The Business Cycle and The Great Depression of the

advertisement

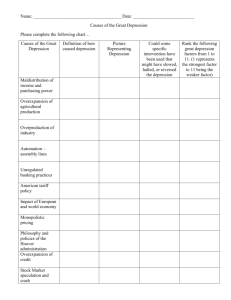

The Business Cycle and The Great Depression of the 1930’s With the stock market “crash” in October, 1929, the U.S. entered a period in its history known as the Great Depression. This lasted for almost the entire decade of the 1930’s, and really didn’t end until the U.S. became involved in World War II in the early 1940’s. What was the Great Depression? How did it happen? What was it like? How did it end? These are all questions we will be answering in this unit. Let’s begin with the basic question: “Just what is a depression?” A depression is really just a normal phase of what economists call the business cycle. In fact, the U.S. has gone through a number of depressions in its relatively short history. So, onto the business cycle... The economy of the U.S., the way the people of our nation get the things they need and want, is constantly changing. There are good times followed by bad times, but the bad times have always been followed by more good times. This cycle keeps repeating itself. It is like a big wheel that is constantly turning. An economist would call the good times a period of prosperity, and the bad times a period of depression. The period of time between prosperity and depression is known as recession, and the period of time between depression and prosperity is called recovery. Confused? Read on! We still haven’t answered our main question, “What is a depression?” Before we do, however, let’s start at the top of the business cycle, where it’s nice, and work our way down to where it’s not so nice. PROSPERITY: 1. 2. 3. 4. lots of business activity; a lot is being produced, and a lot is being bought and sold wages, prices, and profits are high unemployment (the number of people who can’t find work) is low there is a general “feeling” that things are good and will continue to be good RECESSION: 1. 2. 3. 4. business activity begins to slow down; less is being produced, less is being bought and sold wages, prices, and profits begin to fall unemployment begins to rise there is a general “feeling” of uncertainty; people aren’t sure what is going to happen next DEPRESSION: 1. 2. 3. 4. business activity is low; little is being produced, and little is being bought and sold wages, prices, and profits are low unemployment is high (many people are out of work and can’t find a job) there is a general “feeling” of gloom and hopelessness RECOVERY: 1. 2. 3. 4. business activity begins to improve; more is being produced, more is being bought and sold wages, prices, and profits begin to rise unemployment begins to fall there is a general “feeling” that things are getting better O.K., so now we know what a depression and a business cycle is. Let’s work with all of this information a bit before moving on... *Complete Section 1 of your Study Guide. A serious problem of recessions and depressions is that they often “feed on themselves.” In other words, the conditions they create tend to make them worse. This is also called a “vicious” cycle. It gets worse and worse all by itself. One bad thing leads to another, which leads to another, which leads to another, and so on, and so on. Get the idea? We’ll look at an example of this in a minute, but first, let’s look at the fundamental causes of the Great Depression. 1. During the 1920’s businesses produced too much. More goods were made than could be sold. Businessmen seemed to believe that there was no limit to how much they could sell. They were wrong. Surplus goods, those that were made but could not be sold, began to pile up in warehouses. Businesses began to cut back on production. When they did not produce as much, they did not need as many workers. 2. During the 1920’s wages and farm prices remained low. This meant that working people and farmers had little money to spend. Often they had to borrow money to buy the things they needed or wanted. Sometimes they would purchase things in a new way - the installment plan. This meant that they would pay for an item a little at a time over a period of years. This is also known as “buying on credit.” Because of this, many Americans owed much more money than they could pay back in a hurry. 3. During the 1920’s bankers made unwise loans to businesses and individuals. The businesses used the money to expand, and many of the individuals used the money to invest in stocks. If the businesses failed, or the value of the stocks went down, the people who had borrowed the money would not be able to repay the loans. In this case, the money the banks had loaned would be “lost.” When people who had deposited their money in the banks went to get it, it would not be there! 4. During the 1920’s many Americans were trying to “get rich quick.” They invested all of their money in real estate or, more often, in the stock market. To “get rich faster” they borrowed money to invest. Often they owed much more than they could pay back. This was o.k. as long as the value of the property or stock went up, but if the value of that property or stock went down, they would not be able to pay back what they had borrowed. Many people had invested their entire life savings in these efforts to “get rich quick!” So many people were trying to buy stock that demand was greater than supply. This meant that the value (price) of the stock kept going up. The more it went up, the more money people “made.” but what would happen if all of these people suddenly wanted to sell? 5. During the 1920’s trade between the U.S. and other nations declined (went down). This is because of European nations had been hurt by World War I. They were using most of their money to repair the damage of the war. In addition, many countries had placed high tariffs (taxes) on foreign goods. Because they could not sell as much in Europe, manufacturers had another reason to produce less! Time out...before we go on... *Complete Section 2 of the reading guide. So, what was the immediate cause of the Great Depression? That’s an easy one. The immediate cause of the Great Depression was the stock market “crash” that began in late October, 1929. At that time the average value of stocks fell drastically. Why? Because suddenly everyone wanted to sell their stocks at once. Supply was much, much greater than demand, so prices fell, and fell, and fell, and fell.... Millions of dollars were “lost.” This set in motion a vicious cycle (I told you we’d get back to this) that led to the Great Depression! Let’s take a look how... 1. When the stock market crashed, individuals and banks lost the money they had invested in stock. Banks also lost the money they had loaned to people to buy stock. This meant that people who had deposited their money in the bank for “safekeeping” lost their money, too, even though they might not have owned any stock!! 2. People suddenly had little or no money. They could not buy things. 3. Because people were not buying things, stores were selling less. They cut back on their orders from factories. 4. Because stores were ordering less, the factories did not need to make as much. They cut back on production. 5. Because the factories were producing less, they did not need as many workers. People were “laid off.” 6. Because people were out of work, they had no money coming in (this was in the days before unemployment insurance). They could not buy things. 7. Because people were not buying things... So, you can see how the whole thing came about. The stock market crash led to less business which led to unemployment which led to less business which led to more unemployment which led to even less business which led to even more unemployment which led to...well, you get the picture. The result was not pretty. People not only lost their jobs, they often lost their homes. Most people who owned their homes purchased them with borrowed money. If they were unable to repay the loan, called a mortgage, the banks could foreclose (take their homes as payment)! In this same way many farmers lost their farms. This was a truly depressing situation. Maybe that’s why it’s called a depression. We’ll be going on to look at what it was like to live during the Great Depression, but first you must... *Complete Section 3 of the Study Guide. "Bull" v. "Bear" Markets The prosperity of the late 1920s created a "get-rich-quick" attitude in the United States. More and more people set out to make fortunes in the stock market. They followed the prices of stocks in the newspapers as closely as they followed Babe Ruth's batting average. By mid-1929 stock prices had been climbing steadily for months. Many people getting involved in the stock market were buying on margin - purchasing stock with borrowed money. Speculators, or people who make risky investments in hopes of large profits, could buy stock with as little as 10 percent of the total price down. When the stock rose in price, they could sell it, payoff the loan, and pocket the profit. During the booming bull market, a continuing rise in stock prices, margin buying seemed a quick way to wealth. A bear market, a steady drop in stock prices, would mean disaster for anyone who bought stock on margin. Most people in the 1920's, however, thought that the bull market would never end. The market reached a peak in September 1929. Then on October 24 - "Black Thursday" - thousands of investors decided to sell stocks instead of buying them. Many economic factors, including rising interest rates, had made them nervous. Frightened investors jammed telephone lines and crowded into brokers' offices, desperate to turn their stocks into cash. With many sellers and few buyers, the prices of stocks plunged. For example, General Electric Company stock dropped from $315 to $283 per share - a major loss, considering the stock's recent growth. On October 29 - "Black Tuesday" - came an even steeper decline. "When the closing bell rang, the great bull market was dead and buried," recalled one journalist. He went on: "Not only the little speculators, but the lordly, experienced big traders had been wiped out .... Many bankers and brokers were doubtful about their own solvency [financial well-being]." Day after day the drop continued in this Panic of 1929. By the middle of November, General Electric stock was down to $168 a share. The prosperity of the 1920s was over. Before going on, complete Section 4 of your Study Guide. Now...lets review. From Crash to Collapse...From Prosperity to Depression The stock market crash was the start of the worldwide economic downturn known as the Great Depression. At the time, some Americans, including the president, Herbert Hoover, blamed the depression on economic conditions in Europe. European countries had built up staggering debts during World War I. Such debts - owed mainly to the United States - greatly handicapped these countries' postwar economic recoveries. Bank failures. The reasons the depression was so severe, however, lay closer to home. Many investors, including banks, who had bought on margin were left holding worthless stock and were unable to pay their debts. In addition, when farm prices fell in the I 920s, farmers were unable to make their loan payments. By the decade's end, other industries, such as mining, textiles, and construction had also experienced financial problems. When businesses were unable to pay their debts, hundreds of banks failed throughout the country. Fearing more banks would fail, many depositors withdrew their savings. Between the loss of unpaid loans and the withdrawal of deposits, the banking system almost completely collapsed. Over 5,000 banks failed between 1930 and 1933. Millions of people lost their entire savings. Business closures. Other Americans had no savings or were in debt before the crash. Many consumers, lured by installment plans and easy credit, had bought items that they could not afford. When the economy took a downswing, they had a hard time paying for the goods they owned and had no resources to purchase new ones. The boom of the 1920s had enabled a relatively small number of people to obtain a very large percentage of the nation's purchasing power. After a time, the mass of consumers could not afford to buy the goods pouring forth from the factories. Production had increased more rapidly than the income of the average family. Factories slowed down production and laid off workers. Then, in 1930, Congress passed high tariffs to protect U.S. companies from foreign competitors. International trade declined and the economy shrank even more. As a result, many more people lost their jobs. Production fell off further, more businesses closed, and unemployment grew even worse. The Business Cycle Revisited When the depression first became noticeable, few people expected it to be very serious. Americans had come to accept tough economic times as a regular part of the business cycle - recurring periods of depression and prosperity. . Until the Great Depression, the business cycle had followed a particular pattern. During the prosperous part of the cycle, economic activity expanded, and companies produced more goods. When demand rose, factories hired more workers. Eventually, factory output increased faster than goods were being sold. Surpluses piled up in warehouses and in retail stores. Manufacturers then reduced their production, lowered prices, and laid off some of their workers. These unemployed people had less money to buy goods. More manufacturers laid off more workers, and some companies went out of business. At this point, the economy was in a state of depression. When factory output became very low, the surpluses were gradually used up. Then producers who had not gone out of business increased output and rehired workers. These workers, with wages in their pockets, increased their purchases. The economy then entered the recovery stage . Recovery eventually led to prosperity - a time of high profit, full production, and low unemployment once again. A complete business cycle usually lasted from about three to five years. What made the Great Depression different was that it lasted for 10 years. The economy declined steeply from late 1929 until the winter of 1932-33. Then it appeared to be stuck. Recovery was slow and irregular. Through the 1930s unemployment remained very high - more than 20 percent from 1932 to 1935. Workers with years of experience found themselves out of work. Shopkeepers who had devoted their careers to developing their businesses lost everything. Students graduating from schools and colleges could find no one to hire them. The Great Depression affected most Americans in some way. A Wise Economist Asks a Question Study the cartoon below and then answer the questions in Section 5 of your Study Guide.