions.

| All others:

Single or

Married filing

separately,

$6,300

Married filing

jointly or

Qualifying

widow(er),

$12,600

Head of

household,

$9,250

Other

Taxes

Payments

If you have a

qualifying

child, attach

Schedule EIC.

Refund

Direct deposit?

See instructions.

Amount

You Owe

Third Party

Designee

Sign

Here

57 Self-employment tax. Attach Schedule SE . . . . . . . . . . . . . . . . . . . . . . . .

58 Unreported social security and Medicare tax from Form: a

4137

b

8919 . . .

59 Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required .

60a Household employment taxes from Schedule H . . . . . . . . . . . . . . . . . . . . . .

b First-time homebuyer credit repayment. Attach Form 5405 if required . . . . . . . . . . .

61 Health care: individual responsibility (see instructions)

Full-year coverage X . . . .

62 Taxes from: a

Form 8959 b

Form 8960 c

Instructions; enter code(s)

63 Add lines 56 through 62. This is your total tax . . . . . . . . . . . . . . . . . . . . . j

1,800.

64 Federal income tax withheld from Forms W-2 and 1099 . .

64

65 2015 estimated tax payments and amount applied from 2014 return

65

66a Earned income credit (EIC) . . . . . . . . . .NO

. . . . .

66a

b Nontaxable combat pay election 66b

67 Additional child tax credit. Attach Form 8812 . . . . . . .

67

1,000.

68 American opportunity credit from Form 8863, line 8 . . . .

68

363.

69 Net premium tax credit. Attach Form 8962 . . . . . . . .

69

70 Amount paid with request for extension to file . . . . . . .

70

71 Excess social security and tier 1 RRTA tax withheld . . .

71

72 Credit for federal tax on fuels. Attach Form 4136 . . . . .

72

Re73 Credits from Form: a

2439 b

73

served c

8885 d

74 Add lines 64, 65, 66a, and 67 through 73. These are your total payments . . . . . . . j

75 If line 74 is more than line 63, subtract line 63 from line 74. This is the amount you overpaid

76a Amount of line 75 you want refunded to you. If Form 8888 is attached, check here j

Routing

Savings

j c Type: Checking

j

b number

Account

j

d number

77 Amount of line 75 you want applied to your 2016 estimated tax j 77

78 Amount you owe. Subtract line 74 from line 63. For details on how to pay, see instructions . . . j

79 Estimated tax penalty (see instructions) . . . . . . . . .

79

Do you want to allow another person to discuss this return with the IRS (see instructions)?

Yes.

55

56

57

58

59

60a

60b

61

62

63

898.

74

75

76a

3,163.

3,163.

3,163.

78

Complete below.

X

No

Designee's

Personal identification

Phone

number (PIN)

name

no.

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief,

they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

j

j

Your signature

Joint return?

See instructions.

Keep a copy for

your records.

898.

Date

k

l Spouse's signature. If a joint return, both must sign.

Print/Type preparer's name

Paid

AARP FOUNDATION TAX-AIDE

Preparer Firm's name j

Use Only Firm's address j

www.irs.gov/form1040

BCA

j

Your occupation

Student

Date

Preparer's signature

Daytime phone number

614-791-1111

If the IRS sent you an Identity

Protection PIN, enter

it here (see inst.)

Spouse's occupation

Date

Check

if

self-employed

Firm's EIN

PTIN

j

Phone no.

Form

1040 (2015)

Form

5329

Department of the Treasury

(99)

Internal Revenue Service

Additional Taxes on Qualified Plans

(Including IRAs) and Other Tax-Favored Accounts

OMB No. 1545-0074

j

j

Attach to Form 1040 or Form 1040NR.

Information about Form 5329 and its separate instructions is at www.irs.gov/form5329.

2015

Attachment

Sequence No.

Name of individual subject to additional tax. If married filing jointly, see instructions.

Your social security no.

MARK STARLING

Fill in Your Address Only k

kk

kk

If You Are Filing This

Form by Itself and Not

lll

With Your Tax Return

ll

454-25-3380

Home address (number and street), or P.O. box if mail is not delivered to your home

29

Apt. no.

City, town or post office, state, and ZIP code.

If you have a foreign address, also complete

the spaces below (see instructions).

If this is an amended

return, check here j

Foreign country name

Foreign province/state/county

Foreign postal code

If you only owe the additional 10% tax on early distributions, you may be able to report this tax directly on Form 1040, line 59, or Form 1040NR, line 57,

without filing Form 5329. See the instructions for Form 1040, line 59, or for Form 1040NR, line 57.

Part I

1

2

3

4

Additional Tax on Early Distributions.

Complete this part if you took a taxable distribution before you reached age 59 1/2 from a qualified retirement plan (including an IRA) or

modified endowment contract (unless you are reporting this tax directly on Form 1040 or Form 1040NR - see above). You may also have

to complete this part to indicate that you qualify for an exception to the additional tax on early distributions or for certain Roth IRA

distributions (see instructions).

2,000.

Early distributions included in income. For Roth IRA distributions, see instructions . . . . . . . . . . . . . . .

1

Early distributions included on line 1 that are not subject to the additional tax (see instructions).

08

2,000.

Enter the appropriate exception number from the instructions:

. . . . . . . . . . . . . .

2

Amount subject to additional tax. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . .

3

Additional tax. Enter 10% (.10) of line 3. Include this amount on Form 1040, line 59, or Form 1040NR, line 57 .

4

Caution: If any part of the amount on line 3 was a distribution from a SIMPLE IRA, you may have

to include 25% of that amount on line 4 instead of 10% (see instructions).

Part II

5

6

7

8

Complete this part if you included an amount in income, on Form 1040 or Form 1040NR, line 21, from a Coverdell education savings

account (ESA), a qualified tuition program (QTP), or an ABLE account.

Distributions included in income from a Coverdell ESA, a QTP, or an ABLE account . . . . . . . . . . . . . .

5

Distributions included on line 5 that are not subject to the additional tax (see instructions) . . . . . . . . . . .

6

Amount subject to additional tax. Subtract line 6 from line 5

. . . . . . . . . . . . . . . . . . . . . . . . .

7

Additional tax. Enter 10% (.10) of line 7. Include this amount on Form 1040, line 59, or Form 1040NR, line 57 .

8

Part III

9

10

11

12

13

14

15

16

17

Additional Tax on Certain Distributions From Education Accounts and ABLE Accounts.

Additional Tax on Excess Contributions to Traditional IRAs.

Complete this part if you contributed more to your traditional IRAs for 2015 than is allowable or you had an amount

on line 17 of your 2014 Form 5329.

Enter your excess contributions from line 16 of your 2014 Form 5329 (see instructions). If zero, go to line 15 . .

9

If your traditional IRA contributions for 2015 are less than your

maximum allowable contribution, see instructions. Otherwise, enter -0- . . . . .

10

2015 traditional IRA distributions included in income (see instructions) . . . . .

11

2015 distributions of prior year excess contributions (see instructions) . . . . . .

12

Add lines 10, 11, and 12

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13

Prior year excess contributions. Subtract line 13 from line 9. If zero or less, enter -0- . . . . . . . . . . . . . .

14

Excess contributions for 2015 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

Total excess contributions. Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16

Additional tax. Enter 6% (.06) of the smaller of line 16 or the value of your traditional IRAs on

December 31, 2015 (including 2015 contributions made in 2016). Include this amount on Form 1040, line 59,

or Form 1040NR, line 57 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17

Part IV

Additional Tax on Excess Contributions to Roth IRAs.

Complete this part if you contributed more to your Roth IRAs for 2015 than is allowable or you had an amount

on line 25 of your 2014 Form 5329.

18 Enter your excess contributions from line 24 of your 2014 Form 5329 (see instructions). If zero, go to line 23 . .

18

19 If your Roth IRA contributions for 2015 are less than your maximum

allowable contribution, see instructions. Otherwise, enter -0- . . . . . . . . . .

19

20 2015 distributions from your Roth IRAs (see instructions) . . . . . . . . . . . .

20

21 Add lines 19 and 20

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21

22 Prior year excess contributions. Subtract line 21 from line 18. If zero or less, enter -0- . . . . . . . . . . . . .

22

23 Excess contributions for 2015 (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23

24 Total excess contributions. Add lines 22 and 23 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24

25 Additional tax. Enter 6% (.06) of the smaller of line 24 or the value of your Roth IRAs on December 31, 2015

(including 2015 contributions made in 2016). Include this amount on Form 1040, line 59, or Form 1040NR, line 57 25

For Privacy Act and Paperwork Reduction Act Notice, see your tax return instructions.

BCA

Form

5329 (2015)

Form

8863

Department of the Treasury

Internal Revenue Service (99)

Education Credits

OMB No. 1545-0074

(American Opportunity and Lifetime Learning Credits)

j Attach to Form 1040 or Form 1040A.

j Information about form 8863 and its separate instructions is at

Name(s) shown on return

www.irs.gov/form8863.

50

Your social security number

454-25-3380

k

l

MARK STARLING

Complete a separate Part III on page 2 for each student for whom you are claiming either credit

before you complete Parts I and II.

Part I

Refundable American Opportunity Credit

!

CAUTION

1 After completing Part III for each student, enter the total of all amounts from all Parts III, line 30 . . .

2 Enter: $180,000 if married filing jointly; $90,000 if single, head of

2

90,000.

household, or qualifying widow(er) . . . . . . . . . . . . . . . . . . . .

3 Enter the amount from Form 1040, line 38, or Form 1040A, line 22. If

you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income

3

26,200.

from Puerto Rico, see Pub. 970 for the amount to enter . . . . . . . . .

4 Subtract line 3 from line 2. If zero or less, stop you cannot take

4

63,800.

any education credit . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Enter: $20,000 if married filing jointly; $10,000 if single, head of

5

10,000.

household, or qualifying widow(er) . . . . . . . . . . . . . . . . . . . . .

6 If line 4 is:

| Equal to or more than line 5, enter 1.000 on line 6 . . . . . . . . . . . . . . .

| Less than line 5, divide line 4 by line 5. Enter the result as a decimal (rounded to j . . . . . . .

at least three places) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7 Multiply line 1 by line 6. Caution: If you were under age 24 at the end of the year and meet

the conditions described in the instructions, you cannot take the refundable American opportunity

credit; skip line 8, enter the amount from line 7 on line 9, and check this box. . . . . . . .j

8 Refundable American opportunity credit. Multiply line 7 by 40% (.40). Enter the amount here and

on Form 1040, line 68, or Form 1040A, line 44. Then go to line 9 below . . . . . . . . . . . . . . . .

Part II

|

2,500.

1

6

1.000

7

2,500.

8

1,000.

9

1,500.

Nonrefundable Education Credits

9 Subtract line 8 from line 7. Enter here and on line 2 of the Credit Limit Worksheet (see instructions)

10 After completing Part III for each student, enter the total of all amounts from all Parts III, line 31. If

zero skip lines 11 through 17, enter -0- on line 18, and go to line 19 . . . . . . . . . . . . . . . . . .

11 Enter the smaller of line 10 or $10,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Multiply line 11 by 20% (.20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 Enter: $130,000 if married filing jointly; $65,000 if single, head of

13

household, or qualifying widow(er) . . . . . . . . . . . . . . . . . . . .

14 Enter the amount from Form 1040, line 38, or Form 1040A, line 22. If

you are filing Form 2555, 2555-EZ, or 4563, or you are excluding income

14

from Puerto Rico, see Pub. 970 for the amount to enter . . . . . . . . .

15 Subtract line 14 from line 13. If zero or less, skip lines 16 and 17,

15

enter -0- on line 18, and go to line 19 . . . . . . . . . . . . . . . . . . .

16 Enter: $20,000 if married filing jointly; $10,000 if single, head of

16

household, or qualifying widow(er) . . . . . . . . . . . . . . . . . . . .

17 If line 15 is:

| Equal to or more than line 16, enter 1.000 on line 17 and go to line 18

Less than line 16, divide line 15 by line 16. Enter the result as a decimal (rounded to at least three places)

.

18 Multiply line 12 by line 17. Enter here and on line 1 of the Credit Limit Worksheet (see instructions) j

19 Nonrefundable education credits. Enter the amount from line 7 of the Credit Limit Worksheet

(see instructions) here and on Form 1040, line 50, or Form 1040A, line 33 . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see your tax return instructions.

BCA

2015

Attachment

Sequence No.

10

11

12

17

18

898.

19

Form

8863 (2015)

Form 8863 (2015)

Page

Your social security number

MARK STARLING

454-25-3380

k

l

Name(s) shown on return

Complete Part III for each student for whom you are claiming either the American opportunity

credit or lifetime learning credit. Use additional copies of page 2 as needed for each student.

Part III

Student and Educational Institution Information

See instructions.

!

CAUTION

20

21

Student name (as shown on page 1 of your tax return)

MARK

STARLING

2

Student social security no. (as shown on page 1 of your tax return)

454-25-3380

22 Educational institution information (see instructions)

a. Name of first educational institution

b. Name of second educational institution (if any)

COLUMBUS STATE COMMUNITY COLLEGE

(1) Address. Number and street (or P.O. box). City, town or post office,

state, and ZIP code. If a foreign address, see instructions.

(1) Address. Number and street (or P.O. box). City, town or post office,

state, and ZIP code. If a foreign address, see instructions.

515 E State St

COLUMBUS OH 43215

(2) Did the student receive Form 1098-T

from this institution for 2015?

(2) Did the student receive Form 1098-T

X

Yes

No

from this institution for 2014 with Box

2 filled in and Box 7 checked?

from this institution for 2015?

Yes

No

Yes

No

(3) Did the student receive Form 1098-T

(3) Did the student receive Form 1098-T

X

Yes

No

from this institution for 2014 with Box

2 filled in and Box 7 checked?

If you checked "No" in both (2) and (3), skip (4).

(4) If you checked "Yes" in (2) or (3), enter the institution's

If you checked "No" in both (2) and (3), skip (4).

(4) If you checked "Yes" in (2) or (3), enter the institution's

federal identification number (from Form 1098-T).

federal identification number (from Form 1098-T).

37-7253380

23

24

25

26

TIP

Has the Hope Scholarship Credit or American opportunity

credit been claimed for this student for any 4 tax years

Yes - Stop!

before 2015?

Go to line 31 for this student.

Was the student enrolled at least half-time for at least one

academic period that began or is treated as having begun

in 2015 at an eligible educational institution in a program

X Yes - Go to line 25.

leading towards a postsecondary degree, certificate, or

other recongnized postsecondary educational credential? (see instructions)

Did the student complete the first 4 years of postsecondary

education before 2015 (see instructions)?

Was the student convicted, before the end of 2015, of a

felony for possession or distribution of a controlled

substance?

X

No - Go to line 24.

No - Stop! Go to line 31

for this student.

Yes - Stop!

Go to line 31 for this student.

X

No - Go to line 26.

Yes - Stop!

Go to line 31 for this student.

X

No - Complete lines 27

through 30 for this student.

You cannot take the American opportunity credit and the lifetime learning credit for the same student

in the same year. If you complete lines 27 through 30 for this student, do not complete line 31.

American Opportunity Credit

27

28

29

30

Adjusted qualified education expenses (see instructions). Do not enter more than $4,000 . . . . .

Subtract $2,000 from line 27. If zero or less enter -0- . . . . . . . . . . . . . . . . . . . . . . . . . .

Multiply line 28 by 25% (.25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If line 28 is zero, enter the amount from line 27. Otherwise, add $2,000 to the amount on line 29 and

enter the result. Skip line 31. Include the total of all amounts from all Parts III, line 30, on Part I, line 1

27

28

29

4,000.

2,000.

500.

30

2,500.

Lifetime Learning Credit

31

BCA

Adjusted qualified education expenses (see instructions). Include the total of all amounts from all

Parts III, line 31, on Part II, line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.

31

Form

8863 (2015)

Form

8962

OMB No. 1545-0074

Premium Tax Credit (PTC)

j

Department of the Treasury

Internal Revenue Service

j Attach to Form 1040, 1040A, or 1040NR.

Information about Form 8962 and its separate instructions is at www.irs.gov/form8962.

Name shown on your return

2015

Attachment

Sequence No.

73

Your social security number

MARK STARLING

454-25-3380

You cannot claim the PTC if your filing status is married filing separately unless you are eligible for an exception (see instructions). If you qualify, check the box.

Part I

Annual and Monthly Contribution Amount

1

Tax family size. Enter the number of exemptions from Form 1040 or Form 1040A, line 6d, or Form 1040NR, line 7d

2a

Modified AGI: Enter your modified

b Enter total of your dependents' modified

26,200.

AGI (see instructions)

. . . .

2a

AGI (see instructions) . . . . . . . . . .

Household income. Add the amounts on lines 2a and 2b . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Federal poverty line. Enter the federal poverty line amount from Table 1-1, 1-2, or 1-3 (see instructions). Check the

appropriate box for the federal poverty table used.

a

Alaska

b

Hawaii

c X Other 48 states and DC

Household income as a percentage of federal poverty line (see instructions) . . . . . . . . . . . . . . . . . . .

Did you enter 401% on line 5? (See instructions if you entered less than 100%.)

No. Continue to line 7.

X Yes. You are not eligible to receive PTC. If advance payment of the PTC was made, see the instructions for

how to report your excess advance PTC repayment amount.

Applicable Figure. Using your line 5 percentage, locate your “applicable figure” on the table in the instructions . .

Annual contribution amount.

b Monthly contribution amount. Divide line 8a

1,247.

Multiply line 3 by line 7 . . . . .

8a

by 12. Round to whole dollar amount . . .

3

4

5

6

7

8a

Part II

9

10

2

1

2b

3

26,200.

4

5

15,730.

166 %

7

0.0476

104.

8b

Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit

Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage (see instructions)?

Yes. Skip to Part IV, Shared Policy Allocation, or Part V, Alternative Calculation for Year of Marriage.

X No. Continue to line 10.

See the instructions to determine if you can use line 11 or must complete lines 12 through 23.

Compute your monthly

your annual PTC. Then skip

Yes. Continue to line 11. Compute

No. Continue to lines 12-23. PTC and continue to line 24.

lines 12-23 and continue to line 24.

(a) Annual

(b) Annual applicable

(d) Annual maximum

(f) Annual advance

(c) Annual

(e) Annual premium

Annual

enrollment premiums

SLCSP premium

premium assistance

payment of PTC

contribution amount

tax credit allowed

Form (s) 1095-A,

(Form(s) 1095-A,

(subtract (c) from (b), if

(Form(s) 1095-A, line

Calculation

(line

8a)

(smaller

of

(a)

or

(d))

line 33b)

zero or less, enter -0-)

33c)

line 33a)

X

11 Annual Totals

Monthly

Calculation

2,363.

(a) Monthly

enrollment

premiums (Form(s)

1095-A, lines 21-32

column a)

2,930.

1,247.

(b) Monthly applicable

SLCSP premium

(Form(s) 1095-A, lines

21-32, column b)

(c) Monthly

contribution amount

(amount from line 8b

or alternative marriage

monthly contribution)

1,683.

(d) Monthly maximum

premium assistance

(subtract (c) from (b), if

zero or less, enter -0-)

1,683.

(e) Monthly premium

tax credit allowed

(smaller of (a) or (d))

1,320.

(f) Monthly advance

payment of PTC

(Form(s) 1095-A, lines

21-32, column c)

12

13

14

15

16

17

18

19

20

21

22

23

24

25

January

February

March

April

May

June

July

August

September

October

November

December

Total premium tax credit. Enter the amount from line 11(e) or add lines 12(e) through 23(e) and enter the total here

Advance payment of PTC. Enter the amount from line 11(f) or add lines 12(f) through 23(f) and enter the total here

24

25

1,683.

1,320.

26

Net premium tax credit. If line 24 is greater than line 25, subtract line 25 from line 24. Enter the difference here and on Form

1040, line 69; Form 1040A, line 45; or Form 1040NR, line 65. If you elected the alternative calculation for marriage, enter zero.

If line 24 equals line 25, enter zero. Stop here. If line 25 is greater than line 24, leave this line blank and continue to line 27

. .

26

363.

Part III

27

Repayment of Excess Advance Payment of the Premium Tax Credit

Repayment limitation (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Excess advance premium tax credit repayment. Enter the smaller of line 27 or line 28 here and on Form 1040,

line 46; Form 1040A, line 29; or Form 1040NR, line 44 . . . . . . . . . . . . . . . . . . . . . . . . . . .

For Paperwork Reduction Act Notice, see your tax return instructions.

28

29

BCA

27

Excess advance payment of PTC. If line 25 is greater than line 24, subtract line 24 from line 25. Enter the difference here

. .

28

. .

29

Form

8962 (2015)

US8879$1

Form

IRS e-file Signature Authorization

8879

Department of the Treasury

Internal Revenue Service

Submission Identification

Number (SID)

OMB No. 1545-0074

j

j

Do not send to the IRS. This is not a tax return.

j Keep this form for your records.

Information about Form 8879 and its instructions is at www.irs.gov/form8879.

2015

k

l

Taxpayer's name

Social security number

MARK STARLING

454-25-3380

Spouse's name

Spouse's social security number

Part I

1

2

3

4

5

Tax Return Information-Tax Year Ending December 31, 2015 (Whole Dollars Only)

Adjusted gross income (Form 1040, line 38; Form 1040A, line 22; Form 1040EZ, line 4) . . . .

Total tax (Form 1040, line 63; Form 1040A, line 39; Form 1040EZ, line 12) . . . . . . . . . . .

Federal income tax withheld (Form 1040, line 64; Form 1040A, line 40; Form 1040EZ, line 7) .

. .

. .

. .

Refund (Form 1040, line 76a; Form 1040A, line 48a; Form 1040EZ, line 13a; Form 1040-SS, Part I, line 13a) .

Amount you owe (Form 1040, line 78; Form 1040A, line 50; Form 1040EZ, line 14).

Part II

. . . . . . . .

26,200.

1

2

3

4

5

1,800.

3,163.

Taxpayer Declaration and Signature Authorization (Be sure you get and keep a copy of your return)

Under penalties of perjury, I declare that I have examined a copy of my electronic individual income tax return and accompanying schedules and

statements for the tax year ending December 31, 2015, and to the best of my knowledge and belief, it is true, correct, and complete. I further declare that the amounts in Part I above are the amounts from my electronic income tax return. I consent to allow my intermediate service provider,

transmitter, or electronic return originator (ERO) to send my return to the IRS and to receive from the IRS (a) an acknowledgment of receipt or reason for rejection of the transmission, (b) the reason for any delay in processing the return or refund, and (c) the date of any refund. If applicable,

I authorize the U.S. Treasury and its designated Financial Agent to initiate an ACH electronic funds withdrawal (direct debit) entry to the financial

institution account indicated in the tax preparation software for payment of my federal taxes owed on this return and/or a payment of estimated

tax, and the financial institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the U.S.

Treasury Financial Agent to terminate the authorization. To revoke (cancel) a payment, I must contact the U.S. Treasury Financial Agent at

1-888-353-4537. Payment cancellation requests must be received no later than 2 business days prior to the payment (settlement) date. I also

authorize the financial institutions involved in the processing of the electronic payment of taxes to receive confidential information necessary to

answer inquiries and resolve issues related to the payment. I further acknowledge that the personal identification number (PIN) below is my

signature for my electronic income tax return and, if applicable my Electronic Funds Withdrawal Consent.

Taxpayer's PIN: check one box only

X

I authorize

to enter or generate my PIN

ERO firm name

Enter five digits, but

as my signature on my tax year 2015 electronically filed income tax return.

do not enter all zeros

I will enter my PIN as my signature on my tax year 2015 electronically filed income tax return. Check this box only if you are

entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Your signature j

Date j

Spouse's PIN: check one box only

I authorize

to enter or generate my PIN

ERO firm name

Enter five digits, but

as my signature on my tax year 2015 electronically filed income tax return.

do not enter all zeros

I will enter my PIN as my signature on my tax year 2015 electronically filed income tax return. Check this box only if you are

entering your own PIN and your return is filed using the Practitioner PIN method. The ERO must complete Part III below.

Spouse's signature j

Date j

Practitioner PIN Method Returns Only-continue below

Part III

Certification and Authentication-Practitioner PIN Method Only

ERO's EFIN/PIN. Enter your six-digit EFIN followed by your five-digit self-selected PIN.

98765

Do not enter all zeros

I certify that the above numeric entry is my PIN, which is my signature for the tax year 2015 electronically filed income tax return

for the taxpayer(s) indicated above. I confirm that I am submitting this return in accordance with the requirements of the Practitioner PIN method

and Publication 1345, Handbook for Authorized IRS e-file Providers of Individual Income Tax Returns.

ERO's signature j

Date j

ERO Must Retain This Form - See Instructions

Do Not Submit This Form to the IRS Unless Requested To Do So

For Paperwork Reduction Act Notice, see your tax return instructions.

BCA

Form

8879 (2015)

US 1040

Name:

Three - Year Tax Summary

2015

MARK STARLING

Gross Income

Wages and salaries ........................

Interest and dividends ........................

Business income ............................

Sale of assets - gain or loss ..................

Pension and IRA distributions ................

Rents, royalties, etc ........................

Unemployment and social security ..........

Other income ..............................

Total gross income ............................

Adjustments to Income ......................

Adjusted gross income ......................

Itemized or Standard Deductions

Medical expense deduction ..................

Taxes ......................................

Interest ....................................

Contributions ................................

Miscellaneous deductions ....................

Other itemized deductions ....................

Total deductions ............................

Exemptions ..................................

Taxable Income ............................

Tax (2015 - 1040, line 44) ....................

Alternative minimum tax ....................

Other taxes ................................

Credits and Payments

Credits ......................................

Withholding ................................

EIC and Additional Child Tax Credit ..........

Estimated tax payments ....................

Other payments ............................

Total credits and payments ..................

Tax liability after credits ......................

Estimated tax penalty ........................

Refund or (Balance Due)

......................

Federal marginal tax bracket ................

Tax preparation fee ..........................

State refund or (balance due)

1st resident state refund (balance due)........

2nd resident state refund (balance due) ......

1st part-year state refund (balance due) ......

2nd part-year state refund (balance due) ......

1st nonresident state refund (balance due) ....

2nd nonresident state refund (balance due)....

3rd nonresident state refund (balance due)....

4th nonresident state refund (balance due) ....

5th nonresident state refund (balance due) ....

NOTES FOR 2015:

Oc 2015 Universal Tax Systems, Inc. and/or its affiliates and licensors.

SSN:

2012

2013

454-25-3380

2014

23,400.

2,000.

800.

26,200.

26,200.

0

0

9,250.

8,000.

8,950.

898.

0

0

898.

1,800.

1,363.

4,061.

0.0

All rights reserved.

%

0.0

%

3,163.

10.0 %

USSUMRY1