Cigna Corporation Client Report

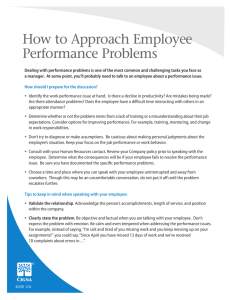

advertisement