Forestry & Forest Products Industry

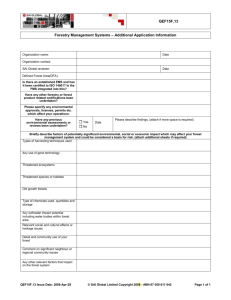

advertisement