Rise of India's Digital Consumer

advertisement

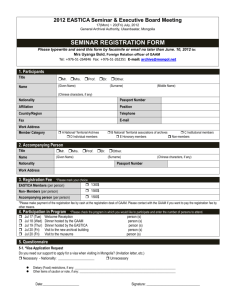

Rise of India’s Digital Consumer Kedar Gavane Director, India kgavane@comscore.com #SOII12 comScore is a Global Leader in Measuring the Digital World NASDAQ SCOR Clients 1700+ worldwide Employees 900+ Headquarters Reston, VA Global Coverage 170+ countries under measurement; 43 markets reported Local Presence 32+ locations in 23 countries #SOII12 Global Coverage, Local Presence #SOII12 Unified Digital Measurement™ comScore Digital Business Analytics User Analytics Audience Measurement Site Analytics Vertical Market Solutions Social Analytics Advertising Analytics Copy Testing Campaign Verification Ad Effectiveness Cross Media Mobile Analytics Mobile Audience Measurement Network Analytics & Optimization Customer Experience & Retention Management Presented by : Kedar Gavane, Director, India #SOII12 Unified Digital Measurement™ (UDM) Establishes Platform For Panel + Census Data Integration Global PERSON Measurement Global MACHINE Measurement PANEL PAGE TAGS Unified Digital Measurement (UDM) Patent-Pending Methodology Adopted by 88% of Top U.S. Media Properties Presented by : Kedar Gavane, Director, India #SOII12 Broad Client base and deep expertise across key industries Media Agencies Telecom/Mobile Financial Retail Travel CPG Pharma Technology #SOII12 Global Trends #SOII12 Global Online Growth Trend 7% Unique Visitors (in millions) Jul 11 15+ Age, Home and Work users 8% 574 3% 617 370 11% 399 206 Asia Pac Jul 12 Europe 213 North America 120 134 11% 121 134 Latin America Middle East & Africa • Worldwide online audience has grown by 7% in the last 12 months • Asia Pac markets have added over 40 million users and continues to grow strongly • Latin America and MEA have grown faster with over 11% Y-o-Y growth Presented by : Kedar Gavane, Director, India #SOII12 BRIC Nations - Growth Comparison 5% Unique Visitors (in millions) Jul 11 Jul 12 41% 15+ Age, Home and Work users 336 322 20% 6% 52 48.9 Brazil 62.6 44.5 59 49.1 Russia 62.6 44.5 China India • India is the fastest growing online market in the last 12 months • Russia and China have added over 10 million users in the last 12 months and continue to grow • India’s explosive online growth to continue, as most online categories show below average penetration compared to global averages Presented by : Kedar Gavane, Director, India #SOII12 Digital consumer achieves critical mass 15+ age, home and work Shared, Mobile and others Time Spent (in billion minutes) Unique Visitors (in millions) 114 83 44.5 88.5 56.3 124.7 62.6 46.3 42.2 Jul 11 Nov 11 July 2011 48 July 2012 Pages Viewed (in billions) 57.7 38.5 36 62.1 54.6 Mar 12 Jul 12 July 2011 69.9 July 2012 • Total internet usage of 124.7 million in July 2012, a 41% growth from last year • Engagement metrics have been maintained • With 124 million internet users, India is at a 10% internet penetration *based on July 2011 to July 2012 data #SOII12 Demographic distribution - Youth driving the growth 1.3 55+ 1.8 2.4 45-54 yrs 3.6 6.5 75% 22.5 15.3 35-44 yrs 9.7 25-34 yrs 13.7 15 23.7 15-24 yrs 7.5 0 21.9 7.5 15 Demographic distribution of UVs in % 22.5 30 • 75% of the audience is below the age of 35 yrs, makes it one of the youngest online population • Females form 39.3% of the total audience • Highest growth seen among 15-24 male and female segments Chart based on July 2012 data for15+ Age, Home and Work users #SOII12 Online Category Trends July 2011-12 #SOII12 Presented by : Kedar Gavane, Director, India The Super Seven - High growth categories YoY Growth % Jul’12 Reach % 80.3 54 News Search 43 Retail 43 Health 43 SN 43 Travel 41 40 60 Games 41 91.5 59.9 59.9 21.1 21.1 95.5 44 • Unprecedented growth in Travel, Search, SN and News, surpassing WW averages • Growth to continue in Retail, Games and Health, as they are below WW averages • Key drivers being content and accessibility • Coupons category has de-grown by 38% as players have moved to allied verticals Graph based on July 2011 and Jul 2012 data for15+ Age, Home and Work users The Top 10 Sites - Year on Year growth 60 45 39% 59.7 15+ Age, Home and Work users 47% 9% 52.1 42.8 35.3 30 36.9 40.3 21% 29.3 42% Facebook Yahoo! 46% 22.6 15.9 Google Jul 12 Unique Visitors (in millions) 24.2 15 0 Jul 11 35% 21.9 15 Microsoft Times Internet Wikimedia 14.9 20.2 BitTorrent 19% 16.2 37% 19.3 Network18 11.9 -6% 16.4 16.2 15.2 Ask Rediff • 3 out of the top 10 have kept pace with the overall growth • Increased engagement among the top 10 in terms of time spent and pages viewed • The frequency of user visits has also increased over 10-40% among the top 10 Presented by : Kedar Gavane, Director, India #SOII12 Explosion of News/Info Consumption News/Info Jul’12 Reach % Unique Visitors (in millions) 50.2 32.7 The Times of India New York Times Digital HT Media Ltd 40.8 32.6 ONEINDIA.COM Sites 35.1 India Today Group IBN Live NDTV The Economic Times The Hindu Group INDIA.COM NEWS Jul 11 Oct 11 Jan 12 Apr 12 20.4 18.7 Yahoo!-ABC News Network Jul 12 The Indian Express Group BHASKAR.COM 11.3 11.1 9.6 8.5 7.9 7 6.7 5.7 4.6 3.7 3.2 • A 54% growth registered, with multiple access points including mobile and tablets • The reach avg is close to global average of 80% and is still growing • One of the most engaged categories with 5 min per visit Chart based on July 2012 data for15+ Age, Home and Work users Growing NRI consumption among local sites India NRI % of Unique Visitors 100% 35% 75% 50% 22% 36% 53% 32% 55% 83% 78% 65% 17% 12% 88% 68% 64% 47% 45% 25% 0% NDTV IBN Live Times of India Manorama Rediff In.com Cricbuzz ICICI Bank • Sizable international audience visitation key sites including News, Portals, Sports and Entertainment • Regional newspapers have the highest share of international audience and are the best way to reach out to NRI consumers • The traffic is growing across categories and we will be looking at reporting it as a separate segment in the coming dayss Chart based on July 2012 data for15+ Age, Home and Work users Online Retail - The boom continues Retail Unique Visitors (in millions) 10 Unique Visitors (in millions) 37.5 7.5 33.3 26.1 27.6 29 5 2.5 0 Jul 11 Jul 11 Oct 11 Jan 12 Apr 12 Jul 12 Oct 11 Amazon sites Jabong Jan 12 Flipkart Myntra Apr 12 Jul 12 Snapdeal Homeshop18 • 3 out of 5 online Indians visit online retail sites, growth of 43% • The category has seen mushrooming of several players across horizontals and verticals • A close battle between Snapdeal and Flipkart in horizontal retail and Jabong and Myntra in the lifestyle category respectively • Aggressive marketing and consumer need have led to this unprecedented growth Chart based on July 2012 data for15+ Age, Home and Work users #SOII12 Fastest growing Retail categories YoY Growth % Apparel 13.4 362 Consumer Goods 2.9 119 Sports/Outdoor 100 Home Furnishing 98 Retail Food Jul’12 Reach % 90 Retail Movies 76 Comparison Shop 75 2.8 1.5 2.1 10 15 • Apparel is the fastest growing retail sub-category, reaching 13% of online users • Consumer Goods, Home Furnishing and Sports have shown early signs of growth and will only grow faster in the coming months • Flowers/Gifts/Greetings category de-grown by 33% • Comparison shopping is expected to keep pace with retail reach of 60% • Vertical Retail segments will be the fastest growing in coming months Chart based on July 2012 data for15+ Age, Home and Work users #SOII12 Reach in Travel category surpasses WW average Jul’12 Reach % 19.2 Indian Railways 11.6 MakeMyTrip 8.3 Yatra Online 4.6 Jet Airways 3.9 TripAdvisor Media Group INDIARAILINFO.COM 3.2 CLEARTRIP.COM 3 Expedia Inc 2.9 Travora Media MUSTSEEINDIA.COM REDBUS.IN Makemytrip 11.6% Yatra 8.3% Cleartrip 3% 2.6 2.3 2 Unduplicated reach : 16.4% • 1 out of 5 online users visit Indian Railways site • High duplication among the OTAs, with customers looking for best fares • Alternative travel options like Bus and Car rentals have picked up in last 12 months Chart based on July 2012 data for15+ Age, Home and Work users #SOII12 e-Commerce Transactions in India Indian Payment Type Transaction Share, Q2 2012 Direct Debit $204 T M M IRCTC 58% $17 Travel Yatra $166 All Others 2% cash/COD 7% Average Transaction Sizes (Apr - Jun Mastercard 12% Flipkar t $35 Retail ’12) 27 $ i h Yeb Myntra $24 Visa 21% • Direct debit or Netbanking is the most popular format of the payment • Travel controls the majority of dollars and transactions in the market, driven largely by IRCTC • COD/Cash payments are more popular in the retail category • IRCTC averages at $17 per transaction and Flipkart stands at $35 per transaction Chart based on data for the months between Apr to Jun 2012 for Travel and Retail category Facebook’s dominance 15+ Age, Home and Work users 47% Jul 11 52.1 Unique Visitors (in millions) 35.3 36% 5.8 Facebook Jul 12 -69% 12.6 5% 7.9 Linkedin 3.8 Orkut 3.8 3.6 Twitter 2% 3.8 3.7 Bharatstudent • Facebook has emerged as the market leader in the SN category • The engagement on Facebook is highest among any category • Facebook users spent 3.8 hrs on an average in July 2012 and 17.4 visits per person • Linkedin has also shown over 36% growth in the last 12 months Presented by : Kedar Gavane, Director, India #SOII12 Entertainment - The blockbuster category Entertainment Jul’12 Reach % Unique Visitors (in millions) 55.8 40.6 Jul 11 41.1 43.6 Oct 11 Jan 12 47.8 Apr 12 Jul 12 53.7 Youtube 14.8 CBS Interactive SONGS.PK 8.8 omg!Yahoo! 8.8 Yahoo! Movies 7.7 BEEMP3.COM 7.6 DAILYMOTION.COM 7.2 ToneMedia 7.1 IMDb 6.9 MP3RAID.COM 6.2 • Entertainment category has 89% reach, still lower than WW average of 94.1% • Entertainment added 15 million UV’s in the last 12 months • Youtube leads the pack with highest reach in the category • The growth comes from bollywood video and music content, more sites to come up with the opportunity Presented by : Kedar Gavane, Director, India #SOII12 Mixed growth in other categories Finance SBI ICICI HDFC Moneycontrol Indian overseas 56.6 9.5 9.2 8.6 7.1 6.7 Biz/Finance - 35% growth Career services Naukri Timesjobs Monsters Shine Indeed 43.3 13.3 6.6 6.6 4.7 4.6 Career Services - 30% growth Real Estate 99acres magicbricks commonfloor indiaproperty makaan 8 1.8 1.8 1.1 1 0.7 Real Estate - 38% growth Automotive zigwheels Cardekho Carwale Gaadi oncars 17.8 3.6 2.8 2.7 1.8 1.5 Automotive - 18% growth Presented by : Kedar Gavane, Director, India #SOII12 Online Video continues to soar Video Viewers (in millions) Min per viewer 433 459 455 Videos viewed (in billion) 373 3.4 1.9 32.4 34.8 42.3 44.5 Jun 2011 Oct 2011 Mar 2012 Jun 2012 • Online video viewers in India have grown over 37.3% • The engagement has reached 3.4 billion videos every month • 52% of the total videos belong to the entertainment category • YouTube top channels are related to Bollywood • Video advertising has grown proportionally with growing inventory 15+ Age, Home and Work users Jun 2011 Jun 2012 Top YouTube Channels Tseries Vevo YoBoHo Eros Shemaroo Rajshri 13.4 12.9 9 8.4 7.5 7.4 Video Views (Millions) Mobile Engagement - The Growing Phenomenon Top categories by % share Access Type by OS Mobile Access 100% 50% 75% 72% Wifi Market Share of OS 45% Others 63% 75% 50% 0% Android 54% Mobile Tablet 25% 24% 25% 74% 75% 74% 55% 51% 25% PC 25% 28% iOS RIM iOS 4% Symbian 16% Symbian RIM 1% Android 16% 44% Weather Telecom SportsEnt - Music • The pages viewed on mobile has grown from 3% in July ’11 to 7% in July ’12 • Mobile and tablets access contribute to 7% of Indian online pages viewed • Food, Travel information, online trading are popular categories on tablets • ioS forms 80% of the tablet market share by page requests Device Essentials - Jun 2012, data based on total pageviews as the universe #SOII12 Future Trends in India - A Summary • Smartphones and tablets to drive engagement and usage further through WiFi access • Explosive growth expected in Games, Health, News and Retail categories. • Entertainment will be the key content growth area across mobile and PCs • Categories like Travel, News and Career services to continue steady growth • Increase in Cash-On-Delivery market share with great share of transactions from Retail • Online advertising to aid brands in reaching younger audiences Questions? #SOII12 Thank you Rise of India’s Digital Consumer Kedar Gavane Director, India kgavane@comscore.com

![[#STRATOS-256] HTTP 500 page returned if user click on the cloud](http://s3.studylib.net/store/data/007375298_1-8a1d7dac356409f0d3c670b454b6d132-300x300.png)