File - Xavier Darnell Lightfoot

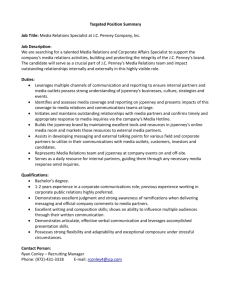

advertisement

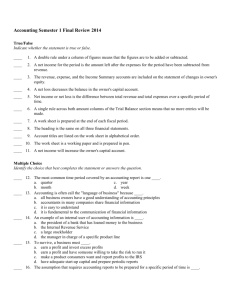

Xavier Lightfoot Intermediate Accounting Essay 1 There are about ten steps to the accounting cycle and I will be discussing them all in my essay while using JCPenney as an example. The first objective in financial reporting is to obtain information about external transactions and this is accomplished by source documents. All source documents are just a way to relay the necessary information for each transaction to the accountant. Source documents could be sales invoices, bills from suppliers, and cash register tapes. The documents will have the date, participating parties, nature of each transaction, and the monetary terms. For instance, JCPenney source documents could be a checks, receipts, or invoices from their suppliers. JCPenney would then use that information from the source documents to perform the next step in the accounting cycle, which is transaction analysis. For transaction analysis JCPenney would go over the different source documents to determine how it effected the accounting equation and what accounts were specifically involved. For example, JCPenney has many different transactions to occur in one business day such as supplies purchased on account costing $1000, salaries of $9,000 were paid to employees, or credit sales that totaled $10,000 that day. All of these are real examples of some transactions that JCPenney would have to deal with on a daily or weekly basis. The third step in the process after transaction analysis would be to record the transaction in a journal. All journals do is provide a chronological record of all the economic events that will affect the company or business. Any kind of transaction can be recorded in the journal because it has a place for the account titles, date of the transaction, account numbers, and explanations of why something is what it is. Therefore if JCPenney wanted to record their credit sales of $10,000 that day then they would do that by recording a debit to accounts receivable and a credit to sales revenue in the journal with the associated dollar amount which in this case would be the $10,000. They also could record the supplies they purchased on account by recording a debit to assets and credit to accounts payable for the $1,000. The fourth step of the process is at the end of the period to post or transfer the debit and credit information used in the journal to the general ledger accounts. Posting is just transferring all the information such as debits and credits recorded in journal entries to the specific accounts affected. The ledger usually has a posting reference such as the page number of the journal that the journal entry was recorded so that it is easy to maneuver between the journal and the ledger. Using JCPenney as an example if we use the same three transactions in the above paragraphs then their ledger would consist of cash, accounts receivable, sales revenue, supplies, and accounts payable. The fifth step of the process is to prepare an unadjusted trial balance. The trial balance is just a list of the general ledger accounts usually listed in the order they appear in the ledger with the date and ending summed balance to go along with it. The purpose of the trial balance is to check to make sure the summed debits of each account equal the summed credits of each account making sure that both sides are equally balanced so that the accounting equation is still correct that assets equal liabilities plus stockholders equity. For JCPenney their unadjusted trial balance would include the ending summed accounts with the proper debits and credits for cash, accounts receivable, sales revenue, supplies, and accounts payable. The sixth step in the process is to record adjusting entries and post them to the general ledger account. Adjusting entries are not transactions that have source documents or an exchange transaction with another entity. All they do is help with accrual accounting and satisfying the matching principle where we recognize revenues earned in that period regardless of when we get the cash. They also recognize expenses incurred no matter when the cash payment is made. So if JCPenney takes in credit sales of $120,000 in the month of January but did not receive $50,000 of those sales till February we would still recognize that revenue in January because that is the period in which it was incurred and vice versa for expenses. The seventh step is very simple we now have to prepare an adjusted trial balance. We do this because the adjusting entries have now been posted to the general ledger accounts and so we must go back and reflect any changes so that we will have an accurate or correct trial balance. The eighth step in the process is what we have been building up to it is the reason we have all the other steps because now it is time to prepare the financial statements. The first statement is the income statement and it basically summarizes the revenues, expenses, gains, and losses of the business. For example, JCPenney’s income statement would include their sales revenue, their costs of goods sold, and all of their expenses such as salaries, supplies, rent, and depreciation. After calculating these numbers you should get the net income, which essentially is the profit of your business or company. The next statement is the balance sheet, which is used to present the financial position of the company on a particular date. The balance sheet presents the assets, liabilities, and stockholders’ equity at a point in time. Balance Sheet items are grouped together in categories or common characteristics. The next statement is the statement of cash flows, which is used to summarize the transactions that caused cash to change during the period. The statement classifies all transactions as an operating activity, investing activity, or financing activity. The last statement is the statement of shareholders’ equity, which is set up to disclose the sources of changes in the various permanent shareholder’s equity accounts that occurred during the period. The ninth step of the process is to close the temporary accounts to retained earnings. The temporary accounts include revenues, expenses, gains, and losses. All of which are reduced to zero balances and closed at the end of the year only. In closing the last and final step of the process is to prepare a post closing trial balance and the purpose of this is to make sure all closing entries were prepared and posted accurately and the accounts are ready for the next year’s transactions.