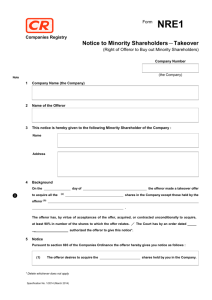

EXIT OFFER LETTER DATED 12 AUGUST

advertisement