No 'F_w*k1,Sef .s - Foundation Center

advertisement

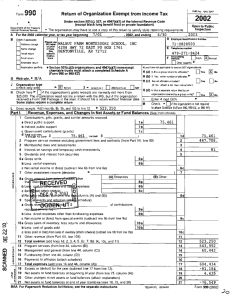

01/19/1995 9954912454 19 41 SCFLEDULE A (Form 990 or 990-EZ) PAGE GREIG CONSTRUCTION Organization Exempt Under Section 501(c)(3) (Except Private Foundation) and Section 5ot(e), 5010, 501(k), 501(n), or Section 49471a1(1) Norrxsmpt Charitable Trust Supplementary Information-(See separate instructions ) oeoa~m~ o~ .m. rr ..a~n " MUST be completed by the above organizations and attached to their Form 990 or 990-EZ w.,r . sM~ . 05 OMRNo 1;,15-OW ~! EmpIOYN identification numDlr Nam. of me argani:anor a ~, ~ Q.mQr~~ av+ P ~p1 S G~ ol S U?ZUT1l0 Compensation of the Five Highest Paid Employees Other Than Officers, Directors, and Trustees (See page 1 of the instructions List each one If there are non e, ente r. _No ne.") (a) Name and address of mcn emoioyae paid mnr. man f50 ODO bbl Title end average noes oar week GevMed to oosd .on C~^'oansabon lal Co~~~nn~tions io ~jnp1il~fF Osnll'I OI~i~S 3 OdPred-omornsillon (el E+oetsc aCCaunl and other 9llo~+a=tes- No Evr,Qloyee, Total number of S50000 other employees paid over 11111 Compensation of the Five Highest Paid Indeper (See page 2 of the instructions List each one (wheth etors for Professional Services or firms ) If there are none, enter " None ") (e1 rvos of service (a) Nsmn aid adCnse, of aecn .rnepel contractor w,0 more man $50 000 No 'F_w*k1,Sef .s (.1 Cninceroelion Total number of others receiving over $50 000 for prpfe9 9iWn31 services Fog PAponwrk Reduction Ad Notice, ax the Instructions for Farm 990 end Form YYO-EZ rv No 1 128-19 Schedule A (Form 990 or 990 IEZ) 2001 01/18/1935 9ci 18 4l 8054912454 PAGE 5REIG COFJSTRUCTIO[4 09 page 2 ~ ~rorm 090 a 990-EZ12001 Yes Statements About Actrvines (See page 2 of the instructions) any During the year has the organization attempted to influence national, state, or loca~ .legislation, including total expenses paid Ii 'Yes ' enter the matter or relerendijm° a legislative attempt to influence public opinion on IMuat equal amounts on hne 38, or incurred in connection with the lobbying activities * S Pan W "n, or line I of Part Vi-B I Vi-a Other Organizations that made an eiec},on under section SO1h) by fii,,g Form 5768 must (.o"iulete Pan of glvirg detailed description statement d Vi-B AND attach a organizations Checking "Yes ' muse complete Pert The lobbying activities 2 During the year, has the organization ether directly or indirectly engaged m any of the following acts with any or 5ubS18n1i31 contributors, trustees, directors, officers, creators key employees, or members 74 their families, with any taxable organization with which any such Carson is affiliated as an officer director trustee . majority explaining the owner or principal benei (if the answer to any question is Yes ' attach a detailed statement transactions a Sale, exchange or leaning of property? No 1 j J 2b b Lending of mosey or other extension of credit? c Furnishing of goods, services, or tacaities7 2c d Payment of compensation for payment or reimbursement d expenses d more than $t 000)' 2d -- 2e e Transfer of any part of Its income or asses' 3 Does the orgenaetbn make grams for scholarships fellowships, student loans att 7 (See Note below 1 l Do you have a section 401 annuity plan for your employ225o Note Attach e statement to explain now the Organization determines that individuals or organizations receiving grants or leans from it m furtherance of its charitable or00rams ' Uuahfy' to receive payments Reason for Non-Private Foundation Status (See pages 3 through 6 of the instructions) The organization .s not a private foundation because It is (Please check only ONE applicable box I 5 6 7 8 9 10 El A church . convention o1 churches or association of churches Section 7701b)(1)(A)f0 '~ A school Section 170(b)(1)(A)li4 (Also complete Part V ) Q A hospital or a cooperative hospital service organization Section t70(bi 0 A Fedoral, state, or local government or gmernmeMei unit Section 174(jI d A medical research organization operated in conjuri with a hospital Section t 701b1(1)IAt(ni) Enter the hospital's name, city. end Mate n nn organization operated fog the benefit of a college or university owned or operated by a governmental unit Section 1'Ofb11111A1(v) (Also complete the Support Schedule in Part IV-A) 11a El public An organization that normally receives a substantial part o1 it support from a governmental unit or from the goneril Section 170(b)(1)(A)I (Also complete the Support Schedule in Part IV-A ) i16 F~] A community trust Section 170(bi (Also complete the Support Schedule in Part IV-A) membership fees . and gross 12 ~ An organization that normally receives (1) more than 33K°ie Of its support from contributions, receipts from activities related to its charitable etc , functions-subject to certain exceptions and (2) no more then 336°/a Of its support from gross investment income and unrelated business taxable income (less se:tion 51 1 tax) from businesses acquires by the organization aver dune 30 1975 See section 509(a)(2) (Also complete the Support Schedule in Pan IV-n I 13 ~ an orqen~, t,on that 1s mot ronhoiied by any disqualified persons (other than foundation maraqers) and supports organizations described in (1) lines 5 through iz above Or (2) sertion 507(clfa~, 15i or (6), if troy meal the test of section 509(1 (See section 509(a)(3) ) of the instructions Provide the following information about the supported organizations (See page 5_ -T (b) Line number (a) Names) of supported arqanization(s) from above is [] nn organization organ i zed end operated to pest for public safety Section 509(a)(4) (See papa 6 of t h e inst ructi ons ) Schedule A (Fens 990 or B90-EZ) 2001 01/18/1395 19 41 PAGE GREIG CONSTRUCTION 13054812454 Schedule A lFwm 900 or 900-EM 2001 Pace 3 Support Schedule (Complete only it you checked a box on line 10 11 or 12 ) Use easel method o! accounting Note You ma use the worksheet m the Instructions for converting from the accrual to the cash method o1 accounnnq " Calendar year (or fled year beginning In) (a) 2000 (b) 1999 t ( e) 1 998 (d) 1997 15 Gifts . grenb, and contributions received (Do ~ ~ . rat include unusual grants See hoe 2B ~ 16 Membership fees received 17 Gross receipts from admissions merchandise sold of lervroes Wormed, or furnishing of facilities In any ectmty that ~a related to the organ imNais Chanteblo, etc , purpose 18 Gross income from interest . dividends amount! received from payment on securities loans (section St21aN5)) rents. royalties and unrelated business taxable income (less section 511 taxes) from businesses Acquired by tie organization 2M~ June 30 1975 79 Net income from unrelated business activities not Included in line 18 20 Tax revenues levied for the organization's benefit and either pad to it or expended on its behalf 21 The value of services d facilities furnished to the organization by e governmental unit without charge Do not include the value of service! a fecih6e! g"nerelly furnished to the public whROUt charge 22 29 Other Income Attach a schedule Do not include gin or (loss) from sale or capital assets Total of lined 15 through 22 25 Enter 1 % of line 23 24 Line 23 minus line 17 26 ~-_- OIpain2a11one described on lines 10 or 11 h c d e t 27 05 -, a (e) Total ~~- - _-- - ~- ~ - Enter 2°A of amount in column le) line 24 7/1 ar, Prepare a list for your records to show the name of and amount contributed by each person (other than a governmental unit or publicly supported organiZahon) whose total gifts for 1997 through 2000 exceeded the 26a amount shown m hoe 29e Do not file this list with your return . Enter the total of all these excess amounra " 2eb Total support for section 509(a)(1) test Enter hoe 2a, column (e) 26c " Ado Amounts from column (e) for lines 18 -- 19 -28e 22 _ _ 26b - " Public support (boa 26c minis line 28d total) " 7!e Public support percentage (line 28e (numerator) divided by Mme 2Ee (denominator) t apt _ _- W11, W1111711171,, -/, Oryanl :a4one described on line 12 . a For amounts included in lines 15 16 and 17 that were received from a "disqualified person ' prepare d list 10r your records to show the name of and total amounts received in warn year from each ryisqualiligCl pnr5on Do not file this list with your return Enter the sum of such amounts for each year (2000) b (19991 (1998) (1997 Far any amount included in line 17 that was received from each person (other than 'disqualified persons") prepare a list for your records to show the name 01 and amount received fog each year, that was more than the larger O} (1) the amount on line 25 for the year or ($) $$ OOG (Include in the list organizations described in lines 5 through 11 as wail as individuals ) Do not file this list with your return After computing the difference between the amount received and the larger amount described m (1) Or (2), enter the Sum of these differences (the excess amounts) for each year (2000) (1 999) c Add Amounts from column (e) for lines d e 1 p h ?E (1 998) 15 (1997) 16 --- 27c - _ -~ Add One 27a total _27d " end line 27b total Public support (line 27c total minus line 27cJ total) ~ 27e Total support for section 509(a)(2) lost Enter amount from line 23, column (e) " I,Zn Public support parpnLerqe (Imp Yle (numerator) divided 6y line 271 (denominator)) " 27 1K Investment income percentage (line 18, column (e) (numerator) divided by line 271 (denominater)~ " Zrri, -_ i Unusual Grant : For en organization described in line 10 11 . or 12 that received any unusual grants during 1997 through 2000 prepare a list for your records to show for each year, the name of the contributor, the date and amount o1 the grant and a brief description of the nature of the gra nt Do not fil e thi s li st with your return Do not inclu d e these grants in line 75 17 20 21 Schedule A (Form 990 or GBO"E21 2001 91/19/1935 19 41 9054912454 GREIG r0NS7RUC710N PAGE A dorm 90o a ooo-EA goat Private School Questionnaire (See page 7 of the instructions ) r ah page 4 (To be completed ONLY by schools that checked the box on line 6 in Part IV) 29 30 37 yes Does the orqanlzatlon have a faaally nonCi :cnminaiory policy toward students by statement in its charter bylaws other governing instrument or in a resolution of in governing body? Does the organization include a statement of its raclallv nondiscriminatory policy toward students m ail it brochures catalogues and other written communications with the public sealing with student admissions, programs, and scholai 99 No 30 Has the organization Publicized its racially nondiscriminatory policy through newspaper or broadcast media during the period o1 solicitation for students, or during the registration period if q has no solicitation program ~n a way that makes the polity known to all part : of the general Community d serves? If "Vas " please describe if 'NO ' Please explain (I! you geed more space attach a separate statement 1 32 b Does the orqanlzahon maintain the frjllow,nq Records indicating the racial composition of the student body faculty and administrative staff'! Records documenting that scholarships and other financial assistance are awarded on a racially nondiscriminatory C Copies of all catalogues, brochures announcements and other written cpmmuniCOnOnS to the public dealing a d basis~ with student admissions . programs and scholarships? Copies of all material used by the organization or an its behalf to Solicit Contributions' V////, 32? 32b 32c, 32d If you answered 'NO'to dnv of the above Please Explain 0! you need more space attach a separate Statement J 33 Does the organization discriminate by race in any way win respect to a Students' rights or prlvllei b Admissions policies? c Employment of faculty or administrative stai d Scnolarshipe or other financial assistance' 0 Educational policies, IF Use of facilities? 9 Athletic programs? h Other extracurricular activities) 33f If you answered "Yes" to any of the above pl?ase explain (if you need mope space attach a separate statement ~ 34 Does the organization receive any financial aid or assistance from a governmental agency b 35 Hay the organization's right to such aid ever been revoked or suspended? If you answered "Vas' to either 34a or b grease explain using an attached statement 0005 the olganl2itiOn certify that It hag complied with the applicable ICQuif6mBnts of sections 4 01 throwgh 4 05 of Rev Prod 75-50 . 1975-2 C 8 SB7 covering racial nondiscr i minati on? If "NO"attach an explanation ~~35 ~X ~ .' scn*auie A (Form 000 or 990 ezl zoo, 01/1911335 18 41 9954812454 PAGE GREIG CONSTRUCTION 04 990 w 990-E21 2001 Lobbying Expenditures by Electing Public Charities (See page 9 of the instructions ) (To be completed ONLY by an eligible organization that fled Form 5768) "_a _ I] if the organization belongs to an affiliated group Ch eck t b C] if you checked "a" and 'limited control Affiliated yrouo tdaia Limb on Lobbying Expenditures (ihe term ' expenditures" means amo un ts paid or incu rred ) 36 Total lobbying expenditures To influence public opinion Iprassroots lobbying) Total lobbying expenditures to influence a legislative body (direct lobbying) 39 37 12 43 as is be completed for ALL elecllnp organaaul '=a~-^0 Total lobbying expenditures (add lines 36 and 371 Other exempt purpose expenditures Total exempt purpose expenditures (add lines 38 and 39) Lobbying nontaxable amount Enter the amount from the following tableThe lobbying nontaxable amount isIt the amount on line 40 Is20% o! the amount on line 40 Not over 5500000 peer 1500 000 Gut not over $i,000000 $100 000 plus I5% of the excess over $500,000 $175 000 plus 1 0% of the excess over $1 000 000 Over $1,000 ODO but not over $1,500 000 Over E1,500 000 but not over $1 % 000 000 8225 000 plus 5% of the excess over $i 500 000 57,000,000 Over $i % OU0000 amount (enter 25% 01 line 411 Grassroots nontaxable Subtract line 42 from line 36 Enter -0- if line 42 i5 more than line 36 Subtract line 41 from line 38 Enter " 0- d line 41 is more than line 38 38 09 40 41 rovisions apply .. 'b) 39 40 41 -n- 42 43 44 - 0 ~U- n . Caution . If there i9 en amount on ether line 43 or tine 44 you must hie Form 4720 4-Year Averaging Period Under Section 501(h) (Some organizations that made a section SOi Ih) election do got have to complete ail of the rave columns below Seethe instructions for lines 45 through 50 on page 11 of the ~ns1i -__, Lobbying Expenditures During a " Vear Avaraplnp Period Calendarr year (or fiscal year beginning m) " 45 Lobbying nontaxable amount 46 Lobbying ceiling amount (150% of line 45(e)) 47 Total lobbying expenditures aB Gras sroots nontaxable amount 49 Grassroots ceding amount f150% of I~ne d81e1) 50 Cuas+roots lobbying expenditures (e) 2001 I_ (b) 2000 ( e~ 1 999 /// --\ , Lobbying Activity by Nonelecting Public Charities (For repo rting only by organizations that did not complete Pa rt VI-A) (See pa Dueng the year did the organization attempt to ~Miuence national state or local legislation including any attempt to influence public opinion on a legislative matter or referendum, through the use of a b c d a f p h 1a1 Total 1a) 1998 12 of the instructions Yes No Amount Volunteers Paid stall or management (include compensation in expenses reported on lines C 1hrpugh h Medisk advertisements Mailings to members, 18g16lators, or the pubic Publications, or published or broadcast statements Grants to Other organizations for lobbying purposes DreGt contact with legislators, then staffs government officials or a legislative body . A_ Rallies demonstrations seminars conventions Spe4ChQS lectures or any other means Total lobbying expenditures (Add lines c through h ) If Yes' to env of the above . also attach a statement arv,na s detailed CeSCnDbon of the lobbying ac ich "CUI. " (FOrrit 990 or 99OE2) 20101 X1/19/1995 19 41 9954912a5a ,REIG CONSTRICTION PAGE ScheEUN A (Form 000 a 990-EP 2001 MM Information Regarding Transfers To and Transactions and Relationships With Noncharitable Exempt Organizations (See page 12 of the instructions) _. ., 07 Page 6 Did the reporting organization directly or indirectly engage in any of the following with any other organization described In section 501(c) of the Code (Other than section SOt Ic)(3) brganiZauonsl of in section 527, relating to political organization 51 e Yes Transfers from the reporting organization to a noncharlt24la exempt organization o1 (1) No Cash an (II) Other assets b Other transactions b( .) (i) Sales or exchanges o1 assets with a noncharitable exempt organization b 0d pp Purchases of assets from a noncharinble exempt organization (m) Rental of facilities, equipment or Other assets (iv) Reimbursement arrangements b'~l _ Is v (v) Loans or loan guarantees fin) Performance of services or membership or fundraising solicitations _ c Sharing of facilities . equipment, mailing fists, other assets, or paid employees .~_ d if tie answer to any o1 the above is 'Yes " complete the following schedule Column (4) should always show the fen market value of the goods . other assets . 0r services given by the reporting organization 11 the organization received less than lair market V21Ue in any transaction or sharing arrangement show m co l um n fdi the value of the goods other assets or services received Line no Amwnl inro1veG Nams of ~~nnc~T~labia aram ol organization D~scnpuon of _rpn^.len ifaneaqioi,i nod smarmy =n wgwiloi,l, - 52a is the organization directly or indirectly affiliated with or related to one or more tax-exempt organizations described in section 501(c) M the Code other than section 501(c)13)) or m section 5277 1b If 'Vas,' Complete the 1o4lowin0 schedule w Nam " of organization rot 7yDe o1 pryenlieno, MnrC an ncYCf.d p,.yar ----- -- ~a ~'J Yes - No --- DAN ripUOn of relationship SchW41e A (Form 990 or 990"EZ) 2001