The Macro-Foundations of Microeconomics: Initial Labor

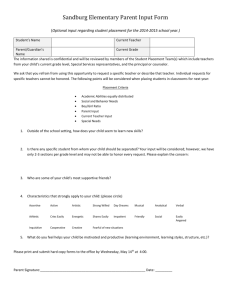

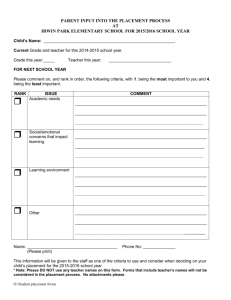

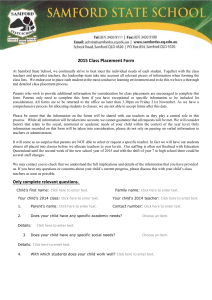

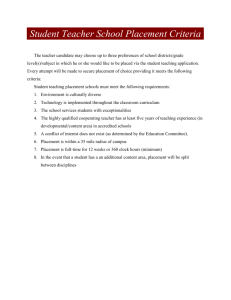

advertisement