2016 OPPS Proposed Rule Summary

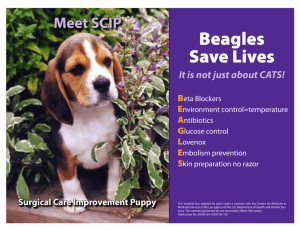

advertisement