Economic Benefits of the Expansion of Avocado Imports

advertisement

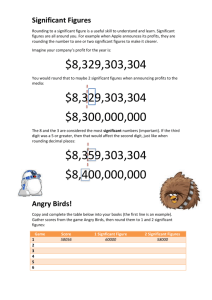

FABA:Foundedonthebeliefthattoutilizeinformationeffectivelyinadecision‐makingprocess,ittakesreal worldexperience,soundeconometricandstatisticalskillsandadvancedanalyticalability. Economic Benefits of the Expansion of Avocado Imports from Mexico: State-by-State Impacts Research Report to the Asociación de Productores y Empacadores de Aguacate (APEAM, A.C.) and the Mexican Hass Avocado Import Association (MHAIA) Forecasting and Business Analytics, LLC. Dr.GaryW.Williams, FABATeamandProfessor, TexasA&MUniversity Dr.OralCapps,Jr., FABAManagingPartnerandExecutiveProfessor, TexasA&MUniversity DanHanselka FABATeamandExtensionAssociate, TexasA&MUniversity ForecastingandBusinessAnalytics,LLC 9409WhitneyLane CollegeStation,TX77845 Phone:979‐255‐7081 Email:capps@faba‐llc.com 1 Webpage:http://www.faba‐llc.com April 2014 Economic Benefits of the Expansion of Avocado Imports from Mexico: State-by-State Impacts Gary W. Williams, Oral Capps, Jr., and Daniel Hanselka Forecasting and Business Analytics, LLC This report is the second of two reports analyzing the economic benefits from U.S. imports of avocados from Mexico. The previous report looked at the aggregate economic effects of those imports across the U.S. as a whole. This report provides a state-by-state breakdown of the impacts. Avocados are consumed in every state of the union. Thus, avocado imports have an impact on the economies of every state as well. Obviously, the impact differs given the different levels of avocado imports that enter each state as driven primarily by differences in per capita state income and population. In 2013, the U.S. imported $991.875 million of Mexican avocados (USDA 2014). Data on U.S. imports of any commodity are not available by state. Consequently, to determine the state-by-state impacts of U.S. avocado imports from Mexico, we estimated the value of avocado imports by state using avocado consumption data and state gross domestic product (GDP) levels as detailed in the methodology section. Using the Information Resources, Inc. (IRI) regional aggregation of states, the estimates suggest that the West region (Arizona, Colorado, Idaho, Montana, Nevada, New Mexico, Oregon, Utah, Washington, and Wyoming) accounted for the largest share of 2013 avocado imports from Mexico at 19.2% followed by the South Central region (Arkansas, Louisiana, Oklahoma, and Texas) at 18.8%, California at 14.0%, the Northeast region (Connecticut, Maine, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island) at 13.0%, the Midsouth region (Delaware, District of Colombia, Kentucky, Maryland, North Carolina, Tennessee, and West Virginia) at 10.3%, the Great Lakes region (Illinois, Indiana, Michigan, Ohio, Wisconsin) at 9.5%, the Southeast region (Alabama, Florida, Georgia, Mississippi, South Carolina) at 8.9%, the Plains region (Iowa, Kansas, Minnesota, Missouri, Nebraska, North Dakota, South Dakota) at 4.6%, and Alaska and Hawaii at 1.5% (Figure 1). Methodology Used in the State-by-State Analysis The same general methodology and procedures used in the first report to analyze the aggregate U.S. economic impact of Mexican avocado imports is used in this analysis of the state-level impacts of those imports with two exceptions. First, this state-by-state analysis employs only the IMPLAN model approach to the economic impact analysis (IMPLAN 2014). The econometric approach used for the analysis of the aggregate U.S. impact of Mexican avocado imports is not replicated in the state-by-state analysis. The econometric approach was utilized in the first study 2 Figure 1: Estimated Shares of U.S. Avocado Imports from Mexico by Region (%), 2013 1.5 14.1 9.5 19.2 10.3 8.9 13.0 4.6 18.8 California Great Lakes Midsouth Northeast Plains South Central Southeast West Alaska and Hawaii primarily as a check of the validity of the IMPLAN results. Given the results of that analysis which validates the IMPLAN approach, a state-by-state econometric analysis is not needed. The second difference in the methodology of the state-level analysis from the aggregate U.S. analysis is that an updated IMPLAN model is used in this analysis. The updated IMPLAN model uses 2012 data and coefficients for the United States and for individual states (rather than 2010 as in the aggregate U.S. analysis) to construct the U.S. and individual state models within IMPLAN. For each state, the 2013 value of the respective state’s imports of Mexican avocado imports was entered into the respective state model as the industry sales for the wholesale trade businesses sector event. Imputation of the 2013 Value of State Imports of Mexican Avocados For this analysis, the value of avocado imports in 2013 by each state had to be estimated because state-level import data are not available. The problem is that shipments of any imported commodity like avocados into some states may simply be transported through the state to other destinations (transshipments). In deriving estimates of the state value of Mexican avocado 3 imports, the initial attention centered on the retail volume (number of pounds) of avocados sold in the United States based on the most recent Regional Composite Data reports available from the Hass Avocado Board (HAB 2014). These respective reports include retail volume and dollar trends and average selling prices delivered quarterly. These reports essentially provide the overview of the avocado category by region at the retail level of the marketing channel. Consequently, these data help retailers, shippers, handlers, and others involved in the avocado business identify opportunities for planning purposes. The Symphony Information Resources Inc. (IRI) Group / FreshLook Marketing organization gathers chain-wide sales across all retail market areas. Regional figures include data collected from all reporting retailers as well as imputed data (non-reporting retailers such as club, warehouse and independent stores) for a total of 100% of retail sales for the area. This information is available on a calendar quarter basis. The IRI sales data are only available by the eight IRI regions, including: (1) California, (2) Great Lakes, (3) Midsouth, (4) Northeast, (5) Plains, (6) South Central, (7) Southeast, and (8) West. These regions are linked by 45 different metropolitan areas/cities of the United States as follows: California: Los Angeles; Sacramento; San Diego; and San Francisco; Great Lakes: Chicago, IL; Cincinnati, OH; Cleveland, OH; Columbus, OH; and Detroit, MI; Mid-South: Baltimore, MD; Louisville, KY; Memphis, TN; Raleigh, NC; Richmond, VA; and Roanoke, VA; Northeast: Albany, NY; Boston, MA; Buffalo, NY; New England; New York; Philadelphia, PA; and Pittsburgh, PA; Plains: St. Louis, MO; Omaha, NE; Des Moines, IA; Minneapolis/St. Paul, MN; Kansas City, KS/MO; and Wichita, KS; South Central: Dallas, TX; Houston, TX; and Little Rock, AR; Southeast: Atlanta, GA; Charlotte, SC; Columbia, SC; Jacksonville, FL; Miami, FL; Orlando, FL; and Tampa/St. Petersburg, FL; West: Boise, ID; Denver, CO; Las Vegas, NV; Phoenix, AZ; Portland, OR; Seattle, WA; and Spokane, WA. Using the most recently available quarterly data from IRI (calendar year 2012) on the retail volume of avocados sold in the United States (pounds of avocados sold by region), the second step of this imputation process was to calculate average regional shares. These average regional shares of avocado consumption were as follows: (1) California, 22.60%; (2) Great Lakes, 8.58%; (3) Mid-South, 9.24%; (4) New England, 11.75%; (5) Plains, 4.18%; (6) Southeast, 8.05%; (7) South Central, 16.96%; and (8) West, 18.63%. The third step in the process of estimating the state level value of Mexican avocado imports was to categorize each state and the District of Columbia into the IRI regions. The fourth step in the imputation process required the translation of the regional share information to respective states. To accommodate this translation, data were acquired concerning the gross domestic product (GDP) by state for 2012. So for any region, the sum of the respective state GDPs in that region was calculated and, subsequently, the GDP shares for each state in the respective regions. These GDP shares were multiplied by the average share of avocado consumption on a region-by-region basis. 4 The fifth step in this process entailed gathering the value of Mexican imports of avocados for calendar year 2013 ($991,875,000) from the Foreign Agricultural Service of the U.S. Department of Agriculture. Because California also produces Hass avocados, it was necessary to acquire the value of avocado production for California in 2013 ($435,023,142) from the California Avocado Commission industry statistical data (CAC 2014). The last step in this imputation process was to multiply the value of Mexican imports of avocados for calendar year 2013 by the average regional share of avocado consumption and to multiply this product by the regional GDP share associated with the individual state. However, for the case of California, the value of avocado production for California was first subtracted from the total value of Mexican imports of avocados for calendar year 2013. Then the difference was multiplied by regional share of avocado consumption for California to arrive at the imputation of the value of Mexican avocado for California. The projections of the total value of Mexican imports of avocados for calendar year 2013 by state are exhibited in Table 1. Not surprisingly, the two top states were California at $139,680,249 and Texas at $136,506,412. These state figures then formed the inputs into the IMPLAN model as described above. Analysis of the State-by-State Benefits from Imports of Avocados from Mexico The estimated state impacts of Mexican avocado imports are summarized alphabetically in Table 2. Details of the impacts by industry within each state are provided in the appendix. For this analysis, states were divided into three categories according to the impact of Mexican avocado imports on the respective states’ economies: (1) high impact, (2) medium impact, and (3) low impact. High impact states include those for which imports of Mexican avocados in 2013 generated more than 500 jobs and contributed more than $100 million to the respective state GDP. Medium impact states include those for which Mexican avocado imports in 2013 created from 100 to 500 jobs and contributed from $10 million to $100 million to the respective state GDP. Low impact states include those for which Mexican avocados generated less than 100 jobs and contributed less than $10 million to the state GDP. Figure 2 groups the states according to the impact of Mexican avocado imports on their economies. The highest impact states are, not surprisingly, California and Texas (in green on the map in Figure 2), states with relatively high state GDPs and, interestingly, large populations of Hispanic consumers and where Hispanic cuisine is highly popular. In California, Mexican avocado imports in 2013 generated 1,359 jobs and contributed $168.2 million to the California state GDP. In Texas, imports of Mexican avocados created 1,292 jobs and contributed $159.0 million to that state’s GDP. 5 Table 1: Estimates of State Value of Avocado Imports from Mexico, 2013 State Import value State $ million Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Import value $ million $9,728,544 $6,180,915 $31,809,917 $10,702,422 $139,680,249 $32,662,938 $9,434,614 $3,506,120 $5,833,951 $41,192,032 $22,980,462 $8,631,994 $6,941,804 $30,342,347 $13,032,923 $6,798,158 $6,196,859 $9,217,273 $23,764,014 $2,207,528 $16,880,109 $16,614,181 $17,479,239 $13,143,970 $5,379,276 $11,543,079 Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming $4,817,774 $4,439,924 $15,921,466 $2,661,779 $20,900,379 $9,606,466 $49,614,657 $24,228,539 $2,052,166 $22,231,493 $15,723,203 $23,682,680 $24,722,246 $2,096,444 $9,340,032 $1,893,758 $14,720,559 $136,506,412 $15,552,225 $1,123,018 $23,692,026 $44,782,102 $3,686,569 $11,414,767 $4,579,400 Total $991,875,000 The medium impact category included 25 states (in blue on the map in Figure 2) located primarily in the West and Great Lakes regions with some states from the Northeast and some from southern regions. Florida registered the largest impact of Mexican avocado imports on its economy among the medium impact states with 447 jobs created and $48.4 million contributed to its state GDP. Florida, the state with the third largest impact of Mexican avocado imports, also has a high state GDP and where Hispanic culture heavily influences food consumption choices and cooking styles. New York and Washington were not far behind Florida with 400 jobs created in each state and $56.4 million and $50.1 million, respectively, in GDP created. Rounding out the top ten were Colorado (347 jobs and $38.5 million in value added), Arizona (339 jobs created and $36.4 in value added), Illinois (291 jobs and $36.4 million in value added), North Carolina (259 jobs and $26.3 million in value added), and Oregon (248 jobs created and $26.2 million in value added). The low impact category included 23 states and the District of Colombia (in red on the map in Figure 2) located primarily in the Plains and Northeast regions with a few of the lower population states in the West region and a few from southern regions (along with Alaska and Hawaii). New 6 Table 2: Summary Economic Impact of U.S. Imports of Mexican Avocados by State, 2013 State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Output Total Value Added Total Employment Total Labor Income Total Taxes* $ million $ million No. Jobs $ million $ million $14.88 $8.71 $55.54 $15.92 $252.77 $58.54 $15.04 $5.44 $7.53 $73.73 $40.15 $13.73 $10.89 $53.66 $20.81 $10.65 $9.78 $14.11 $37.55 $3.56 $27.38 $28.34 $29.42 $23.63 $8.02 $19.74 $7.55 $7.23 $25.09 $4.40 $35.14 $14.45 $80.06 $41.11 $2.92 $38.53 $24.93 $40.34 $42.47 $3.37 $14.48 $2.89 $24.66 $236.04 $27.53 $1.70 $39.00 $74.68 $5.19 $19.43 $6.20 $9.41 $5.79 $36.42 $10.54 $168.15 $38.46 $10.80 $3.75 $5.52 $48.43 $26.75 $8.16 $6.54 $36.41 $13.11 $6.71 $6.34 $9.13 $24.17 $2.24 $18.42 $19.28 $19.25 $15.50 $4.99 $12.55 $4.61 $4.52 $16.34 $2.89 $24.52 $8.59 $56.42 $26.31 $1.94 $24.77 $15.88 $26.15 $28.00 $2.23 $9.27 $1.81 $16.12 $159.00 $16.90 $1.05 $26.05 $50.14 $3.25 $12.20 $4.10 94.2 44.9 339.2 92.2 1,358.6 346.7 74.3 29.4 32.3 447.0 235.6 88.1 74.5 291.2 131.7 67.3 59.2 85.5 226.7 23.3 154.0 156.1 175.8 136.1 51.3 124.3 50.9 46.3 151.6 26.7 179.6 98.7 400.1 258.8 16.3 238.3 153.2 247.6 246.7 19.8 93.6 18.0 148.3 1,291.8 181.3 11.3 223.4 400.0 32.7 123.1 35.0 $5.27 $2.79 $21.67 $5.29 $96.38 $24.23 $6.21 $2.19 $3.69 $27.39 $15.45 $4.61 $3.83 $21.40 $7.55 $3.87 $3.65 $4.83 $13.58 $1.27 $10.83 $12.66 $11.09 $9.46 $2.64 $7.65 $2.56 $2.64 $9.48 $1.87 $14.45 $4.86 $32.48 $15.45 $1.05 $14.52 $8.67 $16.08 $16.74 $1.32 $5.16 $0.99 $9.18 $90.94 $10.08 $0.61 $15.29 $27.71 $1.74 $7.32 $2.07 $2.82 $2.47 $9.71 $3.14 $52.37 $9.33 $2.83 $1.01 $1.46 $14.06 $6.84 $2.47 $1.90 $9.61 $3.61 $1.86 $1.60 $2.75 $6.98 $0.74 $5.84 $5.21 $5.18 $4.04 $1.67 $3.07 $1.52 $1.18 $5.04 $0.74 $7.16 $2.75 $18.78 $7.30 $0.58 $6.59 $4.60 $6.68 $8.02 $0.75 $3.03 $0.53 $4.47 $38.41 $4.56 $0.36 $7.57 $15.93 $1.17 $3.40 $1.48 * Federal, state, and local 7 Figure 2 High Impact States Jobs VA* California 1,358.6 $168.2 Texas 1,291.8 $159.0 Medium Impact States Jobs VA* Florida 447.0 $48.4 New York 400.1 $56.4 Washington 400.0 $50.1 Colorado 346.7 $38.5 Arizona 339.2 $36.4 Illinois 291.2 $36.4 N. Carolina 258.8 $26.3 Oregon 247.6 $26.2 Pennsylvania 246.7 $28.0 Ohio 238.3 $24.8 Georgia 235.6 $26.8 Louisiana 226.7 $24.2 Virginia 223.4 $26.1 Utah 181.3 $16.9 New Jersey 179.6 $24.5 Michigan 175.8 $19.3 Massachusetts 156.1 $19.3 Maryland 154.0 $18.4 Oklahoma 153.2 $15.9 Nevada 151.6 $16.3 Tennessee 148.3 $16.1 Minnesota 136.1 $15.5 Indiana 131.7 $13.1 Missouri 124.3 $12.6 Wisconsin 123.1 $12.2 * Value-added in $ millions 8 Low Impact States Jobs New Mexico 98.7 Alabama 94.2 S. Carolina 93.6 Arkansas 92.2 Hawaii 88.1 Kentucky 85.5 Idaho 74.5 Connecticut 74.3 Iowa 67.3 Kansas 59.2 Mississippi 51.3 Montana 50.9 Nebraska 46.3 Alaska 44.9 Wyoming 35.0 West Virginia 32.7 D.C. 32.3 Delaware 29.4 New Hampshire 26.7 Maine 23.3 Rhode Island 19.8 S. Dakota 18.0 N. Dakota 16.3 Vermont 11.3 VA* $8.6 $9.4 $9.3 $10.5 $8.2 $9.1 $6.5 $10.8 $6.7 $6.3 $5.0 $4.6 $4.5 $5.8 $4.1 $3.3 $5.5 $3.8 $2.9 $2.2 $2.2 $1.8 $1.9 $1.1 Mexico, another state whose culture and cuisine is heavily influenced by Hispanic traditions, experienced the largest economic impact from Mexican avocado imports among the low impact category states (99 jobs created and $8.6 million in value added). The contributions to federal, state, and local taxes by Mexican avocado imports followed generally the same pattern as jobs created and value added generated. In California and Texas, the imports generated $52.4 and $38.4 million in federal, state and local taxes (Table 2). In contrast, in the low impact states, the additional federal, state, and local taxes generated ranged from a high of $3.1 million in Arkansas to a low of $360,000 in Vermont. Just one caution about comparing these state-level numbers to the aggregate national numbers generated in the first report. The total impacts of all of the individual states summed up does not equal the aggregate of the U.S. for any of the categories in Tables 2 and 3 (output, employment, labor income, value added, and taxes). The reason is that state-level estimates only capture economic activity that occurs within state boundaries whereas the national-level estimates captures both the impact within states as well as economic activity that crosses state borders, and, thus, will be larger. Implied State-Level Impact Multipliers When the state-by-state benefits of the Mexican avocado imports are expressed on a per dollar of imports basis, the impacts are more even across the states (Table 3). Thus, a high dollar value of impact divided by a high level of import value is not much different in many cases from a low dollar impact value divided by a low dollar value of imports. The ratio of the value of impact to the value of imports for each state provides a measure of the multiplier effect of the imports. For example, the ratio of value added to import value for a given state indicates the value-added generated for every dollar of Mexican avocados imported into the state. The value-added multipliers range from highs of 1.20 in California and 1.18 in Florida and Minnesota to low of 0.88 in West Virginia and 0.89 in New Mexico and Wyoming. The jobs multiplier (jobs generated per $million in imports) ranged from highs of 11.7 in Utah, 10.9 in Florida, and 10.8 in Missouri and Wisconsin to lows of 5.5 in the District of Colombia, 7.3 in Alaska, 7.9 in Connecticut, and 8.0 in North Dakota. Industry by Industry Breakdown of the State-Level Impacts As with the aggregate U.S. analysis, the industry breakdown of the state-level economic impacts of Mexican avocado imports indicates that wholesale/retail and service industries account for much of the contribution of imports of Mexican imports to state-level economic activity as might be expected. (See the appendix for the tables showing the industry breakdown of the impacts for all 9 Table 3: Economic Multipliers of Avocado Imports by State, 2013 State Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Total Output Total Value Added Total Employment Total Labor Income Total Taxes* $output/$imports $VA/$imports jobs added/$million imports $income/$imports % of import value 1.53 1.41 1.75 1.49 1.81 1.79 1.59 1.55 1.29 1.79 1.75 1.59 1.57 1.77 1.60 1.57 1.58 1.53 1.58 1.61 1.62 1.71 1.68 1.80 1.49 1.71 1.57 1.63 1.58 1.65 1.68 1.50 1.61 1.70 1.42 1.73 1.59 1.70 1.72 1.61 1.55 1.52 1.68 1.73 1.77 1.52 1.65 1.67 1.41 1.70 1.35 0.97 0.94 1.15 0.98 1.20 1.18 1.14 1.07 0.95 1.18 1.16 0.95 0.94 1.20 1.01 0.99 1.02 0.99 1.02 1.01 1.09 1.16 1.10 1.18 0.93 1.09 0.96 1.02 1.03 1.09 1.17 0.89 1.14 1.09 0.94 1.11 1.01 1.10 1.13 1.07 0.99 0.96 1.10 1.16 1.09 0.94 1.10 1.12 0.88 1.07 0.89 9.69 7.27 10.66 8.61 9.73 10.61 7.87 8.39 5.54 10.85 10.25 10.21 10.73 9.60 10.11 9.90 9.55 9.27 9.54 10.54 9.12 9.40 10.06 10.35 9.54 10.77 10.56 10.42 9.52 10.02 8.59 10.27 8.06 10.68 7.96 10.72 9.74 10.46 9.98 9.43 10.02 9.51 10.07 9.46 11.66 10.02 9.43 8.93 8.87 10.78 7.65 0.54 0.45 0.68 0.49 0.69 0.74 0.66 0.62 0.63 0.66 0.67 0.53 0.55 0.71 0.58 0.57 0.59 0.52 0.57 0.58 0.64 0.76 0.63 0.72 0.49 0.66 0.53 0.59 0.60 0.70 0.69 0.51 0.65 0.64 0.51 0.65 0.55 0.68 0.68 0.63 0.55 0.52 0.62 0.67 0.65 0.54 0.65 0.62 0.47 0.64 0.45 29.03 40.04 30.53 29.38 37.49 28.57 30.04 28.91 25.07 34.13 29.75 28.56 27.32 31.66 27.71 27.36 25.83 29.89 29.38 33.72 34.62 31.36 29.61 30.77 30.96 26.56 31.65 26.63 31.63 27.77 34.27 28.68 37.85 30.14 28.42 29.66 29.23 28.20 32.45 35.82 32.47 27.77 30.34 28.13 29.32 32.30 31.96 35.57 31.86 29.75 32.33 * Federal, state, and local 10 50 states and the District of Colombia.) The manufacturing industry in most states is also a major beneficiary of state import of Mexican avocados. Transportation and warehousing and a large number of miscellaneous services account for much of the remaining contribution of imports of Mexican avocados to state economies. Conclusions and Implications The primary conclusion from this state-by-state analysis is that imports of avocados from Mexico have a positive and significant effect on economies of many U.S. states. Specifically, this study finds the following: ● California and Texas are the largest beneficiaries from the economic activity generated by imports of Mexican avocados, including 1,359 and 1, 292 jobs created and $168.2 million and 159.0 million in value added generated in the respective states; ● The other top ten beneficiary states in terms of economic activity generated (value-added) by the imports include (in order): New York, Washington, Florida, Colorado, Arizona, Illinois, North Carolina, and Oregon; and ● The economic activity generated by Mexican avocado imports was relatively low in 23 states and the District of Colombia. On a per dollar of imports basis, however, the impacts among states was more even. The value added generated for each dollar of imports of Mexican avocados ranged from highs of $1.20 in California and $1.18 in Florida and Minnesota to low of $0.88 in West Virginia and $0.89 in New Mexico and Wyoming. The jobs generated per million dollars of Mexican avocado imports ranged from highs of 11.7 in Utah, 10.9 in Florida, and 10.8 in Missouri and Wisconsin to lows of 5.5 in the District of Colombia, 7.3 in Alaska, 7.9 in Connecticut, and 8.0 in North Dakota. As with the study of the aggregate, national economic impacts of Mexican avocado imports, the implication of this study of the state-level impacts is straight forward. Imports of Mexican avocados are pro-growth for state economies just as they are for the overall U.S. economy. Some states benefit much more given their larger GDPs and populations and their tendencies towards cuisines that utilize avocados more intensively. As Mexican avocado imports follow their projected steep growth path over the years, the measured benefits to individual state economies will likely grow as well. The cost of any domestic or trade policy that limits imports of avocados from Mexico will be lost jobs and economic growth across individual states as well as the U.S. economy as a whole. 11 References California Avocado Commission (CAC). 2014. “Industry Statistical Data.” Available on-line at:http://www.californiaavocadogrowers.com/selling/industry-statisticalHass Avocado Board (HAB). 2014. “Regional Composite Data.” Data for years 2009-2012. Available online at: http://www.hassavocadoboard.com/retail/market-composite-data IMPLAN Group, LLC., 2013. “What is IMPLAN?” Huntersville, North Carolina. Available online at: http://implan.com/index.php?option=com_multicategories&view=article&id =282:what-is-implan&Itemid=71 U.S. Department of Agriculture (USDA). 2014. “Global Agricultural Trade System (GATS).” Foreign Agriculture Service, Washington, D.C. Available on-line at: http://apps.fas.usda.gov/gats/default.aspx 12 APPENDIX State by State Industry Breakdown of the Economic Benefits of Mexican Avocado Imports 13 Alabama Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $10,432,800 $239,621 $342,412 $3,652,271 Value-added $6,708,794 $51,204 $234,258 $2,305,277 Employment (no. of jobs) 56.3 0.7 3.0 33.7 Labor Income $3,758,490 $33,943 $132,779 $1,304,264 Taxes* $1,568,305 $1,039 $3,279 $126,201 $224,872 $3,427,400 $120,992 $2,184,285 4.1 29.6 $80,481 $1,223,783 $16,527 $109,674 $10,676 $198,937 $14,876,717 $4,076 $110,416 $9,414,026 0.1 0.5 94.2 $2,471 $42,767 $5,274,713 $5 $19,512 $1,718,340 ** Services (Total) and Total may not add due to rounding Alaska Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $6,467,489 $140,569 $158,397 $1,776,709 Value-added $4,472,241 $37,401 -$1,853 $1,166,148 Employment (no. of jobs) 29.9 0.2 1.7 12.9 Labor Income $1,948,864 $9,555 $148,036 $647,232 Taxes* $1,828,359 $639 $3,474 $48,941 $100,337 $1,676,372 $60,732 $1,105,416 1.5 11.4 $44,741 $602,491 $2,069 $46,872 $1,261 $165,696 $8,710,120 $539 $117,783 $5,792,258 0.0 0.3 44.9 $606 $31,055 $2,785,349 $156 $33,586 $1,915,154 ** Services (Total) and Total may not add due to rounding Arizona Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $35,118,065 $643,505 $1,379,827 $17,587,496 Value-added $23,546,096 $165,681 $821,264 $11,412,151 Employment (no. of jobs) 179.3 2.0 13.7 142.1 Labor Income $14,190,127 $100,425 $643,429 $6,561,609 Taxes* $4,593,963 $3,819 $58,092 $548,421 $974,568 $16,612,928 $563,734 $10,848,417 16.1 126.0 $396,146 $6,165,463 $54,816 $493,605 $57,370 $749,274 $55,535,536 $27,711 $450,186 $36,423,089 0.4 1.8 339.2 $17,457 $161,506 $21,674,553 $72 $80,757 $5,285,124 ** Services (Total) and Total may not add due to rounding Arkansas Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $11,467,736 $228,177 $353,188 $3,639,579 Value-added $7,828,890 $50,960 $239,271 $2,296,257 Employment (no. of jobs) 55.2 0.7 3.1 32.5 Labor Income $3,807,706 $34,000 $139,007 $1,264,796 Taxes* $1,762,718 $1,429 $5,090 $123,193 $212,485 $3,427,095 $112,350 $2,183,907 3.9 28.6 $73,864 $1,190,933 $15,684 $107,509 $15,440 $214,515 $15,918,636 $5,316 $115,271 $10,535,965 0.1 0.6 92.2 $3,691 $41,369 $5,290,571 $39 $21,871 $1,914,340 ** Services (Total) and Total may not add due to rounding California Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $153,663,510 $11,934,334 $6,748,212 $76,914,485 Value-added $105,681,657 $3,389,631 $4,341,693 $52,823,659 Employment (no. of jobs) 734.2 21.7 58.6 533.4 Labor Income $58,744,784 $1,616,495 $3,336,525 $31,746,131 Taxes* $26,498,121 $115,816 $186,281 $2,287,748 $3,850,835 $73,063,650 $2,310,665 $50,512,994 60.1 473.3 $1,590,063 $30,156,068 $265,755 $2,021,993 $602,920 $2,907,979 $252,771,441 $272,787 $1,645,382 $168,154,809 3.1 7.7 1,358.6 $200,535 $733,704 $96,378,174 -$3,095 $274,744 $29,359,615 ** Services (Total) and Total may not add due to rounding Colorado Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $36,066,634 $964,150 $1,341,116 $19,307,347 Value-added $24,199,742 $258,342 $789,057 $12,730,889 Employment (no. of jobs) 183.9 2.6 12.9 144.6 Labor Income $15,453,941 $154,634 $658,566 $7,745,118 Taxes* $3,435,934 $15,320 $49,547 $547,446 $1,035,267 $18,272,080 $599,736 $12,131,153 17.0 127.6 $421,949 $7,323,168 $62,910 $484,536 $96,587 $761,436 $58,537,271 $39,936 $440,807 $38,458,773 0.6 2.0 346.7 $24,724 $188,353 $24,225,335 -$487 $58,681 $4,106,441 ** Services (Total) and Total may not add due to rounding Connecticutt Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $10,187,927 $103,134 $296,792 $4,279,211 Value-added $7,399,482 $35,071 $206,936 $3,048,873 Employment (no. of jobs) 43.2 0.3 2.7 27.7 Labor Income $4,221,884 $24,272 $132,558 $1,783,571 Taxes* $950,841 $1,967 $5,355 $176,749 $200,550 $4,078,661 $119,308 $2,929,565 3.2 24.5 $84,939 $1,698,632 $10,847 $165,902 $2,749 $173,642 $15,043,455 $1,426 $107,521 $10,799,309 0.1 0.4 74.3 $950 $42,025 $6,205,259 -$12 $16,934 $1,151,834 ** Services (Total) and Total may not add due to rounding Delaware Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $3,733,165 $87,093 $108,086 $1,458,273 Value-added $2,623,245 $16,256 $75,071 $1,008,484 Employment (no. of jobs) 17.3 0.1 1.0 10.9 Labor Income $1,577,893 $5,301 $50,155 $542,915 Taxes* $453,970 $390 $674 $54,205 $84,761 $1,373,512 $47,081 $961,404 1.5 9.4 $33,233 $509,682 $5,252 $48,952 $2,575 $52,028 $5,441,220 $954 $29,325 $3,753,334 0.0 0.2 29.4 $599 $13,122 $2,189,985 -$9 $3,267 $512,498 ** Services (Total) and Total may not add due to rounding District of Columbia Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $5,944,765 $3,335 $39,307 $1,490,090 Value-added $4,369,262 $1,098 $3,820 $1,109,812 Employment (no. of jobs) 23.0 0.0 0.5 8.8 Labor Income $2,881,147 $592 $29,812 $772,512 Taxes* $822,922 $129 -$1,166 $38,164 $67,475 $1,422,615 $44,907 $1,064,905 0.9 7.9 $32,384 $740,128 $5,755 $32,409 $0 $54,652 $7,532,150 $0 $39,079 $5,523,070 0.0 0.1 32.3 $0 $7,266 $3,691,327 $0 $6,847 $866,896 ** Services (Total) and Total may not add due to rounding Florida Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $45,435,776 $1,169,534 $1,901,980 $24,102,178 Value-added $30,770,339 $308,965 $1,084,449 $15,566,155 Employment (no. of jobs) 227.3 3.4 20.1 192.8 Labor Income $16,939,931 $189,628 $878,213 $9,184,884 Taxes* $6,860,059 $18,070 $62,209 $1,130,655 $1,212,213 $22,889,964 $714,046 $14,852,109 19.5 173.3 $490,651 $8,694,232 $91,944 $1,038,711 $91,306 $1,031,837 $73,732,610 $49,688 $650,608 $48,430,204 0.8 2.7 447.0 $28,643 $171,085 $27,392,385 $542 $170,838 $8,242,373 ** Services (Total) and Total may not add due to rounding Georgia Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $25,247,926 $797,631 $1,090,525 $12,413,326 Value-added $17,265,190 $239,219 $732,859 $8,210,200 Employment (no. of jobs) 124.4 2.1 8.5 98.8 Labor Income $9,963,963 $132,391 $467,025 $4,757,899 Taxes* $3,021,462 $5,785 $29,670 $384,566 $668,564 $11,744,762 $378,236 $7,831,964 11.3 87.5 $259,285 $4,498,614 $46,362 $338,204 $49,122 $556,452 $40,154,982 $20,062 $284,003 $26,751,533 0.3 1.5 235.6 $17,885 $110,502 $15,449,665 $481 $57,494 $3,499,458 ** Services (Total) and Total may not add due to rounding Hawaii Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $9,257,630 $326,411 $230,775 $3,707,013 Value-added $5,451,689 $54,790 $107,135 $2,417,166 Employment (no. of jobs) 56.1 0.5 2.2 28.8 Labor Income $3,052,918 $24,698 $132,310 $1,359,223 Taxes* $1,396,587 $1,619 $9,397 $146,066 $200,068 $3,506,944 $120,069 $2,297,097 3.1 25.7 $91,917 $1,267,306 $5,705 $140,361 $11,729 $197,706 $13,731,264 $5,373 $122,209 $8,158,362 0.2 0.4 88.1 $5,113 $40,061 $4,614,323 -$120 $17,853 $1,571,404 ** Services (Total) and Total may not add due to rounding Idaho Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $7,501,693 $134,190 $194,586 $2,901,182 Value-added $4,587,749 $27,056 $89,266 $1,748,796 Employment (no. of jobs) 43.9 0.5 2.6 27.1 Labor Income $2,668,215 $20,766 $105,475 $994,883 Taxes* $975,959 $764 $3,320 $87,896 $161,038 $2,740,144 $82,984 $1,665,812 3.1 24.0 $57,477 $937,406 $8,020 $79,876 $19,295 $137,595 $10,888,541 $8,697 $74,709 $6,536,273 0.1 0.4 74.5 $6,399 $30,444 $3,826,183 -$28 $8,520 $1,076,432 ** Services (Total) and Total may not add due to rounding Illinois Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $33,237,750 $1,526,655 $1,422,131 $16,790,619 Value-added $23,182,470 $389,758 $922,958 $11,512,047 Employment (no. of jobs) 155.8 3.1 11.8 119.1 Labor Income $13,617,159 $245,966 $626,208 $6,762,960 Taxes* $3,806,697 $10,402 $39,131 $687,388 $846,257 $15,944,362 $502,647 $11,009,400 13.4 105.7 $335,190 $6,427,770 $77,529 $609,859 $39,132 $645,675 $53,661,962 $16,839 $387,980 $36,412,052 0.2 1.2 291.2 $13,679 $133,574 $21,399,546 -$179 $97,877 $4,641,316 ** Services (Total) and Total may not add due to rounding Indiana Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $14,040,360 $522,657 $560,385 $5,406,937 Value-added $8,926,029 $150,675 $365,489 $3,511,267 Employment (no. of jobs) 77.8 1.2 5.3 46.6 Labor Income $5,241,336 $77,201 $226,726 $1,938,641 Taxes* $1,678,179 $2,809 $8,485 $228,914 $338,023 $5,068,914 $176,027 $3,335,241 6.3 40.3 $121,649 $1,816,992 $23,178 $205,736 $19,003 $258,882 $20,808,225 $8,067 $145,652 $13,107,180 0.1 0.7 131.7 $5,227 $58,684 $7,547,815 -$103 $23,181 $1,941,465 ** Services (Total) and Total may not add due to rounding Iowa Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $7,347,147 $168,734 $249,751 $2,744,613 Value-added $4,692,601 $44,052 $161,620 $1,733,571 Employment (no. of jobs) 40.5 0.5 2.5 23.4 Labor Income $2,755,537 $27,948 $109,882 $943,928 Taxes* $870,499 $871 $3,311 $114,649 $144,146 $2,600,467 $71,644 $1,661,927 2.8 20.6 $49,642 $894,285 $7,655 $106,994 $17,394 $127,196 $10,654,834 $6,716 $73,119 $6,711,679 0.1 0.3 67.3 $4,531 $27,918 $3,869,744 -$63 $10,431 $999,697 ** Services (Total) and Total may not add due to rounding Kansas Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $6,703,756 $145,709 $244,405 $2,550,644 Value-added $4,432,325 $38,811 $166,578 $1,626,836 Employment (no. of jobs) 34.7 0.5 2.2 21.5 Labor Income $2,569,000 $26,148 $104,591 $917,305 Taxes* $664,462 $1,121 $4,474 $95,651 $152,891 $2,397,753 $84,025 $1,542,811 2.7 18.8 $56,452 $860,853 $10,033 $85,618 $11,819 $125,164 $9,781,497 $3,711 $67,144 $6,335,405 0.1 0.3 59.2 $3,219 $25,520 $3,645,783 -$76 $11,314 $776,947 ** Services (Total) and Total may not add due to rounding Kentucky Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $9,862,605 $313,150 $376,233 $3,383,491 Value-added $6,568,133 $81,616 $261,140 $2,125,612 Employment (no. of jobs) 50.2 0.7 3.3 30.6 Labor Income $3,338,544 $41,159 $177,095 $1,236,472 Taxes* $1,529,631 $7,141 $3,520 $123,658 $209,677 $3,173,814 $113,799 $2,011,813 3.7 26.9 $77,556 $1,158,916 $13,778 $109,879 $11,723 $166,384 $14,113,586 $4,583 $92,156 $9,133,240 0.2 0.5 85.5 $2,963 $32,294 $4,828,528 -$74 $11,956 $1,675,832 ** Services (Total) and Total may not add due to rounding Louisiana Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $25,626,058 $1,003,608 $1,008,594 $9,299,394 Value-added $16,933,342 $297,687 $697,517 $5,843,889 Employment (no. of jobs) 132.1 1.3 7.9 83.8 Labor Income $9,504,576 $76,454 $424,115 $3,449,084 Taxes* $3,942,873 $3,407 $16,385 $339,168 $579,600 $8,719,794 $320,895 $5,522,994 10.1 73.7 $225,489 $3,223,595 $33,031 $306,137 $32,518 $582,900 $37,553,072 $13,908 $378,880 $24,165,223 0.3 1.4 226.7 $9,673 $113,663 $13,577,564 $333 $34,222 $4,336,387 ** Services (Total) and Total may not add due to rounding Maine Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $2,395,279 $38,719 $74,119 $1,003,354 Value-added $1,531,442 $9,058 $38,200 $632,303 Employment (no. of jobs) 13.2 0.1 1.0 8.8 Labor Income $843,016 $6,330 $44,898 $367,775 Taxes* $419,940 $979 $1,596 $42,468 $56,498 $946,855 $31,845 $600,457 1.0 7.8 $21,902 $345,873 $4,139 $38,329 $2,842 $42,504 $3,556,817 $1,414 $25,274 $2,237,690 0.0 0.1 23.3 $1,089 $7,964 $1,271,073 -$14 $3,429 $468,397 ** Services (Total) and Total may not add due to rounding Maryland Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $18,163,373 $328,002 $691,342 $7,826,151 Value-added $12,406,888 $80,371 $455,947 $5,244,365 Employment (no. of jobs) 88.0 0.8 6.5 57.8 Labor Income $7,216,229 $53,427 $324,336 $3,151,640 Taxes* $2,886,279 $3,427 $13,950 $263,002 $398,510 $7,427,641 $236,217 $5,008,148 6.4 51.4 $161,064 $2,990,576 $29,792 $233,210 $13,743 $352,572 $27,375,182 $5,962 $224,694 $18,418,227 0.1 0.8 154.0 $3,888 $82,390 $10,831,909 $130 $35,498 $3,202,287 ** Services (Total) and Total may not add due to rounding Massachusetts Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $18,085,220 $412,223 $490,228 $9,017,393 Value-added $12,472,590 $121,509 $257,792 $6,235,582 Employment (no. of jobs) 86.8 1.2 5.9 61.3 Labor Income $8,289,224 $87,543 $316,487 $3,882,942 Taxes* $1,860,462 $3,099 $11,663 $280,819 $474,552 $8,542,841 $281,869 $5,953,713 7.5 53.8 $201,226 $3,681,716 $31,564 $249,255 $6,782 $326,286 $28,338,132 $3,707 $186,534 $19,277,714 0.1 0.8 156.1 $2,214 $80,026 $12,658,436 $30 $13,322 $2,169,395 ** Services (Total) and Total may not add due to rounding Michigan Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $19,008,337 $658,580 $699,355 $8,577,116 Value-added $12,830,875 $145,348 $448,000 $5,568,292 Employment (no. of jobs) 95.5 1.5 6.1 71.3 Labor Income $7,337,529 $95,970 $314,417 $3,226,016 Taxes* $2,249,402 $4,422 $17,673 $351,071 $450,976 $8,126,140 $236,181 $5,332,111 8.4 62.9 $163,876 $3,062,141 $29,358 $321,713 $35,075 $439,536 $29,417,999 $16,360 $237,514 $19,246,388 0.3 1.2 175.8 $15,222 $98,555 $11,087,709 $107 $42,013 $2,664,688 ** Services (Total) and Total may not add due to rounding Minnesota Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $14,463,215 $833,774 $562,926 $7,385,336 Value-added $9,763,581 $221,345 $358,960 $4,963,118 Employment (no. of jobs) 73.3 1.9 4.7 55.2 Labor Income $6,227,566 $125,882 $228,681 $2,787,511 Taxes* $1,448,256 $4,070 $14,511 $300,258 $360,670 $7,024,666 $199,604 $4,763,514 6.3 48.9 $129,412 $2,658,100 $35,869 $264,389 $49,277 $334,849 $23,629,377 $20,327 $177,085 $15,504,417 0.2 0.9 136.1 $14,762 $76,634 $9,461,036 -$227 $26,422 $1,793,289 ** Services (Total) and Total may not add due to rounding Mississippi Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $5,737,011 $142,201 $203,144 $1,814,715 Value-added $3,629,429 $31,287 $134,019 $1,126,767 Employment (no. of jobs) 31.6 0.3 1.9 17.1 Labor Income $1,911,684 $15,489 $80,897 $611,800 Taxes* $1,009,854 $749 $3,289 $81,774 $116,234 $1,698,481 $61,245 $1,065,522 2.2 14.9 $41,686 $570,114 $7,917 $73,857 $9,651 $110,442 $8,017,164 $3,817 $61,351 $4,986,669 0.1 0.3 51.3 $2,859 $21,954 $2,644,683 $43 $7,767 $1,103,476 ** Services (Total) and Total may not add due to rounding Missouri Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $12,619,160 $354,305 $493,830 $5,972,697 Value-added $8,145,716 $96,908 $311,698 $3,846,111 Employment (no. of jobs) 68.7 1.0 4.8 48.8 Labor Income $4,952,259 $57,767 $218,826 $2,352,730 Taxes* $1,217,076 $5,352 $11,174 $201,358 $323,242 $5,649,455 $170,755 $3,675,357 6.0 42.8 $123,926 $2,228,804 $15,039 $186,319 $19,767 $276,933 $19,736,692 $7,378 $147,163 $12,554,975 0.2 0.8 124.3 $5,659 $61,021 $7,648,262 -$71 $20,813 $1,455,702 ** Services (Total) and Total may not add due to rounding Montana Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $5,211,624 $73,383 $179,856 $1,957,557 Value-added $3,252,876 $11,515 $109,504 $1,175,716 Employment (no. of jobs) 29.6 0.2 1.7 18.9 Labor Income $1,777,494 $9,237 $74,237 $666,017 Taxes* $865,801 $653 $4,697 $61,703 $121,963 $1,835,594 $62,009 $1,113,707 2.3 16.6 $46,309 $619,708 $2,009 $59,694 $8,456 $116,469 $7,547,345 $3,832 $59,513 $4,612,955 0.1 0.3 50.9 $2,246 $27,014 $2,556,245 $4 $9,832 $942,691 ** Services (Total) and Total may not add due to rounding Nebraska Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $4,826,778 $93,167 $167,751 $2,077,510 Value-added $3,049,484 $22,584 $108,705 $1,305,530 Employment (no. of jobs) 27.0 0.3 1.6 17.1 Labor Income $1,770,417 $16,434 $72,475 $758,733 Taxes* $540,655 $437 $2,676 $64,306 $105,288 $1,972,221 $54,090 $1,251,440 2.0 15.1 $36,686 $722,047 $6,498 $57,809 $13,083 $50,595 $7,228,883 $4,409 $27,672 $4,518,384 0.0 0.2 46.3 $3,727 $15,142 $2,636,928 -$85 $2,331 $610,320 ** Services (Total) and Total may not add due to rounding Nevada Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $17,222,949 $173,804 $578,154 $6,832,670 Value-added $11,284,348 $50,079 $253,037 $4,589,098 Employment (no. of jobs) 90.0 0.7 6.9 53.5 Labor Income $6,512,994 $35,761 $371,256 $2,493,866 Taxes* $2,865,112 $1,212 $23,290 $281,216 $417,994 $6,414,676 $268,146 $4,320,952 5.9 47.6 $194,128 $2,299,738 $36,133 $245,083 $7,435 $278,690 $25,093,702 $3,490 $163,303 $16,343,355 0.0 0.7 151.6 $2,012 $60,810 $9,476,698 -$55 $22,924 $3,193,698 ** Services (Total) and Total may not add due to rounding New Hampshire Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $2,921,385 $40,930 $65,954 $1,311,119 Value-added $1,940,076 $11,423 $25,833 $876,940 Employment (no. of jobs) 15.4 0.1 1.0 10.0 Labor Income $1,313,790 $8,117 $43,971 $493,966 Taxes* $265,417 $779 $1,555 $54,969 $74,939 $1,236,180 $41,978 $834,962 1.3 8.7 $31,310 $462,656 $2,591 $52,378 $1,125 $59,630 $4,400,143 $535 $35,472 $2,890,278 0.0 0.2 26.7 $545 $13,345 $1,873,733 -$1 $6,001 $328,720 ** Services (Total) and Total may not add due to rounding New Jersey Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $22,762,415 $709,420 $876,585 $10,372,014 Value-added $16,251,983 $151,524 $615,912 $7,238,678 Employment (no. of jobs) 100.5 1.2 6.7 70.2 Labor Income $9,608,173 $106,442 $365,965 $4,266,928 Taxes* $3,012,801 $6,872 $21,658 $431,911 $426,266 $9,945,748 $244,049 $6,994,629 7.1 63.1 $184,091 $4,082,837 $10,168 $421,743 $8,817 $412,637 $35,141,887 $5,396 $261,014 $24,524,507 0.1 0.9 179.6 $2,916 $101,087 $14,451,510 $77 $46,002 $3,519,322 ** Services (Total) and Total may not add due to rounding New Mexico Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $10,259,197 $104,018 $318,760 $3,578,024 Value-added $6,053,472 $18,481 $187,679 $2,237,059 Employment (no. of jobs) 62.5 0.4 3.4 31.8 Labor Income $3,394,064 $14,187 $160,927 $1,245,289 Taxes* $1,583,559 $434 $6,764 $151,655 $229,630 $3,348,394 $126,945 $2,110,114 4.0 27.8 $89,762 $1,155,527 $11,953 $139,703 $11,780 $178,667 $14,450,446 $5,709 $91,112 $8,593,512 0.1 0.5 98.7 $8,377 $36,870 $4,859,713 -$78 $13,053 $1,755,388 ** Services (Total) and Total may not add due to rounding New York Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $53,472,904 $1,087,720 $1,442,513 $23,019,564 Value-added $38,066,010 $340,695 $837,705 $16,566,256 Employment (no. of jobs) 234.5 2.7 15.0 145.3 Labor Income $21,142,820 $185,484 $771,688 $10,119,439 Taxes* $9,158,467 $52,503 $37,555 $880,789 $1,110,887 $21,908,677 $704,507 $15,861,748 15.9 129.4 $463,395 $9,656,044 $115,054 $765,735 $52,765 $984,932 $80,060,398 $24,832 $587,274 $56,422,771 0.5 2.2 400.1 $23,041 $235,251 $32,477,723 -$76 $110,306 $10,239,545 ** Services (Total) and Total may not add due to rounding North Carolina Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $26,442,878 $970,784 $1,073,788 $12,043,886 Value-added $17,060,312 $337,880 $674,442 $7,908,716 Employment (no. of jobs) 143.8 2.5 10.5 100.2 Labor Income $10,317,079 $143,439 $464,346 $4,410,032 Taxes* $3,359,660 $35,783 $26,992 $431,523 $674,152 $11,369,735 $359,341 $7,549,376 12.3 87.9 $256,749 $4,153,283 $32,914 $398,608 $57,653 $516,715 $41,105,705 $25,650 $305,301 $26,312,301 0.4 1.4 258.8 $17,560 $101,722 $15,454,178 $80 $54,601 $3,908,639 ** Services (Total) and Total may not add due to rounding North Dakota Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $2,202,782 $19,193 $50,526 $613,911 Value-added $1,497,237 $4,374 $34,793 $385,495 Employment (no. of jobs) 10.7 0.1 0.4 5.1 Labor Income $819,139 $3,170 $18,810 $203,998 Taxes* $324,069 $59 $697 $19,892 $38,622 $575,289 $20,331 $365,165 0.7 4.4 $13,757 $190,241 $2,458 $17,435 $2,926 $33,006 $2,922,343 $1,180 $15,968 $1,939,047 0.0 0.1 16.3 $1,292 $7,930 $1,054,339 -$21 $1,496 $346,193 ** Services (Total) and Total may not add due to rounding Ohio Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $24,375,472 $984,654 $1,058,420 $11,563,009 Value-added $16,011,276 $258,783 $697,808 $7,504,687 Employment (no. of jobs) 128.9 2.4 9.4 96.0 Labor Income $9,396,360 $148,908 $440,555 $4,412,974 Taxes* $2,876,187 $9,406 $20,680 $418,244 $634,584 $10,928,425 $337,088 $7,167,599 11.6 84.3 $236,728 $4,176,245 $31,194 $387,051 $33,299 $511,771 $38,526,625 $14,512 $283,537 $24,770,603 0.3 1.4 238.3 $11,899 $110,343 $14,521,039 -$169 $52,252 $3,376,600 ** Services (Total) and Total may not add due to rounding Oklahoma Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $16,970,003 $379,527 $593,540 $6,591,290 Value-added $11,049,890 $90,120 $413,363 $4,130,236 Employment (no. of jobs) 89.5 0.9 4.2 57.4 Labor Income $5,912,708 $50,576 $202,541 $2,417,718 Taxes* $2,465,079 $1,760 $8,086 $212,577 $380,680 $6,210,610 $209,013 $3,921,223 6.7 50.7 $144,979 $2,272,739 $17,696 $194,881 $18,470 $380,547 $24,933,377 $7,469 $191,865 $15,882,943 0.2 1.0 153.2 $5,244 $86,144 $8,674,931 -$48 $20,025 $2,707,479 ** Services (Total) and Total may not add due to rounding Oregon Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $25,932,149 $864,487 $1,069,057 $11,945,290 Value-added $17,281,018 $214,448 $675,841 $7,696,465 Employment (no. of jobs) 134.3 2.7 9.5 98.9 Labor Income $10,894,412 $144,807 $461,194 $4,445,623 Taxes* $2,407,683 $8,355 $34,253 $303,515 $665,854 $11,279,436 $363,582 $7,332,883 11.8 87.0 $273,928 $4,171,695 $10,493 $293,022 $70,721 $461,216 $40,342,920 $33,640 $250,247 $26,151,658 0.9 1.4 247.6 $21,359 $108,817 $16,076,212 $272 $32,314 $2,786,392 ** Services (Total) and Total may not add due to rounding Pennsylvania Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $26,931,454 $1,132,085 $1,077,931 $12,671,763 Value-added $18,192,981 $264,817 $669,864 $8,478,735 Employment (no. of jobs) 135.6 2.4 10.9 95.9 Labor Income $10,820,170 $156,146 $532,480 $5,077,518 Taxes* $3,492,714 $4,767 $16,528 $522,060 $618,993 $12,052,770 $336,399 $8,142,337 11.0 84.9 $242,467 $4,835,051 $29,992 $492,068 $39,224 $617,379 $42,469,836 $17,136 $379,224 $28,002,756 0.4 1.5 246.7 $13,607 $137,500 $16,737,420 -$88 $56,955 $4,092,937 ** Services (Total) and Total may not add due to rounding Rhode Island Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $2,266,169 $17,924 $54,749 $999,357 Value-added $1,520,457 $4,819 $27,578 $678,439 Employment (no. of jobs) 11.3 0.1 0.8 7.5 Labor Income $894,813 $4,197 $38,101 $378,979 Taxes* $390,680 $200 $1,627 $43,210 $57,268 $942,090 $32,535 $645,904 1.0 6.5 $22,520 $356,459 $4,661 $38,550 $306 $34,380 $3,372,885 $168 $3,013 $2,234,474 0.0 0.1 19.8 $78 $7,399 $1,323,567 -$1 $3,694 $439,410 ** Services (Total) and Total may not add due to rounding South Carolina Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $10,070,862 $208,058 $340,144 $3,655,629 Value-added $6,621,055 $51,359 $205,551 $2,284,523 Employment (no. of jobs) 52.8 0.6 3.8 35.8 Labor Income $3,561,620 $33,312 $166,458 $1,352,164 Taxes* $1,794,233 $1,723 $5,123 $139,420 $237,213 $3,418,417 $128,143 $2,156,380 4.3 31.5 $89,987 $1,262,177 $13,592 $125,828 $11,331 $189,185 $14,475,210 $5,060 $105,409 $9,272,957 0.1 0.5 93.6 $2,631 $39,003 $5,155,187 $151 $17,171 $1,957,821 ** Services (Total) and Total may not add due to rounding South Dakota Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $2,048,692 $35,032 $52,682 $708,358 Value-added $1,320,829 $8,788 $30,063 $433,845 Employment (no. of jobs) 11.0 0.2 0.6 6.2 Labor Income $711,595 $8,764 $23,972 $235,690 Taxes* $291,883 $248 $675 $26,771 $40,510 $667,848 $19,971 $413,874 0.8 5.4 $13,887 $221,803 $2,169 $24,602 $4,070 $37,224 $2,886,058 $1,485 $19,245 $1,814,254 0.0 0.1 18.0 $1,685 $7,517 $989,223 -$3 $3,084 $322,659 ** Services (Total) and Total may not add due to rounding Tennessee Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $16,067,611 $505,147 $660,549 $7,235,472 Value-added $10,674,339 $138,880 $451,431 $4,757,163 Employment (no. of jobs) 82.9 1.3 5.5 57.7 Labor Income $5,926,565 $74,486 $311,528 $2,818,235 Taxes* $2,296,548 $4,251 $11,316 $295,264 $407,473 $6,827,999 $229,221 $4,527,943 7.0 50.7 $154,065 $2,664,169 $30,693 $264,571 $17,166 $172,276 $24,658,221 $6,852 $90,425 $16,119,090 0.3 0.7 148.3 $3,358 $42,472 $9,176,644 -$28 $10,379 $2,617,730 ** Services (Total) and Total may not add due to rounding Texas Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $149,599,187 $8,241,987 $6,249,243 $67,417,324 Value-added $105,375,705 $2,167,263 $4,238,837 $44,419,738 Employment (no. of jobs) 688.5 14.8 45.8 529.3 Labor Income $60,450,418 $969,596 $2,278,443 $26,036,856 Taxes* $16,665,518 $54,566 $151,702 $2,865,129 $3,739,034 $63,678,290 $2,164,710 $42,255,027 61.5 467.8 $1,420,180 $24,616,676 $328,969 $2,536,160 $353,522 $4,179,181 $236,040,444 $129,231 $2,673,333 $159,004,107 3.6 10.0 1,291.8 $100,110 $1,106,881 $90,942,304 $331 $393,362 $20,130,607 ** Services (Total) and Total may not add due to rounding Utah Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $17,116,756 $770,496 $764,035 $8,513,314 Value-added $10,790,467 $184,131 $461,918 $5,273,066 Employment (no. of jobs) 96.6 2.1 7.5 73.9 Labor Income $6,526,582 $108,677 $371,647 $2,991,509 Taxes* $2,140,807 $3,333 $25,396 $255,094 $431,061 $8,082,252 $230,960 $5,042,105 7.8 66.0 $163,445 $2,828,064 $23,282 $231,812 $30,216 $332,209 $27,527,027 $13,444 $175,212 $16,898,236 0.3 1.0 181.4 $4,811 $81,433 $10,084,659 -$53 $28,764 $2,453,342 ** Services (Total) and Total may not add due to rounding Vermont Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $1,198,162 $14,777 $29,192 $436,641 Value-added $749,746 $3,006 $14,130 $273,487 Employment (no. of jobs) 6.7 0.1 0.4 4.0 Labor Income $428,912 $2,546 $19,001 $153,807 Taxes* $206,100 $119 $514 $19,800 $25,343 $411,298 $13,981 $259,506 0.4 3.5 $10,216 $143,591 $1,347 $18,452 $1,565 $23,163 $1,703,499 $716 $12,076 $1,053,161 0.0 0.1 11.3 $1,008 $5,446 $610,719 -$5 $2,236 $228,763 ** Services (Total) and Total may not add due to rounding Virginia Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $25,549,422 $553,460 $987,331 $11,409,411 Value-added $17,154,733 $189,713 $655,912 $7,751,822 Employment (no. of jobs) 128.9 1.5 8.9 82.5 Labor Income $10,207,527 $84,537 $401,754 $4,492,229 Taxes* $3,530,691 $26,768 $28,226 $382,931 $577,236 $10,832,175 $322,625 $7,429,197 10.0 72.6 $228,908 $4,263,322 $32,381 $350,550 $25,794 $475,593 $39,001,011 $11,621 $285,370 $26,049,170 0.3 1.3 223.4 $6,249 $102,146 $15,294,442 $401 $50,777 $4,019,795 ** Services (Total) and Total may not add due to rounding Washington Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $48,932,962 $2,367,503 $1,863,358 $20,760,374 Value-added $33,882,108 $641,307 $1,226,339 $13,945,301 Employment (no. of jobs) 229.0 4.1 15.1 148.9 Labor Income $18,507,127 $258,769 $840,962 $7,919,684 Taxes* $8,880,939 $14,847 $67,493 $996,785 $1,132,371 $19,628,004 $700,157 $13,245,144 16.9 132.0 $439,790 $7,479,894 $120,897 $875,888 $106,646 $645,949 $74,676,793 $50,065 $393,450 $50,138,571 0.9 1.9 400.0 $45,020 $142,670 $27,714,232 -$110 $92,401 $10,052,357 ** Services (Total) and Total may not add due to rounding West Virginia Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $3,906,650 $34,602 $99,844 $1,090,966 Value-added $2,465,358 $7,212 $65,343 $682,835 Employment (no. of jobs) 21.5 0.1 0.9 10.0 Labor Income $1,283,696 $5,163 $40,724 $394,575 Taxes* $719,989 $112 $1,289 $38,180 $70,514 $1,020,452 $36,847 $645,988 1.3 8.6 $25,434 $369,141 $4,813 $33,367 $1,448 $60,858 $5,194,369 $625 $32,358 $3,253,730 0.1 0.2 32.7 $371 $12,645 $1,737,175 -$4 $5,631 $765,196 ** Services (Total) and Total may not add due to rounding Wisconsin Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $12,452,558 $577,217 $454,032 $5,642,246 Value-added $7,943,641 $162,938 $283,380 $3,635,770 Employment (no. of jobs) 69.2 1.8 4.6 46.6 Labor Income $4,858,006 $115,053 $220,537 $2,052,592 Taxes* $1,456,428 $3,251 $7,545 $234,155 $303,183 $5,339,064 $154,903 $3,480,868 5.8 40.8 $107,408 $1,945,185 $16,171 $217,984 $35,458 $270,111 $19,431,621 $15,966 $162,761 $12,204,457 0.3 0.7 123.1 $14,763 $60,507 $7,321,458 -$156 $23,787 $1,725,009 ** Services (Total) and Total may not add due to rounding Wyoming Industry Wholesale/Retail Manufacturing Transportation & Warehousing Services** - Food & accommodation - Other Agriculture Other Total** * Indirect Business Taxes Output $4,845,607 $29,456 $125,398 $1,127,227 Value-added $3,262,991 $4,489 $81,598 $702,497 Employment (no. of jobs) 23.5 0.1 1.1 10.1 Labor Income $1,626,351 $3,454 $53,401 $369,194 Taxes* $952,593 $234 $2,721 $42,289 $77,082 $1,050,145 $41,615 $660,881 1.4 8.7 $29,748 $339,446 $3,521 $38,768 $1,989 $74,242 $6,203,919 $1,085 $42,456 $4,095,116 0.0 0.2 35.0 $661 $15,877 $2,068,937 $97 $7,368 $1,005,302 ** Services (Total) and Total may not add due to rounding