1

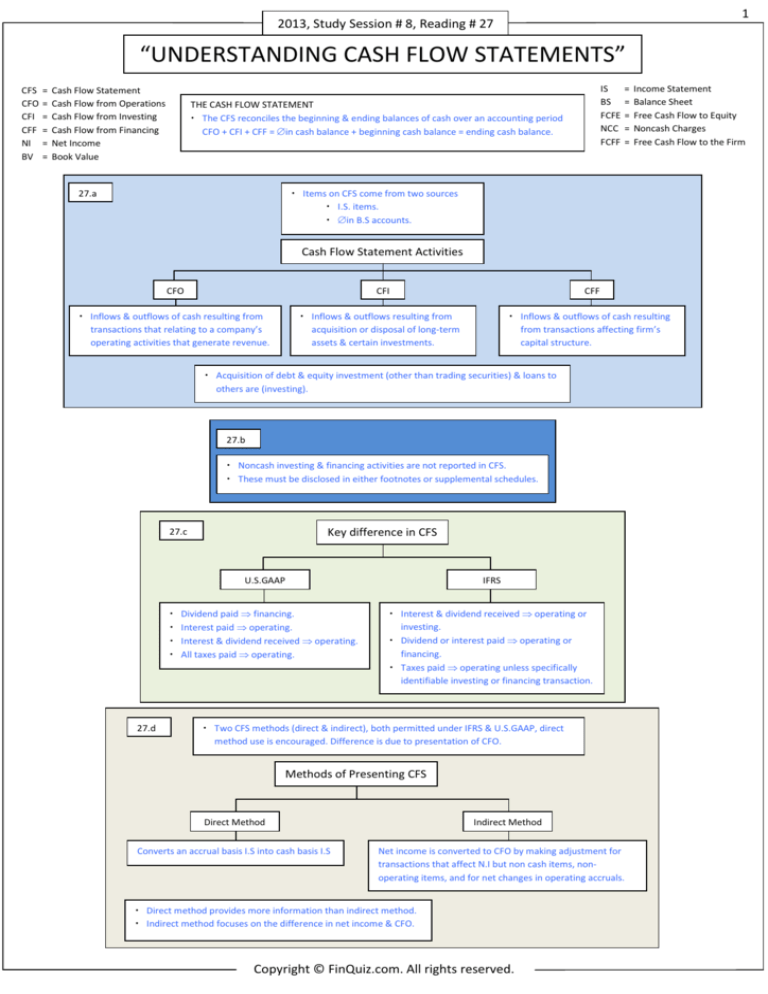

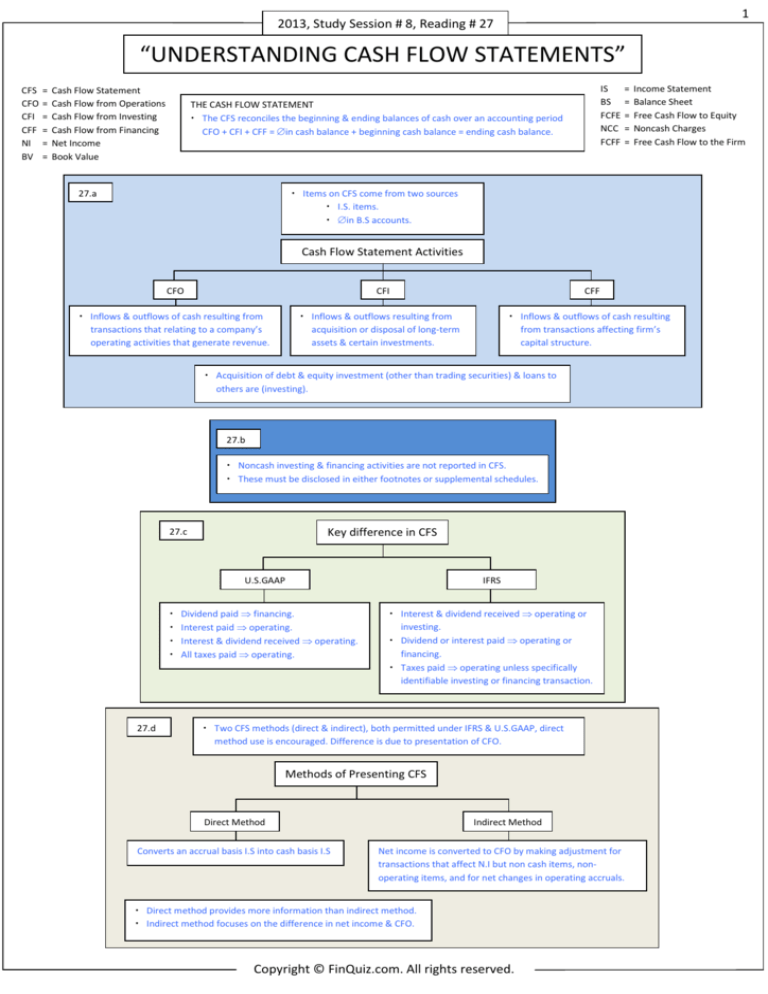

2013, Study Session # 8, Reading # 27

“UNDERSTANDING CASH FLOW STATEMENTS”

CFS

CFO

CFI

CFF

NI

BV

=

=

=

=

=

=

Cash Flow Statement

Cash Flow from Operations

Cash Flow from Investing

Cash Flow from Financing

Net Income

Book Value

IS

BS

FCFE

NCC

FCFF

THE CASH FLOW STATEMENT

The CFS reconciles the beginning & ending balances of cash over an accounting period

CFO + CFI + CFF = ∆ in cash balance + beginning cash balance = ending cash balance.

27.a

=

=

=

=

=

Income Statement

Balance Sheet

Free Cash Flow to Equity

Noncash Charges

Free Cash Flow to the Firm

Items on CFS come from two sources

I.S. items.

∆ in B.S accounts.

Cash Flow Statement Activities

CFO

CFI

Inflows & outflows of cash resulting from

transactions that relating to a company’s

operating activities that generate revenue.

CFF

Inflows & outflows resulting from

acquisition or disposal of long-term

assets & certain investments.

Inflows & outflows of cash resulting

from transactions affecting firm’s

capital structure.

Acquisition of debt & equity investment (other than trading securities) & loans to

others are (investing).

27.b

Noncash investing & financing activities are not reported in CFS.

These must be disclosed in either footnotes or supplemental schedules.

27.c

Key difference in CFS

U.S.GAAP

27.d

Dividend paid ⇒ financing.

Interest paid ⇒ operating.

Interest & dividend received ⇒ operating.

All taxes paid ⇒ operating.

IFRS

Interest & dividend received ⇒ operating or

investing.

Dividend or interest paid ⇒ operating or

financing.

Taxes paid ⇒ operating unless specifically

identifiable investing or financing transaction.

Two CFS methods (direct & indirect), both permitted under IFRS & U.S.GAAP, direct

method use is encouraged. Difference is due to presentation of CFO.

Methods of Presenting CFS

Direct Method

Converts an accrual basis I.S into cash basis I.S

Indirect Method

Net income is converted to CFO by making adjustment for

transactions that affect N.I but non cash items, nonoperating items, and for net changes in operating accruals.

Direct method provides more information than indirect method.

Indirect method focuses on the difference in net income & CFO.

Copyright © FinQuiz.com. All rights reserved.

2

2013, Study Session # 8, Reading # 27

27.d

Disclosure Requirements

U.S.GAAP

IFRS

Direct method presentation must also disclose

adjustments to reconcile N.I to CFO.

Payment for interest & taxes can be reported in

cash flow statement or in footnotes.

Payments for interest & taxes must be

disclosed.

27.f

CFO

Indirect Method

Direct Method

Cash collected from customers.

Cash used in production of goods & services.

Cash operating expenses.

Cash paid for interest.

Cash paid for taxes.

Net income.

± G/L resulted from financing or

investing CF.

+ Noncash charges &

- Non cash revenue.

operating assets (-) while are (+)

Operating liability (+) while are (-).

CFI

Calculated by examining change in gross asset accounts that result from investing

activities.

Cash paid for new asset = ending gross asset + gross cost of old assets sold –

beginning gross assets.

Cash from asset sold = B.V of asset ± G/L on sale.

CFF

27.g

Determined by measuring CF occurring b/w firm & supplier of capital.

Net CF from creditors = new borrowings – principal amounts repaid.

Cash dividend can be calculated from an analysis of retained earnings.

CFO + CFI + CFF = total CF = ∆ in balance sheet cash.

Adjust I.S item for its corresponding B.S. account & eliminate noncash & non operating transactions.

Illustrative conversion process of frequently used accounts is:

Cash collection from customers

Revenue + (–) dec (inc) in AR.

Cash payment to suppliers

COGS + in inventory - in inventory + AP - AP.

Other items follow the same principles.

Cash operating expense

SG&A + in prepaid expense - in prepaid expense. –↑ in other accrued liabilities + ↓

in other accrued liabilities

Copyright © FinQuiz.com. All rights reserved.

3

2013, Study Session # 8, Reading # 27

27.h

Major sources & uses of cash

Sources & uses of cash change as firm moves through its life cycle.

Over the long term, successful firms must be able to generate CFO that exceed capital

expenditure & provide a return to debt & equity holders.

Operating cash flow

+ CFO can be generated by earning – related activities or non cash working capital

(not sustainable).

CFO also provides a check of the quality of a firm’s earnings

Variability of N.I & CFO should also be considered.

Investing cash flow

capex, usually indication of growth.

Firm may reduce capex or even sell capital assets to save cash.

Generating CFO in excess of capex is desirable.

Financing cash flow

Provide information about debt & equity (using cash to repay

debt, reacquire stock or pay dividends).

Common-size CFS

By expressing each line item as a % of revenue.

Alternatively each inflow of cash as a % of total cash inflow &

each outflow as % of total outflow.

27.i

Free CF ⇒ measure of cash that is available for discretionary purpose (after covering capex).

If firms that follow IFRS subtracted dividend paid in calculating CFO, dividends must be added

back for FCFF.

Free Cash Flow

FCFF

FCFE

Cash available to all investors.

FCFF = N.I + NCC + [int(1-tax rate)] – FCInv – WCInv

FCFF = CFO + [int × (1- tax rate )] – FCInv

Firms that follow IFRS must consider dividend &

interest classification.

Cash flow available to common equity holders.

FCFE = CFO – FCInv + Net borrowings.

Copyright © FinQuiz.com. All rights reserved.