Appendix D: Financial Modeling Tools

advertisement

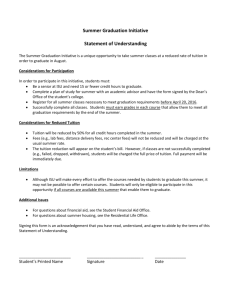

Appendix D Financial Modeling Tools TWU Summary Budgets Revenue/Expense Examples Derived from Revenue-Estimating Spreadsheet developed during the Visioning Process 44 TWU Budget Fiscal Year 2013 BUDGETED BUDGETED REVENUE EXPENSES $ 79,302,689 47% $ 79,302,689 49,973,319 30% 48,274,719 29,179,355 17% 28,764,343 10,169,695 6% 4,374,000 $ 168,625,058 100% $ 160,715,751 BUDGETED SURPLUS $ 1,698,600 415,012 5,795,695 $ 7,909,307 Plant Funds Restricted Funds State Grants & Contracts Private Grants & Contracts Scholarships Federal Grants & Contracts Loan Funds Unrestricted Gift Funds $ $ Total $ Education & General Designated Funds Auxiliary Funds Higher Education Fund Total Operating Budget 36,064,912 $ 1,111,791 6,667,694 18,478,834 5,055,242 242,000 494,219 236,739,749 $ 36,064,912 - 1,111,791 6,667,694 18,478,834 5,055,242 65,000 494,219 177,000 - 228,653,442 $ 8,086,307 45 Detailed Budget By Funding Source Percentage Of Operating Budget Category Amount 27% 6% 13% 1% E&G E&G E&G E&G $ 46,176,745 $ 10,904,887 $ 21,142,057 $ 1,079,000 $ 79,302,689 State Appropriations (Formula Funding) Employee Benefit Appropriations Statutory Tuition & Lab Fees Other Total E&G 17% 4% 7% 1% Designated Designated Designated Designated $ 29,055,807 $ 7,140,477 $ 12,077,035 $ 1,700,000 $ 49,973,319 Designated Tuition Revenues Program & Instructional Enhancement Fees Incidental Fees (application, computer use, transcript) Investment Income Total Designated 4% 1% 2% 3% 3% 4% Auxiliary Auxiliary Auxiliary Auxiliary Auxiliary Auxiliary $ 7,103,324 $ 1,968,123 $ 2,824,158 $ 5,483,024 $ 4,220,133 $ 7,580,593 $ 29,179,355 Student Services Medical Service Fee Fitness & Rec Fees Miscellaneous Income & Services Food Services Housing Total Auxiliary 6% HEF $ 10,169,695 Higher Education Funds (Specific use ‐ capital) 100% $ 168,625,058 Details Total Operating Budget 46 TWU Revenue/Expense Examples In the process of developing a Vision regarding the size and composition of the desired TWU student body of 2018, there was much discussion of which programs generated financial resources for the institution. The Committee heard comments such as: Undergraduate programs at TWU keep the lights on – large numbers of students, large class sizes, less costly faculty, larger teaching loads relative to graduate faculty, etc. Graduate programs generate proportionately larger amounts of revenue due to formula funding rates (up to 20X UG liberal arts), incrementally larger graduate tuition, etc. Which statement is correct? Probably neither as stated. What seems to increase the generation of net revenue (SCH tuition and academic fees less direct academic expenses, such as faculty salaries, grad assistants, etc.) is a relatively large number of credit hours per faculty resource committed. When expressed as a ratio (Academic Revenue/Direct Academic Expense), larger ratios reflect a larger generation of revenue for each dollar expensed. To increase the revenue (and increase the ratio), it is necessary to increase the number of students and/or the rate of reimbursement received by TWU (formula funding, graduate tuition, differential tuition, etc.). To increase the expense (and thereby reduce the ratio), it is necessary to use more highly compensated instructors (Full Professor vs. Assistant Professor) or apply policies that increase the number of faculty units associated with each SCH (e.g., 1.X load credit for a lab, 1.X load credit for graduate courses, 1.X load credit for course enrollment over XX students, 1 hour of load for each 2 thesis students, 1 hour of load for each dissertation student, 1 hour of load for each 6 students in practicum, etc.). The attached tables are based on the Nutrition and Food Sciences Department. In particular, the formula funding rates for UG Lower, UG Upper, Masters, and PhD are used in all of the calculations and actual enrollments in courses are associated with the examples. For the large undergraduate programs (BS Nutrition, BS Nutrition in Business and Industry), enrollments in UG Upper level lecture classes are typically either 40 or 80. The smaller undergraduate program (BAS Culinary) has a typical enrollment around the minimum required level of 12. At the graduate level, the MS programs in Nutrition had about 10 courses with enrollments from 25 to 50 students in recent years. There are another 25 or so courses that enroll from 6 to 12 students each. The PhD program has relatively few lecture courses and those courses typically enroll 8 students each. In addition, some graduate students enroll in practicum, research, and thesis or dissertation. 47 Using the above assumptions and the attached tables, the following are some revenue and/or expense conclusions about the course offering in NFS: • NFS generates strong net revenue ($40-80K) in the following courses: o UG-LL with enrollment of 160 o UG-UL with enrollment of 80, o Masters with enrollment of 30+ In each of the above situations, the revenue to expense ratios were between 4.0 and 5.5. These results provide resources to offset other NFS expenses and provide significant resources to address the operating costs of the university. • NFS generates either negative or tiny net revenue in the following course situations: o UG-UL with enrollment of 12 o Masters with enrollment of 8 o All graduate practicum, research, and thesis In each of the above scenarios, except PhD research, the revenue to expense ratio is 1.0 or slightly higher. Essentially, NFS contributes nothing to non-direct expenses of the department and nothing to the rest of TWU. • The remaining courses fall in between these examples of strong and weak net revenue generation. • To illustrate the relative efficiency of revenue and expense generated at different enrollment and degree levels in NFS, consider the following: o An UG-LL course with 160 students taught by a clinical associate professor and a Master’s degree course with 40 students taught by a tenured full professor generate comparable net revenue with identical Rev/Exp ratios (5.5). o An UG-UL course with 12 students and a PhD dissertation or Masters practicum, research, or thesis course generate comparable net revenue with nearly identical Rev/Exp ratios (~1.0 – basically covers direct instructor expenses). o A PhD course with 8 students, a Masters course with 17 students, and an UG-UL with 48 students, and an UG-LL course with 65 students (all taught by a full professor), each generate a comparable amount of net revenue with about a 3.0 revenue to expense ratio. o These conclusions would vary for other disciplines based on the formula funding multipliers (from 1.0 to ~20) and any student/faculty ratios required by specific program accreditation (OT, PT, Nursing, Dental Hygiene, etc.) or discipline standards (visual art studio, music, etc.) 48