Slide Handout - Certified General Accountants Association of Canada

Course Name: FN2 – Advanced Corporate Finance

Module 3 (Part I)

Module Title: Long-Term Sources of Funds

Lectures and handouts by:

Ron Muller

1

3.1

3.2

3.3

3.4

3.5

3.6

3.7

3.8

Module Summary

Bank Financing (Level 1)

Bonds (Level 1)

Bond refinancing (Level 1)

Preferred shares (Level 2)

Preferred share refinancing (Level 1)

Common shares (Level 1)

Issuing securities (Level 2)

Rights offerings (Level 1)

2

3.1 Bank Financing

• “Term loans” are longer in maturity than working capital financing and are generally secured (capital assets and other)

• Uses of term loans include:

– To finance capital equipment

– To provide permanent working capital

– Temporary cash infusion

3

1

3.1 Bank Financing

• Term loans are typically categorized according to the type of repayment made:

– “ Installment ” loans require equal periodic payments

4

3.1 Bank Financing

• Term loans are typically categorized according to the type of repayment made:

– “ Installment ” loans require equal periodic payments

– “ Balloon ” loans require that an amount owing at the end of the term is either paid or renegotiated

(i.e. the balloon payment)

5

3.1 Bank Financing

• Term loans are typically categorized according to the type of repayment made:

– “ Installment ” loans require equal periodic payments

– “ Balloon ” loans require that an amount owing at the end of the term is either paid or renegotiated

(i.e. the balloon payment)

– “ Bullet ” loans require interest only payments, and the entire principal is paid at the end of term

6

2

3.1 Bank Financing

• The total costs of term loan financing can include:

– “Direct” interest

– “Discount” interest

– Compensating balances

• Term loans may also include a number of “ restrictive covenants ”, such as:

– Minimum level of working capital

– Payment of dividends

– Etc.

7

3.1 Bank Financing

• The use of “ compensating balances ” is not that common anymore and has been largely replaced by various “fees”

• The effects are that:

– you must borrow more in total (since some of the loan amount must be kept on deposit)

– The effective rate is increased

8

3.1 Bank Financing

• Formula to determine the face value of the loan with a compensating balance =

FACE VALUE = funds required

1 – CB

[Equation 3-4] e.g. If the compensating balance is 20% and you want

$50,000, then you must borrow 50,000 / (1-.20) =

$62,500.

9

3

3.1 Bank Financing

“ Discount interest” loans are still used – more common when using bankers acceptances

FACE VALUE = funds required [Equation 3-9]

1 - k nom

m

A bank will provide you a $10,000 discount interest loan with a nominal interest rate of 9% compounded daily. Face value =

10,000 = 10,002.47

1 - .09/365

10

Course Name: FN2 – Advanced Corporate Finance

Module 3 (Part II)

Module Title: Long-Term Sources of Funds

Lectures and handouts by:

Ron Muller

11

3.1 Bank Financing

• Canadian regulations require lenders to disclose the effective interest rate to borrowers

• The “ nominal rate ” = the stated interest rate (quoted on an annual basis)

IT IS THE RATE THAT DETERMINES

THE PAYMENT AMOUNT

12

4

3.1 Bank Financing

• The “ effective rate ” = the true rate per time period, and includes both direct and indirect costs

• Competing financing proposals are compared according to their EAR lower is better!

FORMULA = interest only

EAR = (1 + k

nom

m

) m – 1 [Equation 3-2]

13

3.1 Bank Financing

Example of mortgage calculation:

A bank is offering you a 25 year mortgage at a quoted rate (annual rate) of 10.25%. If you purchased a home

for $125,000 with a down payment of $25,000, what

would your monthly payment be?

Hint: Before you can calculate this answer, you need to determine the periodic interest rate.

14

3.1 Bank Financing

Periodic = (1+.1025) 2/12 – 1 = 0.83648% per month

2

PV = 100,000

FV = 0

N = 25 x 12 = 300 i = 0.83648%

PMT = ? = $911.36

15

5

3.1 Bank Financing

Formula derivation:

(1 + 5.125) 2 = (1 + mo) 12

(1 + 5.125) 2/12 = (1 + mo) 12/12

1 + mo = (1 + 5.125) 1/6 mo = (1 + 5.125) 1/6 -1

16

3.1 Bank Financing

What is the EAR of a compensating balance loan?

e.g. You need $10,000 and your bank has offered a simple interest loan with a nominal rate of 7% compounded annually and you must maintain a compensating balance of 20% of face value.

Effective rate = .07

1 - .20

= 8.75%

17

3.1 Bank Financing

What is the EAR of a discount interest loan?

[Equation 3-8] e.g. Bank will provide a discount interest loan with a nominal interest loan of 9.0%, compounded daily.

Effective rate = (1 + .09/365) 365 - 1 = 9.42%

1-.09/365

18

6

3.1 Bank Financing

Assignment 2, Question 2 asks you to calculate the face value and EAR for four different proposals.

- Discount interest + compensating balance

- Compounded weekly

- Simple interest + compensating balance

- Discount interest

19

3.1 Bank Financing

Bank I proposal is probably the easiest to calculate:

Face value =

EAR =

$150,000

1 – .08 - .1

= ?

0.08

1 – .08 - .1

= ?

20

3.2 Bonds

There are multiple ways of categorizing and/or describing various bonds:

- By security ranking

- By currency and/or country of issuance

- By repayment provisions, if any

- By security rating

- By length of maturity and/or other specific bond features

Terms and features are not always mutually exclusive.

21

7

3.2 Bonds

From Standard & Poor's RatingsDirect:

“The past six weeks have been fairly volatile for the U.S.

corporate bond market, with riskier segments coming under heavier pressure. Yields and credit spreads have been tossing and turning on higher core inflation and geopolitical concerns. Temporary aberrations notwithstanding, we detect enough early warning signals in corporate credit metrics to continue our cautionary stance on the sector, particularly for the high yield segment.”

Source: BusinessWeek Magazine, Summer 2006

22

3.2 Bonds

Examples of Real Government Bond Returns around the World from 1900 to 2000.

Country Mean SD Min % Max %

Canada 1.8% 11% -26% (1915) 42% (1921)

Italy -2.2% 14% -64% (1944) 28% (1933)

US 1.6% 10% -19% (1918) 35% (1982)

Source: www.investopedia.com

23

3.2 Bonds

• “ Mortgage bonds ” are secured by specific assets, and are normally categorized according to their ranking:

– “ first ” or “ senior ” bonds – ranked ahead of any other bonds secured by the same asset

– “ second ” or “ junior ” bonds

24

8

3.2 Bonds

• Bonds are also often categorized according to currency and country of issuance:

– “ domestic ” – e.g. $C bonds issued in Canada by a

Canadian company

– “ foreign ” – e.g. Canadian bond denominated in Swiss francs and sold in Switzerland

– “ Eurobonds ” – e.g. Canadian bond denominated in

American $, but sold in England

25

Course Name: FN2 – Advanced Corporate Finance

Module 3 (Part III)

Module Title: Long-Term Sources of Funds

Lectures and handouts by:

Ron Muller

26

3.2 Bonds

• Bonds can also be categorized according repayment

(retirement) provisions:

• A “ sinking “ fund – bond issuer puts aside $x each year for repayment of debt issue

27

9

3.2 Bonds

• Bonds can also be categorized according repayment

(retirement) provisions:

• A “ sinking “ fund – bond issuer puts aside $x each year for repayment of debt issue

• A “ purchase ” fund – purchases in the market of portions of the outstanding bonds

28

3.2 Bonds

• Bonds can also be categorized according repayment

(retirement) provisions:

• A “ sinking “ fund – bond issuer puts aside $x each year for repayment of debt issue

• A “ purchase ” fund – purchases in the market of portions of the outstanding bonds

• A “ callable ” or “ redeemable ” bond – gives the issuing firm the option for early redemption

29

3.2 Bonds

• Bonds can also be categorized according to security rating.

• In Canada, the Dominion Bond Rating Service provides an independent rating service.

• Similar services in the U.S., such as Moody’s and

Standard and Poor’s.

30

10

3.2 Bonds

• The Dominion Bond Rating Service uses a system of

“AAA” for the highest quality, “AA” for superior quality, and so forth.

• Credit ratings are NOT buy, hold or sell recommendations

• Overall rating is the result of both qualitative and quantitative analysis.

31

3.2 Bonds

• Bonds can also be categorized according to length to maturity and/or other specific features:

Maturity: up to 3 years = short term from 3 – 7 years = medium term over 10 years = long term

Features:

“ Perpetual bonds ” which have no specified maturity

“ Strip bonds ” which are zero-coupon bonds that sell at a discount from par

32

3.2 Bonds

• Bonds are often sold with various “sweeteners” in order to enhance the marketability of the issue:

• Warrants – gives the holder the right to purchase shares at a set price within a specified time period

• Extendible option – gives the holder the option of extending the maturity date

• Conversion option – gives the holder the option of converting the debt into shares

33

11

3.2 Bonds

• “Debentures” are usually unsecured, and therefore subordinated to secured bonds

• Quality of debentures depends on the creditworthiness of the issuer – Provincial governments often issue Debentures

• Generally must provide a higher interest rate yield in order to be marketable

34

3.2 Bonds

The priority of creditors is as follows:

1.

Senior mortgage bonds

2.

Second mortgage bonds

3.

Bank loans

4.

Subordinated debentures

5.

Straight preferred shares

6.

Common shares

35

3.3 Bond Refinancing

• Refinancing questions require that you complete a

NPV analysis

• Appropriate discount rate = the AFTER-TAX borrowing rate of the NEW ISSUE.

• If the new issue has a longer maturity than the old one, analyze the benefits and costs OVER THE LIFE

OF THE OLD.

36

12

3.3 Bond Refinancing

• Refer to Assignment 2, Question 3 for a good format of steps to follow:

– Calculate the value of the call premium associated with old issue

– Calculate the net flotation costs of new issue

– Calculate the net additional interest expenses during the overlap

– Calculate the incremental after-tax interest savings

– Calculate the NPV

37

3.3 Bond Refinancing

Example of issue costs tax shield:

A company can refinance it’s existing 12% debt with new debt at a lower, 10% coupon rate. Underwriting fees are estimated at $750,000 and other floatation costs are estimated at $250,000. All issue costs are amortized over 5 years.

If the tax rate is 40%, what is the present value of the tax shields associated with issue costs?

38

3.3 Bond Refinancing

750,000 + 250,000 x 40% =

5

$80,000

Therefore, tax shield = $80,000 a

5

6%

Discount rate = 10% (1-.4)

N = 5 i = 6% PMT = 80,000

PV = $336,989

FV=0

39

13

3.3 Bond Refinancing

Which of the following statements about a bond purchase fund provision is true?

(a) A purchase fund is money set aside by the bond issuer to provide for the repayment of all or part of a debt issue before maturity.

40

3.3 Bond Refinancing

Which of the following statements about a bond purchase fund provision is true?

(a) A purchase fund is money set aside by the bond issuer to provide for the repayment of all or part of a debt issue before maturity.

(b) A purchase fund is set up to retire, through purchases in the market, a specified amount of outstanding bonds or debentures only if the purchases can be made at or below a stipulated price.

41

3.3 Bond Refinancing

(c) A purchase fund normally retires more of a bond issue than a sinking fund.

(d) Purchase funds normally have provisions for calling bonds, as do sinking funds.

42

14

3.3 Bond Refinancing

(c) A purchase fund normally retires more of a bond issue than a sinking fund.

(d) Purchase funds normally have provisions for calling bonds, as do sinking funds.

Answer: (b) Refer back to Slide 29

43

Course Name: FN2 – Advanced Corporate Finance

Module 3 (Part IV)

Module Title: Long-Term Sources of Funds

Lectures and handouts by:

Ron Muller

44

3.4 Preferred shares

• Some characteristics of equity

– Entitled to dividends, but not a contractual obligation

• Some characteristics of debt

– Specified payments that are fixed

• No maturity date

• Fixed dividend rate

• Rank ahead of common shareholders, but behind debt

• Dividends are paid from “after tax” income

• Various “sweeteners” include cumulative dividends, convertible, retractable, etc.

45

15

3.4 Preferred shares

• Georgia Power Co., 6 1/8% Series Class A

Preferred Stock, Non-Cumulative

• Ticker Symbol: GPE-A

• CUSIP: 373334473 Exchange: NYSE

• Security Type: Traditional Preferred Stock

Source: www.quantumonline.com

46

3.4 Preferred shares

Georgia Power Co., 6 1/8% Series Cl A

Preferred Stock, Non-Cumulative, liquidation preference $25 per share, redeemable at the issuer's option on or after 7/01/2009 at $25 per share plus declared and unpaid dividends, with no stated maturity, and with noncumulative distributions of 6 1/8% ($1.53125) per annum paid quarterly on 1/1, 4/1, 7/1 & 10/1…

47

3.4 Preferred shares

… to holders of record on a date not more than

30 days prior to the payment date as may be determined by the board of directors. In regards to payment of dividends and upon liquidation, the preferred shares rank equally with other preferreds and senior to the preference shares and common shares of the company.

48

16

3.4 Preferred shares

• Why issue preferred shares?

– May not be feasible to market a new debt issue

– Market conditions are temporarily unreceptive to new debt issues

– Company may already have a high debt/equity ratio

– Company is reluctant to assume interest and principal obligations

49

3.5 Preferred share refinancing

• The discount rate that you use in your analysis is the dividend rate on the new issue.

• Since preferred share dividends are normally paid quarterly PV cash savings should be calculated and discounted quarterly. (Watch out!)

• Essentially identical in concept to bank refinancing calculations

50

3.5 Preferred share refinancing

A company has 500,000 preferred shares outstanding. The current dividend rate is $5 per share and the par value is

$100 per share. If the firm can issue new preferred shares at a dividend rate of 4% completely replacing the existing preferred, what would be the present value of the dividend savings in perpetuity?

Solution: PV perpetual = cash flow savings

new rate

$12,500,000

= 500,000 (5-4) =

4%

51

17

3.6 Common shares

• Common shares rank last after debt and preferred shares

• Different classes of common shares can exist

• “ Restricted ” shares are shares that do not entitle shareholders to have full voting rights:

– Could be non-voting

– Could be subordinate voting

– Could be restricted voting

52

3.6 Common shares

• So-called “hybrid” securities are also becoming more common – ie. part bond, part common share

53

3.6 Common shares

• So-called “hybrid” securities are also becoming more common – ie. part bond, part common share

• A typical hybrid is more like a bond since investors receive regular interest payments, but certain

“triggers” will allow the company to defer payments.

54

18

3.6 Common shares

• So-called “hybrid” securities are also becoming more common – ie. part bond, part common share

• A typical hybrid is more like a bond since investors receive regular interest payments, but certain

“triggers” will allow the company to defer payments.

• Also tend to have very long maturities – eg.

American Express hybrid bond has a 60 year maturity

55

3.6 Common shares

• So-called “hybrid” securities are also becoming more common – ie. part bond, part common share

• A typical hybrid is more like a bond since investors receive regular interest payments, but certain

“triggers” will allow the company to defer payments.

• Also tend to have very long maturities – eg.

American Express hybrid bond has a 60 year maturity

• Regulators and debt rating agencies are still struggling on how these securities should be classified.

56

3.6 Common shares

• “

Non-cumulative ” voting = 1 vote per share

• “ Cumulative ” voting = 1 vote per share x the number of directors to be elected. Also referred to as

“ proportional voting ”.

For example, if you owned 100 shares and there are 3 directors to be elected, then you would have 300 votes. This is advantageous for individual investors because they can apply all their votes towards one person.

57

19

3.6 Common shares e.g. A company has 20,000 common shares outstanding with entitlement to vote. It has a cumulative voting scheme. The company has to elect 8 directors and a minority group of shareholders want to elect at least 2 particular directors. How many votes are needed by the minority group?

Use formula in Equation 3-14

N = 2 x 20,000

8 + 1

+ 1 = 4,445

58

3.7 Issuing securities

• What is a “private placement”?

– Only sold to a few buyers

– Buyers are usually institutions

– Purchase amounts are usually high $

– Formal prospectus is not prepared

59

3.7 Issuing securities

Private Placement

- simple contract

- Lower floatation costs

- No registration costs

- can be finalized faster

- has nonstandard features

- may be more expensive since they lack liquidity and investors will demand a higher yield

Public Issue

- complicated process

- higher floatation costs

- formal prospectus

- longer process

- highly standardized

- lower yields are demanded

60

20

3.7 Issuing securities

• The “investment banker” provides advice and services in connection with the sale of new securities

• Compensation can consist of a management fee , underwriting fee , and/or a selling fee

compensation for underwriting risk compensation for marketing and selling efforts

61

3.7 Issuing securities

• The investment banker:

– Serves as an intermediary between the issuer and the purchasers

– Provides advice

– Underwrites the issue

– Helps in setting the offering price

– Sells the security to the public

62

3.8 Rights offerings

• Rights enable current shareholders to subscribe to additional shares at a specified price

• Rights enable current shareholders to maintain their control of the company

• Rights are essentially call options on newly issued shares

• Once rights expire, they are worthless and may not be exercised

63

21

3.8 Rights offerings

• There are four courses of action a rights holder may take:

– Exercise some or all of the rights

– Sell some or all of the rights

– Buy additional rights for trading purposes or eventual exercise

– Do nothing and let the rights expire

64

3.8 Rights offerings

• Value of a right during the rights-on period

[Equation 3-15]

• Value of a right during the ex-rights period

[Equation 3-16]

Both equations consider the market price of the underlying share and the exercise price.

Logic should tell us that the value of a share without the right attached = the value of a share with the right attached – the price of the right.

65

3.8 Rights offerings e.g. A firm has announced a 3 for 1 rights offering. If the market price for the share is $32 per share and the subscription price is $24, what is the value of one right?

Use Equation 3-15

(32 –24) / (3+1) = 2

66

22

Course Name: FN2 – Advanced Corporate Finance

Module 3 (Part V)

Module Title: Long-Term Sources of Funds

Lectures and handouts by:

Ron Muller

67

Handout Question 1 Introduction

TM Corp (Page 1 of Handout)

In this question we will calculate the following:

- call premium

- net floatation costs

- net additional interest expense during the overlap period

- incremental after-tax interest savings

- NPV

68

Handout Question 1 Comments

TM Corp (Page 1 of Handout)

The appropriate discount rate is the new “after-tax borrowing rate”.

Assume that floatation costs are deducted on a straight line basis over 5 years for tax purposes.

Please pause the audio, read and attempt the question in the handout, then listen to the solution.

69

23

Handout Question 1 Solution

TM Corp (Page 2 of Handout)

Call premium

Floatation costs

Interest expense on old issue

Interest earned on funds invested

PV of tax savings on floatation costs

PV of after tax interest savings

(1,200,000)

( 500,000)

( 60,000)

20,000

(1,740,000)

180,092

4,116,935

NPV of refunding 2,557,027

70

Handout Question 2 Introduction

AG Corp. (Page 3 of Handout)

In this question we will calculate the following:

- net floatation costs

- net additional expense during the overlap period

- PV of annual dividend savings

- NPV

71

Handout Question 2 Comments

AG Corp. (Page 3 of Handout)

Appropriate discount rate = cost of new preferred share financing.

When you are calculating the PV of annual dividend savings use quarterly rate.

72

24

Handout Question 2 Comments

AG Corp. (Page 4 of Handout)

When you are calculating the PV of the tax savings on floatation costs use an annual rate. (use the formula sheet)

Please pause the audio, read and attempt the question in the handout, then listen to the solution.

73

Handout Question 2 Solution

AG Corp. (Page 4 of Handout)

Cost of calling (250,000)

Floatation costs

PV of tax savings on floatation costs

After-tax overlap interest received

Overlap dividends paid

(750,000)

238,055

21,250

( 83,333)

(824,028)

PV of annual dividend savings 1,250,000

NPV 425,972

74

Course Name: FN2 – Advanced Corporate Finance

Module 3 (Part VI)

Module Title: Long-Term Sources of Funds

Lectures and handouts by:

Ron Muller

75

25

Handout Question 3 Introduction

(Page 5 of Handout)

In this question we will calculate the following:

- value of a right during rights-on period

- review the effect to overall wealth of selling rights versus exercising rights

- the number of share required if cumulative voting is applicable

76

Handout Question 3 Comments

Use Equation 3-15 for part (a).

If Lucy sells her rights, she will receive 5,000 ($0.80) =

$4,000, and she will continue to own 5,000 shares in the company.

If she exercises her rights, Lucy will purchase 5,000/4 =

1,250 additional shares.

Please pause the audio, read and attempt the question in the handout, then listen to the solution.

77

Handout Question 3 Solution

(Page 6 of Handout) a. The value of a right during the rights-on period:

= (Rights on price – Exercise price)/(Number of rights required for the purchase of 1 new share + 1)

= ($40 – $36) / (4 + 1) = 4/5 = $0.80

78

26

Handout Question 3 Solution

(Page 6 of Handout) b. Prior to the rights offering, Lucy owns 5,000 shares worth $40 each, so the value of her holdings is

$200,000. She owns 5,000 / 40,000 = 12.5% of the shares of the company.

79

Handout Question 3 Solution

(Page 6 of Handout) b. Prior to the rights offering, Lucy owns 5,000 shares worth $40 each, so the value of her holdings is

$200,000. She owns 5,000 / 40,000 = 12.5% of the shares of the company.

• If Lucy sells her rights, she will receive 5,000 ($0.80)

= $4,000, and she will continue to own 5,000 shares in the company. The company will have 40,000

(1.25) = 50,000 shares outstanding, with a total value of 40,000 (40) + 10,000 (36) = 1,600,000 +

360,000 = $1,960,000.

80

Handout Question 3 Solution

(Page 6 of Handout)

• Each share, ex-rights,will be worth 1,960,000 /

50,000 = $39.20. Lucy will continue to have 5,000 shares, which will be worth 5,000 ($39.20) =

$196,000. Overall, her wealth will continue to be

$200,000, but it will be composed of $196,000 of shares in ABC and $4,000 of cash.

• She will have a smaller percentage of outstanding

ABC shares, or 5,000 / 50,000 = 10%.

81

27

Handout Question 3 Solution

(Page 6 of Handout)

• If she exercises her rights, Lucy will purchase 5,000 /

4 = 1,250 additional shares, which will cost her 1,250

($36) = $45,000. Her total wealth in ABC will be

$245,000, and her percentage ownership will remain at 6,250 / 50,000 = 12.5%.

• Refer to the bottom of page 6 of the Handout for a summary analysis.

82

Handout Question 3 Solution

(Page 7 of Handout) c. After the rights issue, ABC will have 50,000 shares outstanding. To ensure that she can elect one member of the board, Lucy would have to have the following number of shares:

(50,000) / (5 + 1) + 1 = 50,000 / 6 + 1 = 8,335 shares

83

Handout Question 3 Solution

(Page 7 of Handout)

• If Lucy exercises all of her rights, she will only own

6,250 shares. To obtain the required shares, she must purchase 2,085 more shares from other investors. These will cost her $36 + 4 rights each, or

$36 + 4 ($0.80) = $39.20 each.

2,085 shares @ $39.20 = $81,732

• Lucy would own 8,335 shares and have $326,732 invested in ABC. She would need to borrow $26,732 to reach this level of investment.

84

28

Handout Question 4 Introduction

(Page 8 of Handout)

• In Question 4 we will discuss a question dealing with cumulative voting

85

Handout Question 4 Comments

(Page 8 of Handout)

• Currently the company has 2,000,000 shares, which equals 2,000,000 rights.

• The new offering will add 2,000,000/4 = 500,000 shares.

Please pause the audio, read and attempt the question in the handout, then listen to the solution.

86

Handout Question 4 Solution

(Page 9 of Handout) a)

Before the offering:

135,000 = [ (d x 2,000,000)/ (15 + 1) ] + 1

134,999 = 125,000d

1.08 = d

Before the offering, you can elect one director.

87

29

Handout Question 4 Solution

(Page 9 of Handout)

• Currently, the company has 2,000,000 shares which equals 2,000,000 rights.

• The new offering will add: 2,000,000/4 = 500,000 shares.

• Without exercising, you will not be able to elect any directors because d = .86 which is less than one.

135,000 = [ (d x 2,500,000)/ (15 + 1) ] + 1

.86 = d

88

Handout Question 4 Solution

(Page 9 of Handout)

The number of shares needed to elect one director is:

N = [ (1 x 2,500,000) / 16] + 1 = 156,251

• Since you own 135,000 shares, you must buy

(156,251 - 135,000) = 21,251 more. Therefore, you must exercise 21,251 x 4 = 85,004 rights to buy the shares.

89

Handout Question 4 Solution

(Page 9 of Handout)

The number of shares needed to elect one director is:

N = [ (1 x 2,500,000) / 16] + 1 = 156,251

• Since you own 135,000 shares, you must buy

(156,251 - 135,000) = 21,251 more. Therefore, you must exercise 21,251 x 4 = 85,004 rights to buy the shares.

• IF, you were to exercise all your rights you could elect: 135,000 + 135,000/4 = [ (d x 2,500,000)/ (15 +

1) ] + 1

1.08 = d

90

30

Course Name: FN2 – Advanced Corporate Finance

Module 3 (Part VII)

Module Title: Long-Term Sources of Funds

Lectures and handouts by:

Ron Muller

91

Handout Question 5 Introduction

(Page 10 of Handout)

• In Question 5 we will discuss a variety of multiple choice questions

Please pause the audio, read and attempt the question in the handout, then listen to the solution.

92

3

4

1

2

5

Handout Question 5 Solutions

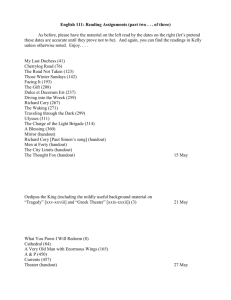

(Page 10 of Handout)

Question Answer

(2)

(3)

(2)

(3)

(1)

93

31

6

7

8

9

10

Handout Question 5 Solutions

(Page 11 of Handout)

Question Answer

(3)

(4)

(2)

(1)

(1)

94

Handout II (Page 1)

- “Stubs”: private equity opens its door to the public

- Originally introduced in the 1990s

- Have recently resurfaced after a period of inactivity

95

Handout II (Page 1)

- “Stubs”: private equity opens its door to the public

- Originally introduced in the 1990s

- Have recently resurfaced after a period of inactivity

- Corporate buyers hit gas on deals

- Private-equity buyouts are being delayed

- Due to tightening credit markets, corporate buyers are once again gaining the advantage over private-equity acquirers

96

32

Handout II (Page 2)

- Finance crunch pinches

- Concerns in the high-yield debt market are altering financing plans

- Share buybacks and debt refinancings are also affected

97

Handout II (Page 2)

- Finance crunch pinches

- Concerns in the high-yield debt market are altering financing plans

- Share buybacks and debt refinancings are also affected

- Sub-prime woes

- Wider spreads in collateralized mortgage backed securities

- Banks and other financial institutions are being hurt

98

Handout II (Page 3)

- Private Placements

- Notice of Private Placement is required to be filed with the TSX

- Private Placement investors also include hedge funds, private equity funds and venture capital funds

- Variety of financing options – subordinated notes, redeemable preferred stock with warrants, etc.

99

33

Topic

Module content summary

Part I

Slide numbers Sample Question

3.1

1 - 11 n/a

100

Topic

Module content summary

Part II

Slide numbers Sample Question

3.1

3.2

11-20

21-25 n/a

Question 1

101

Topic

Module content summary

Part III

Slide numbers Sample Question

3.2

3.3

26-35

36-43

Question 1

Question 1

102

34

3.4

3.5

3.6

3.7

3.8

Topic

Module content summary

Part IV

Slide numbers Sample Question

44-49

50-51

52-58

59-62

63-66

Question 2

Question 2

Question 4 n/a

Question 3

103

35