Warner Music Group - Corporate-ir

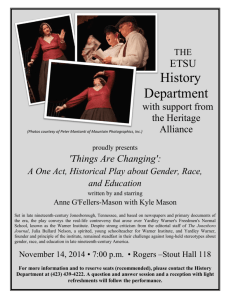

advertisement