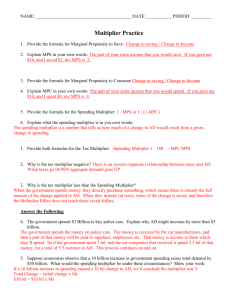

Multiplier Effect

advertisement

Today’s menu: Understanding the M lti li Multiplier Effect i) Understand the multiplier effect. ii) Demonstrate the multiplier effect using savings and investment curves. iii) Calculate C l l t the th value l off the th spending di multiplier. iv) Calculate the impact of the multiplier on income. v) Understand the relationship between spending multiplier, the MPC and the MPS. Calculating the “Multiplier” Definitions Multiplier Effect: describes the fact that expenditures of money will tend to be re re--spent, thus increasing GDP by a larger amount than the initial expenditure. Velocity of Money: describes the average number of times that each unit of money will change hands within a given period of time. then our equilibrium level of income will also increase! 100 80 Aggregate Expen nditure, Savings and Investment Spending Multiplier: the amount by which a change in an autonomous expenditure will be multiplied to determine an overall change in equilibrium expenditure / real GDP G If investment increases... Consumption and Savings Y However, the MPS is such that a small increase in investment leads to a larger increase in Income! 60 40 S 20 I2 I1 I This relative change in income is expressed by the “multiplier”, which is the change in income divided by the change in investment! 0 0 20 40 60 80 100 120 140 -20 -40 Income / Aggregate Output ($ millions) Crude-Quantity Theory of Money: the theory which Crudestates that price levels are directly related to the amount of money in circulation. Y I 1 20 = 10 2.0 = 1 MPS 1 = = 10 = 2.0 0.5 20 Illustrating the Multiplier Effect What if we knew the change in investment... Consumption and Savings 100 Aggregate Expen nditure, Savings and Investment 80 ...and we knew the MPS or the MPC... ? could we figure out the change in income that would result? 60 40 S 20 I2 I1 I 0 0 20 40 60 80 100 120 Of course we could! 140 -20 -40 Income / Aggregate Output ($ millions) Y = I 1 X MPS = 10.00 X = 10.00 X 2 1 The Multiplier Process Round of Spending Investment 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Y = 0.5 Y = 20.00 100.0000 80.0000 64.0000 51.2000 40.9600 32.7680 26.2144 20.9715 16.7772 13.4218 10.7374 8.5899 6.8719 5.4976 4.3980 3.5184 2.8147 2.2518 AE X Total Round of Total Round of Total Investment Investment Spending Spending Spending Spending Spending 100.00 180.00 244.00 295.20 336.16 368.93 395.14 416.11 432.89 446.31 457.05 465.64 472.51 478.01 482.41 485.93 488.74 490.99 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 1.8014 1.4412 1.1529 0.9223 0.7379 0.5903 0.4722 0.3778 0.3022 0.2418 0.1934 0.1547 0.1238 0.0990 0.0792 0.0634 0.0507 0.0406 1 MPS = 100.00 X = 100.00 X 5 492.79 494.24 495.39 496.31 497.05 497.64 498.11 498.49 498.79 499.03 499.23 499.38 499.50 499.60 499.68 499.75 499.80 499.84 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 0.0325 0.0260 0.0208 0.0166 0.0133 0.0106 0.0085 0.0068 0.0054 0.0044 0.0035 0.0028 0.0022 0.0018 0.0014 0.0011 0.0009 0.0007 499.87 499.90 499.92 499.93 499.95 499.96 499.97 499.97 499.98 499.98 499.99 499.99 499.99 499.99 499.99 500.00 500.00 500.00 1 0.2 Y = 500.00 1 Try it yourself! The Multiplier Process 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Total Round of Total Round of Total Investment Investment Spending Spending Spending Spending Spending Investment 100.0000 80.0000 64.0000 51.2000 40.9600 32.7680 26.2144 20.9715 16.7772 13.4218 10.7374 8.5899 6.8719 5.4976 4.3980 3.5184 2.8147 2.2518 100.00 180.00 244.00 295.20 336.16 368.93 395.14 416.11 432.89 446.31 457.05 465.64 472.51 478.01 482.41 485.93 488.74 490.99 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 1.8014 1.4412 1.1529 0.9223 0.7379 0.5903 0.4722 0.3778 0.3022 0.2418 0.1934 0.1547 0.1238 0.0990 0.0792 0.0634 0.0507 0.0406 492.79 494.24 495.39 496.31 497.05 497.64 498.11 498.49 498.79 499.03 499.23 499.38 499.50 499.60 499.68 499.75 499.80 499.84 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 0.0325 0.0260 0.0208 0.0166 0.0133 0.0106 0.0085 0.0068 0.0054 0.0044 0.0035 0.0028 0.0022 0.0018 0.0014 0.0011 0.0009 0.0007 499.87 499.90 499.92 499.93 499.95 499.96 499.97 499.97 499.98 499.98 499.99 499.99 499.99 499.99 499.99 500.00 500.00 500.00 S 8 We’re actually just calculating the multiplier by calculating the sum of a geometric progression. You may have learned this in Algebra as: = a 1-r Where: a= 1st term (amount of money spent) r = common ratio (percentage of a that is re-spent) Thus, r = MPC, and therefore 1 – r would be the MPS. Ergo, a over the MPS will calculate the sum of a geometric progression for an amount of money that is spent, then saved, then re-spent, for an infinite number of terms (terms = no. times the money is spent and re-spent.) [Note: This only works for “convergent” sums.] Consumption and Savings 100 S3 80 Aggregate Expen nditure, Savings and Investment Round of Spending 60 S2 40 Remember... S1 20 I2 I1 I Figure out the spending multiplier AND the multiplier effect (change in income) for each of these three savings curves! The multiplier formula 0 0 20 40 60 80 100 120 140 Multiplier = -20 Y I -40 Income / Aggregate Output ($ millions) The multiplier effect formula Y = I 1 X MPS 2