An Overview of the New Zealand wine industry

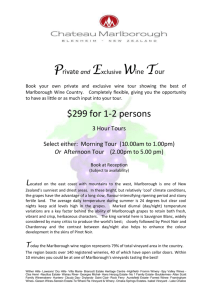

advertisement