Sul Ross State University Rio Grande College Financial Aid

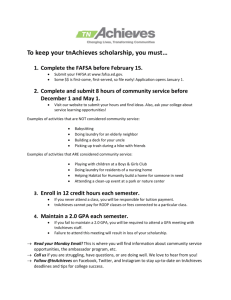

advertisement

Sul Ross State University Rio Grande College Financial Aid Department IMPORTANT NOTICE TO FINANCIAL AID APPLICANTS/RECIPIENTS Please be aware that your Sul Ross email address may be used as an official means of communication to notify you regarding the status of your Financial Aid Application, Award, or other information regarding your request for assistance. You should check your email account daily for updates. For assistance with logging into your Sul Ross email account please contact the SRSU OIT Help Desk at https://lobopass.sulross.edu or 432-837-8888. Additionally, you are responsible for insuring that your current mailing address is maintained on your Banner Self-Service account. How to check and Accept Award Offers Banner Self Service (www.sulross.edu) 1. Click My SRSU 2. Click Banner Self Service 3. Click Login 4. Enter your user ID and Password 5. Click on Financial Aid 6. Click on Financial Aid Status 7. Select Aid Year 8. Click on awarded (blue link) 9. Click on Award Overview 10. Click on Accept Award Offer Sul Ross State University-RGC- Direct Loan Origination Notification Your William D. Ford Direct Federal Stafford Loan origination record has been submitted to the U.S. Department of Education. In order to finalize the loan process, you must complete the following steps: • Entrance Counseling All Sul Ross State University-RGC borrowers must complete an online Entrance Counseling session for their first Direct Loan. Entrance Counseling can be completed at www.studentloans.gov • Master Promissory Note All first-time Sul Ross State University Direct Loan borrowers must complete and sign a Master Promissory Note with the Department of Education. The Direct Loan MPN may be filled out online and signed electronically using your Department of Education personal identification number (PIN) at www.studentloans.gov Exit counseling is required when you have loans and you either: do not attend, graduate, or fall below half time. • Exit Counseling • Go to www.studentloans.gov • Log in using Department of Education PIN and your personal information. • Forgotten PINs may be retrieved at www.pin.ed.gov • Click on the “Complete Counseling” link; then start on “Exit Counseling.” • Choose the school(s) you want and select ‘Add School’ to proceed • Follow Exit counseling instructions, answering the provided quiz questions. • Please notify the Financial Aid Office upon completion. Once you have completed your exit counseling please contact the financial aid office to have your hold removed. Timely receipt of your Loan funds is dependent upon your timely completion of these steps. Student Aid on the Web: www.studentaid.ed.gov To access your federal loan records: www.nslds.ed.gov If you have any questions, you may contact the SRSU-RGC Financial Aid Office at: Del Rio (830) 703-4824 Eagle Pass (830) 758-5021 Uvalde (830) 279-3023 or (830)279-3008 Email: rgcfao@sulross.edu Statement of Student Responsibility for Personal Debt As an RGC student, you are personally responsible for all debts incurred at the College including, but not limited to those associated with Tuition and Fees, Financial Aid, Short-Term Loans, Emergency Loans and returned check fees. In the event that you receive some form of financial aid (Federal Stafford Loan, Pell/SEOG/TPEG Grant, scholarship, 3rdparty billing, sponsorship, etc.), you will be responsible for any amount of debt owed in excess of the financial aid applied for in your account. A delinquent account may affect your course credit, as well as future financial aid awards. Legal action may be pursued on those accounts that become delinquent at the Business Services Department. Withdrawal from the College No fee is charged for executing a complete withdrawal and students may be entitled to a refund of tuition and fees, according to rates set by University policy and listed in the Catalog. Any fees owed to the College prior to withdrawing must be paid. Refund processing may take six to ten weeks. Please refer to rgc.sulross.edu/pages/360.asp. Refund of Fees After payment of registration fees, any student who submits an official withdraw form is entitled for tuition and fee refunds as follows: Before the first class day: 100% During first 5 class days: 80% During second 5 class days: 70% During third 5 class days: 50% During fourth 5 class days: 25% No Refunds Thereafter Drop dates are 100% during first 12 class days, no refunds thereafter. The College reserves the right to audit the fees paid by students and bill or refund accordingly. This audit is based on the official 12th class day enrollment for a long semester. An immediate refund will not be issued upon withdrawal or course drop. Upon request, refunds will be mailed in approximately 30 days to address listed at registration. The refund schedule applies to the total of all tuition and fees owed. Students on the Optional Payment Plan may find refunds smaller than the percentage of the amount paid under the plan. FAQ’s Q. What happens if I drop a class? A. If you drop a class prior to the census date (12th class day), you may be responsible for repayment of the difference between the amount of money you received and the amount specified for the new enrollment status. If you drop a class, you must make sure you remain in compliance with our Satisfactory Academic Progress (SAP) policy. Q. What happens if I withdraw? A. If you withdraw completely or drop below ½ time status, you may be responsible for repaying money received from financial aid, you will be academically ineligible for financial aid if you return to school and fail to remove all academic deficiencies, your grace period begins to count down and if you fail to enroll within 6 months, the repayment will begin on your student loans. SUL ROSS STATE UNIVERSITY FINANCIAL AID SATISFACTORY ACADEMIC PROGRESS POLICY Effective Date: Summer 2013 Federal regulations require Sul Ross State University to establish and apply reasonable standards of satisfactory progress for the purpose of receiving financial aid under the programs authorized by Title IV of the Higher Education Act. The Office of Financial Aid has oversight of student financial aid programs intended to help students achieve access to higher education and accomplish academic goals. Each aid recipient must maintain satisfactory academic progress in a course of study leading toward a degree or certificate. Financial Aid Satisfactory Academic Progress (SAP) is measured after each long semester. Undergraduate Students GPA All undergraduate students: • • • Must maintain a cumulative grade point average (GPA) of 2.0 to remain in good standing. Will be placed on Financial Aid Warning if their cumulative GPA falls below 2.0. Students on Financial Aid Warning are eligible to receive financial aid but are cautioned to strive to improve their academic standing. The grade for a course is not calculated in the grade point average if the course is repeated and a passing grade is received. For repeated courses the final grade will be counted and all hours attempted, including repeated courses, will count toward the time limit below. Undergraduate students on Financial Aid Warning will be placed on Financial Aid Suspension if they fail to achieve a cumulative GPA of 2.0 at the end of their semester of warning. Completion In addition to maintaining the overall GPA requirement, students must make reasonable progress toward their degree or certificate. All undergraduate students: • • Must successfully complete at least 67% of all hours attempted. Grades of F, W, PR, and I are not considered as satisfactory completion but do count as attempted hours. Will be placed on Financial Aid Warning if their overall percentage of completion rate falls below 67%. Undergraduate students on Financial Aid Warning will be placed on Financial Aid Suspension if they fail to achieve an overall completion rate of 67% at the end of their semester of warning. Time Limits All undergraduate students are expected to complete their program of study within the following time frames: • • • • Certificate: 68 hours attempted Associate Degree: 107 hours attempted Bachelor’s Degree: 180 hours attempted Second Degree: 45 hours attempted Undergraduate students who have exceeded these time limits will no longer be eligible for financial aid. These limits include all courses attempted, including summer sessions, periods when the student doesn’t receive any Title IV aid, work toward all degrees (regardless of change in major or degree), withdrawn courses, and repeated courses. Graduate Students GPA All graduate students: • Must maintain a cumulative grade point average (GPA) of 3.0 to remain in good standing. • Will be placed on Financial Aid Warning if their cumulative GPA falls below 3.0. Students on Financial Aid Warning are eligible to receive financial aid but are cautioned to strive to improve their academic standing. Graduate students on Financial Aid Warning will be placed on Financial Aid Suspension if they fail to achieve a cumulative GPA of 3.0 at the end of their semester of warning. Completion In addition to maintaining the overall GPA requirement, students must make reasonable progress toward their degree or certificate. All graduate students: • • Must successfully complete at least 67% of all hours attempted. Grades of F, W, PR, and I are not considered as satisfactory completion. Will be placed on Financial Aid Warning if their overall percentage of completion rate falls below 67%. Graduate students on Financial Aid Warning will be placed on Financial Aid Suspension if they fail to achieve an overall completion rate of 67% at the end of their semester of warning. Time Limits All graduate students are expected to complete their program of study within 54 hours attempted, after which they will no longer be eligible for financial aid. Financial Aid Suspension Financial Aid Warning is limited to one semester. A student who fails to meet the overall standards while on Financial Aid Warning will be placed on Financial Aid Suspension. Appeal of Financial Aid Suspension Students with special circumstances may appeal their Financial Aid Suspension in writing to the Financial Aid Appeals Committee. Forms are available in the Financial Aid Office. The Financial Aid Office may also be contacted for information on appeals filing deadlines. The decision of the Financial Aid Appeal Committee will be final. • Appeals may be made based on: • A death in the immediate family. • Serious injury or illness of the student or a member of the immediate family. • Improvement sufficient to meet required standards in hours and/or GPA while attending a subsequent semester at student’s own expense. • Special circumstances to be reviewed on a case-by-case basis. (Students on Financial Aid Suspension who have not attended college for at least one calendar year may appeal based on change of circumstances.) • • A student whose appeal is granted will be reinstated on Financial Aid Probation. A student on Financial Aid Probation must complete the probationary period with at least a 2.0 GPA (3.0 for Graduates) and complete 67% of all their coursework. A student on Financial Aid Suspension whose appeal is denied may attend SRSU at his/her own expense, if eligible. Financial Aid may be reinstated under the following conditions: • The required cumulative GPA is attained; and • An overall completion rate of 67% of hours attempted is achieved. Financial Aid 101 ___________________________________________________________________________ Steps to Financial Aid Complete the 2014-2015 Free Application for Federal Student Aid (FAFSA) using completed 2013 tax information to apply for Fall 2014, Spring 2015, and Summer 2015. Using estimated taxes will slow your financial aid processing down considerably. FAFSA on the web is a free U. S. Department of Education web site where you can complete a FAFSA online and submit it via the Internet. The Internet address is www.fafsa.ed.gov. List Sul Ross State University's School Code 003625 on the FAFSA. Submit all required financial aid forms and requested information to the Sul Ross State University Financial Aid Office as soon as possible. No federal or state need-based aid can be awarded until all documents are received. Read and respond promptly to any information received from the Financial Aid Office. Enroll in at least six hours each semester for which you apply for financial aid and meet Satisfactory Academic Progress standards. Consult the Financial Aid Office if you are an undergraduate student planning to drop below twelve (12) hours or a graduate student planning to drop below six (6) hours. Keep your mailing address up-to-date with the Office of Admissions and Records. _____________________________________________________________________________________________________________________ Types of Financial Aid Grants FEDERAL PELL GRANT Pell Grant is a federally funded program designed to help students pursuing their first bachelor's degree. Pell Grants provide eligible students with a foundation of financial aid to help defray the cost of post-secondary education. Students must complete the FAFSA to determine eligibility. TEXAS GRANT PROGRAM The Toward EXcellence, Access & Success (TEXAS) grant was established in 1999 by the Texas Legislature to provide need-based financial aid to Texas students who completed a college-preparatory curriculum in high school. Eligible students may receive an amount up to the cost of required tuition and fees each academic year of eligibility (some restrictions apply). To be eligible for the TEXAS grant, students must be a Texas resident, graduated from a public or accredited private high school no earlier than fall 1998, and demonstrate exceptional financial need as determined by the Free Application for Federal Student Aid. If you meet these requirements, please submit a copy of your high school transcript to our office. Preference will be given to students with the lowest EFC (Estimated Family Contribution) and will continue as funds permit. FEDERAL SUPPLEMENTAL EDUCATIONAL OPPORTUNITY GRANT (FSEOG) This is a federally funded, need-based program designed to assist students who demonstrate exceptional financial need and who, without the grant, would be unable to continue their education. Applicants must be working on their first bachelor's degree and be enrolled at least half-time. Students must complete the FAFSA to determine eligibility for the FSEOG. It is a campus-based federal program and funding is limited to amounts allocated by the Department of Education. STATE GRANT AND SCHOLARSHIP PROGRAMS - Texas Higher Education Coordinating Board These grants are authorized by the State of Texas. Please contact our office for award criteria for these programs. • Texas Public Educational Grant (TPEG) • Student Deposit Scholarship Program • License Plate Insignia Scholarship Program • Tuition and Fees Exemption Programs • Texas Grant Employment FEDERAL COLLEGE WORK STUDY (FCWS) The Federal College Work Study Program provides part-time, on-campus employment for U.S. citizens, permanent residents and certain other non-citizens who are half-time students and have a demonstrated financial need. The maximum amount a recipient may earn under this program is determined through the Free Application for Federal Student Aid (FAFSA). INSTITUTIONAL STUDENT EMPLOYMENT Institutional Student Employment provides part-time, on-campus employment for U.S. citizens, permanent residents, and certain other non-citizens who are half-time students, but does not require demonstration of financial need. Students employed under these program are paid minimum wage and may work up to 19 hours per week (depending on eligibility and class schedule). Funds are distributed on a monthly payroll basis. Loans • Federal Direct Loan Program - Subsidized and Unsubsidized Stafford Loans • Federal Direct Parent Plus Loans • Private Loans ___________________________________________________________________________ Financial Aid Frequently Asked Questions Q. What are my chances of receiving financial aid? A. The only way to determine your eligibility for financial aid is to submit a Free Application for Federal Student Aid (FAFSA). The likelihood of receiving some form of financial aid is probably better than most students and their families anticipate. Q. What is the deadline to apply for financial aid? A. To receive maximum consideration for aid, the FAFSA must be received by the institution for processing prior to April 1 each year. Students requesting scholarship consideration must submit their requests to the Scholarship Office prior to March 1 of that year. Q. Is there a maximum income level that will disqualify me from receiving financial aid? A. Most people have the misconception that income is the only factor in determining need for financial aid. However, other variables are considered such as: family size, number of family members in college, age of older parent, savings, investments and various other allowances to the family's income and assets. Q. Are there other forms that I can fill out in order to be considered for any other grants? A. The FAFSA is the only application required in order to be considered for all grant programs available through processing by the financial aid office. Notification of all eligible programs will be provided in the form of a printed award letter listing the types of aid you can expect to receive for the school year. The award letter must be completed and returned to the financial aid office for processing. Q. In order to receive financial aid do I have to apply every year? A. Yes. In order to receive consideration for eligible programs you must file a Free Application for Federal Student Aid (FAFSA) each year. File the FAFSA as close to January as possible. For speedy processing you can apply over the Internet at: www.fafsa.ed.gov. Q. If my parents are divorced or separated, which parent do I put on the FAFSA? A. You should provide information from the parent that provided you with the most support in the past year. If the parent who provided you with the most support has remarried, your step-parent's information must also be provided on the FAFSA. Q. Why can't I apply for financial aid without using my parent's information on the FAFSA form? A. When you apply for federal student aid, your answers to certain questions will determine whether you are considered dependent on your parents or independent. If you are considered dependent on your parents, you must report their income and assets as well as your own. If you think you have unusual circumstances that would make you independent, talk to your financial aid administrator. Q. What happens if I drop a class? A. If you drop a class prior to the census date, you may be responsible for repayment of the difference between the amount of money you received and the amount specified for the new enrollment status. If you drop a class, you must make sure you remain in compliance with our Satisfactory Academic Progress (SAP) policy. Q. What happens if I withdraw? A. If you withdraw completely or drop below 1/2 time status, you may be responsible for repaying money received from financial aid. You will be academically ineligible for financial aid if you return to school and fail to remove all academic deficiencies. Your grace period begins to count down and if you fail to enroll within 6 months, the repayment will begin on your student loans. Q. Will the financial aid transfer from one school to another? A. No. Financial aid does not transfer from school to school. Student planning to transfer to another school should contact the Financial Aid Office at both schools to find out what is required. Q. What is verification? And why was I chosen? A. You should save all records and all other materials used in completing the application because you may need them later to prove that the information you reported is correct. This process is called verification. Many students are selected for verification randomly by the federal processor. However, verifications are also chosen due to mistakes and important data missing on the form such as those questions pertaining to income. Q. Why is the maximum amount of loan money limited? A. Students applying for the Federal Stafford Loan are subject to annual and aggregate loan limits that are based on the academic level, dependency status, and length of the academic program. The Federal Direct Loan Program presets the Stafford Loan limits. Q. What if my financial aid is not available by the due date for my tuition? A. Students may apply for short-term loans to help pay for certain semester educational expenses. Yes, there is a small short-term loan percentage rate but it is very minimal compared to other alternatives. These loans must be repaid before the semester ends.