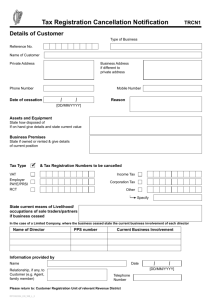

Statement of Practice - IT/3/07

advertisement