Principles of Expenditure Analysis

advertisement

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

I. Government Expenditures

Most taxation and government borrowing is motivated by desires for

services of one kind or another, from missiles to medicine, from social

insurance to bicycle trails.

A king or prince raises taxes to fund a palace or army.

A democratic community wants roads, police protection, and safe water

supplies.

A sudden collective emergency may have to addressed with new social

services and social insurance (bailouts). A tornado may pass through

town, an invading army may be on its way, or the Olympics may be

hosted.

There are a few exceptions to this general rule.

Voters may want to discourage certain activities and impose "sin" taxes

on those activities to discourage them. Here the purpose is not taxation

to fund services, but taxation to change behavior.

Interest groups may want particular activities subsidized from public

funds, because they expect to profit by producing, rather than

consuming, the government services.

We’ll take such cases up after the midterm..

For the most part, it can be argued that if you want to understand tax

policies you have to understand the demand for government services

(and transfers).

The demand for most government services is for the most part similar

to the demand for private services. They are useful (roads and public

education) or demanded for their own sake (parks).

Many economists suggest that some services (public goods) are more

likely to be provided by governments than others, but initially such

considerations can be ignored. We’ll analyze which goods are most

likely to increase social net benefits when they are provided by the

government after the mid term.

For today’s lecture, we will simply assume that specific services are to

be provided or subsidized by government.

The production levels of specific services can be influenced in a number

of was

The government can organized the production and distribution of a

service, as it does for the most part with public education.

It can also subsidize the production of a service, which tends to reduce

the price of the service and increase it’s consumption services.

There are, in turn, a variety of ways that an activity or service can be

subsidized.

This lecture addresses how expenditures, especially subsidies, affect

market outcomes.

Government expenditures, like government taxes, have direct affects on

economic outcomes through a combination of effects on relative prices

and on personal wealth.

Most of these effects can be modeled using the same tools that we used

to analyze the effects of taxation.

In the case of purchases of goods and services, or of inputs to use to

produce such goods and services, the effect is simply to increase the

market demand for these goods, driving up their prices, and inducing

greater supply.

In the case of subsidies, the effects on consumers and firms are

essentially the same as for “negative” taxes.

That is to say, most targeted subsidies have effects on markets and

individual behavior that are very similar to those of excise taxes.

The create a “subsidy wedge” between the price consumers pay for a

service and that which producers receive.

In this case, however, the price received by producers is usually greater

than that paid by consumers, Pf = Pc + S, rather than less than it.

At the level of individuals, either net benefit diagrams or indifference

curve analysis can be used illustrate how different kinds of subsidies

(marginal, lump sum, conditional and unconditional) affect rational

decision makers.

The market level effects can be analyzed using supply and demand

curves, as we did in the previous lectures for excise taxes.

Many government programs are explicit or implicit subsidies in that

they indirectly reduce the price of a service for consumers (and/or

producers).

Page 1

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

In some cases, this is done with direct cash payments, in others it is

done implicitly through matching grants of one kind or another, special

pricing, or through regulation.

Consider the case of toll and free highways, co-payments in medical

programs, partial payments of rent for low income renters, support for

R&D with private applications, tax loopholes for charitable activities,

and loans at below market rates to encourage specific private

investments (as in higher education).

We begin our analysis of government expenditures by looking at the

effects of targeted government subsidies.

The dead weight loss of “targeted” or “cost sharing” subsidy is

analogous to that associated with an excise tax.

{ The economic cost of a subsidy also includes the excess burden of the

taxes used to finance it.

{ The diagrams developed below focus on the revenues required to fund the

subsidy, but these other costs should be kept in mind.

Illustration of the benefits of a subsidy:

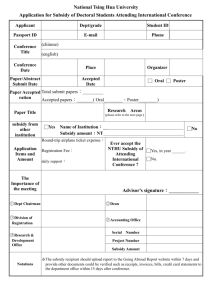

Effects of a Targeted Subsidy

$/Q

II. On the Microeconomics of Subsidies

The distributional effects of a subsidy (or transfer) can be measured in

two ways:

First, it can be calculated as an accountant might, as a cash receipt

similar to ordinary income is calculated.

(This is the most widely used measure by macro-economists,

accountants, and newspaper reporters.)

This approach implicitly assumes that the entire benefit of a subsidy

accrues to the persons or firms that receive the “check” from the

treasury.

Alternatively, the distribution of benefits can be calculated by

determining the net benefits generated by the subsidy relative to the

"no subsidy state."

That is to say, the net benefit of a subsidy can be measured as the

increase in consumer surplus and profits generated by the subsidy.

(This measure of the effects of a subsidy program is the most widely

used among microeconomists and public economists.)

As in the case of taxes, there is a difference between the cost of the

subsidy (amount paid out) and the amount of additional consumer

surplus and profit generated.

{ Subsidies tend to extends trades beyond the level at which trade produces

marginal benefits greater than marginal costs.

{ The deadweight loss of a subsidy can also be measured as the extent to

which "social surplus" is increased by a particular subsidy relative to the

cost of the subsidy.

S

I

Pf

VI

II

VIII

P*

III

Subsidy

IX

VII

Pc

IV

V

D

X

Q*

Q'

Quantity Sold

Suppose that a market is initially in an equilibrium without subsidies or

taxes, so that demand equals supply at P*. In this case, there is no

"subsidy wedge" between the price paid by consumers, Pc, is the same

as that received by firms, Pf; so Pf=Pc=P*.

Now, suppose that a subsidy of S is imposed on each unit of the good

sold in this market, perhaps a rent subsidy.

After the subsidy is place, P* is no longer a market clearing price:

If S is simply subtracted from P* by firms, consumers will want to

purchase too much at their new price (Pc = P* - S) to match supply,

which would remain at Q*.

On the other hand, if firms simply "kept" the subsidy, they would

want to provide more units than can be sold. The supply at Pf = P* +

Page 2

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

S is greater than the demand at P*, which would remain at Q* since in

that case Pc = Q*.

To clear the market, thus, consumers have to pay less than P* per item

sold, and firms have to receive more.

At the new equilibrium output, the demand curve will be exactly B

dollars below the supply curve, Qd(Pf - S) = Qs(Pf).

At the new equilibrium output, as depicted above, supply equals

demand, and the price paid by consumers is exactly S dollars lower than

the amount firms receive (Pf = Pc + S). Note also that Q' units of the

good are sold, with Q'>Q*.

At this equilibrium, there is a sense in which the targeted subsidy has

simply been taken by firms, because Pf = Pc + S.

However, there is another sense in which the benefit of the subsidy is

shared by firms and consumers, because both consumer surplus and

profits have been increased by the subsidy!

Consumer Surplus increases from area I + II (before the subsidy at

Q*) to area I + II + III + VII after the subsidy is in place and output

rises to Q'.

Similarly, Profit increases from III + IV (before the subsidy at Q*) to

area III + IV +II+VI (after the subsidy at Q').

Thus, the benefit for consumers is III + VII , and for firms is II+VI.

Note that this increase of consumer and firm net benefits exists

regardless of who actually receives the check from the state or

federal treasury.

Price movements ultimately determine the actual division of benefits

between firms and consumers.

{ If firms receive the check, their effective "receipt" is reduced by the

decrease in price paid by consumers.

{ If consumers receive the checks, their effective "receipt" is reduced by the

price increase of firms in the market subsidized.

The money paid out by the treasury is its fiscal cost, S*Q'.

Q' units are sold and the "government" pays S dollars toward each unit

sold.

Consequently, the total expenditure, SQ', can be measured with area II

+ III +VI + VII + VIII + IX in the diagram. (The area of a rectangle

Q' wide and S tall is Q'S.)

Note that this "cash" measure of the cost of the subsidy is larger than

the "net benefits" generated by it.

The increase in industry profit plus the increase in consumer surplus

equals (II + +VI) + (III + VII).

The total benefit of this subsidy is VIII + IX smaller than the cost of

the program.

This area of "lost net benefits" is sometimes referred to as the

deadweight loss of a targeted (or "marginal") subsidy.

The true economic cost of a subsidy is larger than the direct fiscal cost

of the subsidy, because of the DWL of the taxes used to finance the

subsidy program and the administrative cost of both the subsidy

program and tax collection.

Both the extent of the deadweight loss and the distribution of the

benefits vary with the slopes of the supply and demand curves in the

subsidized industry.

Generally, relatively more of the benefit falls on the side of the market

with the least price sensitive curves.

That is to say, if the demand curve is less elastic than the supply curve

more of the benefit is received by consumers than firms. (In the

extreme case in which market demand is completely inelastic or the

industry supply curve is completely elastic, all of the benefit falls on

consumers!)

On the other hand if the demand curve is very elastic, because good

substitutes exist, or the supply curve is relatively inelastic then more of

the benefit of a subsidy goes to firms in the subsidized industry. (In

the extreme case in which the market supply of the product of interest

is completely inelastic or consumer demand is perfectly elastic, all of

the benefit goes to suppliers.)

The excess benefit of a subsidy tends to increase with the price

sensitivity (slope or elasticity) of the demand and supply curves.

Supply and demand curves tend to be more elastic in the long run

than in the short run, so the excess burden of a subsidy tends to be

larger in the long run than in the short run.

Insofar as long run supply is relatively more price sensitive (elastic) than

demand in the long run, the benefit of a new subsidy or increase in

subsidy tends to be gradually shifted from firms to consumer in the long run.

Page 3

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

For example, Marshallian competitive markets have perfectly elastic

(horizontal) supply curves in the long run, which implies that narrow

subsidies on Marshallian products are shifted entirely to consumers in

the long run.

In cases in which only consumer demand is more price elastic in the

long run than in the short run (as when demand for a good is

determined in part by consumer capital goods, like automobiles), a

subsidy for gasoline or highway use tends to be gradually shifted from

consumers to firms (owners of capital and natural resources) in the

long run.

In cases where both sides of the market (firms and consumers) are

more price elastic in the long run than in the short run, the LR

distribution of the benefit will reflect their relative abilities to adjust.

However, all such long run adjustments imply that deadweight losses

from targeted subsidies are larger in the long run than in the short run.

(The height of the DWL triangle does not change but its length

increases.)

Illustrations: effects of an excise subsidy in the short run and long run

for different kinds of markets

Ssr

P

S

Slr

P*

S

D

Pc"

Q* Q'

P

P*

Pc

Q houses

Q"

Dsr

S

Note that in the first case, supply is more elastic in the long run than

in the short run, so the initial benefit from the subsidy is largely for

firms, but in the long run the benefit is shifted to consumers.

{ The after subsidy price falls at first for firms, but rises back to P*. The

price to consumers falls just a bit at first, but falls to P*+Pc in the long

run.

The second case is an unusual case where demand is more price

sensitive (elastic) in the long run than in the short run.

{ However, because supply is completely elastic in both the long and short

run, the benefit falls entirely on consumers in both the short and long run.

As an exercise, construct a case in which the benefit goes

entirely to firms in both the long and short run.

One advantage of calculating the benefit of a subsidy as the change in

profit and consumer surplus generated by that program rather than total

government expenditures is that allows one to calculate how the

benefits of a subsidy are distributed within the markets subsidized (and

in other related markets).

The benefits of a subsidy are often realized by persons or firms who

are do not directly receive the subsidy payments.

For example, a rent subsidy is normally paid to renters who are able to

pay more for housing than they could before.

This bids up rents and the prices of rental housing, which benefits

land lords and builders.

Calculated as cash payments, one could say that the benefit of a rent

subsidy is realized entirely by renters.

However, if landlords increase their prices (rent), then the benefit of

the subsidy has really been "shifted" forward from renters to land

lords, even though landlords never actually receive a check from the

government treasury.

In many cases, the persons most affected by a subsidy are not the

persons who "directly" receive the subsidy checks or coupons!

S

S

Dlr

Q*

Q'

Q"

Q tires

Page 4

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

III. Normative Principles of Subsidy Programs

The relative merits of lump sum and marginal subsidies (block and

matching grants) can be assessed using the indifference curves and

budget constraints in a manner very similar to that used above to

analyze the effects of lump sum and marginal taxes ( uniform broad

based and narrow based taxes).

Illustration of the inefficiency of matching grants (marginal subidies).

Suppose that “Al” is purchase two goods and that one of these is

subsidized in a manner that reduces its effective price (as in the demand

and supply diagrams above).

Q good 2

Based on the geometry above, it seems clear that the net benefits of

most subsidies are often smaller than their costs, because the increase in

social surplus is often smaller than the money spent on the program

(and the cost of raising that money).

In cases in which, equity or redistribution is the goal of a subsidy (as

with food stamps and many rent subsidies), the distribution of net the

subsidy benefits will also matter.

Do the benefits mostly go to the poor, or to those selling services to

the poor?

In such cases, “distribution of burden” diagrams are often used to

analyze the relative merits of alternative subsidy programs.

There are also cases in which social net benefits increase as a

consequence of the subsidy (Pigovian subsidies), but these will be dealt

with after the midterm.

It is also possible to use our geometric tools to determine the relative

merits of alternative subsidy programs as we did with alternative taxes.

Lump sum subsidies will generally have a smaller deadweight loss, as

shown below, than marginal subsidies or matching grants.

In all of these cases, distribution of burden diagrams can also be used to

analyze political incentives that various groups have to lobby in favor or

against particular subsidy or tax programs, as we will see in future

lectures.)

Figure 4:Welfare Advantage of

a Well Designed

Lump Sum Subsidy

C

A

Q2’

Evaluating the normative merits of a subsidy program requires analysis

of net benefits associated with a subsidy.

B

0

Q1’

W/P1

W/P1’

Q good 1

(W+S)/P1 where S = (P1-P1’)Q’

Suppose that "A" is the original (pre subsidy) bundle consumed by a

consumer.

The subsidy decreases the relative price of good 1 from P1 to P1'

{ This change in prices causes a new budget constraint and induces the

consumer to purchase bundle B.

{ Note that the consumer has more utility at B than at A, because she is on a

higher indifference curve.

{ However, the same amount of government money would have increased

her utility by even more, if it were given as a lump sum grant or subsidy.

The cash-equivalent lump sum subsidy produces a budget constraint

parallel to the original one (with the same relative prices) passing

through bundle B.

Note that under the equivalent lump sum subsidy, Al could have

purchased bundle C which is better than bundle B.

C is on a higher indifference curve than B is, so it produces more

utility for Al than B does.

Page 5

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

{ The cash equivalent lump sum subsidy is equal to [(P1-P1’)*Q1’, the

change in the consumer’s price induced by the subsidy time the number of

units purchased.

{ The budget constraint after the marginal subsidy on good 1 reduces the

consumer's price for good 1 from P1 to Pd = P1-S (which is shown as P1'

in Figure 4).

The difference between the utility produced by a lumpsum subsidy and

the marginal subsidy is a measure of the deadweight loss or inefficiency

of a marginal subsidy.

The lower utility of the targeted subsidy suggests that such subsidies

(ones that directly change relative prices) tend to be less efficient than

those which do not, as with a lump sum tax.

That is to say “neutral” subsidies tend to be more efficient ways to

increase recipient utility (welfare) than marginal or matching grants.

To many “utilitarians,” this diagram implies that a subsidy system

“should be” NEUTRAL if it wants to maximize its effect on consumer

welfare.

The above diagram demonstrates that a marginal subsidy yields a

smaller increase in welfare than possible from an equally expensive

lump sum or general subsidy--other things being equal

{ So the budget constraint with the subsidy can be written as: W = PdQ1 +

P2Q2 or W = P1'Q1 + P2Q2.

{ A perfectly neutral subsidy system does not directly affect private decisions

across markets for private goods and services, because it does not affect

relative prices faced by firms or consumers.

{ It does however, increase demand for normal goods and reduce demand

for inferior goods, which will have some relative price effects.

{ And, of course, even neutral subsidies have to be paid for with taxes or

loans.

(In cases where the purpose of the subsidy is to change behavior, a

marginal or targeted subsidy tends to be more effective than a lump

sum subsidy, because they have a larger direct effect on behavior. We

take up “Pigovian subsidies and taxes after the mid term exam.)

ALGEBRAIC APPENDIX

That the line passing through bundle B and parallel to the original

budget constraint characterizes the consumer's budget constraint under

the equivalent (equally costly) lump sum subsidy to the marginal (or

matching) subsidy assumed can be demonstrated with a bit of algebra.

The original budget constraint is W = P1Q1 + P2Q2, which includes all

the combinations of Q1 andQ2 that can be purchased for W dollars at

the ( pre subsidy) market prices P1 and P2.

The specific combination of goods 1 and 2 selected by the consumer

under the marginal or targetted subsidy is bundle B which is labeled as

(Q1', Q2').

{ That point lies on the subsidized budget constraint so W= PdQ1' + P2Q2'

It is convenient to rewrite Pd as P1-S to get W= (P1-S)Q1' + P2Q2'

{ so W= PdQ1' + P2Q2' W = (P1-S)Q1' + P2Q2' which implies that

{ W = P1Q1' + P2Q2' - (SQ1') (at point B)

If the amount SQ1' had been simply given to the consumer as a “lump

sum,” rather than the cost of good 1 subsidized, his or her new budget

constraint would have been:

{ W + (SQ1') = P1Q1 + P2Q2

{ Note that this new budget line includes the point (Q1', Q2'), point B on

the diagram.

The “lump sum equivalent” budget constraint, thus, passes through

point B and is parallel to the original one (without a subsidy).

{ Both the pre-subsidy budget constraint and the budget constraint with a

lump sum subsidy have the same slope, namely: -(P1/P2).

IV. Conditional Subsidies

The above examples are what might be called “unconditional” subsidies.

The lump sum subsidies could be spent on anything that a person wants

and the cost reducing subsidies applied to all units of the good

purchased.

These are not the only kinds of subsidy programs that can be designed.

Subsidy programs can also be conditional in the sense that the amount

received under a lump sum subsidy might have to be spent on particular

things (such as food) or a cost reducing subsidy might only be available

for small purchases or for large purchases.

Such conditional subsidies can also be analyzed with our geometric tool

box, although the geometry (and mathematics) tends to be more

complicated.

Page 6

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

Illustrations of Conditional Subsidies

Consider a lump sum grant that has to be spent on food (as in the

present food stamp program).

{ Note that if one simply spent all of the conditional lump sum subsidy on

food one can purchase amount F of food and W/Po of the other goods.

Q

other

W/Po

{ There is a kink in the budget constraint at this point (assuming that the

food can not be sold on the black market).

{ Note that a person that finds this “corner” to the his or her utility

maximizing combination of food and other goods will not necessarily be at

a point where his or her indifference curve is tangent to his or her budget

constraint. (Draw this case and explain why this happens.)

budget constraint with first F

units of food subsidized

F

Q

other

W/Po

W/Pf

(FS+W)/Pf Q food

iii. Our earlier analysis suggests that it is possible to shift from a conditional

targeted grant to a conditional lump sum grant and make (most) persons

better off.

budget constraint given F

{ (As an exercise illustrate this point and explain its logic. Hint, a conditional

lump sum grant for many people is equivalent to an unconditional lump

sum grant.)

V. Appendix: Tax Subsidies, Printing Money, and Borrowing

F

W/Pf

F+W/Pf

Q food

Consider a similar targeted (cost reducing) subsidy that applies only to

the first F units of food purchased.

{ The price of food falls by S dollars per unit for the first F units. After the

subsidy is exhausted, the consumer has to pay the prevailing market price

for additional food.

{ Note that there is again a kink in the budget constraint.

Most income tax systems include a variety of exemptions and

deductions that define taxable income.

On the one hand, these simply define what the tax base is.

In some cases, adjustments are necessary to determine economic

income, itself, which is net receipts concept.

On the other hand, many of the deductions are implicit subsidies of one

kind or another, in the sense that one can think of a deduction or

exclusion as a separate subsidy program.

For example, suppose that there was a simple flat tax of 25% on all

economic income and that interest on mortgages is deductable.

That implies an implicit 25% subsidy for mortgages because a tax

schedule of:

{ T’ = .25(Y - M) where Y is economic income and M is the mortgage

payment is equivalent to a flat tax T = .25Y plus a subsidy of S = .25M

Page 7

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

{

{

{

{

{

Note that the taxpayer’s after tax income in this case is

Y-T+S = .75Y + .25M

which is the same as that under the first tax with a mortgage deduction

Y-T’ = Y-(.25(Y - M)) = Y-.25Y+.25M = .75Y + .25M

In this sense, many adjustments to an income tax can be thought of as

“tax subsidies.”

The normative implications of such subsidies can be analyzed with

either tax or subsidy normative theories, but some of the equity

arguments are clearest when one applies the subsidy norms.

{ Is it appropriate for other tax payers to subsidize housing purchase?

Especially those of the relatively wealthy?

Digression-Long Footnote on debt and printing money.

It bears noting that a good deal of government finance involves

borrowing and printing money rather than ordinary taxation.

{ Indeed, many poorly run governments prefer to just "print money" to pay

for their expenditures.

{ Others would prefer to borrow all moneys spent,

{ and would resort to taxation as a last resort, were it not for the

deadweight losses generated by these other methods of government

finance.

In terms of the language used to discuss taxation, printing money may

have a larger economic and political burden in the future than taxation,

by both reducing the value of money held by private persons, producing

inflation, and distorting relative prices throughout the economy.

{ Inflation is an implicit tax on those who hold money.

{ Discuss the extent to which it satisfies or conflicts with normative theories

of taxation.

Borrowing shifts the burden of tax payments from current taxpayers to

future ones (or at least from those not generationally connected to

individuals that are).

{ Discuss the effects of posponing taxation (or shifting it to other

generations) using our tax and/or subsidy normative theories.

{ It also has macro-economic effects on the distribution of capital within a

society that may affect long term growth rates.

{ As a consequence, both printing money and debt-finance may be more

difficult to use repeatedly than taxation. Explain Why?

VI. Appendix: Progressive, Proportional and Regressive

Subsidies

Normative theories that focus on “equity” often support subsidies that

redistribute wealth or income from relatively rich persons to relatively

poor persons.

For example, society A would be considered better than society B

under most distributional theories, if everyone is richer in A than in B

(Rawls).

Other normative distributional theories might regard society A to be

better than A if most persons are richer in A than in B, or if the average

person is richer in society A than in society B.

{ (In this last theory that attempts to maximize average income, only

economic efficiency matters. why?)

The Pareto principles:

State A is better than (or Pareto superior to) state B if at least one person is

better off at A than B and no one is worse off.

A Pareto optimal state occurs when no Pareto superior moves are

possible.

The Pareto principle implies that inequality that increases total wealth or

total social net (by for example creating incentives to work a bit harder

or more productively) benefits tends to improve the state of the world

as long as no one is harmed by the new wealth or new social net

benefits.

In contrast, many mainstream normative theories imply that there are

“efficiency-equity” tradeoffs.

That is to say, in some cases it is all right to sacrifice a bit of equity if

efficiency increases enough.

And conversely, in some cases it is all right to sacrifice a bit of efficiency

if equality increases enough.

What “enough” means varies according to the normative theory (or

normative intuition) being applied.

Page 8

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

Definitions and Relationships useful for characterizing positive

characteristics of subsidy schedules that are relevant for distributional

normative theories:

The subsidy base, B, is the activity, good, or service that is

subsidized. (food, rent, work, oil production, bus tickets, corn

production, R&D, etc.)

The average subsidy rate of a particular subsidy often varies with an

individual's holding of the subsidy base. If an individual pays subsidy

Ti on a holding of Bi, his average subsidy rate is Si/Bi. (If Si = $50

and Bi = 200, the average subsidy rate for this subsidy is 50/200 =

0.25 or 25%.)

The marginal subsidy rate of a particular subsidy is the change in

subsidies owed for a one unit increase in holdings of the taxable base,

SB. (So, if a subsidy payer earning 50,000/year pays a subsidy of

10,000 and a taxpayer earning 50001 pays a subsidy of 10,000.50, his

or marginal subsidy rate is 0.50/1 = 50%. Fifty percent of each

additional dollar earned is taken from the "last" dollar of income

earned by a taxpayer earning 50,000/year.)

In a diagram of subsidy schedules. If MSR is above ASR, then the

ASR curve will be rising (the marginal subsidy rate will be pulling the

average up). If MSR is below ASR, then the ASR curve will be falling

(the marginal subsidy rate will be pulling the average down). If the

MSR = ASR, the ASR will be neither rising nor falling.

Since individual decisions are determined by marginal cost and

marginal benefits at various quantities, it is the marginal subsidy

rate rather than the average subsidy that affects subsidy receiver

behavior.

Calculating the Progressivity (etc) of subsidy schedules

Although the terms progressive, proportional, and regressive are used

less frequently to describe subsidy programs than tax systems these

terms can be applied, and are often important in policy discussions

about the relative merits of a particular subsidy schedule or program.

In principle, the reference point for calculating “progressivity” can be

either the subsidy “base,” or personal income.

{ For most positive analyses, the “base” tends to be used.

Calculated relative to its base, a progressive subsidy schedule has an

average subsidy rate that falls with purchases of the subsidized good,

etc..

Calculated relative to income, a progressive subsidy program's has an

average subsidy rate that falls with income.

{ Such progressive subsidies are said to promote “equity.”

When a subsidy program is designed, its positive characteristics have to

be determined, and so its progressivity, proportionality, or regressivity is

normally judged relative to the "thing" subsidized (that is with respect to

its base).

{ For example, the average subsidy rate of an agricultural subsidy can be

designed to decline (on average) as farm size increases (progressive).

{ The average subsidy rate of an agricultural subsidy can also be designed to

be the same for all sizes of farms (proportional).

{ Or, the average subsidy rate can be designed to increase as farm size

increases (regressive).

In public policy debates, the discussion of subsidies and other transfer

programs often centers on a subsidy's relationship to personal income.

(Do poor people get more than rich people, or vice versa?)

Using income as the reference point, a progressive subsidy is a

subsidy whose average benefit falls as the income of an individual

increases.

{ [Such subsidies often have marginal subsidy rates that decrease with the

"base," although not all progressive subsidies have this property. This

tends to be true, for example, of social security benefits. ]

A proportional subsidy is a subsidy whose average subsidy benefit

does not change with income. (Such subsidies normally have a

constant marginal subsidy rate, as true of most sales subsidies and

some income subsidies. A flat (proportional) subsidy on income has

the form: S = aY.) [farm subsidies and unemployment insurance]

Using income as the reference, a regressive subsidy is a subsidy whose

average subsidy benefit increases with income. Such subsidies often

have declining marginal subsidy rates with ownership of the item or

activity subsidized, however, not all regressive subsidies have this

property. [state subsidized higher education]

{ For most normative analyses personal income tends to be used.

Page 9

EC 441: Handout 4: The Microeconomic Effects of Government Subsidies, Transfers, and Similar Expenditures

Some Geometric Puzzles:

Economic efficiency-based normative theories are sometime said to

oppose consumption and borrowing subsidies, but to favor subsidies

that encourage saving and investment, because these are argued to

increase long run economic growth.

The intuition behind the effect is based on supply and demand.

If the price of saving increases relative to consumption, individuals will

consume more and save less.

As capital is accumulated, the productivity of labor increases and so

does national income.

However, you can use an indifference curve diagram to show that a

permanent saving’s subsidy does not have any relative price effect on

savings versus consumption decisions.

As an exercise draw the effect of an investment-savings subsidy in a

two period intertemporal choice diagram.

Note that a subsidy that proportionately reduced the absolute price of

consumption in both periods , would not change relative prices of

consumption now and in the future, and so would operate like a lump

sum tax.

Does a permanent savings subsidy really increase saving? Why or why

not?

{

Page 10