Euromonitor International - Global Wine Trends

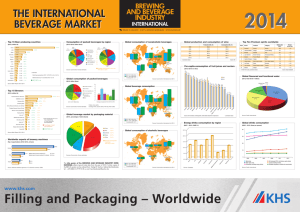

advertisement

1 TRENDS AND OPPORTUNITIES SHAPING THE GLOBAL WINE INDUSTRY MERWIN GROOTBOOM REGIONAL BUSINESS DEVELOPER: SUB-SAHARA AFRICA 31ST MAY 2011 – SAWIS INFORMATION CENTRE OPEN DAY © Euromonitor International 2 •MACRO VIEW •STATE OF THE GLOBAL WINE MARKET •GROWTH OPPORTUNITIES •GLOBAL TRENDS AND PROSPECTS © Euromonitor International 3 Macro View © Euromonitor International MACRO VIEW A FRAGILE RECOVERY IS UNDERWAY 4 Real GDP Growth by Region: 2009-2011 10 8 2009: 89 2010: 17 % growth 6 4 2 Number of countries which saw negative real GDP growth in 2009 & 2010 0 -2 -4 -6 -8 2009 © Euromonitor International 2010 2011 MACRO VIEW UNEMPLOYMENT SEEN AS THIRD WAVE OF CRISIS Unemployment Rate in World’s Worst Affected Countries 2010 16 14 25 12 10 20 15 8 6 10 4 2 5 0 -2 0 -4 Unemployment rate 2010 © Euromonitor International % change Unemployment rate - % EAP 30 Change since 2007 5 14 Number of countries with an unemployment rate above 10% in 2007 25 Number of countries with an unemployment rate above 10% in 2010 MACRO VIEW HOW WILL THE ECONOMY PERFORM? Near term outlook remains uncertain Growth to be driven by emerging markets – especially in Asia Unemployment to remain high Consumer spending still under pressure Government debt to remain a key area of concern Shift in global power to emerging markets will continue © Euromonitor International 6 7 State of the Global Wine Market © Euromonitor International 3 BILLION State of the global wine market 8 1.3 PERCENT 9 litre cases of wine sold in 2010 4 © Euromonitor International LITRES CAGR volume growth for wine globally between 2005 and 2010 of wine is consumed per cap globally STATE OF THE GLOBAL WINE MARKET GLOBAL WINE PER CAPITA CONSUMPTION IN 2010 Portugal Highest Per Cap Consumption Globally © Euromonitor International 9 STATE OF THE GLOBAL WINE MARKET AFTER THE SLUMP... 10 Global Wine Sales 2005-2010 3.5 Billion 9L Cases 2.5 4 2 3 1.5 2 1 % Growth 5 3 1 0.5 0 0 2005 2006 Wine volumes in billion 9L Cases © Euromonitor International 2007 2008 % Total volume growth 2009 2010 % Total value growth US$ fixed STATE OF THE GLOBAL WINE MARKET BEER TAKES SHARE FROM WINE AND SPIRITS 11 Alcoholic Drinks by Category – Total Volume 2015 78.4% 8.1% 11.2% 2010 78.0% 8.3% 11.4% 2005 76.8% 8.6% 12.2% 2000 75.1% 0% 20% Beer Cider/Perry © Euromonitor International 40% 10.0% 60% RTDs/High-Strength Premixes 13.1% 80% Spirits 100% Wine 12 © Euromonitor International Growth opportunities GROWTH OPPORTUNITIES ASIA PACIFIC WILL CONTINUE TO DRIVE WINE SALES 13 % Total Volume CAGR 2010 2010-15 Wine Sales by Region 2010-2015 12 Asia Pacific 10 8 6 4 Western Europe Middle East Eastern Europe and Africa 0 -4 Latin America North America 2 -2 -2 0 Australasia 2 4 6 8 10 % Total Value CAGR 2010-15 Global wine volumes are expected to grow by 3% CAGR between 2010-15 Still light grape wine will remain the largest category © Euromonitor International 12 GROWTH OPPORTUNITIES US IS LARGEST CONSUMER BUT CHINA WILL BE BY 2015 Largest Still Grape Wine Markets Globally in Volume 2010 Largest Still Grape Wine Markets Globally in Volume 2015 USA 12% Others 31% Italy 12% Others 30% China 15% USA 11% France 10% Portugal 2% Russia 3% Spain 4% Argentina 5% © Euromonitor International United Kingdom 6% 14 Brazil 2% Russia 3% Spain Germany 4% 8% Argentina China 4% 7% Italy 10% Germany United 7% Kingdom 6% France 8% GROWTH OPPORTUNITIES WESTERNATION, PREMIUMISATION AND HEALTH DRIVE WINE 15 China: Wine by Type Performance 2010-2015 3000 80 25 Chinese Wine Imports By Origin 2005-2010 20 2000 15 1500 10 1000 500 5 0 0 60 Million litres Million litres 2500 %Total volume CAGR 70 50 40 30 20 10 0 2010 2015 © Euromonitor International 2010-15 % CAGR 2005 2010 GROWTH OPPORTUNITIES FAVOURABLE DEMOGRAPHICS AID WINE SALES IN BRAZIL Still light grape wine 2 L/cap 2010 6% total volume CAGR 2010-2015 More women in the labour force 2009: 50% of the population reached the middle class Northeast region growing Urbanisation key © Euromonitor International 16 17 © Euromonitor International Global Trends and Prospects GLOBAL TRENDS AND PROSPECTS WINE KEY DRIVERS AND TRENDS 18 Cocooning Internet / Technology Convenience Value for Money Polarisation EcoCredentials Healthier Options Simplified Offerings © Euromonitor International GLOBAL TRENDS AND PROSPECTS ON-TRADE SUFFERS AS COCOONING ACCELERATES 19 3 5 2.5 4 2 3 1.5 2 1 1 0.5 0 0 -1 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Wine - Off-trade Volume Wine - Off-trade Volume © Euromonitor International Wine - On-trade Volume Wine - On-trade Volume % volume growth Billion 9L cases Global Wine On- vs. Off-Trade Performance 2005-2015 GLOBAL TRENDS AND PROSPECTS QUALITY WINE IN BAG-IN-BOX SUITED TO HOME CONSUMPTION 20 Off-trade – Million units 180 160 140 120 100 80 60 40 20 0 © Euromonitor International 16 14 12 10 8 6 4 2 0 -2 -4 -6 % Volume CAGR 2005 2005-2010 Leading Off-trade Markets for Bag-in-Box 2010 GLOBAL TRENDS AND PROSPECTS VALUE FOR MONEY EVIDENT IN OFF-TRADE 21 Wine Off-trade Channel Performance 2005-2010 Food/drink/tobacco specialists Small Grocery Retailers Discounters Internet Retailing Supermarkets/Hypermarkets -4 -2 0 2 4 6 8 10 2005-2010 % Volume CAGR © Euromonitor International 12 14 16 GLOBAL TRENDS AND PROSPECTS WINE: PREMIUMISATION, POLARISATION AND AFFORDABILITY 22 Red wine: Greece Under EUR3.5 2005 2010 Red wine: China 2005 2010 2.7% 3% Under RMB19.99 30% 21% EUR3.51 to EUR5.5 6% 7.5% EUR5.51 to EUR6.5 RMB20 to RMB29.99 30% 30% 7% 9% RMB30 to RMB49.99 29% 30% RMB50 to RMB59.99 8.5% 13.5% RMB60 to RMB89.99 1.5% 3% 1% 2.5% 100% 100% EUR6.51 to EUR8 EUR8.01 to EUR9.4 EUR9.41 to EUR11 EUR11.01 and above Total © Euromonitor International 20.3% 22.2% 23.8% 21% 22% 21% 18% 16.5% 100% 100% RMB90 and above Total GLOBAL TRENDS AND PROSPECTS 25 20 15 10 5 0 23 7 6 5 4 3 2 1 0 -1 2010 % CAGR 2010-2014 Total Volume - Billion Units UN-TRADITIONAL SIZES MORE DYNAMIC Total volume 2010 % CAGR 2010-2014 © Euromonitor International GLOBAL TRENDS AND PROSPECTS CONVENIENCE PRODUCT EXAMPLES © Euromonitor International 24 GLOBAL TRENDS AND PROSPECTS CANS – THE NEXT BIG THING? 25 60 20 50 15 40 10 30 5 20 0 10 -5 0 -10 % Off-trade trade volume CAGR Off-trade volume – million units Leading Off-trade Markets for Cans in 2010 Off-trade volume 2010 % CAGR 2010-2014 © Euromonitor International GLOBAL TRENDS AND PROSPECTS PET BOTTLES – SLOW TO CATCH ON 26 Challenges Opportunities ‘Smaller’ on shelf profile – “Is that a half bottle?” Associated with soft drinks Shorter shelf life Taste perceptions – “I don’t want my wine to taste plasticky” Changing consumption culture – buy to drink now Lighter/safer to transport Single serve sizes – most of the weight is wine, not package Green perceptions – if the consumer can be educated © Euromonitor International GLOBAL TRENDS AND PROSPECTS ECO-CREDENTIALS PRODUCT EXAMPLES © Euromonitor International 27 GLOBAL TRENDS AND PROSPECTS MILLENNIALS ARE TECH SAVVY AND WORD OF MOUTHERS Technology adopters Online community Egocentric Hedonistic spenders Civic-minded/socially conscious Tolerant Fashion influencers Media mistrusters/spin detectors Civic-minded/socially conscious Technology adopters Online community Mass-advertising rejecters Word of mouthers Debt incurrers Media mistrusters/spin detectors Mass-advertising rejecters Work/life balancers Obedient, but not subservient Tolerant Apathetic and sometimes frivolous © Euromonitor International Word of mouthers 28 GLOBAL TRENDS AND PROSPECTS INTERNET CONTINUES TO RESHAPE THE WORLD Half of all Internet users will be in Asia Asia 50 Rest of world 100% 40 90% 30 20 10 0 2000 2010 2020 711 million Chinese Internet users in 2020 281 million US Internet users in 2020 © Euromonitor International % of world’s Internet users % of world population More than 40% of the world’s population will be on the Internet in 2020 29 80% 70% 60% 50% 40% 30% 20% 10% 0% 2000 2010 2020 GLOBAL TRENDS AND PROSPECTS INTERNET / TECHNOLOGY EXAMPLES © Euromonitor International 30 GLOBAL TRENDS AND PROSPECTS TO SUM UP 31 Value for Money • Wine offerings will have to justify their prices to increasingly price-savvy audiences in a new era of thrift. Emerging Markets Key • Countries like China and Brazil are key as future opportunity markets but lets not forget about the developed markets. Glass keeps the top spot Green packaging formats Differentiation via innovative packaging Internet/ Technology © Euromonitor International • Centuries of traditional glass bottle use have resulted in one of the most consolidated categories for packaging, this pack type will remain key for premium wines. • Reducing distribution and breakage costs, while answering environmental concerns, will force manufacturers to go the extra mile in terms of packaging innovation. • Appealing to the new wine consumer, standing out on a shelf full of glass bottles, the shaped liquid carton, metal can and small size PET bottles are all taking share. • Social networking, online retail, consumer reviews “word of mouse” etc. will continue to play a huge role in shaping consumer trends. 32 THANK YOU FOR LISTENING Merwin Grootboom Regional Business Developer: Sub-Sahara Africa merwin.grootboom@euromonitor.com © Euromonitor International