Electronic and Physical Market Channels

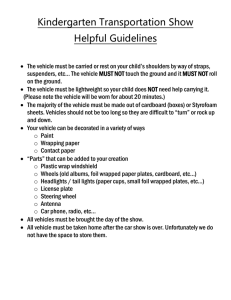

advertisement