Student Accounts Receivable – Tuition Revenue Cycle Table of

advertisement

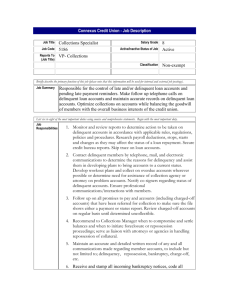

FINANCE AND PLANNING Student Receivables Student Accounts Receivable – Tuition Revenue Cycle Table of Contents 01. Policy and Procedure Statement ............................................................................................... 2 02. Reason for Policy ...................................................................................................................... 2 03. Who Needs to Know This Policy ............................................................................................... 2 04. Legal Obligations ....................................................................................................................... 2 05. Explanation of Policy and Procedure ........................................................................................ 2 06. Responsibilities of the Collections Dept. ................................................................................... 3 07. Responsibilities of Students ...................................................................................................... 3 08. Responsibilities of the Registrar ................................................................................................ 3 09. Responsibilities of Other Departments ...................................................................................... 3 10. Billing and Collection Procedure ............................................................................................... 3 11. Collection Agency Policy & Procedures .................................................................................... 4 12. Accounts Receivable Write-Off Procedures .............................................................................. 5 13. Reserve Policy ........................................................................................................................... 5 14. Accounts Receivable Aging and Reconciliation to General Ledger ........................................... 5 15. Collection Process Flowchart .................................................................................................... 6 Page 1 1 of 6 FINANCE AND PLANNING Student Receivables 01. Policy and Procedure Statement This document covers the key policies and procedures governing the recording, collection, analysis and reporting of student accounts receivable. 02. Reason for Policy A student is responsible for the payment of charges incurred at the university by the stated payment deadline. The purpose of this policy is to detail the specific process and action steps to be used to resolve any outstanding student account balance. 03. Who Needs to Know This Policy The Collection Department, members of the Office of Student Assistance, Admissions staff, academic advisors and anyone else who comes in contact with students in an advisory capacity. 04. Legal Obligations The university is entitled to collect all earned revenues and to pass on the costs of these collection efforts to the student. The communication of this fact must be presented in as many places as possible, to ensure students are aware of their obligation and the consequences for non-payment. 05. Explanation of Policy and Procedure During the normal course of events, once a payment due date has been missed, past due notices will be sent to students, typically on monthly intervals. If the balance remains unpaid, the student may not return for subsequent semesters and the account will be transferred to the Pace Collections Department. This department will then attempt to reach the student to arrange payment of the debt. It is the responsibility of the student to make sure the address Pace has on file is their current address. Delinquent outstanding balances, including those from installment payment plans and unpaid fines, are subject to collection by the University or, at the University’s option, its designated agent. Late charges and interest may be added to a delinquent outstanding balance. In addition, the actual collection expenses, including attorneys’ fees, if any, incurred by the University will be added to the delinquent outstanding balance. Any student who has a delinquent outstanding balance is not eligible to enroll at the University. The University will not provide copies of transcripts to or on behalf of any student with a delinquent outstanding balance. A delinquent outstanding balance will be reported to all national credit bureaus once it is sent to a collection agency and may significantly and adversely affect the student’s credit history. The University may pursue legal action to recover the amount of the delinquent outstanding balance plus any late charges, interest, actual collection expenses, court costs, and attorneys’ fees. Page 2 2 of 6 FINANCE AND PLANNING Student Receivables 06. Responsibilities of the Collections Dept. The Collections Dept. has a responsibility to: Maintain a list of delinquent outstanding balances, and attempt to contact the student about making payment arrangements. In addition, place appropriate holds on the account to prevent the issuance of transcripts or future registrations. Upon contact, inform students of their delinquency, the amount due, and the consequences which may result from non-payment of outstanding amounts – namely, transference of the balance to a third party collection agency. At which time, national credit bureaus will begin to be informed each month of the status of the student’s bad debt. When appropriate, allow the third party agency to initiate a legal action for recovery. 07. Responsibilities of Students Students are expected to keep their accounts current. Students must also notify the school each time there is a change in their address. If a student account is sent to the collection department it is very important that the student at least reply in order to begin a dialogue on the resolution of the account balance. Ignoring attempts for contact will only result in the account being sent to a third party collection agency, where the collection costs of as much as 33% of the amount owed will be added. Once an account goes to a collection agency, it will not be retracted. 08. Responsibilities of the Registrar The Registrar is to report all delinquent tuitions and fees, including fines, to Collections. In addition, the Registrar is responsible to work in conjunction with the collections office by ensuring the enrollment of students and the transmission of transcripts adhere to this policy as described below. Any student who has a delinquent outstanding balance is not eligible to enroll at the University. The University will not provide copies of transcripts to or on behalf of any student with a delinquent outstanding balance. OSA, in consultation with Finance, can make exceptions based on certain amounts or special circumstances. 09. Responsibilities of Other Departments All departments that may have outstanding incidental student balances, such as library fines, parking tickets, material fees, book sales, and meal plans, are responsible for reporting unpaid fines to the Registrar’s Office for inclusion in student billing. 10. Billing and Collection Procedure The following steps are followed in collecting student accounts receivable: Page 3 3 of 6 FINANCE AND PLANNING Student Receivables 1. The student completes the enrollment process including financial aid packaging 2. The student registers and is asked to pay 100% of the balance due by the tuition due date. This means early August for the fall term and early January for spring. If necessary, a payment plan may be established with Tuition Pay (as administered through Sallie Mae). 3. Student tuition and fee invoices are mailed to students who complete early registration at least 30 days prior to the due date. Students who complete registration late are required to pay the balance in full prior to the start of the semester. 4. If payments have not been received by the semester void date, usually within 2 to 4 weeks of the start of the semester, the Office of Student Assistance (OSA) voids the registration of any student who has not paid their tuition balance in full. However, each semester there are certain groups OSA protects from being included in the void for various reasons (i.e. certain balance thresholds). There is a one week period after the void during which the student can reverse this transaction by paying their balance in full. 5. Once the void is entered in the system, OSA begins the process of sending out past due billing notices for all open balances. 6. OSA past due billings continue until a CO hold is placed on the account and the account has been placed with an outside collection agency. 7. The internal collections department efforts begin approximately 10 months after payment due date. A second letter is sent in month 11 and a third letter is sent in month 12. The student is given 15 days after the third letter before action is taken. If payment is not received, the balance is deemed uncollectible by Pace University and the amount is given to a collection agency for further action and then written-off after about 2 months. Refer to #.15- Collection Process Flowchart 11. Collection Agency Policy & Procedures The university uses outside collection agencies to pursue all student account balances outstanding for more than 150 days. The collection agency retains the placement indefinitely and continues to credit report until such time as we request the account be closed and returned. Once an account is placed with an outside collection agency, an inquiring student should be referred by Pace staff to the Pace internal collections office first for questions regarding the repayment of their balance. The student will then be referred to the appropriate person at the collection agency to discuss their account further. Pace staff should be available to answer questions regarding the outstanding balance due but all payments should be mailed directly to the collection agency. Once the account has been given to the collection agency, no payments should be accepted by Pace staff. The fee a collection agency charges is by definition, expressed as a percentage of anything they collect on behalf of the University. The University, having given the students ample opportunity to repay their balances, directs any collection agency to remit to the University 100% of any balance owed to the University which is placed with them. This means the collection agency fees must be added to the balance the student owes. Page 4 4 of 6 FINANCE AND PLANNING Student Receivables 12. Accounts Receivable Write-Off Procedures Approximately two months after an account has been placed with a collection agency, the account is written off if no payment is received. When the list of students is prepared for the collection agency, the Tuition Collections Specialist presents the list to the Assistant Controller – rd Tuition Revenue Cycle for approval. This approval is for both the transfer to a 3 party collection agency and the subsequent write-off. Any amounts collected by a collection agency are accounted for as follows: the collection agency st keeps their agency fee and remits to the university the remaining balance. When a 1 payment has been received, the entire balance originally written off is written back on as a receivable at the time of payment. 13. Reserve Policy An allowance for doubtful accounts is an account established to record a reduction for accounts receivable balances, to allow for those accounts that will not be collected. The reserves are established when there is a basis to doubt the full collection of amounts due. The adequacy of reserves is evaluated each year as part of the year-end closing process and also at mid-year. The method for calculation of the reserve allowance is based on account aging and related estimated collection percentages and is compared to historical write-off averages for reasonableness. The goal is to properly and accurately present the accounts receivable balance. 14. Accounts Receivable Aging and Reconciliation to General Ledger Each day the Accounts Receivable Aging Report is produced and stored on a shared drive for use by the Assistant Controller – Tuition Revenue Cycle. The total on this aging can be tied in to the total debits on the Trial Balance Report (credit balances are not considered as part of the aging). The Accounts Receivable reconciliation is performed several times per month. The Banner report for viewing an individual student ledger is TSAAREV. In that, you may search for a student by Banner ID, name, or SSN. Page 5 5 of 6 FINANCE AND PLANNING Student Receivables 15. Collection Process Flowchart PP = Payment Plan PP established (10, 8, or 5 pay) or balance in full due Does student make payment(s)? Y End Student disputes balance, we research validity of claim Y Valid claim? Y Adjust balance End N 5-6 mo’s after semester ends, accounts identified for collection Collection hold (CT) placed and 1st in-house collection letter mailed Do they respond? End N N Send out letter #2 Student pays balance in full Y Make in-house PP or remit next AMS payment Y Do they respond? Student pays balance in full Y Do they make payments? Y End N End Y N Do they make payments? Make in-house PP Y Send out letter #3 marked with red ‘Urgent” stamp Y N Student pays balance in full End Send out Final notice letter marked with red “Urgent” stamp Do they respond? N Place acct with agency. Place CO hold, then w/o as bad debt Did they pay? Reverse W/O Y N Page 6 6 of 6 Will eventually find another agency to place account with for 2nd collections End