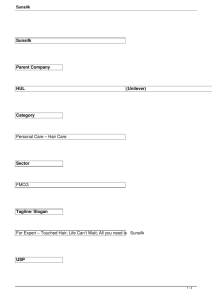

Hair Care Survey on Parlors & Salons in Dhaka

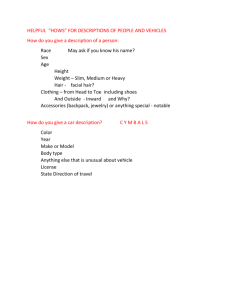

advertisement