Euromonitor International

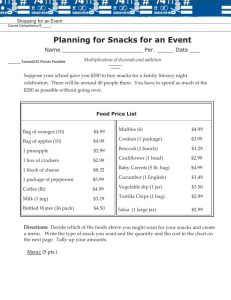

advertisement

Euromonitor International The rise of private label in savoury snacks Presented by Lamine Lahouasnia – Head of Packaged Food Research @SNACKEX #SNACKEX @Euromonitor @LLahouasnia London Who are Euromonitor? • Global provider of Strategic Market Intelligence Chicago Singapore Shanghai • 11 Regional offices - 800+ analysts in 80 countries Dubai • Cross-country comparable data and analysis Vilnius • Consumer focused industries, countries and Cape Town consumers • 5 - 10 year forecasts with matching trend analysis • All retail channels covered • Subscription services, reports and consulting Santiago Tokyo Sydney Bangalore Definition of snacks Europe: The Size of the Savoury Snack Market in 2012 Tortilla/Corn Chips 4% Pretzels 7% Chips/Crisps 23% Extruded Snacks 42% EUR 17 billion Nuts 24% What’s Really Driving Private Label? Image courtesy of Jeff Eaton How far has private label come in packaged food? 600 22% 500 21% 400 20% 300 19% 200 18% 100 17% - 16% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Private Label Branded Food Private Label Share Private Label Share Retail Value RSP - € billion Packaged Food: Branded vs. Private Label in Europe, 2003-2012 So what about snacks? 18 22% 15 21% 12 20% 9 19% 6 18% 3 17% - 16% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Private Label Branded Food Private Label Share Private Label Share Retail Value RSP - € billion Snacks: Branded vs. Private Label in Europe, 2003-2012 How private label snacks fits in with the rest of packaged food Private Label Value Share Europe: Private Label Penetration in Packaged Food, 2012 50% 45% 40% 35% 30% 25% 20% 15% 10% 5% 0% Baby food Snacks Chilled processed food What has driven the rise of private label food in Europe? Retail consolidation The success of modern retail Is there a choice? Economic Environment Financial squeeze Can I get the same for less? Trust in private label Looks the same, tastes the same Is it the same? Battle for industry consolidation: Germany Top 5 Companies’ - Retail Value RSP % of the Market Germany: Consolidation in Packaged Food and Grocery Retailing, 2004-2012 70 60 50 40 30 20 10 0 2004 2005 2006 2007 Packaged Food 2008 2009 2010 Grocery Retailers 2011 2012 Battle for industry consolidation: Poland Top 5 Companies’ - Retail Value RSP % of the Market Poland: Consolidation in Packaged Food and Grocery Retailing, 2004-2012 70 60 50 40 30 20 10 0 2004 2005 2006 2007 Packaged Food 2008 2009 2010 Grocery Retailers 2011 2012 Battle for industry consolidation: Russia Top 5 Companies’ - Retail Value RSP % of the Market Russia: Consolidation in Packaged Food and Grocery Retailing, 2004-2012 70 60 50 40 30 20 10 0 2004 2005 2006 2007 Packaged Food 2008 2009 2010 Grocery Retailers 2011 2012 So, who has the upper hand? 70 60 40 30 34% 50 25% Top 5 Companies’ - Retail Value RSP % of the Market Industry Consolidation: Packaged Food vs. Grocery Retailers, 2004-2012 20 10 0 2004 2005 2006 2007 2008 2009 2010 2011 2012 The relationship between retail consolidation and private label 50 80 40 60 30 40 20 20 10 0 0 Eastern Europe Packaged Food Grocery Retailers Western Europe Private Label Penetration Private Label Penetration - % 100 SV LT ET SK CS HU LA RO PL CR BU BS RS UK BL RU MD GG AT DE FI CH SE GB DK FR NL IE BE NO PT ES IT GR TR Share of the Top 5 Companies - % Europe: Consolidation in the Packaged Food and Grocery Retailing Industries, 2012 Private Label Priorities for Snacks Image courtesy of Geoff Lane Private label positioning in snacks: Tesco Chips/Crisps: Private Label Price Positioning, 2013 Tyrell's Red Sky Kettle Select Vegetable Kettle Chips Burts Jack Pots Nandos Real Crisps Kettle Ridge Chips Tesco Finest Walkers Crinkles Walkers Extra Crunchy Walkers Sensations McCoys Tesco 0.00 Creating the private label space Undercutting branded competition 0.50 1.00 1.50 Price per Unit - £ 2.00 2.50 Private label positioning in snacks: Asda Chips/Crisps: Private Label Price Positioning, 2013 McCoy's Kettle Chips Ruffles Walkers Crinkles Mackies Lays Asda Extra Special Asda Asda Chosen by You Crowding out the private label space Hunky Dory Walkers Extra Crunchy Walkers Sensations - 0.50 1.00 1.50 Price per Unit - £ 2.00 2.50 Private label positioning in snacks: Sainsbury’s Chips/Crisps: Private Label Price Positioning, 2013 Tyrell's Vegetable Crisps Walkers Extra Crunchy Tyrell's Red Sky McCoy's Kettle Chips Sainsbury's Taste the Difference Creating the private label space Walkers Sensations - 0.50 1.00 1.50 2.00 Price per Unit - £ 2.50 3.00 3.50 Private label positioning in snacks: Waitrose Chips/Crisps: Private Label Price Positioning, 2013 Tyrell's Burts Walkers Crinkles Walkers Extra Crunchy Red Sky Kettle Chips Walkers Sensations Corkers Waitrose Creating the private label space Kettle Ridge Chips 0.00 0.50 1.00 1.50 Price per Unit - £ 2.00 2.50 Packaging imitation crucial for economy private label snacks Albert Heijn Esselunga Carrefour Packaging type Colour Imagery Cross category ranges needed for standard and premium private label What are the priorities for private label snacks in Europe? Domination of the economy ranges Price to be primary offering Imitation is key Premium ranges to be next challenge Cross category range More of a priority than standard requirement segment for retailers Specialty ranges also becoming popular Initial focus on health and Future likely to see wellness establishment of ethical ranges What the Future Holds for Private Label Snacks Image courtesy of Femto So where now for private label snacks? 18,000 22% 15,000 21% 12,000 20% 9,000 19% 6,000 18% 3,000 17% - 16% 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 Private Label Branded Food Private Label Share Private Label Share Retail Value RSP - € billion Snacks: Branded vs. Private Label in Europe, 2003-2012 A perfect storm is brewing for private label in Europe Disposable incomes stagnating Retail modernisation to continue Grocery retailers to prioritise PL Trading down likely to return Europe: Outlook for Disposable Incomes, 2012-2017 7 6 CAGR % 5 4 3 2 1 0 -1 GG UK RU LA LT RO BU BS ET BL PL MD RS CR CS SV HU SK TR NO SE DK IE CH FI AT DE GB FR ES GR PT BE NL IT Eastern Europe Western Europe Modern retail is everywhere 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2002 2012 SV ET LA LT SK CR HU CS PL RU UK BU RO BS RS MD BL GG DK FI NO AT GB IE NL DE SE FR CH PT ES IT BE GR TR Modern Grocery Retail Share Europe: The Rise of Modern Grocery Retail, 2002/2012 Eastern Europe Western Europe Where to invest… Sales Growth Margin Growth …when expansion is no longer an option? Selling Space - Year on Year Growth (%) Western Europe: The Slowdown in Grocery Expansion, 2004-2012 20 10 0 -10 -20 2004-05 2005-06 2006-07 2007-08 2008-09 2009-10 2010-11 2011-12 Aldi Group Carrefour SA Schwarz Beteiligungs GmbH Tesco Plc Average Is it inevitable? Shapes ‘Pester Power’ Event association Party food Flavours Nontraditional Health and Wellness Healthier alternative Innovation Marketing THANK YOU FOR LISTENING