Honeywell 2011 Annual Report - Investor Relations Solutions

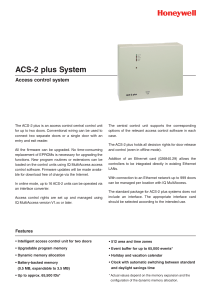

advertisement