Sage Accounts

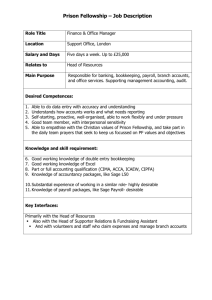

advertisement

Online Courses SAGE Accounting Course From £71.50 For more information, contact NPTC Group learndirect team Neath Port Talbot Campuses: 01639 648110/648170 or Powys Campuses 0845 4086288/4086270 Alternatively e-mail us at learndirect@nptcgroup.ac.uk SAGE Bookkeeping Stage 1 Course Duration: Access Period: Course Level: Course Fee: 4 Hours 6 Months Introductory £71.50 (Course Only) £40.00 (Exam) Introduction Course Features If you want to develop your bookkeeping skills for your business or your job, then this course will give you the basic knowledge you need to use Sage Bookkeeping. You’ll work through the course online, where you’ll complete a series of exercises. All you need is access to the Internet. You’ll learn how to get to grips with the software - covering everything from the very basics through to day-to-day use. Who is the course for? This course is for anyone who wants to get a better understanding of Sage Bookkeeping. It’s perfect if you run your own small-to mediumsized business, or just want to show your employer that you have the skills to use this software. You don’t need to have any prior knowledge or experience with Sage Bookkeeping to take this course. What will you get from this course? You'll learn how to: Understand the basics of bookkeeping Get to grips with double entry bookkeeping Better understand how to work with your customers and suppliers Understand VAT and VAT returns You’ll have on screen simulations to take you through each stage of your learning, and interactive quizzes will test your knowledge as you go along. You’ll even receive a learndirect statement of completion when you’ve finished the course. You’ll have access to this course for six months from the date of purchase – giving you plenty of time to finish your course. Please note: you will need to access the course every month to ensure that it remains active. If a course is not active for a period of time, learndirect reserve the right to suspend learning. This course is based on version 18 of the Sage Software. Course Modules: The Basics of Bookkeeping Skills Introducing Double Entry Bookkeeping The Trial Balance Report Working with your Customers Working with your Suppliers Understanding VAT and the VAT Return Essential Management Reports For more information, please contact NPTC Group learndirect team Powys Campuses: 0845 4086288/4086270 or Neath Port Talbot Campuses: 01639 648110/648170 Alternatively e-mail us at learndirect@nptcgroup.ac.uk Course Code: 104371BT003 SAGE Bookkeeping Stage 2 Course Duration: Access Period: Course Level: Course Fee: 5 Hours 6 Months Introductory £71.50 (Course Only) £40.00 (Exam) Introduction Course Features If you want to develop and advance your bookkeeping and accounting skills for your business or your job, then this course will give you the knowledge you need to use Sage Bookkeeping. You’ll work through the course online, where you’ll complete a series of exercises. All you need is access to the Internet. You'll build on your existing basic knowledge from Sage Bookkeeping Stage 1. Who is the course for? This course is great if you want to develop your understanding of Sage Bookkeeping and move on to more advanced features. You’ll have on screen simulations to take you through each stage of your learning, and interactive quizzes will test your knowledge as you go along. You’ll even receive a learndirect statement of completion when you’ve finished the course. You’ll have access to this course for six months from the date of purchase – giving you plenty of time to finish your course. It's perfect if you run your own small- to mediumsized business, or just want to show your employer that you have the skills to use this software. Please note: you will need to access the course every month to ensure that it remains active. If a course is not active for a period of time, learndirect reserve the right to suspend learning. This course is ideal if you've already taken Sage Bookkeeping Stage 1. This course is based on version 18 of the Sage Software. What will you get from this course? Course Modules: When you have completed this course, you will be able to: Understand the basics of Sage Bookkeeping Do accounting for reduction Do accounting for write-offs Reconcile Sage with your bank account Apply performance measures Review the Fundamentals Working with Prepayments and Accounts Accounting for Depreciation Accounting for Write-Offs Reconciling your Bank Account Apply Performance Measures For more information, please contact NPTC Group learndirect team Powys Campuses: 0845 4086288/4086270 or Neath Port Talbot Campuses: 01639 648110/648170 Alternatively e-mail us at learndirect@nptcgroup.ac.uk Course Code: 104371BT003 SAGE 50 Accounts Course Duration: Access Period: Course Level: Course Fee: 6 Hours 6 Months Introductory £136.50 Introduction Sage 50 Accounts is the perfect software for smallto medium-sized businesses. It will help give you the tools to help you manage your cash flow and VAT returns, and even help with the management of customer details and suppliers. This course will help you get to grips with the software - covering everything from the very basics through to day-to-day use. Who is the course for? Course Features You’ll work through the course online, where you’ll complete a series of exercises. All you need is access to the Internet. You’ll have on screen simulations to take you through each stage of your learning, and interactive quizzes will test your knowledge as you go along. You’ll even receive a learndirect statement of completion when you’ve finished the course. You’ll have access to this course for six months from the date of purchase – giving you plenty of time to finish your course. This course is for anyone who wants to get a better understanding of Sage 50 Accounts. Please note: you will need to access the course every month to ensure that it remains active. It's ideal if you run your own small- to medium-sized If a course is not active for a period of time, learndirect reserve the right to suspend learning. business, or just want to show your employer that you have the skills to use this software. This course is based on version 17 of the Sage Software. You don’t need to have any prior knowledge or experience with Sage 50 Accounts to take this course. Course Modules: Does this course lead to a Qualification? No, but the course was developed by Sage to help users to take advantage of the features on Sage 50 Accounts. Navigation and Settings Nominal Ledger and Chart of Accounts Entering Opening Balances Recording Nominal, Customer and Supplier Transactions Error Corrections Bank Reconciliation Access Rights For more information, please contact NPTC Group learndirect team Powys Campuses: 0845 4086288/4086270 or Neath Port Talbot Campuses: 01639 648110/648170 Alternatively e-mail us at learndirect@nptcgroup.ac.uk Course Code: 104371BT002 SAGE Instant Accounts Course Duration: Access Period: Course Level: Course Fee: 8 Hours 6 Months Introductory £71.50 (Course Only) Introduction Managing your small business accounts using Sage Instant Accounts instead of manual bookkeeping is a brilliant way to save you time and effort. Course Features You’ll work through the course online, where you’ll complete a series of exercises. All you need is access to the Internet. This course will help you get to grips with the software - covering everything from the very basics through to day-to-day use. You’ll have on screen simulations to take you through each stage of your learning, and interactive quizzes will test your knowledge as you go along. Who is the course for? You’ll even receive a learndirect statement of completion when you’ve finished the course. This course is for anyone who wants to get a better understanding of Sage Instant Accounts. You’ll have access to this course for six months from the date of purchase – giving you plenty of time to finish your course. It's ideal if you run your own small business, or just want to show your employer that you have the skills Please note: you will need to access the course to use this software. every month to ensure that it remains active. If a course is not active for a period of time, You don’t need to have any prior knowledge or learndirect reserve the right to suspend learning. experience with Sage Instant Accounts to take this course. This course is based on version 18 of the Sage What will you get from this course? You'll learn how to: Enter accounting data Use Sage Instant Accounts to create products and invoices Back up and check data then correct any accounting mistakes Cross check your bank statement with the transactions you’ve made Produce and print a VAT return and know what to do at a period end Software. Course Modules: Configuring Sage Instant Accounts Operating Sage Instant Accounts Reconciling Sage Instant Accounts Period End Routines For more information, please contact NPTC Group learndirect team Powys Campuses: 0845 4086288/4086270 or Neath Port Talbot Campuses: 01639 648110/648170 Alternatively e-mail us at learndirect@nptcgroup.ac.uk Course Code: 104371BT003