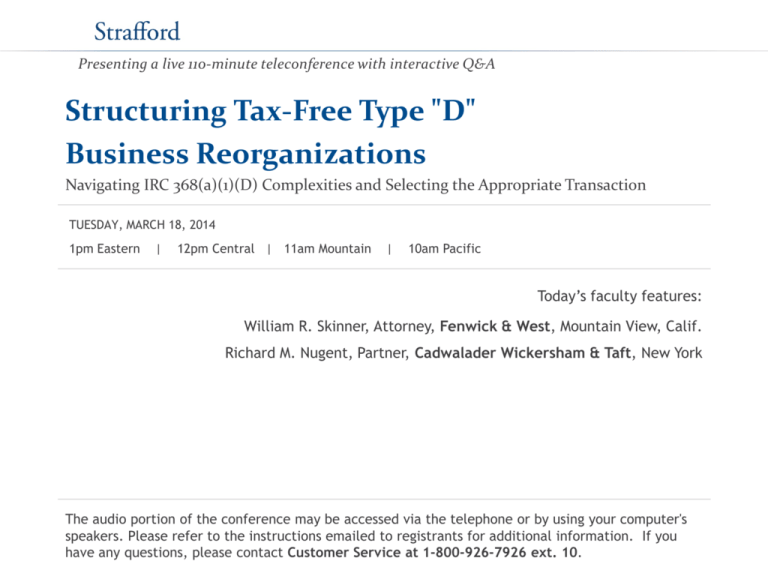

Presenting a live 110-minute teleconference with interactive Q&A

Structuring Tax-Free Type "D"

Business Reorganizations

Navigating IRC 368(a)(1)(D) Complexities and Selecting the Appropriate Transaction

TUESDAY, MARCH 18, 2014

1pm Eastern

|

12pm Central | 11am Mountain

|

10am Pacific

Today’s faculty features:

William R. Skinner, Attorney, Fenwick & West, Mountain View, Calif.

Richard M. Nugent, Partner, Cadwalader Wickersham & Taft, New York

The audio portion of the conference may be accessed via the telephone or by using your computer's

speakers. Please refer to the instructions emailed to registrants for additional information. If you

have any questions, please contact Customer Service at 1-800-926-7926 ext. 10.

Tips for Optimal Quality

FOR LIVE EVENT ONLY

Sound Quality

If you are listening via your computer speakers, please note that the quality

of your sound will vary depending on the speed and quality of your internet

connection.

If the sound quality is not satisfactory, you may listen via the phone: dial

1-866-873-1442 and enter your PIN when prompted. Otherwise, please

send us a chat or e-mail sound@straffordpub.com immediately so we can address

the problem.

If you dialed in and have any difficulties during the call, press *0 for assistance.

Viewing Quality

To maximize your screen, press the F11 key on your keyboard. To exit full screen,

press the F11 key again.

Continuing Education Credits

FOR LIVE EVENT ONLY

For CLE credits, please let us know how many people are listening online by

completing each of the following steps:

•

Close the notification box

•

In the chat box, type (1) your company name and (2) the number of

attendees at your location

•

Click the SEND button beside the box

For CPE credits, attendees must listen throughout the program, including the Q &

A session, and record verification codes in the corresponding spaces found on the

CPE form, in order to qualify for full continuing education credits. Strafford is

required to monitor attendance.

If you have not printed out the “CPE Form,” please print it now (see “Handouts”

tab in “Conference Materials” box on left-hand side of your computer screen).

Please refer to the instructions emailed to registrants for additional information.

If you have any questions, please contact Customer Service at 1-800-926-7926

ext. 10.

Program Materials

FOR LIVE EVENT ONLY

If you have not printed the conference materials for this program, please

complete the following steps:

•

Click on the ^ symbol next to “Conference Materials” in the middle of the lefthand column on your screen.

•

Click on the tab labeled “Handouts” that appears, and there you will see a

PDF of the slides for today's program.

•

Double click on the PDF and a separate page will open.

•

Print the slides by clicking on the printer icon.

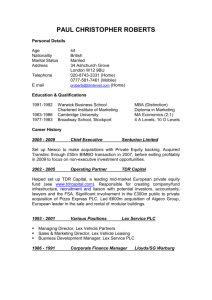

Tax-Free Acquisitive D

Reorganziations

Strafford CLE Webinar

March 18, 2014

William R. Skinner, Esq.

wrskinner@fenwick.com

Fenwick & West LLP

Silicon Valley Center

801 California Street

Mountain View, CA 94041

Phone: 650.988.8500

www.fenwick.com

© Fenwick & West LLP, 2012. All rights reserved.

Overview

Statutory Requirements for the Two Types of D

Reorganizations

All Cash Acquisitive D Reorganizations

Tax Consequences to the Parties to the D Reorganization

Characterization Issues

6

The Type D Reorganization – Statutory Requirements

Sec. 368(a)(1)(D) defines a D reorganization as involving the

following elements:

Transfer of “all or part” of transferor’s assets to a

corporation

Transferor and/or its shareholders “control” the corporation

immediately after the transfer

Transferor distributes the stock or securities received as

part of plan of reorganization in a distribution qualifying

under § 354, § 355 or § 356

7

The Type D Reorganization – Two Paradigms

Acquisitive D

Divisive D

Shareholders

2

§ 355

Distribution

P

P

Liquidation

of S1

S1

1

S

2

1

S2

“Substantially

All” S1’s

Assets

Assets

8

The Type D Reorganization – Two Paradigms

Divisive D reorganizations.

Acquiring’s stock must be distributed in a spin-off that

qualifies under § 355.

“Control” test looks to § 368(c) definition.

Acquisitive D Reorganizations.

Acquiring must acquire “substantially all” of the assets of

Transferor. § 354(b)(1)(A).

Definition of “control” looks to § 304(c):

• Control = 50% vote or value

• Control may be direct or indirect.

• § 318 constructive ownership rules also apply.

9

Acquisitive D ReorganizationsLiquidation – Reincorporation Doctrine

A

2

§ 331

Liquidation

1

$700 Cash

S

T

$300 Cash

$700 Business Assets

Sell T

Business

Assets

Under pre-1986 law, the shareholder sought to receive T’s cash

in a tax-favored capital gain transaction.

D reorganization treatment resulted in A being taxable at

ordinary rates on the “boot dividend” (see § 356(a)(2)).

10

Special Rules for Acquisitive Ds

Non-Statutory Reorganization Requirements.

Continuity of interest test appears not to apply to Acquisitive

D reorganizations. See Prop. Reg. § 1.368-1(b)(1); Reg.

§1.368-2(l).

Continuity of business enterprise does apply, but usually is

met by virtue of T transferring substantially all of its assets

to A.

A non-tax corporate business purpose is also required.

Reg. § 1.368-2(l) permits “all cash” D reorganizations to satisfy

§ 368(a)(1)(D) so long as A and T’s shareholders own the two

companies in identical proportions.

T is deemed to receive a “nominal share” of A stock in order

to satisfy the “distribution requirement.”

11

Cash D Reorganization

Reg. § 1.368-2(l)(3), Example 3

P

“Nominal Share”

3

Distribution of

“Nominal” S4

Share

“Nominal Share”

S1

S2

S3

S4

2

1

T Liquidates

T

FMV $70

Conclusion: T undergoes a § 368(a)(1)(D) reorganization into

S4.

12

Integrated Transaction Doctrine

P

T

Transfer T

Shares to S

for $

S

T

2

T LLC

Convert T

to an LLC

Under integrated transaction doctrine, two steps (Drop and

Check) are treated as a D reorganization of T into S. See Rev.

Rul. 2004-83.

13

Tax Consequences of Acquisitive D Reorganizations

Generally, no gain or loss is recognized to the transferor

corporation. See § 361(b)(1)(A). Acquiring corporation

succeeds to Transferor’s tax attributes under § 381(a).

Shareholder recognizes gain, but not loss, to the extent that (A)

money and other property exceeds (B) gain on the exchange.

§ 356(a)(1) (the “Boot-within-Gain Limitation”).

If the gain has the effect of a dividend, the shareholder shall

recognize a dividend to the extent of its ratable share of the

undistributed earnings of “the corporation.” See § 356(a)(2).

Compare results of a § 304 transaction.

14

Example of Boot Treatment

D

$100 Cash

Basis $100

FMV $100

F2

F1

D Reorganization

$20 E&P

$500 E&P

$10 Foreign

Taxes (33% rate)

$55 Foreign

Taxes (10% rate)

Under § 356(a)(2), D’s gain / deemed dividend is limited to its

gain realized on the exchange of F1’s stock for cash (here $0).

What would be the results if D’s basis in F1’s stock was only

$50?

15

Cash D Reorganization vs. Section 304 Transaction

Comparison Point

Cash D

§ 304

Basis Recovery

Recognize gain to the

extent of cash, and

then recover basis

Recognize dividend to

the extent of E&P, then

recover basis before

recognizing gain.

Source of Dividend

Unclear (Target only

vs. Target and

Acquiring Combined)

Both Companies’ E&P

Combined

Whose E&P First?

Unclear

Acquiring First, then

Target

Section 367(a)

Consequences

None.

US Transferor must

enter Gain-Recognition

Agreement (GRA).

See Notice 2012-15.

Tax Attributes

T’s attributes carryover

to A under § 381

No carryover of

attributes.

16

Rev. Rul. 70-240

2

B

X Liquidates

Gain $30

X

E&P $10

1

Y

Sale of Operating

Assets

E&P $50

B recognized a $30 deemed dividend (out of X and Y’s

combined E&P). See also CCA 201032035.

Compare case law - e.g., American Manufacturing, 55 T.C. 204

(1970) (§ 356(a)(2) looks to Target’s E&P only).

17

Gain Recognition Agreement Consequences

D

1

F1

Transfer F1’s

Stock to F2

F2

2

F1 checks

the box to

liquidate

F1

Result: No gain recognition agreement (GRA) under § 367(a)

is required to be filed on the D reorganization of F1 into F2.

Reg. § 1.367(a), Example 16.

18

Basis Recovery and the Nominal Share

In D reorganization, basis is recovered against boot under

normal § 356 rules (pro rata unless terms specify that particular

shares are exchanged for cash).

Loss cannot be recognized. See § 356(c).

If there is unrecovered basis, it attaches to the nominal share

deemed issued in the reorganization.

Reg. § 1.368-2(l)(2) provides for deemed transfers that may

eliminate basis in the “nominal share.”

The shareholder may designate a share of stock in Acquiring to

which any basis in the nominal share attaches. See Reg. § 1.3581T(a)(2)( iii).

19

Example of Basis Allocation

D

$100 Cash

Basis $130

FMV $100

F2

F1

D Reorganization

D receives $100 of cash (as recovery of basis) and a nominal

F2 share with $30 of basis.

D can designate an F2 share to receive $30 of basis.

20

A More Complex Nominal Share Example

P

3

FS Distributes

“Nominal Share”

P Contributes

“Nominal Share”

FP

FS

2

4

Basis $130

FMV $100

FT Liquidates

1

FT

Sale of Assets

for $100

FA

FS receives $100 of cash and a nominal share of FA with $30

of basis. FS is deemed to distribute the nominal share under

§311(b). P is then deemed to transfer the nominal share to FP

in a § 351 transaction.

21

Slide Intentionally Left Blank

Consolidated Return Treatment

The foregoing treatment does not apply to D reorganizations

with boot inside of a consolidated group.

Rather, Reg. § 1.1502-13(f)(3) treats the shareholder member

as if it received hypothetical stock in Acquiring, followed by a

§302(d) redemption of the hypothetical stock.

This deemed dividend will generally be excluded from

income under Reg. § 1.1502-13(f)(2).

However, negative investment adjustments may cause the

nominal share to have an Excess Loss Account (ELA) that

is triggered on the subsequent transfers.

23

Reg. § 1.1502-13(f)(7), Example 4 – Part 1

P

B

M

2

1

S Liquidates

$100

Basis $25

Value $100

Assets

S

Facts: All Entities are domestic corporations. S undergoes a

cash D reorganization into B.

24

Reg. § 1.1502-13(f)(7), Example 4 – Part 2

2

Distribution of

Nominal Share

M

P

Nominal Share

B

Hypothetical

Shares

1

$100 302(d) Redemption of

Hypothetical Shares

Analysis. § 302(d) redemption creates a $75 excess loss

account (ELA) in nominal share of B stock. Following S’s

liquidation, M distributes the nominal share to P.

Distribution of nominal share gives rise to $75 gain under

§311(b) that is deferred under § 1.1502-13.

25

Selected Characterization Issues

Liquidation-reincorporation vs. Upstream merger and

asset drop

D reorganization with Boot vs. F reorganization and

Separate § 301 dividend.

Rev. Rul. 78-130 and drop-and-check transactions.

26

Liquidation – Reincorporation

Assume the sequencing of Rev. Rul. 2004-83 is reversed – i.e.,

Parent converts Target to a disregarded entity, and then

transfers Target DRE to Acquiring Corporation.

Is the form respected (upstream merger followed by § 351

transfer) or is this recast as a sideways D reorganization of

Target into Acquiring?

Reg. § 1.368-2(k) – a merger followed by an asset transfer

within the “qualified group” is not to be “disqualified or recharacterized” as a result of certain stock or asset transfers.

The qualified group is defined by Reg. § 1.368-1(d)(4) as the

Issuing corporation and all corporations owned by issuing

through one or more chains of § 368(c) control.

27

Example

P

1 Convert S 1 to

2 Assets Group A Extracted from

S1 to P

3 S1 LLC Contributed

LLC / DRE

to S2

S2

S1

Assets

A

Assets

B

See PLRs 201201012, 201127004 and 200952032 (form is

respected under Reg. § 1.368-2(k)).

Would result be the same if substantially all of S1’s assets were

28

reincorporated into S2?

PLR 201037026

Parent

S7

S6

1 Liquidate S 40

S13

S 40

NewCo

IRS characterized transaction as cash D reorganization of S40

into NewCo. Note S40’s assets left the “qualified group.”

29

D Reorganization vs. F Reorganization

Under IRS ruling practice, F reorganization treatment trumps D

reorganization treatment. See Rev. Rul. 87-27; Rev. Rul. 57276.

This characterization may be significant through:

Determining whether cash distributions are boot taxable

under § 356 vs. separate § 301 distributions

Determining manner in which Target’s E&P carries over to

Successor. See Reg. § 1.367(b)-9.

30

PLR 201001002

4

USP

Transfer Property

into NewCo

3

Distribute

cash/

property

NewCo

1 Transfer F7

2

F7

Liquidate F7

F7

Holding: Transaction was an F reorganization of F7 into

NewCo, with cash distributed in a § 301 distribution. The later

§ 351 transfer was respected as a separate step. See also

PLR 201406005.

31

Rev. Rul. 78-130

USP

Foreign

OpCo

§ 351Transfer

Foreign

OpCo

Foreign

HoldCo

Transfer Assets

and Liquidate

Transfer of

Other Assets

NewCo

IRS treated transaction as a Triangular C of Foreign OpCo into

NewCo instead of a § 351 transfer followed by a D

reorganization. Query whether this ruling remains valid. Cf.

PLR 201150021.

32

CIRCULAR 230 DISCLOSURE

To ensure compliance with requirements imposed by the

IRS, we inform you that any U.S. federal tax advice in this

communication is not intended or written by Fenwick &

West LLP to be used, and cannot be used, for the purpose

of (i) avoiding penalties under the Internal Revenue Code

or (ii) promoting, marketing, or recommending to another

party any transaction or matter addressed herein.

33

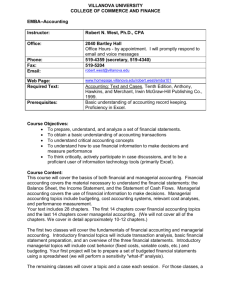

Divisive “D” Reorganizations

Richard M. Nugent

Cadwalader, Wickersham & Taft LLP

March 18, 2014

richard.nugent@cwt.com

Topics

Page

Introduction

2

IRS Private Letter Rulings

8

General Section 355 Requirements for Tax-Free Distributions

10

Section 355(e) Anti-Morris Trust Rules

19

Monetization Strategies for Section 355 Transactions

24

Sample Market Transactions

38

35

Introduction

*Portions of these slides were drawn from slides I previously prepared with my partner, Linda Z. Swartz. Any errors are mine alone.

36

What is a Divisive D Reorganization?

BEFORE

AFTER

Shareholders

Shareholders

Parent

Business A

Business B

Parent

Newco

Business A

Business B

• Unless otherwise noted, Parent and Newco are U.S. corporations, and Parent conducts at least 2

independent businesses and contributes 1 to Newco in the restructuring.

37

Divisive Section 368(a)(1)(D) Requirements

●

A D reorganization includes a corporation’s transfer of all or part of its assets

to another corporation if, immediately after the transfer, the transferor

corporation or 1 or more of its shareholders controls the transferee corporation

within the meaning of section 368(c), and the transferor distributes the

transferee’s stock in a transaction qualifying under section 355.

●

Section 368(c) requires ownership of at least 80% of a corporation’s total

voting power and 80% of the shares of each class of the corporation’s

nonvoting stock (“80 Control”).

●

Obama Administration proposal would require ownership of at least 80%

of a corporation’s stock by voting power AND value.

38

Section 368 Divisive D Reorganization Requirements

●

Asset transfer from Parent to Newco.

●

Section 368 control test.

●

IRS disregards subsequent disposition of Newco stock by Parent

shareholders.

●

Section 368 business purpose test.

●

Section 368 continuity of business enterprise test.

●

Newco’s assumption of Parent liabilities and Parent’s potential receipt of

Newco cash and/or debt securities (discussed in “monetization” Section

below).

39

Section 355 Introduction

●

●

Basic section 355 structures: spin-offs, split-offs and split-ups.

●

Spin-off is a pro rata distribution of Newco stock to all Parent shareholders.

●

Common form of business separation.

Split-off is a distribution of Newco stock in full or partial redemption of 1 or more

shareholders’ Parent stock. If split-off is undersubscribed, Parent must distribute

remaining Newco stock to all eligible shareholders in a “clean-up” spin-off.

●

Parent avoids gain recognition on distribution of appreciated Newco stock in

retirement of Parent shares.

●

Share repurchases may improve Parent’s earnings per share (“EPS”).

●

Split-offs present significant deal execution risk due to need for sufficient

shareholder participation.

40

Section 355 Introduction

●

Split-up is division of 2 or more Parent businesses between 2 Newcos.

●

Parent contributes 2 or more businesses to 2 Newcos, and distributes

the stock of each Newco to Parent shareholders.

●

Parent must liquidate.

41

IRS Private Letter Rulings

42

IRS Private Letter Rulings

●

Significant corporate and shareholder taxes are generally at stake in a

transaction structured to qualify as a tax-free divisive D reorganization.

●

Therefore, historically, receipt of an IRS PLR confirming the transactions taxfree status was a condition precedent to consummation.

●

In 2013, the IRS announced 2 substantial curtailments to obtaining PLRs for

divisive D reorganizations.

●

First, in Revenue Procedure 2013-3, the IRS announced it would no longer

issue PLRs relating to 3 particular transactions that may occur in connection

with a divisive D reorganization.

●

Second, in Revenue Procedure 2013-32, the IRS announced that it will no

longer rule on whether a transaction satisfies section 355, although the IRS

will rule on 1 or more issues related to section 355 to the extent the issue is

significant.

●

Given these IRS announcements, transactions generally must need to

proceed on the basis of counsel’s tax opinion. However, counsel may not be

able to deliver a “will” opinion in some cases due to an absence of on-point

authority.

43

General Section 355 Requirements for Tax-Free Distributions

44

General Section 355 Requirements

●

Parent must have valid corporate business purpose for separation.

Treas. Reg. § 1.355-2(b).

●

●

Good business purposes include:

●

improving “fit and focus”,

●

facilitating subsequent merger involving Parent or Newco with a

third party.

●

allowing issuance of stock of 1 business to employees of that

business,

●

isolating assets of 1 business from risks of another,

●

rendering stock of Parent or Newco more attractive as acquisition

currency, and

See, e.g., Treas. Reg. § 1.355-2(b)(4), Exs. 3 & 8; Rev. Rul. 2004-23,

2004-1 C.B. 585; Rev. Rul. 2003-74, 2003-2 C.B. 77; Rev. Rul. 2003-75,

2003-2 C.B. 79; Rev. Rul. 76-527, 1976-2 C.B. 103; Rev. Proc. 96-30,

1996-1 C.B. 696, modified by Rev. Proc. 2003-48, 2003-2 C.B. 86.

45

General Section 355 Requirements

●

Post-distribution continuing relationships between Parent and Newco may

include transition services, overlapping directors and commercial

arrangements, e.g., leases/licenses. Continuing relationships must be

consistent with stated business purpose for distribution and facilitate Newco’s

transition to independent company.

●

The IRS logically subjects all continuing relationships to enhanced

scrutiny in “fit and focus” distributions. See Rev. Proc. 96-30, 1996-1

C.B. 696, modified by Rev. Proc. 2003-48, 2003-2 C.B. 86.

46

General Section 355 Requirements

●

●

Parent must hold 80% Control of Newco immediately before the distribution.

Section 355(a)(1)(A).

●

Parent may be able to recap into 80% Control as long as recap represents a permanent

change in Newco’s capital structure. See, e.g., Rev. Rul. 76-223, 1976-1 C.B. 103;

Rev. Rul. 69-407, 1969-2 C.B. 50. The IRS will no longer rule on this issue pending

further announcement.

●

Parent may acquire 80% Control of Newco less than 5 years before the distribution, but

only in a wholly tax-free transaction. Section 355(b)(2)(D).

●

If Parent acquired less than 20% of Newco stock in taxable transactions within

preceding 5-year period (such stock, “hot stock”), Parent must recognize any built-in

gain on the distribution of the hot stock, and the hot stock constitutes taxable boot to

Parent shareholders. Section 355(a)(3)(B), (c)(2)(A).

Parent must distribute Newco stock representing 80% Control, and may not retain any

Newco stock as part of a tax avoidance plan. Section 355(a)(1)(D).

●

A tax avoidance plan may exist if a distribution of the relevant Newco shares would

constitute a distribution of “other property.” Treas. Reg. § 1.355-2(e)(2).

47

General Section 355 Requirements

●

Prior IRS ruling guidelines for permitted stock retention established a four-part

test: (i) sufficient business purpose for retention, (ii) no officer or director

overlap, (iii) disposition of retained stock within 5 years after distribution, and

(iv) Parent and/or affiliates will vote retained stock in proportion to votes cast

by other Newco shareholders. Rev. Proc. 96-30, 1996-1 C.B. 696, modified by

Rev. Proc. 2003-48, 2003-2 C.B. 86.

●

Sufficient business purposes for retention include (i) satisfaction of Parent’s

employee compensation obligations, (ii) avoiding disruption to orderly trading

of Newco stock, (iii) using retained stock to secure Parent’s loans, (iv)

satisfaction of legal or regulatory requirements, and (v) signaling confidence in

Newco’s business as a standalone enterprise.

48

General Section 355 Requirements

●

●

Immediately after the distribution, both Parent and Newco must be engaged in

the active conduct of a business (“ATOB”). Section 355(b)(1).

●

Parent and Newco must have either actively conducted their respective

ATOBs for at least 5 years prior to the distribution or acquired them in

wholly tax free transactions within such period. Section 355(b)(2)(B)-(D).

●

Each ATOB must be of meaningful size. See, e.g., Rev. Proc. 2003-48,

2003-2 C.B. 86 (eliminating advance ruling requirement that relevant

business represent at least 5% of Parent’s gross assets for advance

ruling purposes).

ATOB test applies on an affiliated group basis, eliminating need for

complicated restructurings to reposition active businesses required under prior

law. Section 355(b)(3).

49

General Section 355 Requirements

●

Distribution must not be a “device” for distribution of Parent or Newco earnings

and profits (“E&P”). Treas. Reg. § 1.355-2(d).

●

Post-distribution taxable sale of Parent or Newco stock may raise device

concerns. Treas. Reg. § 1.355-2(d)(2)(iii). This is especially true if the

sale was already agreed to at the time of the distribution.

●

Must consider all device and non-device factors under a facts and

circumstances test. Treas. Reg. § 1.355-2(d).

●

Reduced risk of device issue in 100% split-off because tendering

shareholders generally would receive capital gain treatment in the event of

a taxable distribution (given their reduced interest in Parent after the share

redemption). Treas. Reg. § 1.355-2(d)(5)(iv).

50

General Section 355 Requirements

●

Generally need 50% shareholder continuity of interest in Parent and Newco after

distribution. Treas. Reg. § 1.355-2(c)(1), Exs. 2-3.

●

Parent will be taxed on distribution if any shareholder receives at least 50% of

Parent or Newco stock in exchange for Parent stock purchased within 5 years of

the distribution. Section 355(d)(1).

●

Section 355 will not apply if either Parent or Newco is a disqualified investment

corporation (“DIC”) immediately after the distribution, and any person holds at

least a 50% interest in the DIC (by vote or value) immediately after the transaction

that such person did not hold immediately before the transaction.

51

General Section 355 Requirements

●

Parent must allocate a portion of its E&P to Newco. Section 312(h).

●

●

●

E&P allocation is generally based on respective FMV of Parent’s retained

and transferred businesses. Treas. Reg. § 1.312-10(a). In a “proper case”,

Parent may use net basis of retained and transferred assets as basis for

allocation. See Bennett v. U.S., 427 F.2d 1202 (Ct. Cl. 1970).

Newco generally must be a U.S. corporation, because section 367 limits tax-free

distributions of foreign Newco stock.

●

Tax-free to U.S. Parent only to extent stock is distributed to qualified U.S.

persons (U.S. individuals and corporations). Treas. Reg. § 1.367(e)-1(b).

●

Presumption of foreign status for shareholders. Treas. Reg. § 1.367(e)-1(d).

Foreign Parent that is not itself subject to U.S. tax generally will still focus on

section 355 qualification if Parent has a significant U.S. shareholder base.

52

Slide Intentionally Left Blank

Section 355(e) Anti-Morris Trust Rules

54

Section 355(e) - Distributions Before Acquisitions

●

Imposes corporate level tax on a distribution that is followed by an acquisition of 50% or more

of Parent or Newco stock (by vote or value) effected pursuant to plan or series of related

transactions. Section 355(e)(2).

●

Enacted in 1997 in response to Congressional concern that some spin/merge transactions

more closely resembled a sale of Newco’s business, rather than a tax-free restructuring.

●

A “plan” generally exists only if there was an agreement, understanding, arrangement or

substantial negotiations between Parent/Newco and an acquirer during the 2-year ending on

the distribution date.

●

The Treasury regulations provide several safe harbors that, if applicable, disregard a

subsequent acquisition of Parent or Newco stock after a section 355 distribution.

●

Immediate Acquisition Safe Harbor: No agreement, arrangement, understanding or

substantial negotiations, which each require discussion of significant economic terms,

such as price, have occurred within 2-year period before the distribution.

Treas. Reg. § 1.355-7(b)(2), (h)(1).

●

6 Month Acquisition Safe Harbor:

●

No agreement, understanding, arrangement or substantial negotiations during

period beginning 1 year before, and ending 6 months after, the distribution;

●

Acquisition occurs more than 6 months after distribution; and

●

Substantial non-acquisition business purpose for the distribution.

Treas. Reg. § 1.355-7(d)(1).

55

Distributions Before Acquisitions

●

1 Year Acquisition Safe Harbor:

●

●

No agreement, understanding, arrangement or substantial negotiations on the

distribution date or within 1 year after the distribution. Treas. Reg. § 1.3557(d)(3).

IPO Safe Harbor:

●

Non-acquisition business purpose for the distribution; and

●

No agreement, arrangement, understanding or substantial negotiations

concerning the acquisition of 25% or more of the company during the period

beginning 1 year before, and ending 6 months after, the distribution.

Treas. Reg. § 1.355-7(d)(2).

56

Distributions Before Acquisitions

●

Facts and Circumstances Test:

●

If no safe harbor applies to a distribution, a facts and circumstances test

governs. Regulations contain several examples of plan and non-plan

factors.

●

A strong non-acquisition business purpose for a distribution that would

have occurred regardless of a subsequent acquisition may demonstrate

the absence of plan for section 355(e) purposes. Treas. Reg. § 1.3557(b)(2); see, e.g., Rev. Rul. 2005-65, 2005-2 C.B. 684 (merger of Parent

and acquirer after Parent publicly announced, but before it effected, the

distribution of Newco, did not violate section 355(e) because (i) there was

a business purpose for the distribution other than completion of the

merger, (ii) distribution would have occurred regardless of the merger, (iii)

merger discussions followed public announcement of the distribution, and

(iv) Parent did not need to merge with acquirer to continue its business).

57

Distributions Before Acquisitions

●

An unexpected change in market or business conditions tends to demonstrate

the independence of the distribution and the acquisition. Treas. Reg. § 1.3557(b)(4); see, e.g., P.L.R. 2001-15-001 (Apr. 16, 2001) (permitting Parent’s

acquisition of third party after announcement of the split-off of a Parent

subsidiary; unanticipated regulatory changes permitted Parent to pursue

acquisition).

●

Regulations include “hot stock” example where third party acquired Newco

within 6 months after the distribution. Treas. Reg. § 1.355-7(j), Ex. 3

(acquisition of Newco shortly after distribution was “reasonably certain”;

distribution and acquisition were not part of a plan because, prior to the

distribution, neither Parent nor Newco had an agreement, arrangement,

understanding or substantial negotiations concerning the acquisition).

58

Monetization Strategies for Section 355 Transactions

59

Economic Benefits of Monetization Strategies

●

A spin-off generally dilutes Parent’s EPS because Newco’s earnings are

removed from the Parent group. Monetization techniques may minimize

dilution.

●

A split-off of Newco may also minimize the distribution’s dilutive EPS effect.

Strategies to Retire Parent Stock:

●

Effect distribution as split-off in which electing Parent shareholders tender

all or a portion of their Parent stock for Newco shares.

●

Use cash borrowed (and distributed) by Newco to repurchase additional

Parent stock.

Strategies to Eliminate Parent Third Party Debt:

●

Transfer Parent liabilities to Newco prior to distribution.

●

Retire Parent debt with cash, debt and/or stock distributed by Newco.

60

Monetization Strategies for Section 355 Transactions

Shareholders

Shareholders

Parent

Parent

Newco

(Former Parent

Assets)

Newco

Stock

Assets

Newco

●

Parent distributes Newco stock to Parent shareholders in divisive D reorganization/section

355 transaction.

●

Monetization strategies include liability assumption, leveraged distribution, debt-for-debt

exchange, stock-for-debt exchange, pre-distribution partial IPO of Newco and postdistribution stock sale by Newco.

●

These are discussed below.

61

Liability Assumptions by Newco

Shareholders

Shareholders

Parent

Assets

&

Liabilities

Parent

Newco

(Former Parent

Assets & Liabilities)

Newco

Stock

Newco

●

Newco generally can assume Parent liabilities up to Parent’s tax basis in assets transferred to

Newco. Section 357(c)(1).

●

Section 357(c) applies to liability assumption between consolidated group members if

transferee member (Newco) leaves consolidated group as part of the same plan or

arrangement as the liability assumption. Treas. Reg. § 1.1502-80(d)(1).

62

Leveraged Distributions by Newco

Shareholders

Shareholders

Creditors

Parent

Assets

&

Liabilities

Parent

Newco

(Former Parent

Assets & Liabilities;

New Newco Debt)

Newco

Stock &

Cash

Newco

●

Newco can borrow and distribute cash up to Parent’s tax basis in assets transferred to Newco

(after reduction for assumed liabilities).

●

Parent generally must keep Newco cash in a segregated account and distribute it within 1

year after the distribution pursuant to the plan of reorganization.

63

Leveraged Distributions by Newco

●

Subject to caveats below, Parent generally should not recognize gain on the receipt of

Newco cash that is redistributed to Parent shareholders or Parent creditors under the plan

of reorganization. Section 361(b)(1).

●

Parent generally may distribute Newco cash to Parent’s shareholders either as a

special dividend or, under certain circumstances, to redeem Parent shares.

●

The IRS generally requires a recipient of Newco cash, debt securities and/or stock who

exchanges Parent debt to exchange “historic debt” of Parent in order to qualify as a

“creditor” of Parent for Section 361 purposes. See, e.g., Alexander Sheds Light on

meaning of No-Rule’s “In Anticipation of “ a Spin-Off, 2014 TNT41-6 (Mar. 3, 2014)

(suggesting key date is whether Parent issued relevant debt before spin-off was first

presented to Parent’s board of directors); Lee A. Sheppard, “NYSBA Considers ‘Cash

Wreck’ in Spinoffs,” 114 Tax Notes 507 (Feb. 5, 2007) (discussing Alexander’s comments

on historic debt).

●

Newco’s distribution of cash in excess of Parent’s tax basis in Newco stock to Parent may

create an excess loss account (“ELA”) that generally would be recaptured on the

distribution of the Newco stock outside of Parent’s consolidated group. See Sections

358(a)(1)(A) and 361; Treas. Reg. § 1.1502-19(c)(1)(ii).

64

Exchanges of Newco Debt Securities for Parent Debt

Shareholders

Shareholders

Creditors

Creditors

Parent

Assets

&

Liabilities

Parent

Newco

(Former Parent

Assets & Liabilities;

New Newco Debt)

Newco

Stock &

Securities

Newco

●

Newco can issue “securities” to Parent in a D reorganization, which Parent may use to retire

Parent debt. The only limit on the amount of Newco securities is the “debt for tax”

requirement. Section 361(a).

●

Parent debt retired in the debt exchange must constitute “historic debt” of Parent.

●

In order to provide Parent debt holders with cash, an Investment Bank (“IB”) may purchase

Parent debt and exchange it for Newco securities.

65

Exchanges of Newco Debt Securities for Parent Debt

●

IB must act as a principal for its own account, rather than as Parent’s agent, in

order to qualify as a section 361 “creditor”. If IB is treated as Parent’s agent,

Parent would likely be treated as selling Newco securities for cash and using

the cash to repurchase Parent debt.

●

The IRS has issued PLRs approving structures where IB holds (i) Parent

debt for at least 5 days before executing exchange agreement with

Parent, and (ii) Newco debt for an additional period thereafter (9 days).

●

IB generally can hedge its risks, e.g., interest rate and credit exposure

with respect to the debt, with parties unrelated to Parent.

●

Newco can also distribute non-security debt tax-free, up to Parent’s tax basis

in the assets contributed to Newco (after reduction for assumed liabilities).

Section 361(b)(3).

●

In the past, legislation has been introduced in Congress to equate the

treatment of the distribution of Newco debt securities with that of a Newco

cash dividend. If enacted, such legislation would preclude tax-free

distributions of Newco securities in excess of Parent’s tax basis in Newco

stock.

66

Distribution of Newco Stock to Parent Debtholders

Historic

Shareholders

Shareholders

Creditors

Parent

Parent

Former

Parent

Creditors

Newco

(Former Parent

Assets)

Newco

Stock

Assets

Newco

●

Parent must distribute Newco stock representing 80% Control to Parent shareholders, which

effectively caps the amount of Newco stock Parent can issue to Parent’s creditors at 20%.

Section 368(a)(1)(D).

●

Parent may be able to effect section 355 distribution and also provide Parent creditors with

more than 20% of Newco’s value if Newco adopts a permanent high vote/low vote (e.g., 5:1

votes per share) structure, and Parent’s shareholders receive at least 80% of Newco’s total

voting power. Rev. Rul. 69-407, 1969-2 C.B. 50.

●

Note that Obama Administration would change the 80% Control test.

67

Distribution of Newco Stock to Parent Debtholders

●

Parent debt retired in a stock-for-debt exchange must satisfy the “historic debt”

and agency rules referenced above.

●

Newco stock distributed in a stock-for-debt exchange generally should be

treated as distributed pursuant to plan of reorganization if Parent (i) is

obligated to distribute Newco stock, and (ii) completes all steps

contemplated by the plan of reorganization within 1 year. See Comm’r v.

Gordon, 391 U.S. 83 (1968); P.L.R. 2003-01-011 (July 2, 2002).

●

Any Newco stock not treated as distributed pursuant to the plan of

reorganization will be treated as retained stock. Parent must

demonstrate the absence of a tax avoidance plan for the retained

stock in order to preserve the distribution’s tax-free qualification

under section 355.

68

Pre-Distribution Partial IPO of Newco

IPO

Purchasers

Shareholders

Shareholders

High Vote

Stock

Creditors

Parent

Parent

Low Vote

Stock

Newco

(Former Parent

Assets)

High Vote & Low

Vote Newco Stock

Assets

Newco

●

Newco can issue high vote stock to Parent in exchange for contributed assets and low vote

stock, representing up to 49.99% of Newco’s value and 20% of Newco’s voting power, to public

in IPO, and then distribute IPO proceeds to Parent as a dividend. Parent can use cash to repay

Parent debt and then distribute its high vote Newco stock to Parent shareholders under

section 355.

●

Note that Obama Administration proposal would change 80% Control test.

69

Pre-Distribution Partial IPO of Newco

●

Newco will not be subject to tax on the sale of stock in the IPO. Section 1032.

●

Under current law, Newco’s formation and distribution should qualify as a

divisive D reorganization and section 355 transaction if the IPO is limited to

20% of Newco’s voting power.

●

●

Structures that could be recast as a pre-distribution sale of more than

20% of Newco’s voting power would, if recast, preclude (i) a

D reorganization because Parent’s shareholders would not have 80%

Control of Newco immediately after the transaction, and (ii) section 355

qualification because Parent would not distribute 80% Control of Newco.

Note that distribution of IPO proceeds to Parent may create an ELA in Newco

stock that would be triggered upon distribution of Newco stock outside Parent

consolidated group.

70

Post-Distribution Stock Sale by Newco

Shareholders

Shareholders

Purchaser

Creditors

Parent

Parent

Newco

Stock &

Demand Note

Assets

Newco

(Former Parent

Assets)

Newco

●

Parent contributes assets to Newco in exchange for Newco stock and a demand note

with FMV equal to 20% of Newco stock. Parent distributes 100% of Newco stock to

Parent shareholders.

●

After distribution, Newco approaches IB, which purchases up to 20% of Newco’s stock.

Newco repays demand note with sales proceeds, and Parent uses funds received to

repay Parent debt.

71

Post-Distribution Stock Sale by Newco

●

Risk that order of transactions will not be respected, and Parent will be treated

as selling Newco stock to IB before distribution.

●

Limiting demand note to 20% of Newco stock should preserve

section 355 treatment even if Parent were forced to recognize some gain

under a pre-distribution deemed sale recast. See Waterman Steamship

v. Commissioner, 430 F.2d 1185 (5th Cir. 1970); Section 355(a)(1)(D).

●

Issue regarding whether Parent can distribute loan proceeds tax-free to

creditors because Parent receives demand note from Newco, but distributes

cash to creditors. See Section 361(b)(3) (Parent must transfer to creditors the

property received in the exchange).

●

Even if distribution of demand note is tax-free, it may produce an ELA, which

would be triggered upon distribution of Newco stock to Parent’s shareholders.

72

Slide Intentionally Left Blank

Sample Market Transactions

74

PPG Spin-Off of Commodity Chemicals Business

and Merger with Georgia Gulf

Shareholders

Debtholders

PPG

1. Commodity Chemical Assets

2. Assumed Liabilities

1. Newco Stock

2. Cash

3. Newco Securities

Loan Proceeds

Commodity

Newco

Bank

PPG contributed commodity chemicals business to Commodity Newco in exchange for

100% of Commodity Newco’s stock, cash, Newco debt securities and Newco’s assumption

of PPG liabilities.

75

PPG Spin-Off of Commodity Chemicals Business

and Merger with Georgia Gulf

Shareholders

Commodity

Newco

PPG

●

PPG distributed 100% of Commodity Newco stock to PPG shareholders in a split-off.

●

PPG used cash dividend and Commodity Newco debt securities to repay PPG debt.

76

PPG Spin-Off of Commodity Chemicals Business

and Merger with Georgia Gulf

PPG

Shareholders

Georgia Gulf

Shareholders

PPG

Shareholders

Historic

Georgia Gulf

Shareholders

50.5%

Commodity

Newco

Georgia Gulf

49.5%

Georgia Gulf

Commodity

Newco

●

After distribution, Georgia Gulf acquired Commodity Newco, and Newco’s

shareholders received approximately 50.5% of combined company’s stock.

●

IRS issued PLR confirming transaction’s tax-free status.

77

Alltel Spin-Off of Wireline Business and

Merger with Valor Communications

Senior

Noteholders

Shareholders

Commercial

Paperholders

Alltel Corp.

1. Newco Stock

2. Cash

3. Newco Securities

1. Wireline Assets

2. Liabilities

Loan Proceeds

Wireline

Newco

Bank

Alltel contributed wireline business to Wireline Newco in exchange for 100% of

Newco’s stock, Newco debt securities, cash and Newco’s assumption of Alltel

liabilities.

78

Alltel Spin-Off of Wireline Business and

Merger with Valor Communications

Shareholders

Creditors

Wireline

Newco

Alltel Corp.

●

Alltel distributed 100% of Newco stock to shareholders pro rata.

●

Alltel used cash from Newco to retire Alltel debt and/or repurchase Alltel stock

●

Alltel used Newco securities to retire Alltel commercial paper and senior notes (“Alltel

Debt”) through IB. IB acquired Alltel Debt for its own account at least 14 days before

Newco distribution, and held Alltel Debt for at least 5 days before executing exchange

agreement with Alltel.

79

Alltel Spin-Off of Wireline Business and

Merger with Valor Communications

Creditors

Alltel

Shareholders

Valor

Shareholders

Alltel

Shareholders

85%

Wireline

Newco

●

Valor

Communications

Historic Valor

Shareholders

15%

Creditors

Valor

Communications

After distribution, Newco merged into Valor with Valor surviving, and Alltel’s shareholders

received approximately 85% of combined entity’s stock.

80

Alltel Spin-Off and Merger–Tax Analysis

●

●

Newco Spin-Off

●

Corporate business purposes include improving “fit and focus” and facilitating

merger. See, e.g., Rev. Rul. 2003-74, 2003-2 C.B. 77; Rev. Rul. 2003-75,

2003-2 C.B. 79; Rev. Rul. 76-527, 1976-2 C.B. 103; Rev. Proc. 96-30, 19961 C.B. 696, modified by Rev. Proc. 2003-48, 2003-2 C.B. 486.

●

Distribution of Newco securities to IB in retirement of Alltel debt is also

permitted in connection with a section 355 distribution. Section 361(c)(1).

Valor Merger

●

●

Section 355(e) satisfied because former Alltel shareholders owned 85% of

combined entity’s stock after merger. Section 355(e)(2).

The IRS confirmed the transaction’s tax-free status. See P.L.R. 2006-29-007

(July 21, 2006).

81

Weyerhaeuser’s Split-Off of Fine Paper

Business and Merger with Domtar

Weyerhaeuser Inc.

1. Fine Paper Assets

2. Liabilities

1. Newco Stock

2. Cash

Loan Proceeds

Newco

Bank

Weyerhaeuser contributed fine paper business to Newco in exchange for

100% of Newco stock, assumption of Weyerhaeuser liabilities and cash

distribution of Newco loan proceeds.

82

Weyerhaeuser’s Split-Off of Fine Paper

Business and Merger with Domtar

Weyerhaeuser

Shareholders

Weyerhaeuser

Newco

●

Weyerhaeuser distributed 100% of Newco stock to its shareholders, including

holders of Weyerhaeuser exchangeable shares, in a split-off.

●

Weyerhaeuser used Newco cash distribution to repay Weyerhaeuser’s debt.

83

Weyerhaeuser’s Split-Off of Fine Paper

Business and Merger with Domtar

Domtar

Shareholders

Weyerhaeuser

Shareholders

Weyerhaeuser

Shareholders

Former Domtar

Shareholders

55%

Domtar Inc.

Newco

45%

Newco

●

Domtar, a Canadian company, merged into Newco with Newco surviving.

●

Weyerhaeuser shareholders owned approximately 55% of Newco’s stock

immediately after the merger.

84

Weyerhaeuser’s Distribution and Merger –

Tax Analysis

●

Newco cash dividend was tax-free to Weyerhaeuser up to amount of

its net tax basis in assets contributed to Newco because Weyerhaeuser

distributed the cash to its creditors under Newco plan of reorganization.

Section 361(b)(3).

●

No apparent section 355(e) concerns with Domtar merger because

Weyerhaeuser shareholders received approximately 55% of combined entity’s

stock. Section 355(e)(2).

●

Tax-free treatment not certain if Domtar were surviving corporation.

●

Under section 367, U.S. person’s transfer of U.S. target’s stock to foreign

corporation such as Domtar would be taxable if U.S. transferors receive

more than 50% of foreign acquirer’s stock (which is necessary to satisfy

Section 355(e)). Treas. Reg. § 1.367(a)-3(c)(1).

●

●

Difficult to rebut section 367 presumption that all target shareholders

are U.S. persons. Treas. Reg. § 1.367(a)-3(c)(2).

The IRS confirmed the distribution’s tax-free status. See P.L.R. 2007-18-024

(May 4, 2007).

85

This presentation was not intended or written to be used, and cannot be used,

for the purpose of avoiding U.S. federal, state, or local tax penalties.

30135296

86