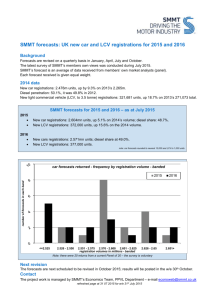

Van travel trends in Great Britain

advertisement