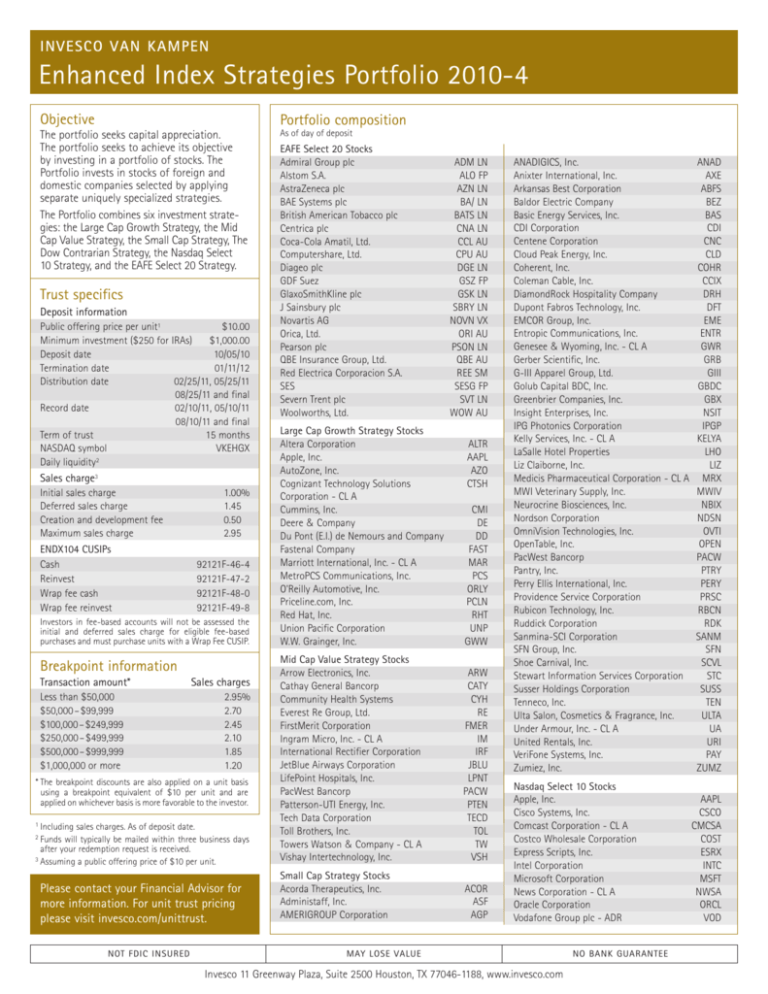

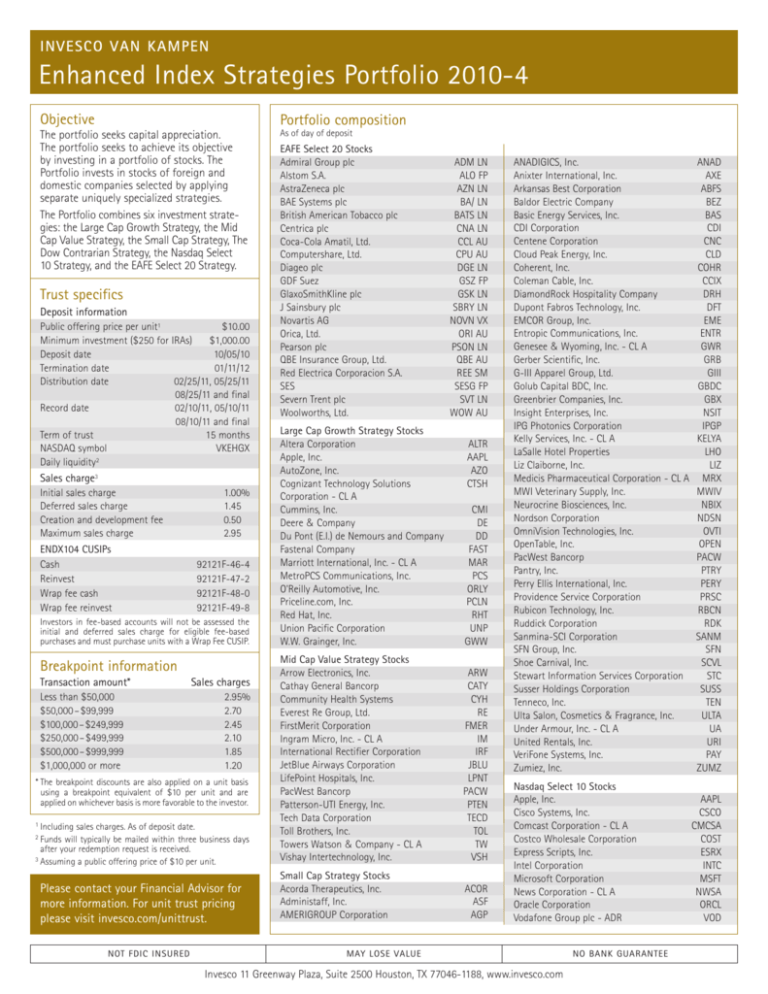

INVESCO VAN KAMPEN

Enhanced Index Strategies Portfolio 2010-4

Objective

Portfolio composition

The portfolio seeks capital appreciation.

The portfolio seeks to achieve its objective

by investing in a portfolio of stocks. The

Portfolio invests in stocks of foreign and

domestic companies selected by applying

separate uniquely specialized strategies.

The Portfolio combines six investment strategies: the Large Cap Growth Strategy, the Mid

Cap Value Strategy, the Small Cap Strategy, The

Dow Contrarian Strategy, the Nasdaq Select

10 Strategy, and the EAFE Select 20 Strategy.

As of day of deposit

Trust specifics

Deposit information

Public offering price per unit1

$10.00

Minimum investment ($250 for IRAs)

$1,000.00

Deposit date

10/05/10

Termination date

01/11/12

Distribution date

02/25/11, 05/25/11

08/25/11 and final

Record date

02/10/11, 05/10/11

08/10/11 and final

Term of trust

15 months

NASDAQ symbol

VKEHGX

Daily liquidity2

Sales charge3

Initial sales charge

Deferred sales charge

Creation and development fee

Maximum sales charge

ENDX104 CUSIPs

Cash

Reinvest

Wrap fee cash

Wrap fee reinvest

1.00%

1.45

0.50

2.95

92121F-46-4

92121F-47-2

92121F-48-0

92121F-49-8

Investors in fee-based accounts will not be assessed the

initial and deferred sales charge for eligible fee-based

purchases and must purchase units with a Wrap Fee CUSIP.

Breakpoint information

Transaction amount*

Less than $50,000

$50,000–$99,999

$100,000–$249,999

$250,000–$499,999

$500,000–$999,999

$1,000,000 or more

Sales charges

2.95%

2.70

2.45

2.10

1.85

1.20

* The breakpoint discounts are also applied on a unit basis

using a breakpoint equivalent of $10 per unit and are

applied on whichever basis is more favorable to the investor.

1

Including sales charges. As of deposit date.

Funds will typically be mailed within three business days

after your redemption request is received.

3 Assuming a public offering price of $10 per unit.

2

Please contact your Financial Advisor for

more information. For unit trust pricing

please visit invesco.com/unittrust.

NOT FDIC INSURED

EAFE Select 20 Stocks

Admiral Group plc

Alstom S.A.

AstraZeneca plc

BAE Systems plc

British American Tobacco plc

Centrica plc

Coca-Cola Amatil, Ltd.

Computershare, Ltd.

Diageo plc

GDF Suez

GlaxoSmithKline plc

J Sainsbury plc

Novartis AG

Orica, Ltd.

Pearson plc

QBE Insurance Group, Ltd.

Red Electrica Corporacion S.A.

SES

Severn Trent plc

Woolworths, Ltd.

ADM LN

ALO FP

AZN LN

BA/ LN

BATS LN

CNA LN

CCL AU

CPU AU

DGE LN

GSZ FP

GSK LN

SBRY LN

NOVN VX

ORI AU

PSON LN

QBE AU

REE SM

SESG FP

SVT LN

WOW AU

Large Cap Growth Strategy Stocks

Altera Corporation

Apple, Inc.

AutoZone, Inc.

Cognizant Technology Solutions

Corporation - CL A

Cummins, Inc.

Deere & Company

Du Pont (E.I.) de Nemours and Company

Fastenal Company

Marriott International, Inc. - CL A

MetroPCS Communications, Inc.

O'Reilly Automotive, Inc.

Priceline.com, Inc.

Red Hat, Inc.

Union Pacific Corporation

W.W. Grainger, Inc.

CMI

DE

DD

FAST

MAR

PCS

ORLY

PCLN

RHT

UNP

GWW

Mid Cap Value Strategy Stocks

Arrow Electronics, Inc.

Cathay General Bancorp

Community Health Systems

Everest Re Group, Ltd.

FirstMerit Corporation

Ingram Micro, Inc. - CL A

International Rectifier Corporation

JetBlue Airways Corporation

LifePoint Hospitals, Inc.

PacWest Bancorp

Patterson-UTI Energy, Inc.

Tech Data Corporation

Toll Brothers, Inc.

Towers Watson & Company - CL A

Vishay Intertechnology, Inc.

ARW

CATY

CYH

RE

FMER

IM

IRF

JBLU

LPNT

PACW

PTEN

TECD

TOL

TW

VSH

Small Cap Strategy Stocks

Acorda Therapeutics, Inc.

Administaff, Inc.

AMERIGROUP Corporation

ACOR

ASF

AGP

ALTR

AAPL

AZO

CTSH

ANADIGICS, Inc.

Anixter International, Inc.

Arkansas Best Corporation

Baldor Electric Company

Basic Energy Services, Inc.

CDI Corporation

Centene Corporation

Cloud Peak Energy, Inc.

Coherent, Inc.

Coleman Cable, Inc.

DiamondRock Hospitality Company

Dupont Fabros Technology, Inc.

EMCOR Group, Inc.

Entropic Communications, Inc.

Genesee & Wyoming, Inc. - CL A

Gerber Scientific, Inc.

G-III Apparel Group, Ltd.

Golub Capital BDC, Inc.

Greenbrier Companies, Inc.

Insight Enterprises, Inc.

IPG Photonics Corporation

Kelly Services, Inc. - CL A

LaSalle Hotel Properties

Liz Claiborne, Inc.

Medicis Pharmaceutical Corporation - CL A

MWI Veterinary Supply, Inc.

Neurocrine Biosciences, Inc.

Nordson Corporation

OmniVision Technologies, Inc.

OpenTable, Inc.

PacWest Bancorp

Pantry, Inc.

Perry Ellis International, Inc.

Providence Service Corporation

Rubicon Technology, Inc.

Ruddick Corporation

Sanmina-SCI Corporation

SFN Group, Inc.

Shoe Carnival, Inc.

Stewart Information Services Corporation

Susser Holdings Corporation

Tenneco, Inc.

Ulta Salon, Cosmetics & Fragrance, Inc.

Under Armour, Inc. - CL A

United Rentals, Inc.

VeriFone Systems, Inc.

Zumiez, Inc.

Nasdaq Select 10 Stocks

Apple, Inc.

Cisco Systems, Inc.

Comcast Corporation - CL A

Costco Wholesale Corporation

Express Scripts, Inc.

Intel Corporation

Microsoft Corporation

News Corporation - CL A

Oracle Corporation

Vodafone Group plc - ADR

MAY LOSE VALUE

Invesco 11 Greenway Plaza, Suite 2500 Houston, TX 77046-1188, www.invesco.com

NO BANK GUARANTEE

ANAD

AXE

ABFS

BEZ

BAS

CDI

CNC

CLD

COHR

CCIX

DRH

DFT

EME

ENTR

GWR

GRB

GIII

GBDC

GBX

NSIT

IPGP

KELYA

LHO

LIZ

MRX

MWIV

NBIX

NDSN

OVTI

OPEN

PACW

PTRY

PERY

PRSC

RBCN

RDK

SANM

SFN

SCVL

STC

SUSS

TEN

ULTA

UA

URI

PAY

ZUMZ

AAPL

CSCO

CMCSA

COST

ESRX

INTC

MSFT

NWSA

ORCL

VOD

Portfolio composition - continued

As of day of deposit

Morningstar Equity Style BoxTM

As of the business day before deposit date

Large value 14.59%

Large blend 20.88%

Large growth 21.74%

Mid value 4.58%

Mid blend 5.88%

Mid growth 8.33%

Small value 12.31%

Small blend 5.91%

Small growth 5.78%

The trust portfolio is provided for informational purposes

only and should not be deemed as a recommendation to

buy or sell the individual securities shown above. Invesco

Van Kampen unit investment trusts are distributed by the

sponsor, Van Kampen Funds Inc., and broker dealers including Invesco Distributors, Inc. Both firms are wholly owned,

indirect subsidiaries of Invesco Ltd.

Small Cap Strategy5

Outlined below is the selection process for each of the six

different strategies that are combined to create the Enhanced

Index Strategies Portfolio.

Small Cap Growth Component

1. Eliminate stocks from the Russell 2000 Index with share prices of less than $5.

2. Rank remaining stocks by Earnings Pressure.SM

3. Select the 25 stocks with the highest Earnings Pressure.SM

In addition, a stock will be excluded and such stock will be replaced

with the stock with the next highest Earnings Pressure if, based on

publicly available information as of the selection date, the company is

the target of an announced business acquisition which Invesco expects

will close within six months of the date of deposit.

The Dow Contrarian Strategy

Select the 10 stocks from the Dow Jones Industrial Average with the

lowest percentage price change over the preceding 52-week period.

Large Cap Growth Strategy

1. Eliminate stocks from the S&P 500 Index with share prices of less than $5.

2. The remaining stocks are ranked by price momentum and the 75 stocks

with the highest price momentum are selected. (A comparison of

current stock price versus historical stock prices).

3. Rank these 75 stocks by Earnings PressureSM 4, a proprietary measure

developed by Lightstone Capital Management.

4. The strategy selects the 15 stocks with the highest Earnings Pressure,

provided that no more than six stocks may be selected from any single

industry (as defined by Zacks Investment Research), no more than two

stocks may have a market capitalization of less than $5 billion dollars

and provided that the stock of any affiliate of Invesco or any of its

affiliates, will be excluded and replaced with the stock with the next

highest Earnings Pressure.

In addition, a stock will be excluded and such stock will be replaced

with the stock with the next highest Earnings Pressure if, based on

publicly available information as of the selection date, the company

is the target of an announced business acquisition which Invesco

expects will close within six months of the date of deposit.

Small Cap Value Component

1. Eliminate stocks from the Russell 2000 Index with share prices of less than $5.

2. Rank remaining stocks in index by price-to-sales ratio (PSR).

3. Select 200 stocks with the lowest PSR. (A low PSR may help dampen

the risks associated with a pure-growth strategy).

4. Select the 25 stocks with the highest Earnings Pressure.SM

In addition, a stock will be excluded and such stock will be replaced

with the stock with the next highest Earnings Pressure if, based on

publicly available information as of the selection date, the company is

the target of an announced business acquisition which Invesco expects

will close within six months of the date of deposit.

EAFE Select 20 Strategy

1. Apply quality screens to the MSCI EAFE Index6 to include only those

companies with positive one- and three-year sales and earnings

growth and three years of positive dividend growth.

2. Select stocks with the highest market capitalization (the top 75%).

3. Select the 20 stocks with the highest dividend yields.

Mid Cap Value Strategy

1. Begin with the Standard & Poor’s MidCap 400 Index.

2. Screen out all stocks with a share price under $5.

3. Take the 100 stocks with the lowest price/book ratio.

4. Select the 15 stocks with the highest Earnings Pressure.SM In addition,

a stock will be excluded and such stock will be replaced with the stock

with the next highest Earnings Pressure if, based on publicly available

information as of the selection date, the company is the target of

an announced business acquisition which Invesco expects will close

within six months of the date of deposit.

Nasdaq Select 10 Strategy

1. Select the 20 largest market capitalization stocks in the Nasdaq-100 Index.

2. From these 20, select the 10 stocks with the highest annual dollar sales

as of the most recently reported 12-month period.

BLEND GROWTH

LARGE

Consumer discretionary 13.27%

Consumer staples 6.85%

Energy 3.43%

Financials 11.52%

Health care 10.45%

Industrials 15.02%

Information technology 29.74%

Materials 3.58%

Telecommunication services 2.78%

Utilities 3.36%

VALUE

MID

AA

BAC

CSCO

XOM

GE

HPQ

INTC

JNJ

JPM

MSFT

SMALL

The Dow Contrarian Strategy Stocks

Alcoa, Inc.

Bank of America Corporation

Cisco Systems, Inc.

Exxon Mobil Corporation

General Electric Company

Hewlett-Packard Company

Intel Corporation

Johnson & Johnson

JPMorgan Chase & Company

Microsoft Corporation

Sector diversification and

style breakout

Earnings Pressure is a proprietary formula which uses the increase in estimates of future earnings by analysts

that follow each stock. The portfolio consultant calculates Earnings Pressure as follows: (1) Obtain the

Consensus EPS for the next 12-month period for each stock included in the Index from which the stocks are

chosen as of the selection date of the Portfolio. (2) Obtain the Consensus EPS for the end of each of the most

recent three months prior to the selection date of the portfolio and combine them to obtain the average

Consensus EPS over the most recent three months (fixed multipliers are used to increase the weighting of the

more recent Consensus EPS figures). (3) Calculate the relative changes in Consensus EPS over the most recent

three months by subtracting the amount obtained in (2) above from the amount obtained in (1) above (the

Change in Consensus EPS) and the dividing the Change in Consensus EPS). (4) The resulting Relative Change

in Consensus EPS as calculated in (3) above is then divided by the standard deviation amount from the Zacks

database which measures the variation among the individual analyst EPS data. (5) The resulting amount as

calculated in (4) above is then multiplied by the number 1 plus the net number of total upward revisions

minus total downward revisions in individual analyst EPS data during the most recent three month period.

This is Earnings Pressure.

5

In connection with the Strategic Small-Cap Strategy, if one or more stocks are selected by both the growthcomponent and the value-component criteria, it will be counted as one selection only. As a result, to get to a

total of 50 stocks, additional stocks will be identified and selected by alternately applying the growth

component to arrive at another stock and then applying the value component to arrive at another stock,

continuing as necessary to get to 50 stocks. Approximately equal dollar amounts are invested in each stock.

6

The strategy does not include stocks from Singapore, which in the opinion of Invesco may be subject to undue

market volatility and political instability over time. Any stocks which are passive foreign investments companies

are also eliminated from the strategy.

In general the classifications used were based first on market capitalization using the definition: Small-Cap-less

than $1 billion; Mid-Cap-$1 billion to $5 billion, Large-Cap-over $5 billion. Invesco uses Price/Book to determine

the growth and value characteristics. Stocks with high relative price-to-book ratios are considered growth, while

stocks with low relative price-to-book ratios are considered value stocks.

4

Before investing, investors should carefully read the prospectus and consider the investment objectives, risks, charges and expenses. For this and

more complete information about the trust(s), investors should ask their advisers for a prospectus or download one at invesco.com/unittrust.

Risk considerations

There is no assurance the trust will achieve its investment objective. An investment in this unit investment trust is subject to market risk, which is the possibility that

the market values of securities owned by the trust will decline and that the value of trust units may therefore be less than what you paid for them. This trust is

unmanaged and its portfolio is not intended to change during the trust’s life except in limited circumstances. Accordingly, you can lose money investing in this trust.

You should consider this trust as part of a long-term investment strategy and you should consider your ability to pursue it by investing in successive trusts, if

available. You will encounter tax consequences associated with reinvesting from one trust to another.

Investing in foreign securities involves certain risks not typically associated with investing solely in the United States. This may magnify volatility due to changes in

foreign exchange rates, the political and economic uncertainties in foreign countries, and the potential lack of liquidity, government supervision and regulation.

This trust is concentrated in the information technology industry. There are certain risks specific to technology stocks such as volatile stock prices, rapid product

obsolescence, and speculative trading.

Stocks of small companies are often more volatile than those of larger companies as a result of several factors such as limited trading volumes, products or financial

resources, management inexperience and less publicly available information.

The Russell 2000 Index is an unmanaged index generally representative of the U.S. market for small-capitalization stocks.

The Morgan Stanley Capital International Europe, Australasia, and Far East Index (“MSCI EAFE”) is an unmanaged index generally representative of major overseas stock markets.

NASDAQ 100 index represents 100 of the largest non-financial, domestic and international companies traded on the NASAQ Stock Market, Inc. based on market capitalization.

The Standard & Poor’s MidCap 400, introduced in 1991, is now the most widely used index for mid-sized companies. S&P MidCap 400 covers approximately 7% of the U.S. equities market.

The Dow Jones Industrial AverageSM is a product of Dow Jones Indexes, a licensed trademark of CME Group Index Services LLC (“CME”), and has been licensed for use. “Dow Jones®”, “Dow Jones

Industrial AverageSM”, “DJIASM”, and “Dow Jones Indexes” are service marks of Dow Jones Trademark Holdings, LLC (“Dow Jones”) and have been licensed for use for certain purposes by

Invesco and certain trusts. The trusts, based on the Dow Jones Industrial AverageSM, are not sponsored, endorsed, sold or promoted by Dow Jones, CME or their respective affiliates and none of

them makes any representation regarding the advisability of investing in such products(s).

Indices are statistical composites and their returns do not include payment of any sales charges or fees an investor would pay to purchase the securities they represent. Such costs would lower

performance. It is not possible to invest directly in an index.

John B. Lightstone, PhD, and Lightstone Capital Management are the property of John B. Lightstone, PhD, and Lightstone Capital Management, who are not affiliated with Invesco Funds Inc.

Lightstone Capital Management is also being compensated for portfolio consulting services, including selection of the stocks for the trust.

The Nasdaq-100,® Nasdaq-100 Index,® and Nasdaq® are trade or service marks of The Nasdaq Stock Market, Inc. (which with its affiliates are the Corporations) and are licensed for use

by Invesco. The trust has not been passed on by the Corporations as to their legality or suitability. The trust is not issued, endorsed, sold, or promoted by the Corporations. THE CORPORATIONS

MAKE NO WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE TRUST. The trust's selection process is proprietary and is the subject of a United States patent under license to Invesco

and the trust.

The trust is not sponsored, endorsed, or promoted by MSCI Inc., and MSCI Inc. bears no liability with respect to any trust or any index on which the trust is based. The prospectus contains a

more detailed description of the limited relationship MSCI Inc. has with the sponsor and any related trust.

Morningstar Datalab is the source for the style box that appears on the previous page. The Morningstar Equity Style Box™ is based on holdings as of the date of deposit of the trust and may

vary thereafter. The Morningstar Equity Style Box™ placement is based on two variables. First, on a trust’s market capitalization relative to the movements of the market and second, the

valuation by comparing the stocks in the trust’s portfolio with the most relevant of the three market capitalization groups. Source: Morningstar, Inc., Chicago, IL 312-696-6000.

© 2010 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and

(3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information.

Past performance is no guarantee of future results.

Value, blend and growth are types of investment styles. Growth investing generally seeks stocks that offer the potential for greater-than-average earnings growth, and may entail greater risk

than value or blend investing. Value investing generally seeks stocks that may be sound investments but are temporarily out of favor in the marketplace, and may entail less risk than growth

investing. A blend investment combines the two styles.

www.invesco.com/unittrust

Invesco

11 Greenway Plaza, Suite 2500

Houston, TX 77046-1188

www.invesco.com

Invesco Distributors, Inc.

U-ENDX104-FCT-1 10.10