Most of what you need to know about Cash Handling and Taking

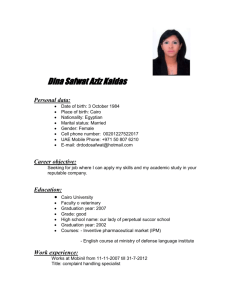

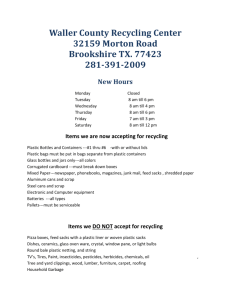

advertisement

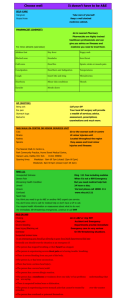

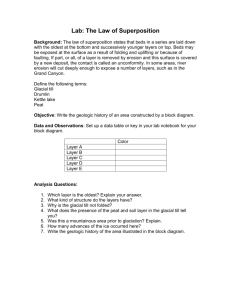

Most of what you need to know about Cash Handling and Taking Payments Workbook Cash Management Cash Handling An efficient cash control system will ensure management are immediately aware of any discrepancies between sales, stock and what is in the till. Even the most sophisticated till systems are only as good as the information that is entered. It is, therefore, essential that every member of the team is at least financially aware, and preferably, independent throughout their shift. By involving every member of the team in the financial control of the business and including them in regular business performance reviews, you can ensure team ownership of cash control. Till security Working in the licensed retail sector usually means hard work and long hours. Trying to ensure that the business is successful may mean that work gets harder and hours get longer. Consequently, it is important to ensure, for all the effort involved, no monies are lost between the sale to a customer and the cash being safely banked. This section looks at making sure owner and operators know how to monitor and control cash receipts. In the licensed retail industry, types of till in operation range from a simple electronic till, a pre‐set style of electronic till, to an EPOS (Electronic Point of Sale) system, which is a computerised till with keypad input. The EPOS systems usually provide extensive management information, which helps control all aspects of the business, including petty cash expenditure. It is important to use the right till system for the business. A good till system in a licensed retail premises, should: 9 Help to prevent or overcome fraudulent practices, pilfering and carelessness by staff 9 Give the owner/operator sufficient information to run the business efficiently 9 Give the owner/operator information appropriate for the size and type of business. Till opening, operation and closing Till opening, operation and closing procedures will vary in each establishment depending on the system in place and the type of business. However, there are general guidelines which staff should follow. Staff may be responsible for ensuring there is sufficient cash available in the till for each opening time. The cash in the till is known as the ‘float’. Ensure that staff check that at the beginning of each session there is sufficient change in the float, and a small selection of notes. It is common practice to have an identified amount in the till at the beginning of each day, and to require team members to check that this amount is in the till. The till drawers may need to be emptied or rotated throughout the opening hours to keep cash secure, and levels of change will need to be checked periodically to avoid any disruption to service. Till operating procedures should be in writing to make sure everyone is trained to follow the same procedure and is aware of their responsibilities. In a licensed retail premises, where large numbers of people may use the till, there will be fewer mistakes and bad practice reduced or avoided. © Tim Webb 05/2010 2 Cash Management Operating procedures should cover till handover. If staff handover to each other during shifts, they need to explain any known errors in processing payments or using the tills. They need to explain whether any bills are ‘open’ in order to prevent non‐payment by customers. Template for Success • Responsibility for individual’s own till balance • Team responsibility for till balance • Team awareness of on going business performance, including performance against budget and overall business efficiency • Stock control knowledge • Incentives for staff to take ownership of business success Cash control procedures should include… • Daily or session cash balancing, along with strict stock control procedures • A receipt should be obtained for any cash payments to suppliers • All cash in and out of the tills must be accounted for • All drinks should be paid for or free drinks recorded • Mid‐session till checks and changing the amount in the float can help if a problem with cash control is suspected By doing this you are setting barriers, physical in some instances but also mentally in the minds of unscrupulous staff. The more security barriers you can erect between thieves and your money the better! Staff may also steal, if they realise that there are no rigid cash handling systems in place, and may well take advantage of you. The passing of free drinks to friends, short‐changing customers, and under‐ringing the till are all forms of theft, but for some strange reason are not considered so by many bar staff. Do not believe that sophisticated till systems will totally eradicate all theft, they will not, but they are useful in putting yet another barrier in the mind of a would be thief. Some operators are under a misapprehension that when staff under ring a till, they automatically take the money out of the till at that time. Whilst this practice may occasionally happen, the experienced thief would not countenance this practice. They would under ring the till until they have built up for instance £10, and it is at that stage that they will take the whole of the amount in just one action. A popular way of getting money out of the till, without attracting attention is to work with an accomplice. In this case the staff member serves their accomplice with a drink, the person served proffers a £10 note, but the member of bar staff gives change for a £20 note. Nice and simple, and without any fuss! Prevalent ways of under ringing tills by experienced will not include ringing ‘No Sale’ or ‘Void’, as they know these are easy to spot. They are more likely to take an amount for a round of drinks and instead of ringing the correct amount in, will go to the till and ring in a bag of crisps and a box of matches. © Tim Webb 05/2010 3 Cash Management • Generally customers will not scrutinise everything coming up on the till screen, if there is one visible, and other bar staff will be busy with their own chores. • Always check your stock sheets with your Stock taker for any imbalance in crisps, nuts, cigars, matches; it could just stop you losing money. Conducting random mid‐session till checks may help detect the practice of under‐ ringing. Staff Control As the manager of a business you must ensure that all staff are aware of security, and of the importance of confidential information remaining confidential from anyone outside the business, including their friends and family. Confidential information can include: 9 Financial information about the business or the business performance 9 Security information about who does the banking, when and where banking is done, who holds security keys or alarm codes 9 Company information, such as salaries, staffing or product margins 9 Information about other staff, such as their telephone numbers, addresses or work schedules 9 Customers’ financial details, which may be used in fraud. Staff should be made aware that none of the above information should be discussed with customers – it may be considered a disciplinary offence. By involving every member of the team in the financial controls and security of the business, and in regular business performance reviews, owner/operators can ensure greater team ownership of payment control. Security of cash on premises and cash transferral Owner/operators need to consider the value of cash on the premises, ensure they secure it from public access, and that staff are aware of their responsibilities. These responsibilities should include: 9 Daily or session cash balancing, along with strict stock control procedures 9 Receipts should be obtained for any cash payments to suppliers 9 All cash in and out of the tills must be accounted for 9 All drinks should be paid for or free drinks recorded 9 Mid‐session till checks and changing the amount in the float can help if a problem with cash control is suspected 9 Make sure that staff never leave the till unattended with the drawer open – it must be closed after each transaction. Safe Cash Handling for You and Your Staff Having some form of well structured cash handling procedures for your staff, will again put barriers in the minds of the unscrupulous staff member, but it will also protect you and your staff from equally unscrupulous customers, and the risk of genuine mistakes. When you or your staff accept a note from a customer, you must.... © Tim Webb 05/2010 4 Cash Management • • • • As you receive the note is taken from the customer, check that it is not a forgery, then announce the value of the note to the customer. By doing this, the prospective thief will realise that cash handling systems are in place, and other customers at the bar may have their attention drawn to the note being passed. Place the note on the till, and key in the amount of the note tendered (if possible), count the change required. Place the note into the till with the picture of the ‘Queens Head’ up and pointing towards you, and then close the drawer. This makes it quicker to sort out the notes for banking, but more importantly, provides a final check of the note’s denomination as you put it into the till. The change should then be counted out into the customers hand, declaring the value of the note tendered again. Cheques You will all decide on your own policy concerning whether to take cheques or not, whether to impose a charge for cashing cheques, and who will be responsible for making sure procedures are being followed. It is, however, extremely unwise, to accept any cheques that are not supported by a valid cheque guarantee card, and you should always ensure that you...... • Accept the cheque and card from the customer • Make sure that the date on the cheque is correct, and that the figures written on the cheque correspond with the written value • Check that the card is valid, and that the name and the signature correspond • Check that the bank sort code is the same on the card as on the cheque • Check the signatures on the card and the cheque correspond • Rub your thumb along the security strip, if has been tampered with, it will feel rough not smooth, try your own to see how it should feel. • You write the card number on the back of the cheque, not the customer. Credit /Debit Cards © Tim Webb 05/2010 5 Cash Management • • • • • • Check the card is current, and one that you accept ‐ it does happen, the name and signature tally, and that the security strip is intact The card is placed into the machine and it will dial automatically for authorisation Enter the value of the transaction on the card machine. Ask the customer to enter their pin number Wait for the machine to complete the authorisation process and finish receipt printing before you return the card to the customer A reward is still paid for the recovery of stolen or fraudulently used cards, and if there is any doubt as to a card’s validity, a call should be made to the card merchant services number. © Tim Webb 05/2010 6