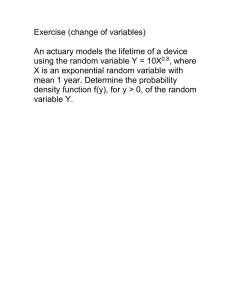

As the luxury demographic blurs globally and exclusive

advertisement

s the luxury demographic blurs globally and exclusive services (invite-only luxury cars, on-demand yacht delivers) rise, what does the future luxury market look like? A Hint: it’s customisable, sustainable and poly-cultural. Think Tank > Innovation > Future Forward Salvatore Ferragamo Panah With China minting one new billionaire a week and India outpacing the UK, Germany and France in homegrown billionaires by 2023, the global face of wealth is rapidly changing From Ferrari's invite-only car to Burberry's VIP salon in Beverly Hills, a new standard of luxury services offer for VIC (very important clients) is emerging Referred to as 'the next China for luxury items in terms of opportunity', retailers are beginning to dip their toes into the world of luxury e-commerce, a platform that will reach $21b by 2020 and is expected to drive 40% of sales growth for luxury brands Time is the the ultimate luxury, and high-net-worth individuals (HNWI) expect services that save time (on-demand helicopters, anyone?) and experiences that promote mindfulness (goodbye, gadgets!) Luxury is increasingly about having a clean conscience: acts of gratitude are replacing 'chequebook charity', and sustainability is growing more stylish daily as microalgae dyes and lab-grown materials (including ivory) make green the new black Studio Blond & Bieber Think Tank > Innovation > Future Forward Overview Think Tank > Innovation > Future Forward Once a clear differentiator between The Haves and The Have Nots, the luxury market's new normal is one of increasingly blurred global demographics, driven largely by uneven growth rates. The American middle class have yet to return to the free spending of the late 1990s, which isn't surprising as 81% of American counties have lower median incomes than 15 years ago, despite an overall economic growth of 83%. Britain isn't faring any better: between 1980 and 2010, middle-income households have decreased 43% compared to a 33% increase in wealthy households. In contrast, emerging countries are seeing accelerated growth in all luxury markets. Brain Pickings According to McKinsey & Company, emerging countries will account for more than 55% of the total in 2025, growing three times faster than mature countries, "with seven new cities landing on the list of top luxury cities: Beijing, Chongqing, Guangzhou, Hong Kong, Rio de Janeiro, Shenzhen, and Tianjin". Estimates show that by 2025, the top luxury growth categories in emerging markets are women's ready-to-wear (32%), luxury spirits (44%), and high-end cosmetics (47%). Stampd Think Tank > Innovation > Future Forward Garance Doré Louis Vuitton Hermès Stealth Wealth As the boundaries of luxury demographics grow increasingly blurred, two standout consumer groups to follow closely are emerging: Carnivores and Canaries. Carnivores are newly minted millionaires (globally, 920,000 were minted in 2014) that spend lavishly and equate brands with a reflection of status. This consumer group is thriving in Asia, which is now home to more millionaires and billionaires than any other region, and while North America currently holds the title for total value of wealth held by high-networth individuals ($16.2 trillion), APAC is expected to take the lead by 2016. India's wealthy are also thriving – in 2015 the country led global growth for both high-net-worth people (26% growth) and total wealth (28%). For Carnivores living in APAC and India, exclusivity and brand recognition are essential – 56% feel its important they recognise the brand they are wearing or using, and 86% buy products based solely on exclusivity. Additional findings by Agility Research & Strategy show this group embracing luxury ecommerce, with 59% of Chinese consumers buying luxury goods online and 80% researching luxury products online prior to purchase. In contrast, Canaries prefer the in-store experience as they view luxury not on a brand basis but rather as part of a wider scope that extends to experiences and services with high prices. Impacted by the Great Recession, Canaries are cautious and calculated spenders, many of whom flaunt their wealth through lifestyle choices rather than product. This stealth wealth mindset is affecting the luxury marketplace: 69% of millionaires said they did not spend anything on collectibles in 2014, yet gourmet food and wine markets are booming (Champagne imports rose 19% in 2014), and global tourism continues to soar, setting a global record of 1 billion arrivals in 2014. Think Tank > Innovation > Future Forward Ravish London Think Tank > Innovation > Future Forward "By 2023, only three countries in the world, namely the USA, China and Russia, will have more billionaires than India,” says Samantak Das, chief economist and research director at Knight Frank India. Though the Chinese luxury market is undergoing massive shifts in quantity (slower economic growth, a ban on government gifts) and quality (a more mature market is embracing quiet luxury in lieu of multiple logos and heavy branding), a new billionaire was created almost every week in China during Q1 of 2015. India is expected to have more billionaires than the United Kingdom, Germany or France in less than 10 years. Though the UK is being outpaced in billionaire creation, London is the destination of choice for the ultra rich, topping New York as the most desirable city for the world's supremely wealthy in 2014. It also beats the rest of the world on sales of homes over £100m. Lakme Fashion Week Lakme Fashion Week Business of Fashion Ravish London Business Insider While luxury homes make of 28.1% of the luxury market spend, the luxury lifestyle markets are steadily rising. Art sales have more than double since 2009, reaching $16bn in 2014. The global luxury car market is up 10% ($100bn in sales in 2014) but the biggest winner is the luxury travel market, which has grown 48% since 2010. Think Tank > Innovation > Future Forward PARA VERIFICAR EL REPORTE COMPLETO, ENTRE EN CONTACTO CON NUESTRO EQUIPO Y PEDÍ UN ACCESO DE PRUEBA PARA DESCUBRIR TODO LO QUE WGSN PUEDE HACER POR TU NEGOCIO.