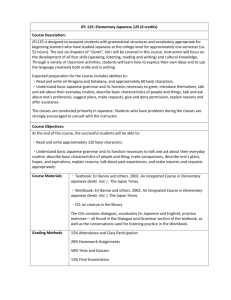

Catch-Up and Leapfrog between the USA and

advertisement