Arizona's Trade and Competiveness in the U.S.

advertisement

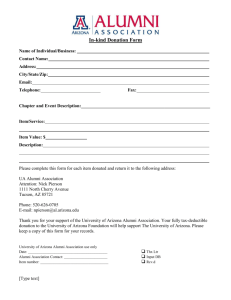

The University of Arizona | Eller College of Management Arizona-Mexico Economic Indicators Arizona’s Trade and Competiveness in the U.S. – Mexico Region Summary 2015 Prepared by Economic and Business Research Center azmex.eller.arizona.edu Sponsored by DATA HIGHLIGHTS This document highlights changes which occurred in 2014, as well as five-year and ten-year trends for selected indicators. Data cover Arizona, U.S. border states, Mexico border states, as well as national totals for Mexico and the U.S. These figures are drawn from the Arizona-Mexico Economic Indicators Report 2015, and the AZMEX Indicators website (azmex.eller.arizona.edu). The following list shows year-over-year growth rates for selected indicators in 2014: Arizona total population grew 1.5% in 2014 Arizona real GDP grew 1.4% in 2014 Arizona exports to Mexico increased 22.2% in 2014 Arizona manufacturing exports to Mexico increased 19.1% in 2014 Vehicle and passenger crossings are up 4.2% and 5.9%, respectively, at Arizona BPOE in 2014; as are buses (8.3%) and bus passengers (1.4%); U.S. commodities exported to Mexico via Arizona BPOE increased 1.7% in 2014 U.S. electric and electronic products exported to Mexico via Arizona BPOE increased 3.7% in 2014 U.S. electric and electronic products imported from Mexico via Arizona BPOE increased 4.5% in 2014 Arizona manufacturing employment grew 0.7% in 2014 Arizona % of population over 25 with a BA or higher increased 0.4% in 2013 (Note: 2014 data not yet available.) 25 22.2 20 year/ year percent growth in 2014 18.5 15 10 8.3 5.9 4.2 5 1.5 1.4 3.7 1.4 1.7 0 1|Page Economic Business and Research Center, Eller College of Management, The University of Arizona 4.5 0.7 DATA HIGHLIGHTS The following list shows growth for selected indicators over the past decade, 2005-2014, with a few exceptions due to data availability, which are indicated. It should be noted that this decade spans the Great Recession of 2007-2009. Export numbers are in U.S. dollar value. Arizona population grew 15.3% (2005-2014) Share of Arizona population 65 and over grew 18.8% (2004-2013) Arizona real GDP grew 4.1% (2005-2014) Arizona exports to Mexico grew 81.6% (2005-2014) Arizona exports to Canada grew 39.6% (2005-2014) Arizona exports of manufacturing products to Mexico and Canada grew 18.9% and 33.2% (2005-2014), respectively Number of truck crossings through all Arizona BPOE grew 9.9% (2005-2014) The largest increase in truck crossings occurred at the Nogales BPOE at 17.2% (2005-2014) Number of truck crossings through Douglas BPOE grew 16.5% (2005-2014) Number of train crossings at Arizona BPOE grew 1.3% (2005-2014) Douglas is the only BPOE in Arizona which experienced an increase in pedestrian crossings at 42.0% (2005-2014) Arizona employment in pharmaceutical and medicine manufacturing grew 83.3% (2004-2013) Number of patents issued in Arizona in 2014 grew 72.8% (2005-2014) Number of life and physical scientists grew 36.2% (2003-2012) (Note: 2012 is latest data available.) Percent of population 25 years and older with bachelor degrees or higher grew 16.6% (2005-2013) (Note: series begins in 2005, and latest available is 2013, so this data range is only nine years, rather than a full decade.) 90 81.6 83.3 percent growth 2005-2014 80 *See bullet-points for irregular date ranges 72.8 70 60 50 42 39.6 40 36.2 33.2 30 20 15.3 18.9 18.8 17.2 16.6 16.5 9.9 10 4.1 1.3 0 2|Page Arizona-Mexico Economic Indicators, www.azmex.eller.arizona.edu DATA HIGHLIGHTS The data below describe growth over the past decade in Arizona’s percent share of southern border state totals for selected indicators. Southern border state totals refer to the sum of Arizona, California, New Mexico, and Texas. The decade covered is 2005-2014, with two exceptions due to data availability, which are indicated. It should be noted that this decade spans the Great Recession of 2007-2009. Arizona’s percent share of bus crossings from Mexico grew 9.0% (2005-2014) Arizona’s percent share of personal vehicle crossings from Mexico grew 14.5% (2005-2014) Arizona’s percent share of U.S. exports entering Mexico via border states grew 8.9% (2005-2014) Arizona’s percent share of U.S. exports of transportation manufacturing products entering Mexico via border states grew 13.7% (2005-2014) Arizona’s percent share of transportation manufacturing products entering the U.S. from Mexico via border states grew 21.9% (2005-2014) Arizona’s percent share of employment in pharmaceutical and medicine manufacturing grew 63.3% (2004-13) (Note: 2013 data are the latest available.) Arizona’s percent share of life and physical scientist grew 9.0% (2003-11) (Note: data are only complete through 2011, thus this growth represents only eight years.) 70 percent growth 2005-2014 63.3 *See bullet-point for irregular date range 60 50 40 30 21.9 20 14.5 10 9 13.7 9 8.9 0 AZ’s bus AZ’s personal AZ’s share of crossings from vehicle crossings U.S. exports to Mexico from Mexico Mexico via border states AZ’s share of U.S. exports of transp. mfg. products to Mexico AZ’s share of Pharmaceutical U.S. imports of and medicine transp. mfg. mfg. products from employment* Mexico 3|Page Economic Business and Research Center, Eller College of Management, The University of Arizona Life and physical scientists* DATA HIGHLIGHTS The data below show five-year and one-year growth rates for selected indicators for Sonora, Mexico border states, and Mexico national totals: Sonora total population grew 6.1% (2010-2014) and 1.4% in 2014 Sonora real GDP grew 28% (2009-2013) and 5.3% in 2013 (Note: 2014 data not yet available.) Mexico IMMEX employment grew 23.9% (2010-2014) and 5.8% in 2014 Border states IMMEX employment grew 24.7% (2010-2014) and 5.7% in 2014 (Note: border states total is the sum of Baja California, Coahuila de Zaragoza, Chihuahua, Nuevo Leon, Sonora, and Tamaulipas.) Sonora IMMEX employment grew 24.5% (2010-2014) and 3.6% in 2014 Sonora FDI grew 134.9% (2010-2014) and 148.2% in 2014 Sinaloa FDI grew 71.8% (2010-2014) and decreased 44.7% in 2014 Sonora’s share of Mexico FDI grew 170.2% (2010-2014) and 386.1% in 2014 (Note: this growth rate was too large to represent on the chart.) 180 percent growth 2010-2014 160 *2009-2013 140 120 100 80 60 40 20 0 Sonora population Sonora Real GDP* Mexico IMMEX Employment Border States Sonora IMMEX Sonora FDI IMMEX Employment Employment Sinaloa FDI Sonora's share of Mexico FDI 7 6 year/ year percent growth in 2014 *2013 5 4 3 2 1 0 Sonora population Sonora Real GDP* Mexico IMMEX Employment Border States IMMEX Employment Sonora IMMEX Employment 4|Page Arizona-Mexico Economic Indicators, www.azmex.eller.arizona.edu Arizona-Mexico Economic Indicators: Summary 2015 The facts and trends assembled in this document are drawn from the Arizona-Mexico Economic Indicators: Annual Report and the Arizona-Mexico Indicators website: azmex.eller.arizona.edu The AZMEX website is a dynamic tool providing access to the most recent data at any time. So, if you find these data helpful, we hope you will visit the website often for the most recent data updates, analysis, and news. The site is also designed to be easily accessible from mobile devices, such as tablets and phones. The website monitors Arizona trade and competitiveness in the U.S.-Mexico region across six major categories: Arizona Trade Border Crossings Commodity Flows Economy Foreign Direct Investment Population You will find: 3,000+ indicator series; visualizations of important trends; comparisons across major border ports of entry, U.S. and Mexico border states, and national benchmarks; articles and news; and easy download of all data presented. You can also download the Arizona-Mexico Economic Indicators: Annual Report from the website. This report summarizes important changes and trends which have developed over the past year. The AZMEX website was launched in December, 2014, by the Economic and Business Research Center in the Eller College of Management at The University of Arizona, with collaboration and financial support from four of Arizona leading economic development organizations – Arizona-Mexico Commission, Arizona Commerce Authority, Arizona Department of Transportation, and Arizona Department of Tourism. The motivation for building this new set of online indicators is to monitor Arizona trade and competitiveness in the U.S.Mexico region across a range of key economic categories. While designed primarily to meet the needs of organizations engaged with improving Arizona trade and competitiveness, the AZMEX website will also be a useful tool for citizens, business leaders, and public sector decision makers interested in the unique opportunities the border region has to offer. 5|Page Economic Business and Research Center, Eller College of Management, The University of Arizona