Business Cycles and the World Wine Market Lisa Corin Phares

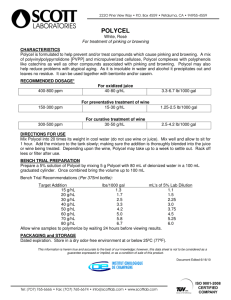

advertisement