Client Manual

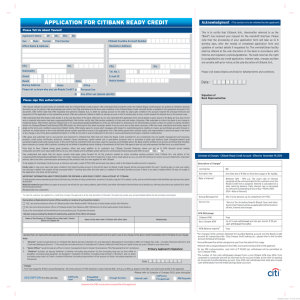

advertisement